IQS factors 2020/21: Looking back and ahead

Executive summary:

- 2020 was an unfavourable year for factor-based strategies though factors behaved largely in an expected manner

- Size was the only factor in positive territory, while Momentum and Quality moderately underperformed and Value and Low Risk were the worst factors

- Sudden and frequent reversals in factor return leadership paired with elevated factor volatility made it hard for multi-factor models to outperform

- Despite painful short-term performance consistency in factor returns gives confidence in the long-term outperformance potential of factors

Looking back: The big factor picture 2020

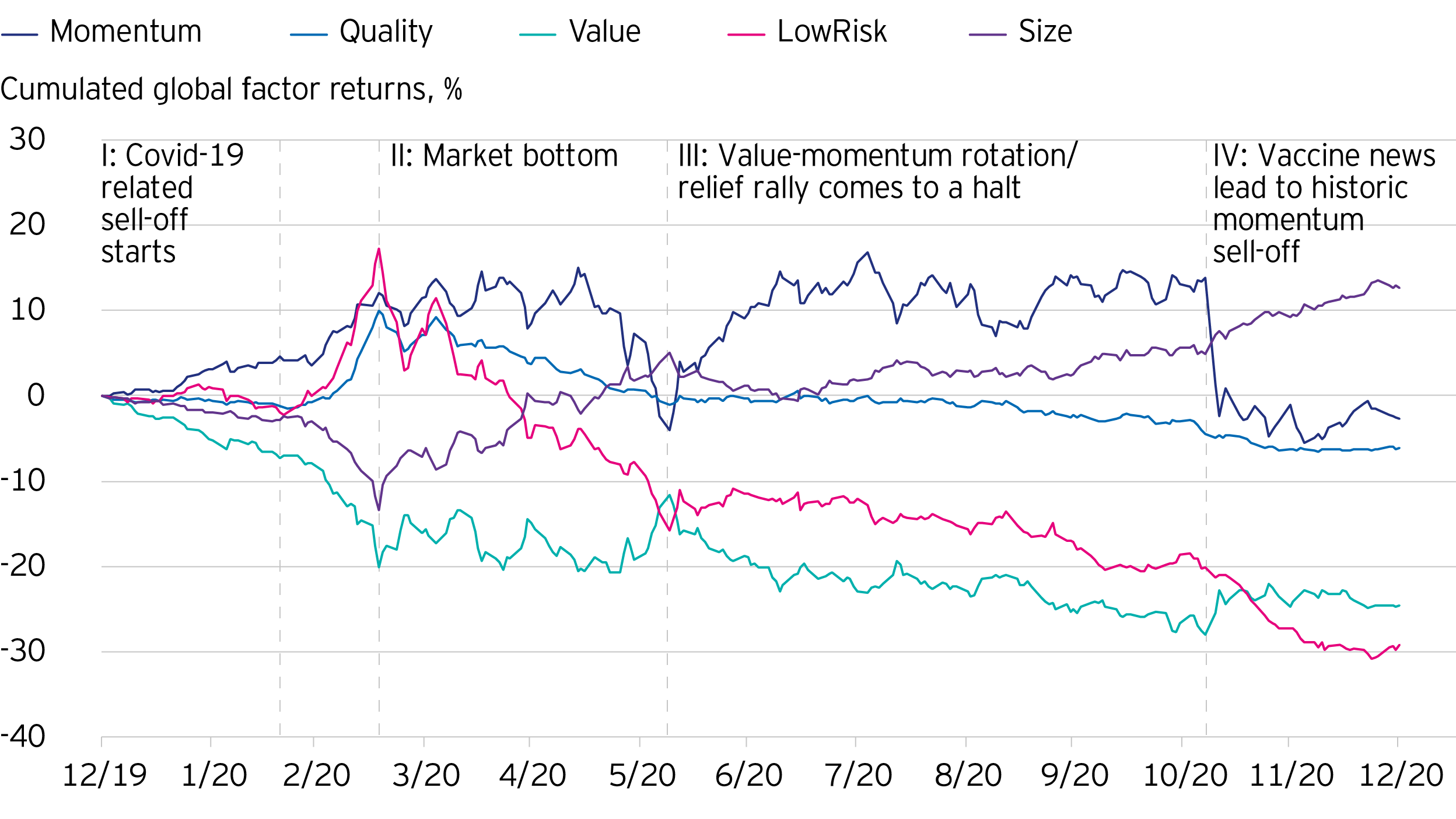

Despite all odds, global equity markets have recovered all losses from the Covid-19 induced market sell-off at the beginning of 2020. However, the resulting volatility and sudden changes in investor sentiment left clear marks in the factor landscape in 2020 and severely impacted factor performance. With the benefit of hindsight, we can determine four turning points as outlined in Figure 1 below.

