Responsible investment philosophy at Invesco

Invesco has been associated with Responsible Investing for over 30 years now. Invesco’s Responsible Investment framework encompasses investment stewardship as an asset manager and corporate social responsibility as a corporate citizen.

As a responsible corporate citizen, Invesco is committed to adopting and implementing responsible investment principles in a manner that is consistent with our fiduciary responsibilities to clients and it has strengthened its industry position in responsible investment stewardship in several impactful ways, including industry advocacy, leadership and innovation.

To reflect this commitment, we became a signatory of the Principles for Responsible Investment (PRI) in 2013 and have been awarded an A+ rating for our overall approach to responsible investment (Strategy and Governance) for the fourth consecutive year in 2020, as well as achieving an A or A+ across all categories for incorporating ESG into our investment practices.1

We are disclosers to Carbon Disclosure Project (CDP) and supporters of Task Force for Climate-related Financial Disclosure (TCFD).

Our Responsible Investing approach as an asset manager is focus on integrating ESG risk and opportunity factors into investment decisions. This integration extends to engagement and active ownership in that we discuss with investee companies or issuers material ESG factors, track and monitor engagement. ESG integration combined with active engagement are the pillars of our ESG approach. We have built a holistic framework that analyses qualitative inputs, quantitative impacts, investment decisions, and active ownership. We believe active ownership is one of the most effective mechanisms to reduce risks, enhance returns, and have a positive impact on society and the environment.

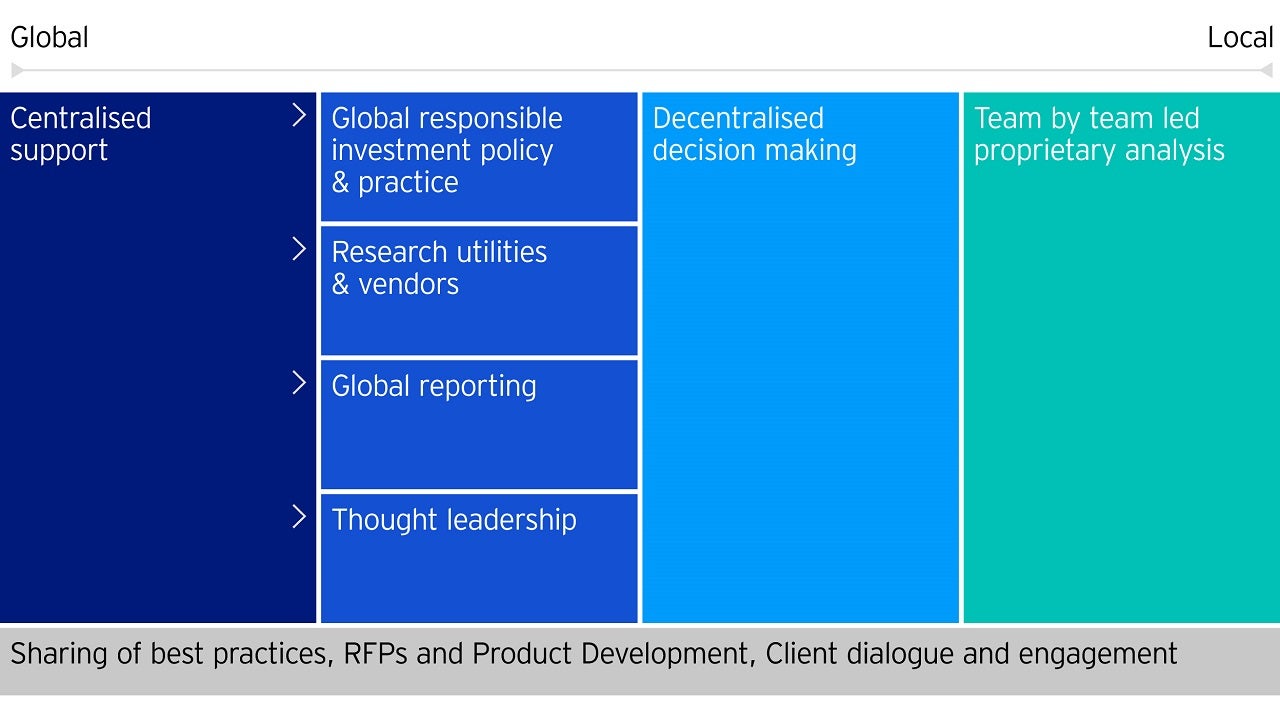

From the top down, Invesco merges centralized support with decentralized decision making. The Corporate Responsibility Committee promotes effective social responsibility for the firm, establishes best-in-class capabilities around key governance topics, and works with investment teams in incorporating ESG-related dynamics into their processes. While there is global centralized support, the decision making happens on the ground-level with the investment analysts who know their asset classes and sectors best.

