Markets and Economy Higher earnings visibility and growth offered by domestic sectors

In China, we expect the domestic economy to fully recover and, at the same time, US-China tensions to continue for the foreseeable future.

Digital trend is supported by improving infrastructure spend and innovative corporate strategies.

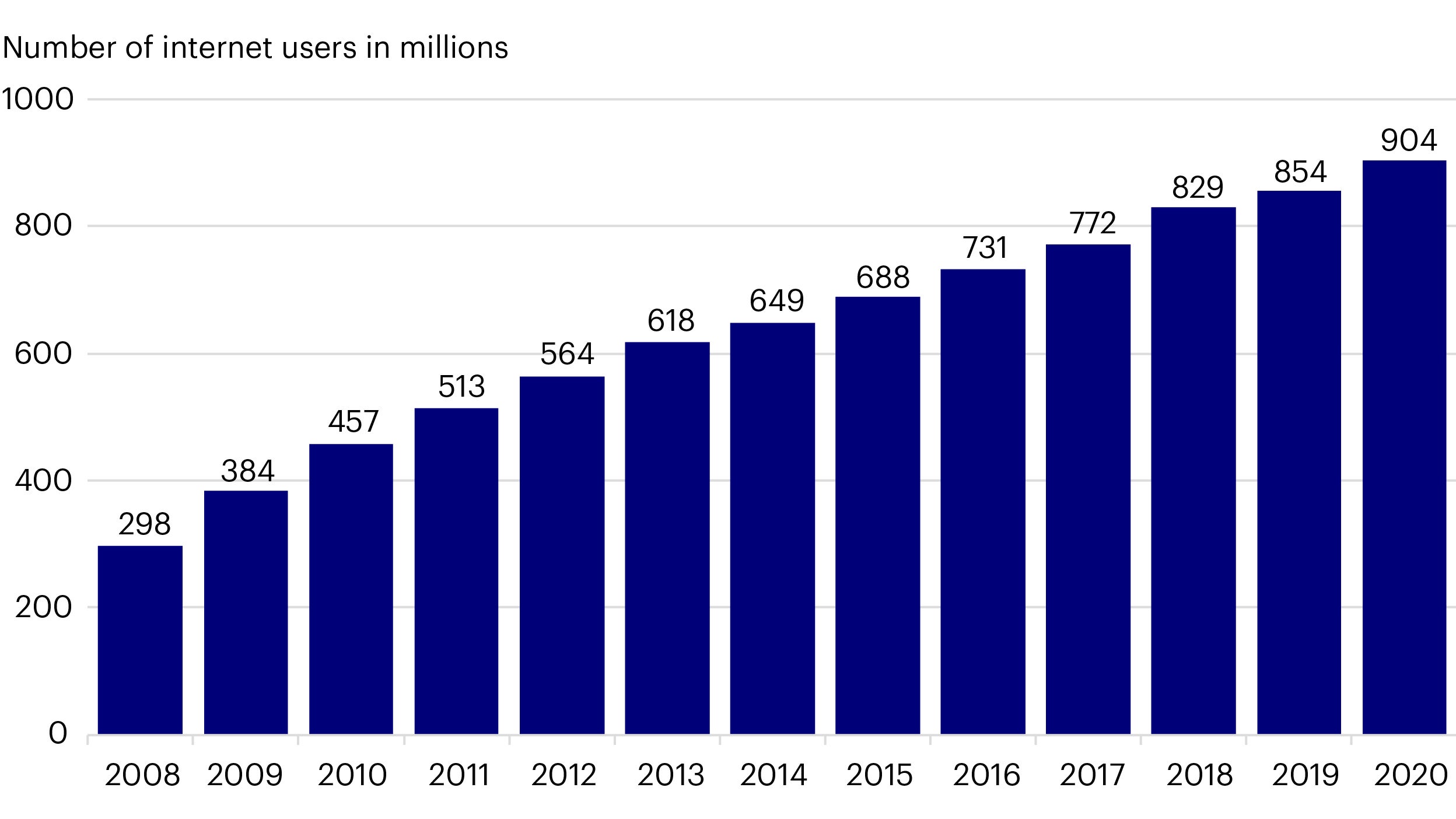

Compared to five years ago, the average download speed of mobile broadband in China has increased by about six times while the fee for mobile internet (mobile phone users accounted for 99% of the internet users) has dropped by over 90 percent. A faster internet service at lower cost has greatly boosted usage growth. China is now a digital society with more than 900 million internet users (figure 1). It has pledged to invest more than US$3.78 trillion in new digital infrastructure over the next 5 years1. In 2020 alone, as much as US$423 billion has already been allocated to projects including 5G base stations, data centres and artificial intelligence.

The digital trend is very evident. A Chinese consumer’s daily life involves frequent engagements with different types of online platforms offering both products and services. This has encouraged many internet companies to use innovative strategies to engage consumers. The importance of the digital trend can be seen in the MSCI China index composition where the communication services and consumer discretionary sectors constitute more than 20% of the index. The large companies in these sectors are mainly in the internet space.

A good example is our holding in an online platform which is capitalising on the growing digitalisation of consumer markets. Despite being a late comer to the food delivery market, the company gained market share from its competitors to become the number one platform for food delivery. Using this position, it has been successful in cross-selling higher-margin lifestyle services in leisure and entertainment.

