Market sentiment continues to improve

Key takeaways

Improving risk appetite is indicative of near-term prospects for a recovery, increasing the likelihood of improving growth, led by a rebound in Europe.

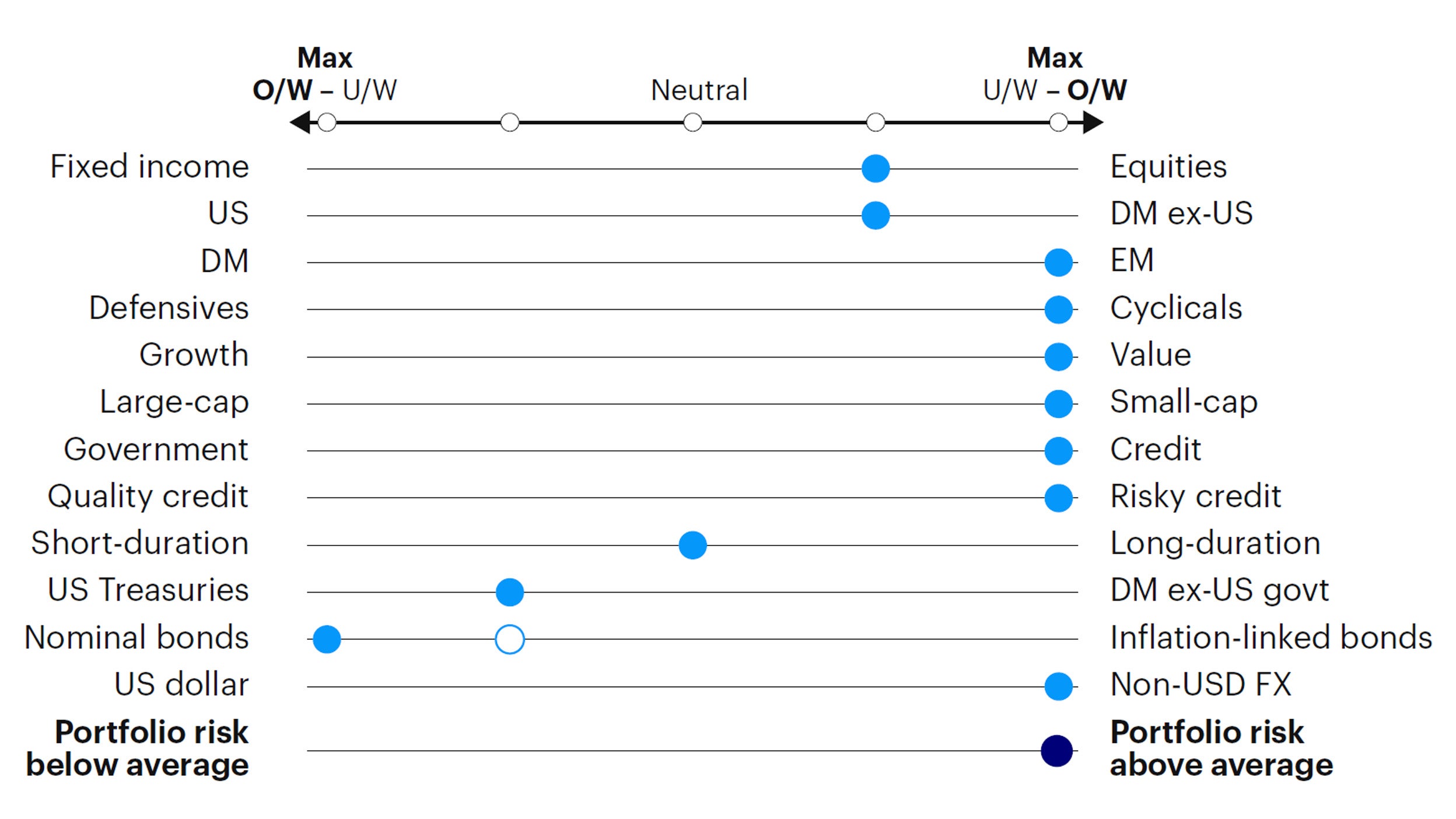

We overweight portfolio risk in the Global Tactical Asset Allocation model, favouring emerging and developed ex-US equities, value, smaller capitalizations, and cyclical sectors.

We overweight risky credit, neutral duration and underweight the US dollar relative to benchmark.1

Market sentiment continues to improve. Our barometer of global risk appetite posted another noticeable increase over the past month, led by outperformance in emerging market (EM) equities relative to developed markets, tightening in sovereign EM spreads and US dollar depreciation.

Our framework confirms the increasing likelihood of a recovery in the global economy. In fact, our regional leading economic indicators suggest this recovery may be already underway in the eurozone and the UK, in sharp contrast with market consensus and recent downward growth revisions by the European Central Bank and Bank of England.

While it is premature to assume durability in this rebound, signs of stabilisation in Europe provide an important signal of resilience in the region that is most vulnerable to economic and confidence shocks from the Ukraine/Russia war. Indeed, this rebound in European indicators is led by a bottoming out in consumer sentiment surveys and improving manufacturing business sentiment.

Overweight portfolio risk vs. benchmark, overweight equities, credit, emerging markets and cyclicals. Source: Invesco Investment Solutions, Dec. 31, 2022. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Download the PDF report to read our views in full. We discuss the macro backdrop and share insights on various regions and asset classes.