Fixed Income A proven approach

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

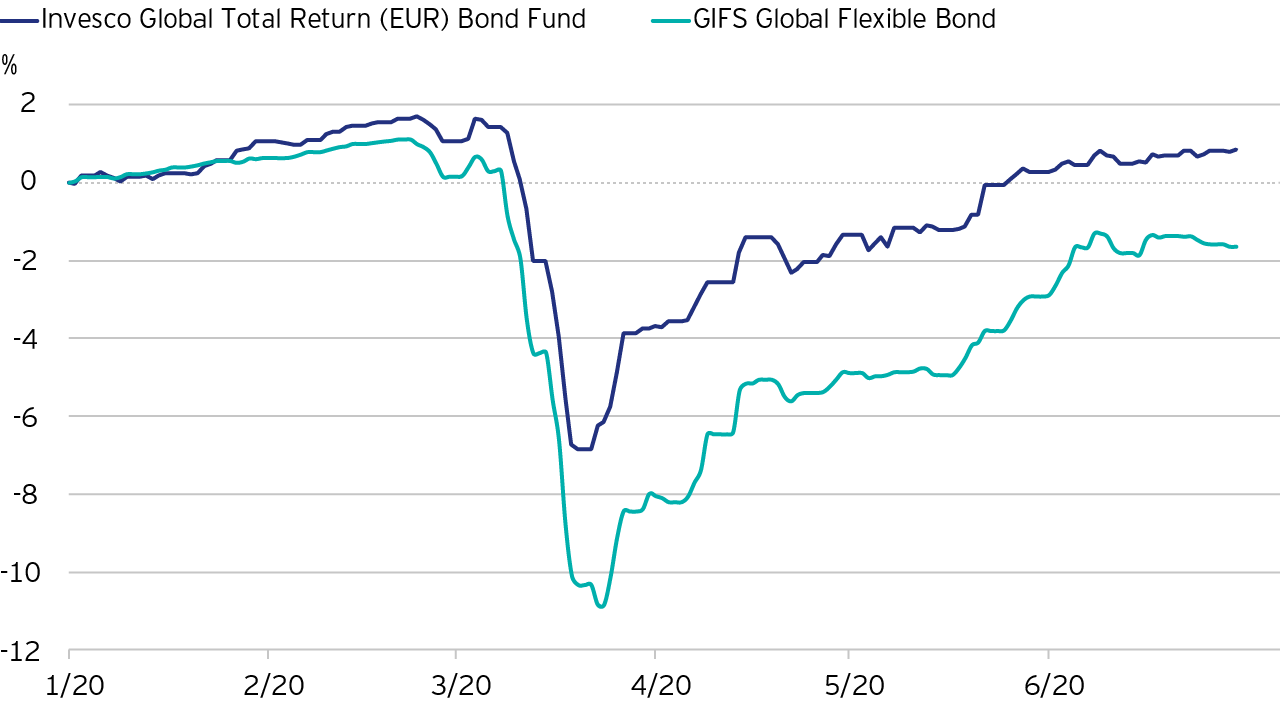

The Invesco Global Total Return (EUR) Bond Fund performed well in its peer group during the Covid-19 led market sell-off, it having only modest amounts of credit risk and sufficient duration. As illustrated in figure 1, the fund’s drawdown was much shallower than many of its peers and much of the loss has now been recovered with year to date returns to the end of June positive for the fund.

At the start of the period, two-thirds of the fund was allocated to cash, core government bonds and bonds maturing within 1-year). 28% was held in credit risk with the two largest exposures, subordinated financials and emerging market bonds. Currency exposure included some emerging markets as well as oil producers such as Norway.

| 30-06-15 30-06-16 |

30-06-16 30-06-17 |

30-06-17 30-06-18 |

30-06-18 30-06-19 |

30-06-19 30-06-20 |

|

| Invesco Global Total Return (EUR) Bond | -0.71 | 4.15 | -1.63 | 4.98 | 2.52 |

| GIFS Global Flexible Bond | -0.20 | 3.34 | -1.99 | 2.68 | -0.33 |

Past performance is not a guide to future returns. Data as at 30 June 2020. Fund performance figures are shown in euros, inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs. The figures do not reflect the entry charge paid by individual investors. Sector average performance is calculated on an equivalent basis. Source: Invesco, © Morningstar 2020. All rights reserved. Use of this content requires expert knowledge. It is to be used by specialist institutions only. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results. The performance data shown does not take account of the commissions and costs incurred on the issue and redemption of units. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

The flexibility of the Invesco Global Total Return (EUR) Bond’s mandate, and the fund managers’ willingness to use it, can be seen in the historical asset allocation and duration positioning.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date. Changes in interest rates will result in fluctuations in the value of the fund. The fund uses derivatives (complex instruments) for investment purposes, which may result in the Fund being significantly leveraged and may result in large fluctuations in the value of the fund. Investments in debt instruments which are of lower credit quality may result in large fluctuations in the value of the Fund. The fund may invest in distressed securities which carry a significant risk of capital loss. The fund may invest extensively in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events. The fund may invest in a dynamic way across assets/asset classes, which may result in periodic changes in the risk profile, underperformance and/or higher transaction costs.

This marketing communication is exclusively for use by Professional Clients and Financial Advisers in Continental Europe (as defined below), Qualified Investors in Switzerland, Qualified Clients/Sophisticated Investors in Israel and Professional Clients in Cyprus, Jersey, Guernsey, Isle of Man, Malta and the UK. This document may also be used by financial intermediaries in the United States as defined below. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise. This document is not for consumer use, please do not redistribute. Data as at 30.06.2020, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports , the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.

This marketing communication is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. Please be advised that the information provided in this document is referring to Invesco Global Total Return (EUR) Bond Fund Class A ( accumulation - EUR) exclusively. This fund is domiciled in Luxembourg.