During the pre-Covid-19 period, factors picked up where they left off in 2019: Momentum led the way while Value and Size struggled, and defensive factors stayed muted.

As soon as the pandemic started to spread globally (I), equity markets reversed their initially mild response and plummeted into bear market territory at the fastest pace on record. During this period, factor performance matched expected patterns: The underperformance of more cyclical factors (Size and Value) accelerated significantly, reflecting the troubles of smaller businesses and capital intense industries that suffered most from the Covid-19 induced economical shutdown. At the end of the quarter, Value had recorded one of its worst quarters in history. On the contrary, defensive stocks with strong balance sheet fared relatively well. As the latter ones had already been sought-after investments before the pandemic, we found Momentum to outperform the broader market next to Low Risk and Quality.

Once the market bottomed in March (II) driven by decisive interventions from central banks, fiscal stimulus and the first successful indications of lockdown measures, investors changed their positioning and shifted into a more risk-on mode. Thus, we witnessed a strong performance of smaller sized stocks and high-risk/high-beta names. However, Value, usually the go-to factor in recoveries, traded sideways in a volatile fashion only slightly outperforming Momentum factors.

During May, it became clear that an indicated Value-Momentum reversal was premature (III): Momentum factors started to dominate the scene once again and any sustained recovery attempt of Value was quickly reversed. The polarization of equities continued over the following months and stocks that were perceived to be beneficiaries of the pandemic continued to attract investors’ attention, while cyclicals continued to struggle.

This suddenly changed when positive news on vaccine efficiency (IV) hit the market on 9th November resulting in a historical Momentum sell-off. The announcement drove investors out of prior Covid winners and into previously shunned value stocks and cyclical names that are dependent on an effective vaccine to reopen the economy. Momentum was positioned on the other side of this rotation as the factor favored companies that either benefitted from Covid-19 induced trends or were able to deliver non-cyclical growth. Consequently, Momentum experienced its worst daily drop on record so far overshadowing the positive performance of Value. However, the pronounced sudden rotation once again demonstrated the benefits being diversified between multiple factors.

In summary, while four out of five factors ended the year in negative territory the performance behavior was explainable and largely consistent with past events. Through various ups and downs smaller sized stocks came out as winners followed by Momentum despite the huge loss in November. For Quality, the year ended with an underperformance: after the recovery in March the factor was largely neglected in an upward-trending market. It appeared that market participants simply cared less about financial stability – perhaps driven by safety nets rolled out by central banks and governments worldwide. This was also true for Low Risk but to a larger extent making it one of the weakest performing factors in 2020. For Value, 2020 marked yet another disappointing year although the latest developments since November give hope for a more prosperous 2021.

