Invesco European Low Volatility Strategy

Invesco has developed a proprietary, factor-based methodology, which aims to deliver client outcomes better than those of traditional active or passive equity approaches and focuses on low volatility stocks within Europe.

At a glance

Factor investing aims to systematically exploit drivers of risk and return in order to create portfolios that deliver an enhanced risk-return profile. It is not about traditional stock selection but rather understanding the building blocks of stock returns.

Potentially higher returns

Efficient risk management

Individual customisation

Objective

A conservative equity portfolio with asymmetric return profile following a quantitative, factor-based stock selection process with a focus on less volatile stocks. The objective of the strategy is to outperform the MSCI Europe Index over a medium-term horizon (typically, a 3-year rolling period) with less volatility and drawdown risk, and to subsequently exhibit a higher risk-adjusted return.

Investment process

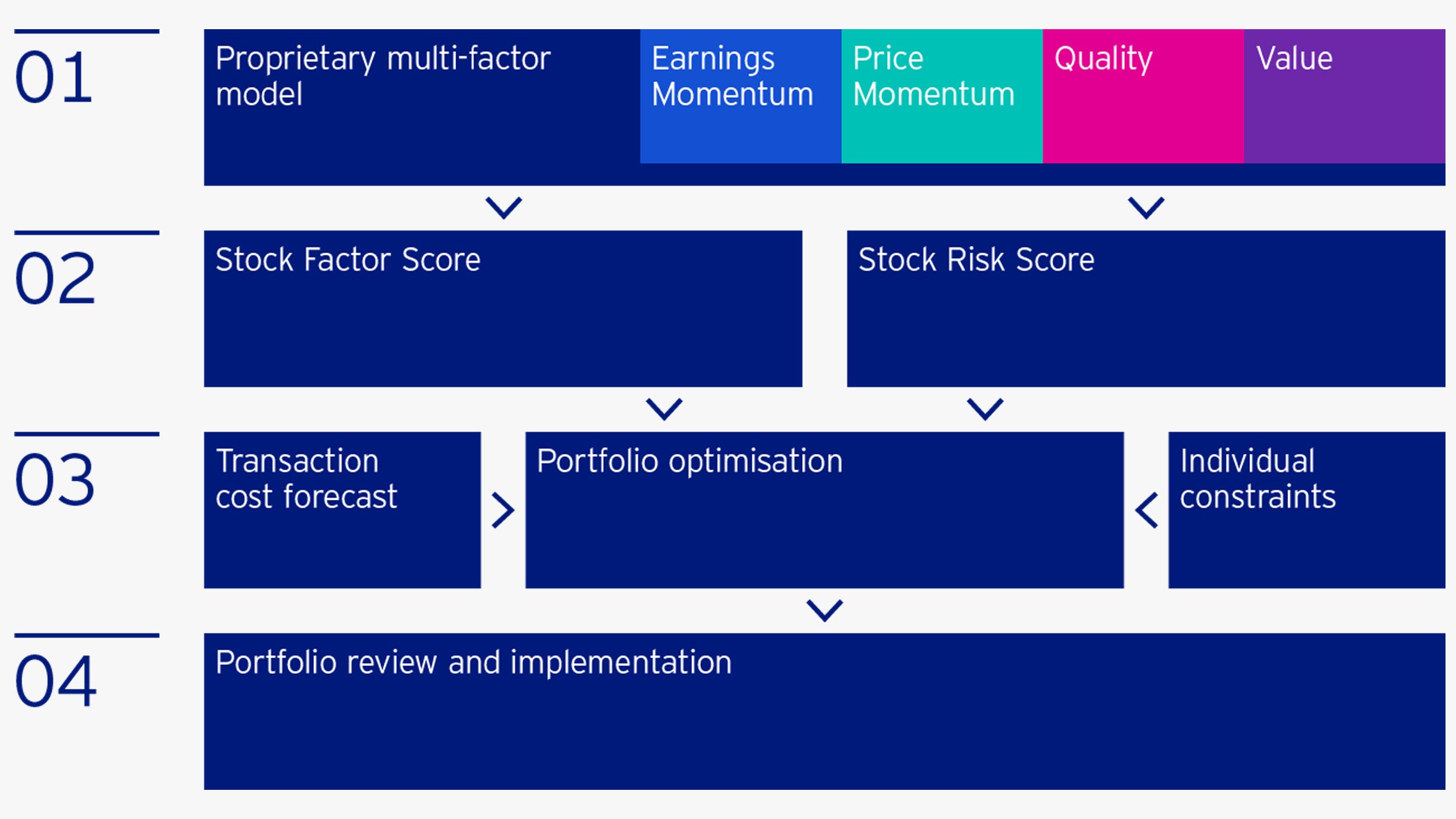

Our factor-based equity strategies aim to capture alpha by following a a systematic, rules-based investment process. This begins with stock selection using our proprietary, multi-factor model.

Our proprietary multi-factor model

This is based on our belief that a stock’s risk and return is systematically driven by quantifiable factors / attributes. The model ranks the stocks in our investible universe from the most attractive to the least attractive.

From our perspective, a stock is attractive, if:

- it is attractively valued compared with its peers;

- improving earnings momentum suggests further upside;

- it shows positive momentum, indicating positive price momentum; and/or

- it is a high-quality stock in terms of profitability and has a strong balance sheet.

Risk and return forecast

- Based on our multi-factor model, we provide risk and return forecasts for a universe of more than 4,000 global stocks.

- Forecasts are determined on a region- and sector-neutral basis to ensure fair comparisons.

Portfolio optimisation

- In identifying a portfolio that is optimised for risk and return, we consider transaction costs, liquidity, individual constraints etc.

- The optimisation process has a very high degree of flexibility and customisation, allowing us to generate portfolios with various risk-return profiles.

- We are able to implement a wide range of constraints, including tracking error, market beta, sector limits and factor exposure.

Final portfolio review and implementation

- Final plausibility and consistency check

- Implementation of the approved portfolio

Why Invesco

