Kristina (00:05):

Hi, I'm Kristina Hooper, Chief Global Market strategist at Invesco, and I'm delighted to bring you our 2023 investment outlook. Back in September, the World Bank warned that central banks around the world have been raising interest rates this year with a degree of synchronicity not seen over the past five decades, which has increased the risks facing the global economy. The outlook for the global economy is largely dependent on central bank actions, and the path of monetary policy going forward is very reliant on the path of inflation going forward. So to address the breadth of possibilities that lie ahead in this environment, we have provided a base case scenario which we believe is highly probable, as well as an alternate scenario that we believe is less likely.

(00:56):

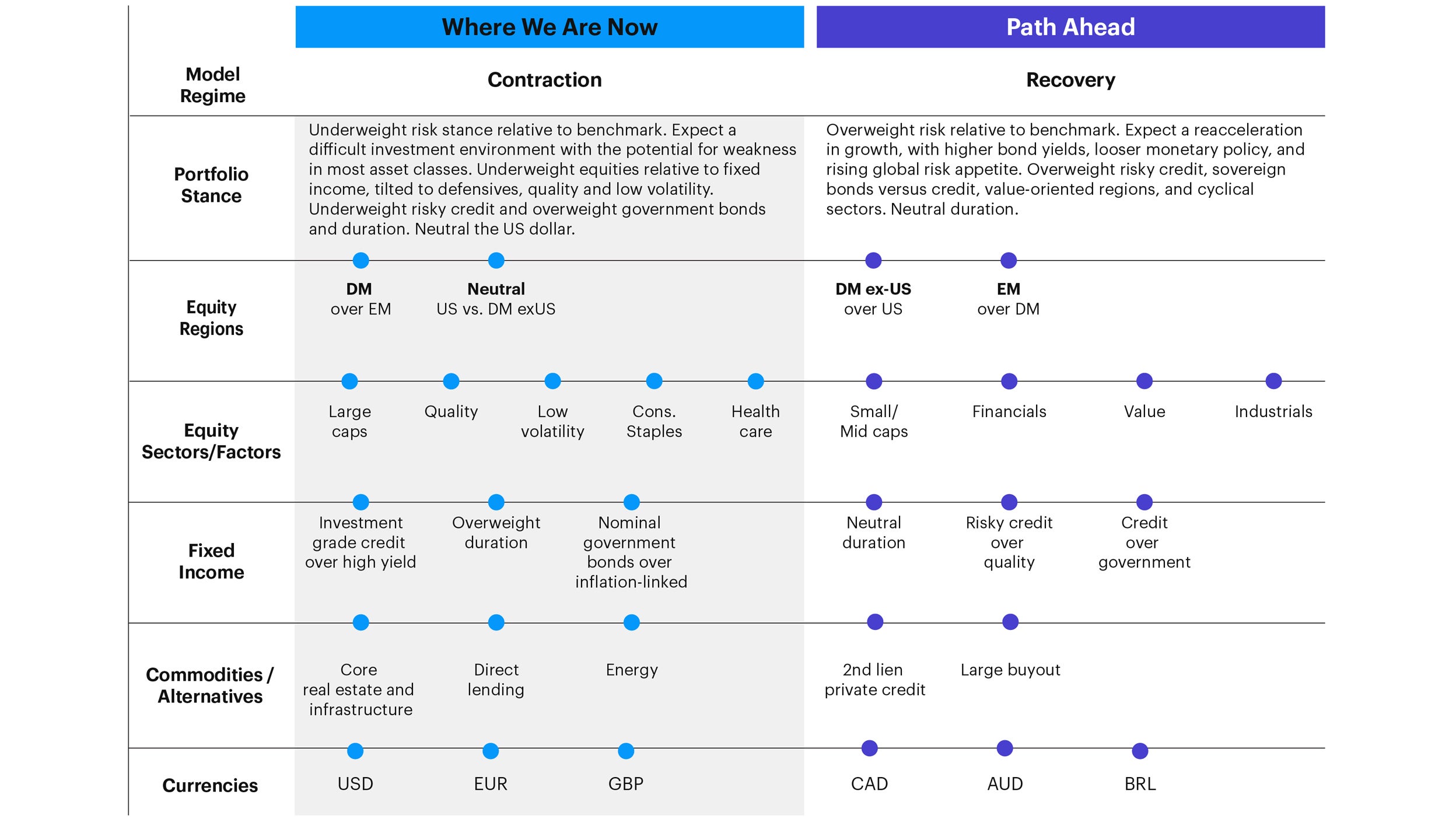

So let me start with the base case. We believe we're currently in the contraction phase of the economic cycle with global growth below trend and decelerating, which we expect will continue in the near term. We think the contraction globally will be a modest soft patch, although some economies will be hit harder than others. So as 2023 begins, we would favor a defensive position tactically. Now we expect inflation to moderate and central banks to pause tightening in the first half of 2023. The market is likely to begin to anticipate this in advance of an actual pause, which would mean the economic recovery would start to be priced in. We expect the economic recovery to unfold later in the year, where global growth will be below trend, but rising.

(01:48):

In our alternate scenario, inflation remains stubbornly high, forcing central banks to continue tightening monetary policy for longer. In our view, this would maintain the contraction regime for longer than we anticipate in our base case. We would expect this to increase the probability of a global recession, resulting in worse growth and further pain in risk assets. Thank you for listening. For further details, including our detailed asset allocation views, please download our complete Invesco 2023 Investment Outlook.