Tactical Asset Allocation - November 2024

Synopsis

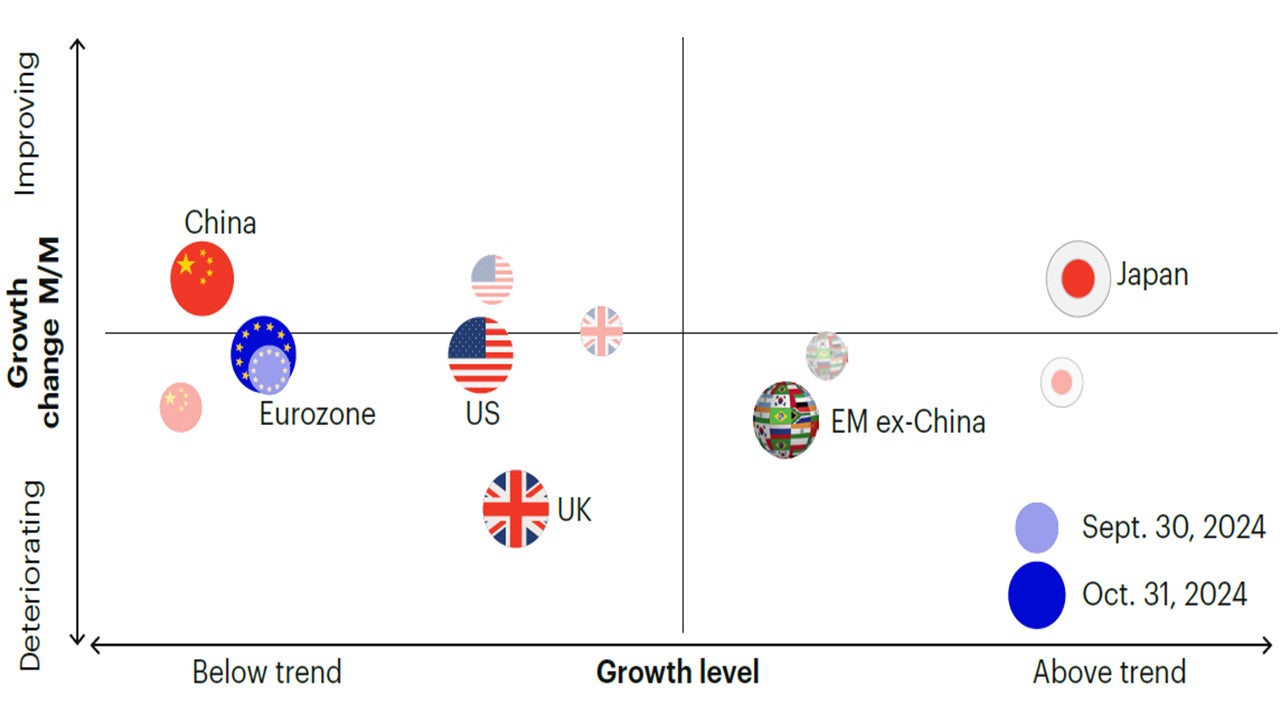

Chinese equities have given back approximately 50% of the rally following the announced monetary stimulus in late September. We believe China’s macro challenge resembles prior deleveraging episodes from the US, Japan, and Europe, and requires a much stronger commitment to sizeable and lasting fiscal stimulus. We remain underweight in emerging market equities.

Following our month-end update, financial markets responded to the US election outcome by repricing a meaningful positive growth shock for the United States, while the impact on global markets remains highly uncertain. These dynamics are consistent with two main policy drivers, namely fiscal spending and import tariffs.