Invesco’s active approach to factor investing embraces a true diversity of thought. The team is committed to an extensive programme of research, drawing on a broad range of academic resources and our own expertise with the aim of constantly improving client outcomes.

- A pioneer in factor investing – Invesco has more than 35 years of experience with a track record dating back to 1983.

- A proprietary factor suite – based on significant, ongoing research designed to harvest factor premiums ever more efficiently.

- An active, integrated multi-factor approach – we take into account the interconnection of factor premiums, providing the potential to generate sustainable excess returns in different market cycle phases.

- An integrated ESG approach – we use holistic ESG criteria at various stages of our multi-factor investment approach. In addition, we pursue an active dialogue with companies and investor-driven proxy voting using Invesco’s proprietary Proxy Voting Platform. We have used proprietary signals within the Quality factor to account for governance aspects over many years. We also consider ESG factors in our portfolio risk management by managing ESG exposure and excluding shares with negative ESG momentum when determining the investment universe.

- A sophisticated and stable investment team – we have more than 60 team members with a diverse range of academic and professional backgrounds.

Investment team

The Invesco Quantitative Strategies team is responsible for managing equity active factor investing strategies. Through a strong commitment to research, the team continues to evolve its investment process and seeks to foster a purposeful evolution of the model, i.e. the enhancement of existing factors and the development of new factors.

- Locally grounded, globally networked: five locations across four continents: Boston, Frankfurt, Melbourne, New York and Tokyo.

- Sophisticated: over 60 investment experts — 21 CFA charter holders, 13 doctorates and more than 18 years’ average industry experience.

- Stable: an average team tenure of 11 years.

Highlighted strategies

Explore

Explore

How can we help?

Let us know using the form opposite and one of our specialist team will quickly get back to you.

Important information

- Data as at September 2019, unless otherwise stated. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise. Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities

Investment risks

- The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. The strategy may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of a portfolio. The Manager, however, will ensure that the use of derivatives does not materially alter the overall risk profile of the strategy.