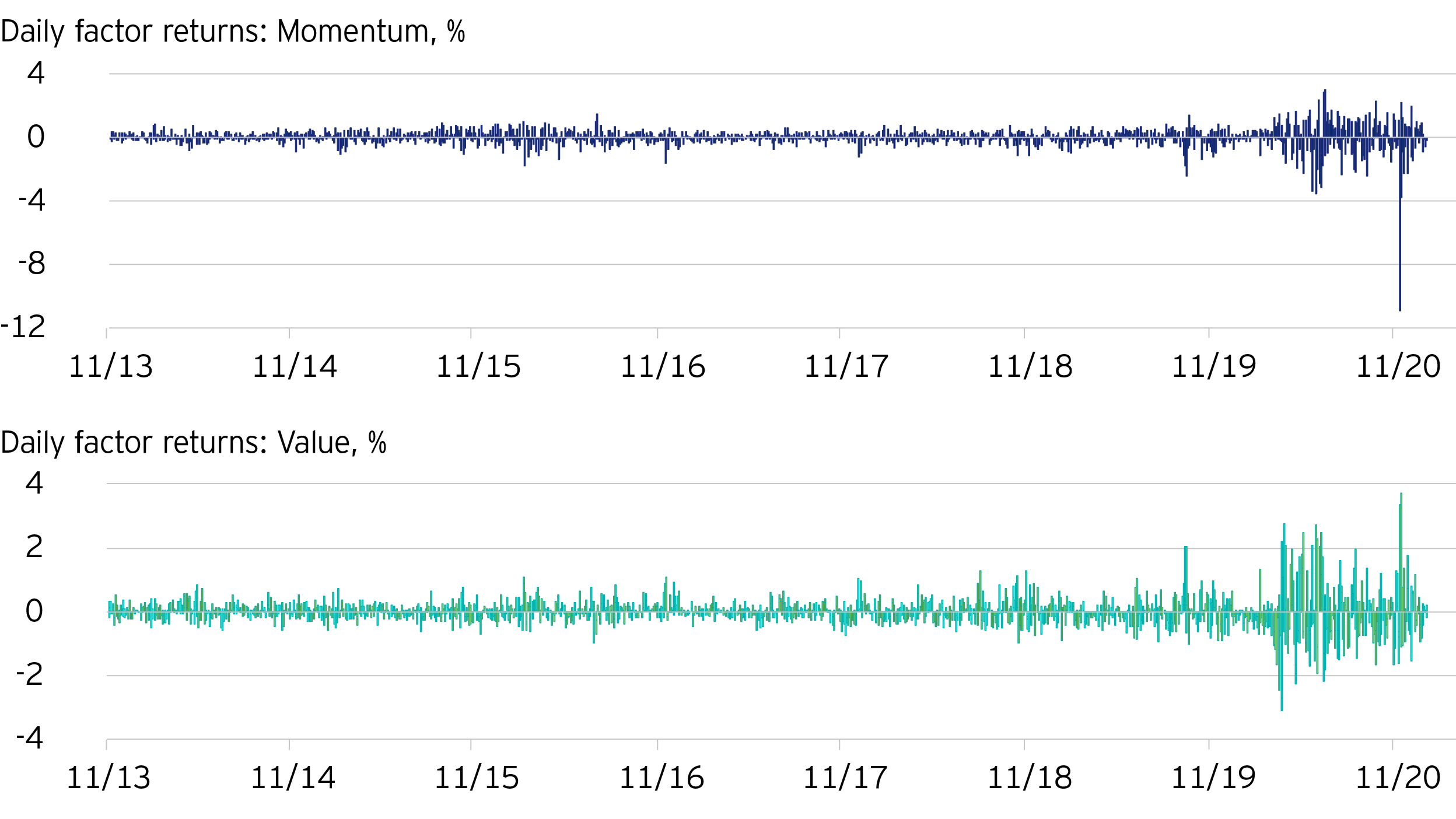

Putting factor movements in context: Unprecedented return swings across equity factors

By any means, factor movements in 2020 were extreme compared to the previous years as the daily factor return plots in Figure 2 illustrate. Underneath the broader market rally, we observed almost daily changes in the performance leadership of different equity factors: cyclical factors, predominantly Value and Size, clawing back ground on one day, just to be on the losing side on the next day again, indicating the fragility of the underlying market. The sudden and frequent reversals in factor return leadership paired with the elevated volatility of factors prevented the development of larger trends in the factor landscape. Despite offering diversification, in general multi-factor models struggle somewhat in these types of market environments. This was particularly true when the vaccine break through triggered a factor rotation and a record Momentum reversal.

Factors behaved similar across regions

The factor behaviour was consistent across all regions as we observed only little regional divergence from the patterns described above. Value struggled uniformly across the globe and its poor performance impacted factor investors in every region including Emerging Markets. Quality helped to mitigate the drawdown in February but was neglected afterwards and finished the year in negative territory in most regions. Europe proved to be an exception as Quality was moderately positive in this region. The factor rotation in November hurt Momentum, leading the factor into negative territory in the USA and globally whereas Emerging Markets were less affected.

Regional factor performance in 2020

| Momentum | Quality | Value | |

|---|---|---|---|

| Global | -3% | -6% | -25% |

| USA | -11% | -10% | -27% |

| Europe ex UK | 5% | 4% | -18% |

| UK | 0% | -2% | -14% |

| Japan | 13% | -8% | -30% |

| Australia | 16% | -19% | -20% |

| Rest of the world | -2% | -9% | -16% |

| Emerging Markets | 28% | 0% | -29% |

Table 1: Regional factor performance in 2020. Source: Invesco. Factor returns are defined as spread returns of the top versus bottom deciles (quintiles were used for the UK, Europe ex UK, Australia and Rest of the World). The underlying portfolios are resampled daily, and returns are square root of market-cap weighted.

2021 ahead: Where do factors go from here?

