Embracing LNG

Cleaner fuels

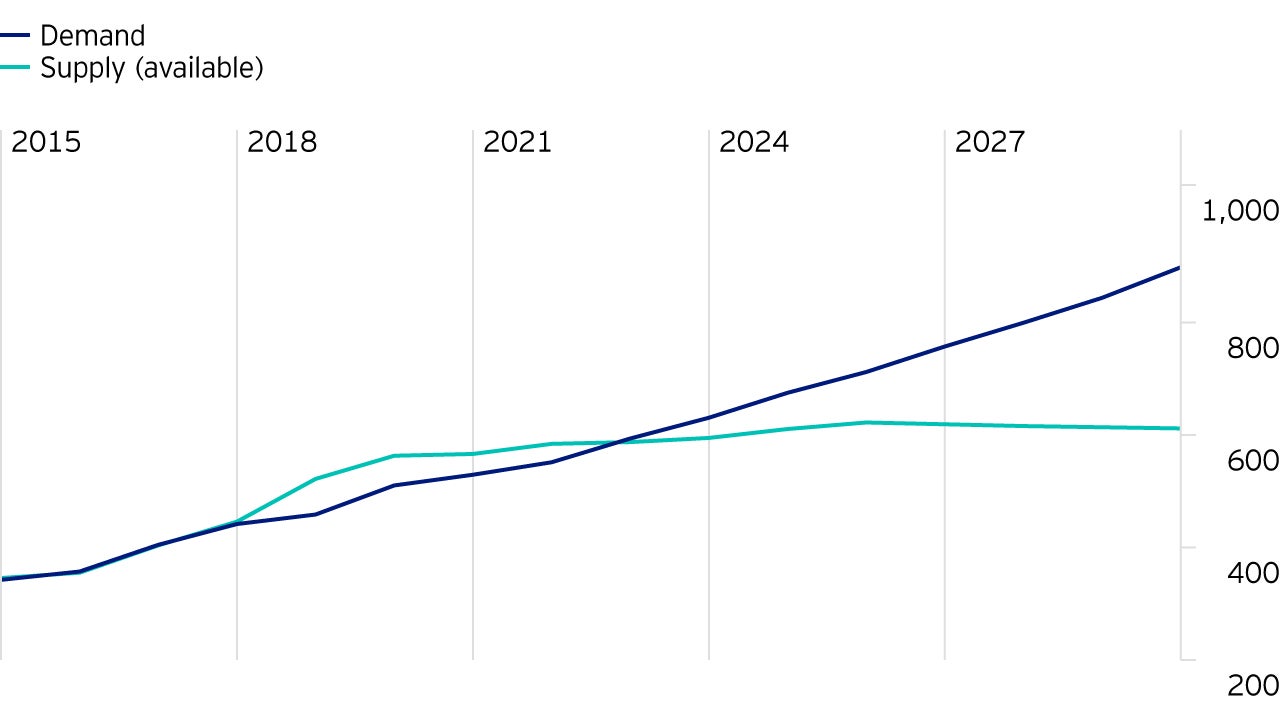

Global interest in cleaner fuels is helping to increase the demand for LNG. We expect this trend to continue into the foreseeable future.

Two major structural shifts are happening now: the globalisation of LNG - traditionally a local or, at best, regional commodity - and the political will in China and elsewhere in Asia to secure affordable, reliable, and clean energy.

LNG has long been viewed as the “fuel of choice,” a privilege confined either to producing countries like the US and Russia, or to the domain of the economically developed, like Europe or Japan.

We believe that this old-world view is now collapsing.

Earlier last year, China became the largest importer of natural gas, overtaking Japan.

LNG specifically is becoming the “fuel of necessity,” with growth likely to be driven by China and other Asian countries.

Our meetings with policymakers in China reconfirmed this outlook - fostering a healthy environment is being viewed as critical to maintaining social stability, and nurturing gas consumption are integral to both.

The supply side is shifting as well.

Qatar, which accounted for nearly a third of the market in 2016, will likely be temporarily overtaken by Australia next year.

The US, irrelevant on the LNG map until three years ago, could account for one-sixth of global LNG production as soon as 2020.

Finally, Russia should challenge all three contenders for the LNG throne, securing at least one-tenth of the market by the middle of the next decade, and a credible chance to become the “next Qatar” in the long run.

Investment approach

Our approach to investing in commodity companies is no different from our approach with any other sector.

We look for companies with a unique and scalable asset base, management/owners who are culturally inclined to consistently create value, and stock valuations that, for some temporary reasons, reflect neither of these strengths.