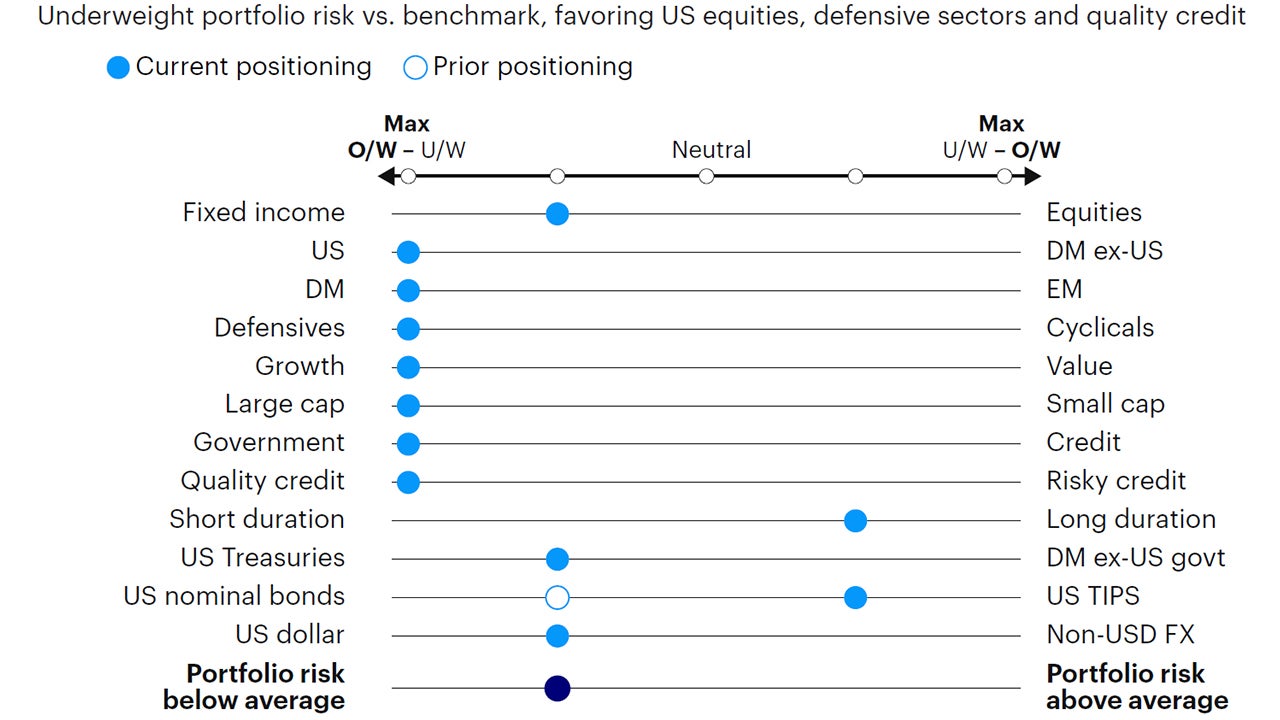

Our framework remains in a contraction regime. We maintain a defensive asset allocation relative to benchmark, overweighting fixed income relative to equities, favoring US equities and defensive sectors with quality and low volatility characteristics. In fixed income, we remain overweight duration and underweight credit risk. Maintain overweight to the US dollar.

Maintain defensive portfolio positioning. Overweight fixed income vs. equities, favoring US equities, defensive equity factors, higher duration, and credit quality.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update

