Equities As China ramps up regulations, can investors keep calm and carry on?

Given the recent flurry of regulations in China, are Chinese equities still investable? Developing Markets CIO Justin Leverenz answers this question and more.

After a difficult decade, we see causes for optimism about emerging markets (EM) in the decade ahead.

The teens proved to be a difficult decade for EM.

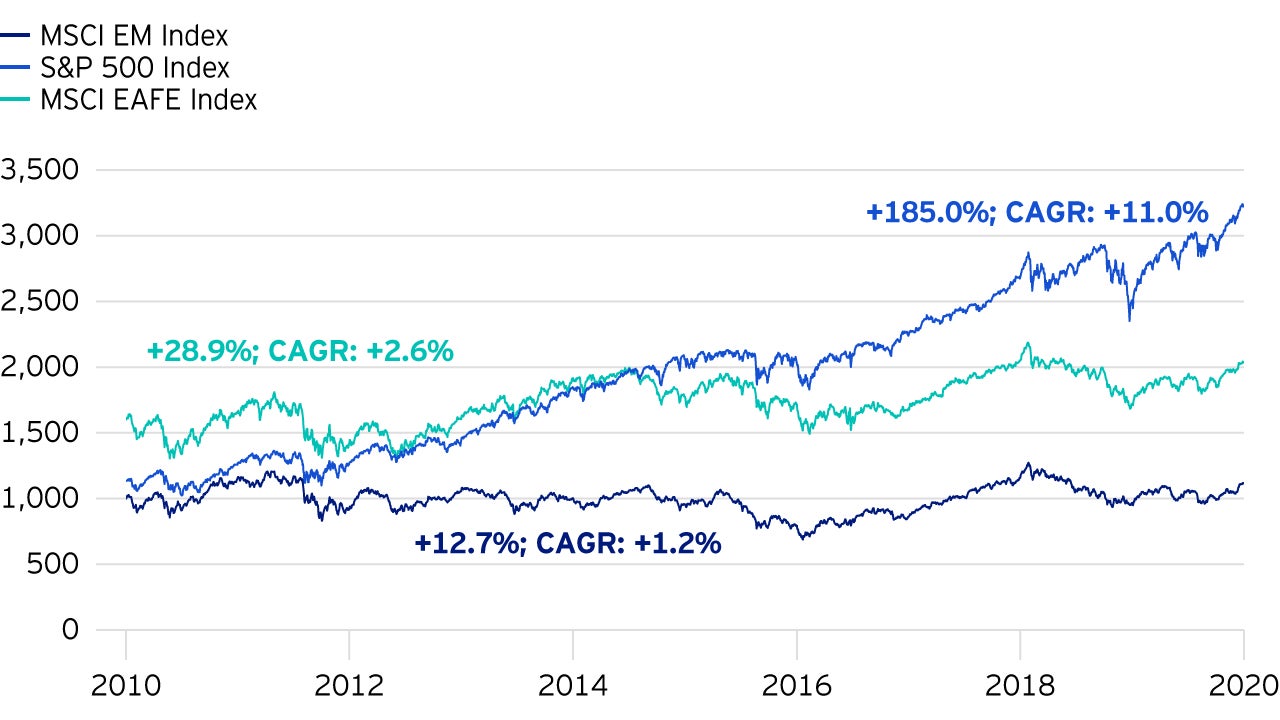

That setback came after EM stocks delivered strong returns in the first decade of the 2000s, as the MSCI EM Index outperformed the S&P 500 by 11% (US$ terms) on an average annual basis.1

By contrast, EM equity returns over the past ten years proved to be disappointing, as the MSCI EM Index underperformed the S&P 500 by 9.8% (US$ terms) on an average annual basis.1

Two key factors drove that poor performance.

The poor fortunes of EM during the past decade also put to rest many of the assumptions investors had made about EM.

The notion that all the BRICS countries - Brazil, Russia, India, China and South Africa - were on the same development track proved to be overly optimistic.

Growth in Russia, Brazil and South Africa came to a halt, as the economies were adversely affected by weak commodity prices.

India continued to be in a deep economic slump.

All four of these countries were also plagued by some combination of weak domestic savings, high levels of inequality with low social mobility, insufficient fiscal capacity to spur their economies, and low degrees of economic openness, the latter of which negatively impacts the ease of exports and imports.

China’s growth rate, which had been as high at 9.5% in 2011, slowed through the decade and hovered in the 6% range by the end of the decade.1

The slowdown in China seemed to catch some by surprise.

While China is still among the world’s fastest-growing economies, it couldn’t sustain the torrid pace it had set previously.

Some of the contributing factors included a saturation in its share of the global export market and the fact that its real estate and automobile sectors had reached the peak of their cycles.

While spending from the government helped bolster the country’s flagging growth, those fiscal interventions proved to be unsustainable in the medium term.

While some investors may have lost some faith in EM, we foresee several trends that we think will help turn around the fortunes of select EM and reward investors who are careful stock pickers in these regions.

We think private investment should recover and there should be greater geopolitical confidence along with cautious policy stimulus.

We expect the shift towards consumption and private investment in the country should be propelled further by greater social spending in areas such as pensions and health care.

We believe a weaker US dollar and low interest rates globally should allow central banks in emerging countries to be more aggressive with monetary easing.

With a lower cost of capital, private sector investment should also likely recover.

We expect the global manufacturing recession to reverse.

In our view, credit markets in countries outside of China should also recover from their current abnormally low levels.

For many of the same reasons stated above - the prospect of a weak US dollar and low global interest rates - we think the EM equity markets, which are already relatively inexpensive, could recover in the years ahead and potentially outperform the US stock market.

We foresee substantial opportunities for outsized returns in neglected EM value stocks, as shown by the bifurcation of performance between high-quality growth stocks and everything else from a bottom-up perspective.

Given the recent flurry of regulations in China, are Chinese equities still investable? Developing Markets CIO Justin Leverenz answers this question and more.

The universe of attractive investment opportunities in China is growing. But with concern there is some froth building, we believe this calls for an active approach that separates hype from reality.

Why are we so excited about the drug innovation ecosystem in China?