Shared ethos of corporate and investment stewardship establishes organization cultural alignment as our baseline

Investor member of the Institutional Investors Group on Climate Change (IIGCC) – Joined in January 2020

PRI Investor Signatory since 2013 - we became a signatory of the UN-backed Principles for Responsible Investment in 2013 and have since achieved an A+ in Governance and Strategy for 3 consecutive years. This rating demonstrates our extensive efforts in terms of ESG integration, active ownership, investor collaboration and transparency.

Task Force for Climate Related Disclosure (TCFD) Supporter (since March 2019) and disclosers, first disclosure March 2020

Carbon Disclosure Project (CDP) discloser since 2016. The 2019 Score was B-. Invesco is also Investor member of CDP Council of Institutional Investors (CII) – since 2019

Sustainability Accounting Standards Board (SASB) – since 2019

Farm Animal Investment Risk & Return Initiative (FAIRR) – since 2019

Member of the Council of Institutional Investors (CII)

UK Stewardship Code (Tier 1) – Since 2013

Quoted Companies Alliance (QCA) – since 2018

Climate Bonds Initiative – partner since May 2020

UK Sustainable Investment and Finance Association (UKSIF) – since 2017

Investment Association (UK)

Italian Sustainable Forum (ITASIF)

Asian Corporate Governance Association (ACGA) – since 2012

Responsible Investment Association (RIA) (Canada) – since 2018

Global Real Estate Sustainability Benchmark (GRESB) Participant Member – since 2014

Japanese Stewardship Code signatory – since 2014

Investment stewardship

Climate Action 100+ participating as leader in selected companies - January 2020

Coalition for Climate-Resilient Investment (CCRI) - founding member - January 2020

Sustainability Accounting Standards Board (SASB) Standards Advisory Group - Since 2019

UKSIF Board of Directors - since 2018

ICI Global ESG Task Force - since 2018

Climate Financial Risk Forum (CRRF) (UK) - since 2019

Climate Financial Risk Forum (CRRF) Risk Working Group (UK) - since 2019

Active participation in PRI advisory committees and working groups, such as currently the PRI Taxonomy Consultation Group - since January 2020

Invesco has been also been a member of various other PRI committees/ groups in the past, including:

o PRI Fixed Income Advisory Committee

o PRI Global Policy Reference Group

o PRI Macroeconomic Risk Advisory Group

o PRI Plastics Investor Working Group

Quoted Companies Alliance (QCA) Financial Reporting Expert Group (UK) - since 2019

Investor Forum (UK) - since 2015

Asia Investor Group on Climate Change (AIGCC) - since 2020

Climate Change

Environmental issues, including climate risks and opportunities, impact our business, our stakeholders and the communities in which we operate. We believe proactively managing risks and opportunities associated with climate change reinforces our ability to deliver an investment experience with enhanced risk-adjusted return potential.

We view climate change as an evolving issue and we are continuously building on our approach to managing risks and opportunities associated with climate change. We consider climate change issues as one component of our ESG investment practices as well as how we operate our company.

For example, some of our climate change projects include carbon offsetting initiatives. In 2019, we offset a portion of our 2018 corporate air and rail travel that was booked via American Express. Through these offsets, we invested in a landfill energy conversion project at Spartanburg Landfill Gas in South Carolina, US, and a conservation project at Rimba Raya Biodiversity Reserve in Indonesia. We plan on offsetting our 2019 business travel greenhouse gas (GHG) emissions, too, and are currently working on finding the right program. For detailed discussion of Invesco’s current approach and status of managing climate change risks, see our new Climate Change report.

Climate-related investment risks and opportunities, as well as the responsibility for identifying material issues, is considered for some of our investment strategies and products. Moving forward, we intend to apply scenario analysis to a selection of our investment funds, as well as incorporate these considerations in our full global investment portfolio by 2023.

Related insights

Footnotes

-

1 2020 Assessment Reports for Invesco Ltd., PRI. The investment categories are evaluated using six performance bands (A+, A, B, C, D, and E), where A+ distinguishes the top scoring signatories, representing a score of 95% or above and A distinguishes a score of 75% or above. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

Important information

-

All information is at 30/09/20.

This marketing communication contains information that is for discussion purposes only and is exclusively for professional investors in Austria, Belgium, Denmark, Dubai (DIFC), Finland, France, Germany, Guernsey, Isle of Man, Italy, Jersey, Lichtenstein, Luxembourg, Netherlands, Norway, Spain, Switzerland, UK. This marketing communication is not for consumer use, please do not redistribute.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.