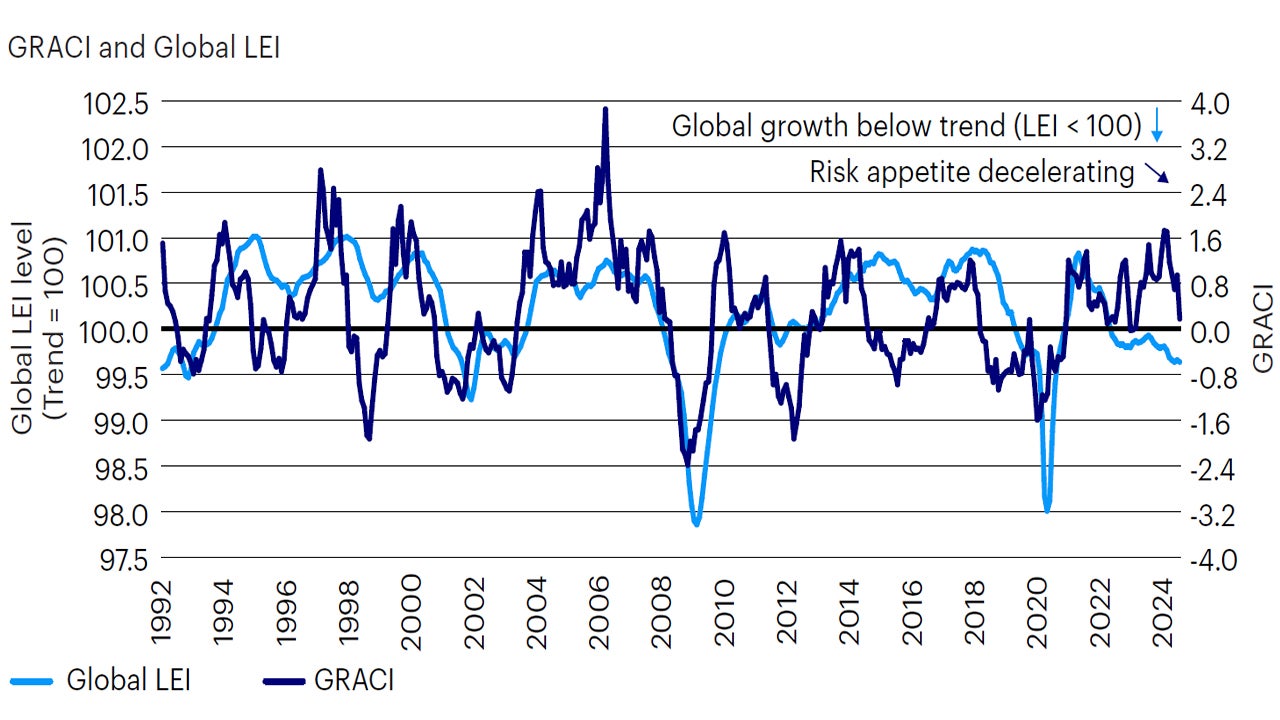

Ahead of the US election results, our macro framework indicated the global economy remains in a contraction regime of below-trend and decelerating growth, an environment identified since July. Leading economic indicators suggest growth remains broadly stable and below trend, while market sentiment and growth expectations adjusted to incoming information surrounding monetary policy, election cycles and earnings releases. By the end of October, our barometer of global market sentiment declined and remains on a decelerating trend, pointing to declining growth expectations. This deceleration can largely be attributed to the recent convergence in the performance between riskier and safer asset classes, coupled with fading contribution from strong market performance in 2023 when growth expectations experienced meaningful upward revisions in response to a goldilocks backdrop of falling inflation and stable growth. Following the result of the US election, and what appears to be a positive growth shock, at least for US assets, we will monitor the evolution of global risk appetite over the coming months and determine, through our rules-based process, whether a sustainable shift to rising market sentiment is taking place (Figures 1 and 2).

Over the past month, equity, credit, and government bond markets broadly experienced modest negative returns, with emerging markets and developed ex-US equities underperforming US equities, credit and government bonds. Following the strong outperformance between late September and early October, Chinese equities gave back approximately 50% of the rally, with market participants underwhelmed by the size and details of subsequent fiscal stimulus announcements. As detailed in our last note, these developments are in line with our expectations and belief that a much larger fiscal stimulus is required to address China’s macro challenges. Historical precedents, such as the US in the 1930s, Japan in the 1990s, and Europe in the post-GFC decade, are reminders of the inefficacy of easy monetary policy and cheap credit when the private sector is deleveraging in response to depreciated asset values following a debt-fueled cycle. As the private sector is collectively deleveraging, increasing the savings rate and shrinking domestic demand, larger fiscal stimulus is required for the public sector to step-in and offset the collapse in private demand.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of Oct. 31, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions as of Oct. 31, 2024.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of Oct. 31, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from Jan. 1, 1992 to Oct. 31, 2024. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