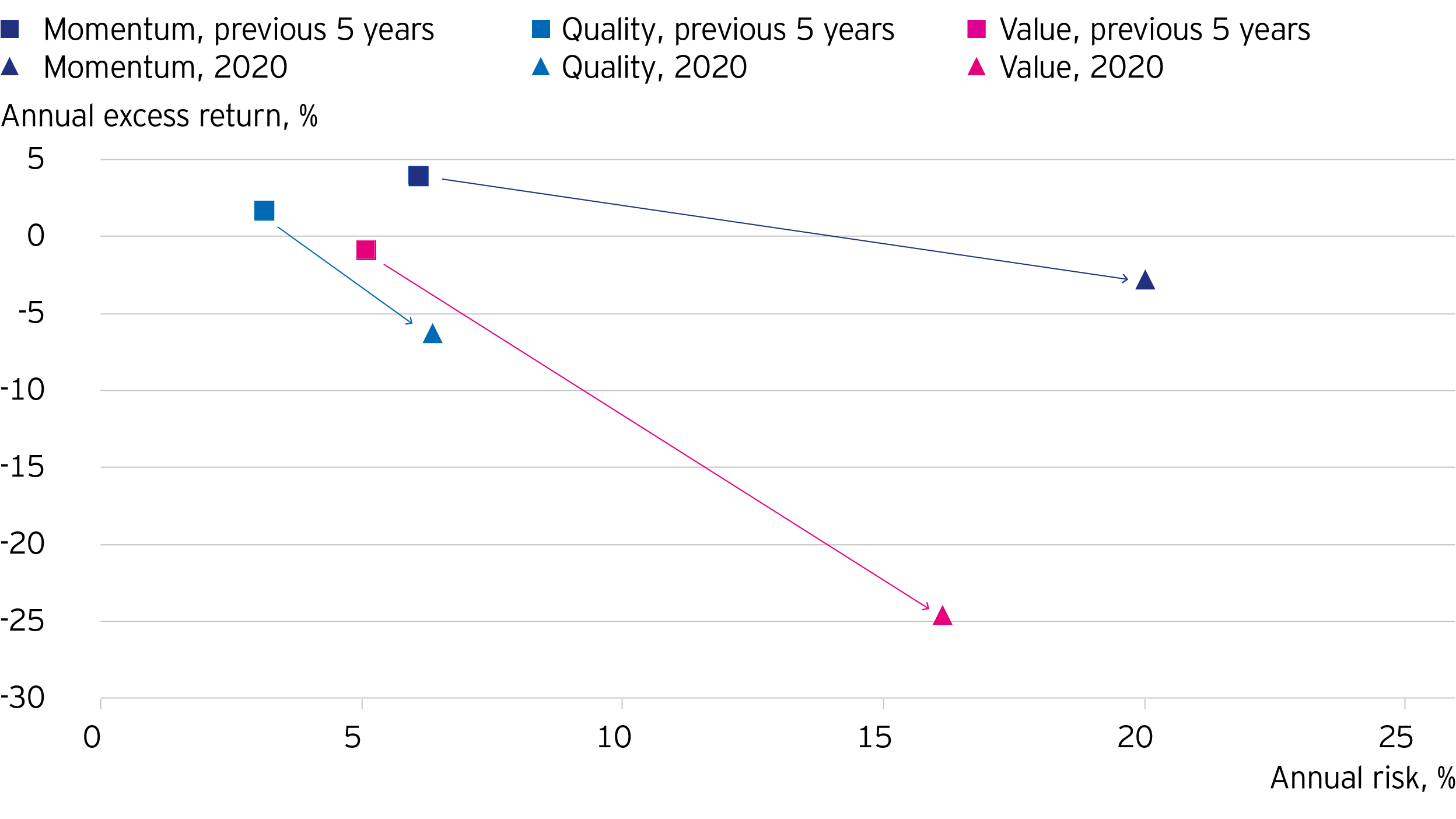

2020 was clearly an exceptional year. This becomes even more evident when we put the last year into contrast with the previous five years. Figure 3 plots our factors in a risk-return chart. Triangles represent the risk-return characteristics of 2020 while the squares denote the risk-return profile over the previous five years. We expect factors to outperform over the course of an economic cycle. From 2015 to 2019, a multi-factor approach delivered appealing risk-adjusted returns, despite the challenging contributions from Value and an overall difficult 2019. However, in 2020, all factors fared significantly worse relative to their medium-term profile though in line with expected behavior.

After all, 2020 has shown that we can expect Momentum, Low Risk and Quality to outperform during market selloffs, while cyclical factors such as Value and Size do not necessarily reverse as soon as a market bottom is reached. Instead Value required a clear prospect of a stable economic recovery to rebound – such as the vaccine news in November. If the global vaccine rollout proves effective, Value will have some clear recovery potential. Exposure to Quality remains crucial and will help to offset market turbulences while Momentum will likely regain its strength as soon as new market trends establish. This gives us confidence that the current weakness is of painful though temporary nature. Overall, the underlying rationales for factor investing remains unchanged. Hence, to reap the benefits from time-tested factors one must be patient in their pursuit.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.