Novatek

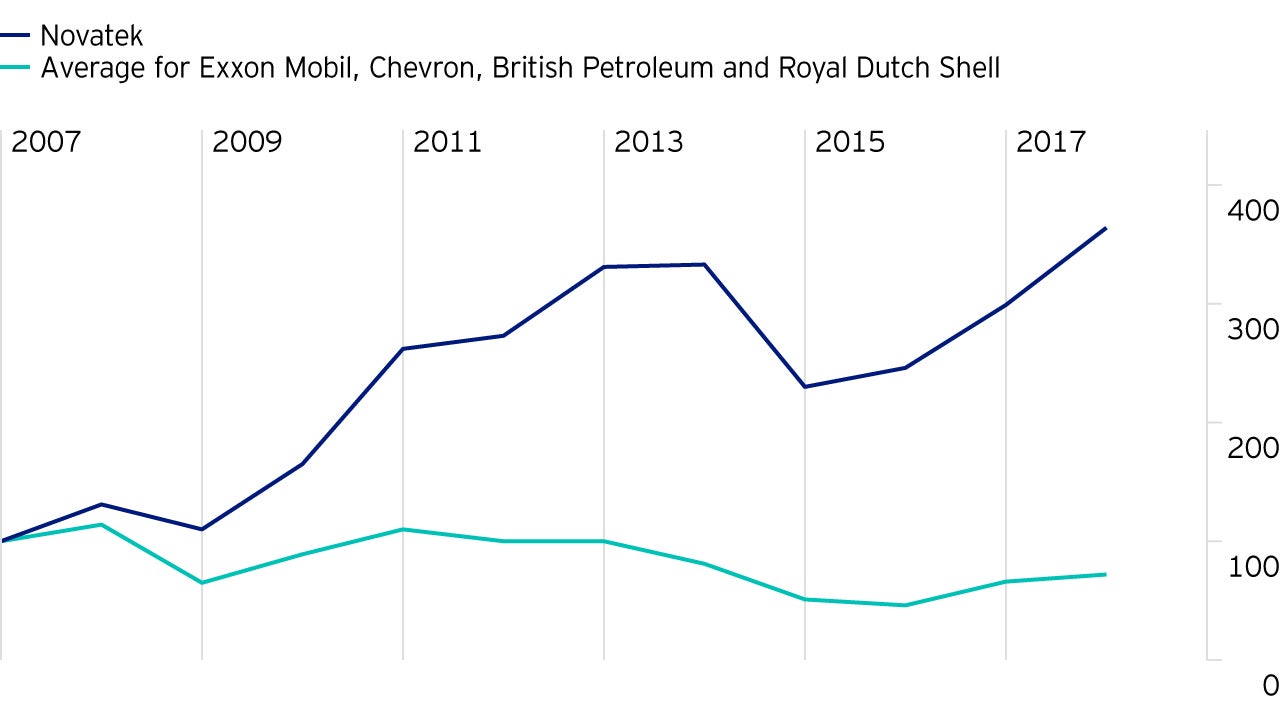

Our search has been global, but we believe one of the most promising opportunities is Novatek, a Russian-listed private gas company. (This stock is held in the Invesco Developing Markets Equity Strategy).

While the entire industry was suffering from a lack of capital discipline, Novatek launched its first and the world’s largest (non-government owned) LNG project - Yamal LNG - at the end of 2017.

It did so on time, on budget, and in the harshest environmental conditions imaginable (the Russian Arctic).

Many of the firm’s future projects, in our view, will enhance its strengths.

Novatek’s long-term strategy is to increase its LNG production capacity target to 70 million tonnes per year by 2030, up from a previous target of 57 million.

Hence, we were not surprised last year when the French oil and gas company Total SA acquired a stake in its second future project (Arctic LNG-2) at a valuation of more than half of Novatek’s market capitalisation.

In May this year, Novatek announced that its third major LNG plant in the Yamal-Nenets Autonomous District will be launched in 2022 (Obsky LNG).

Given the Russian government’s focus on developing LNG, and what we perceive as Novatek’s flawless execution over its 24-year history, and its strong partners like Total and China’s CNPC, we see a bright future for this company.

Investment risks

- The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. As a large portion of the strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in value. The strategy invests in a limited number of holdings and is less diversified, and therefore this may result in large fluctuations in value. Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Important information

- This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities. Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. Further information on our products is available using the contact details shown.

How can we help?

Let us know using this form and one of our specialist team will quickly get back to you.