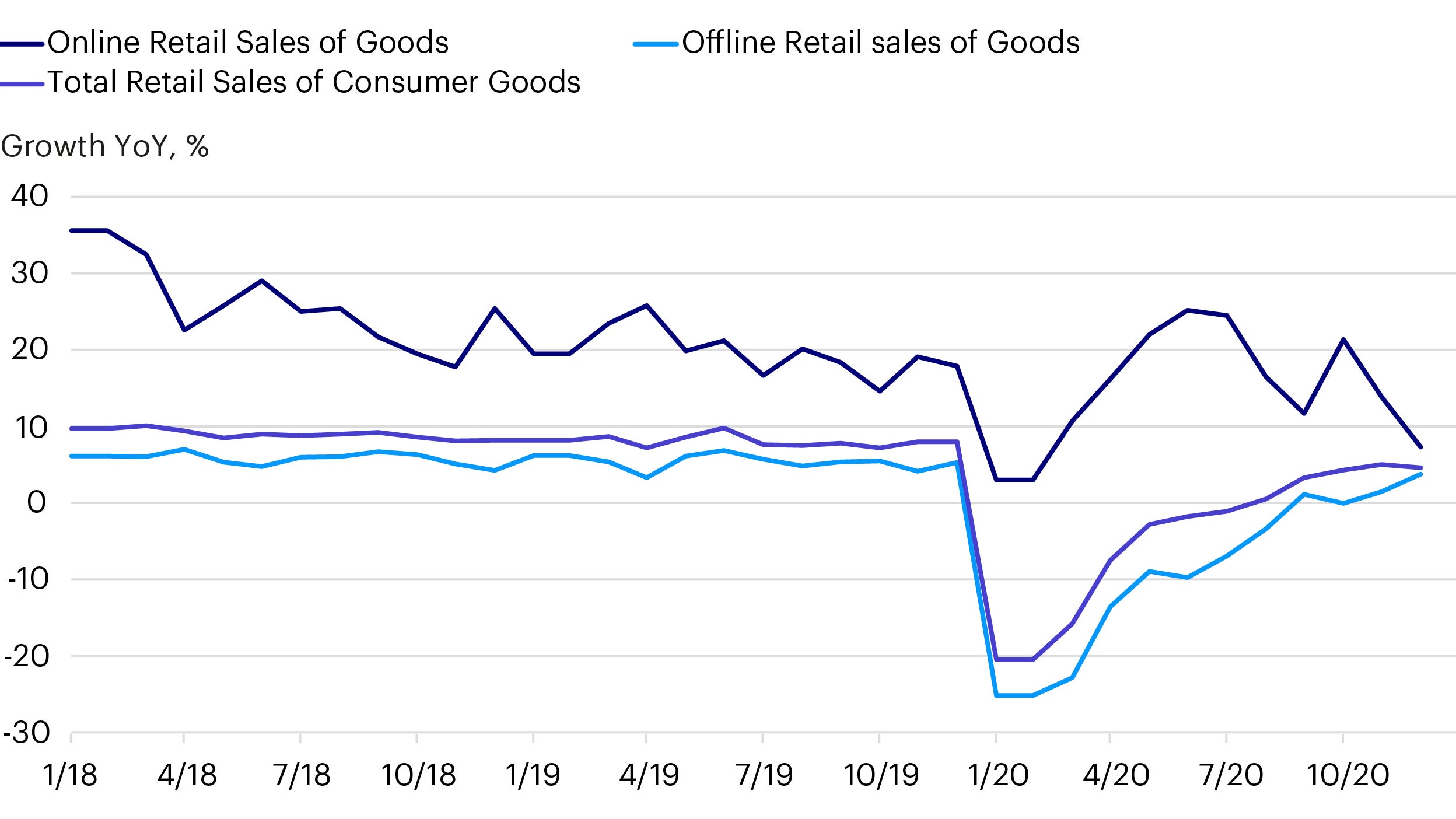

The Covid-19 outbreak is accelerating the digital trend by encouraging the purchasing of products and services on-line. E-commerce platforms acted fast to capitalise on this growth by launching a new shopping festival, Double Five, throughout which customers were provided with discounts and incentives to generate strong sales growth. The Covid-19 outbreak also encouraged other new strategies. For instance, a leading internet conglomerate (a holding) introduced an international version of its cloud-based video conferencing tool in more than 100 countries to capture market share. These strategies resulted in the e-commerce retail sales growth remaining resilient during Covid-19 (figure 2).

The Covid-19 backdrop also led to the emergence of new markets such as the telemedicine market. During the crisis, e-commerce platforms, which had previously just delivered drugs or booked appointments, began to provide treatment and advice. For example: a subsidiary of our holding in a large online platform claimed that monthly consultations had grown tenfold since the outbreak: an arm of another large platform (a holding) launched a free “online clinic”; and WeDoctor, an app backed by a leading internet conglomerate (a holding) mobilised 20,000 physicians to work online during the epidemic thereby encouraging the use of its platform going forward.

1 Source: Haitong Securities as of May 2020.

In China, we expect the domestic economy to fully recover and, at the same time, US-China tensions to continue for the foreseeable future.

Our investment strategy favours private enterprises. They are highly competitive and innovative, constantly utilising new technologies to deliver market leading products and services.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. As a large portion of the fund is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the fund. As this fund is invested in a particular country, you should be prepared to accept greater fluctuations in the value of the fund than for a fund with a broader investment mandate. The fund may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the fund. The fund invests in a limited number of holdings and is less diversified. This may result in large fluctuations in the value of the fund.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Data as at 31 May 2020, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports , the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.

This is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. Please be advised that the information provided in this document is referring to Invesco China Focus Equity Fund Class A (accumulation - USD) exclusively. This fund is domiciled in Luxembourg.