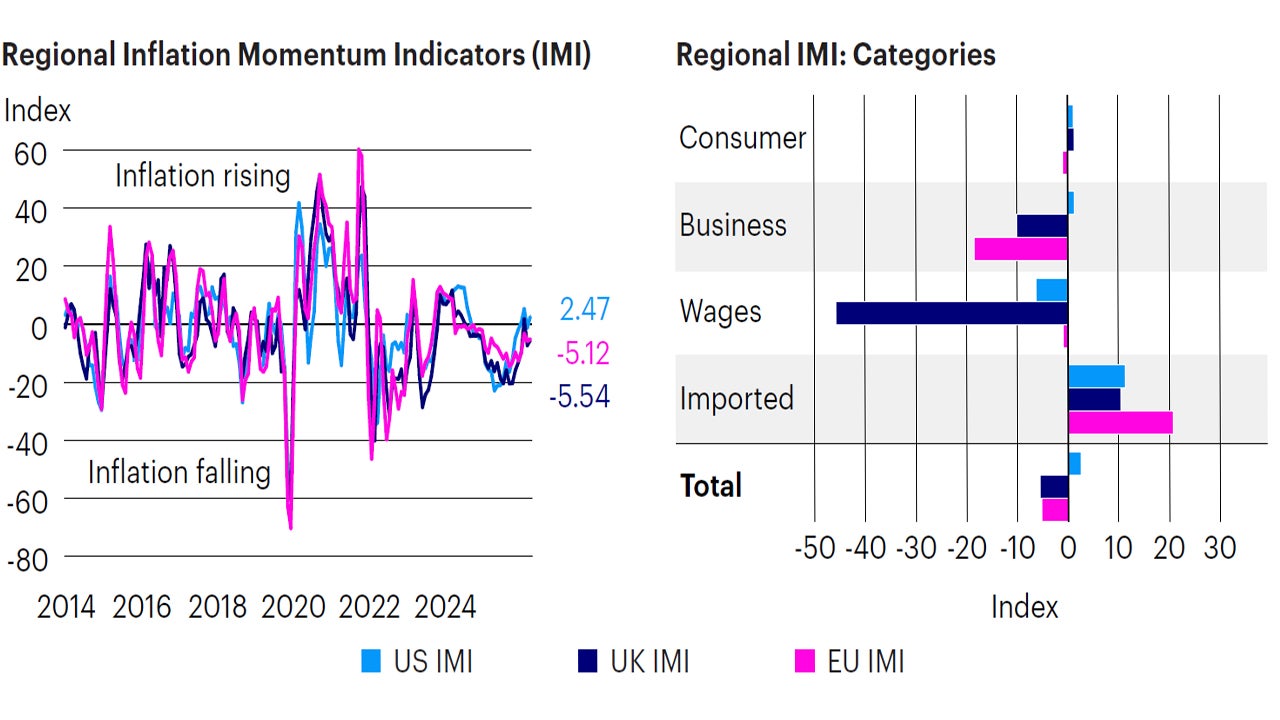

Sources: Bloomberg L.P. data as of Oct. 31, 2024, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

US elections

Following our month-end update, the US election delivered a definitive outcome for the White House and the US Senate while we await results for the US House of Representatives. Financial markets across asset classes have repriced a meaningful positive growth shock for the United States, as represented by the outperformance of US equities over fixed income, outperformance of cyclical sectors, small and mid-cap equities relative to large caps, the sell-off in Treasury yields, tightening in credit spreads and a strong rally in the US dollar. However, the impact on the rest of the world appears more mixed and uncertain, with international developed and emerging market equities underperforming due to US dollar strength and weakness in foreign currencies. These market dynamics are consistent with two primary policies expected to influence market dynamics in the foreseeable future, namely expansionary fiscal policies and import tariffs, with the latter explaining the headwinds for international equity markets. Regardless of the outcome for the House of Representatives, it appears fiscal spending and extension of tax cuts will likely take place. While the price action may stabilize over the next few days, it will be important to evaluate the resilience of risk assets given the rise in long-term Treasury yields in the medium term and the broader impact on global risk appetite outside of US assets.

Investment positioning

There are no changes in portfolio positioning this month. We underweight risk relative to benchmark in the Global Tactical Allocation Model,1 underweighting equities relative to fixed income, favoring US equities and defensive sectors with quality and low volatility characteristics. In fixed income, we underweight credit risk2 relative to benchmark and overweight duration via investment grade credit and sovereign fixed income at the expense of lower quality credit sectors. (Figures 4 to 7). In particular:

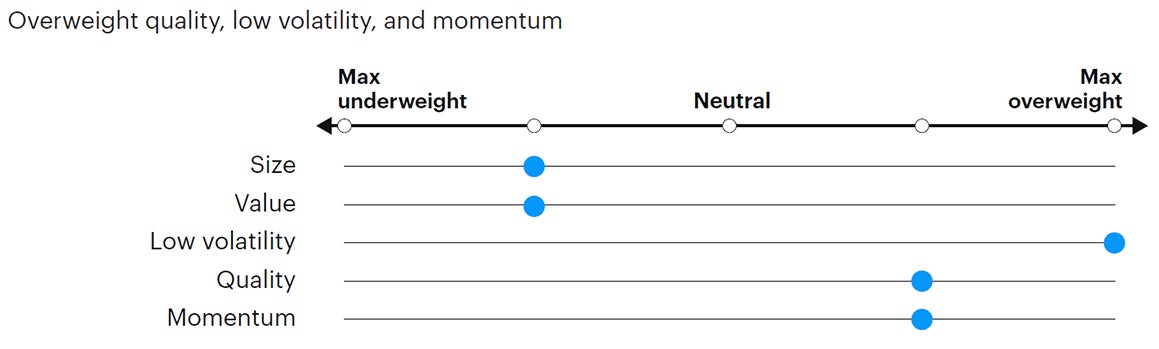

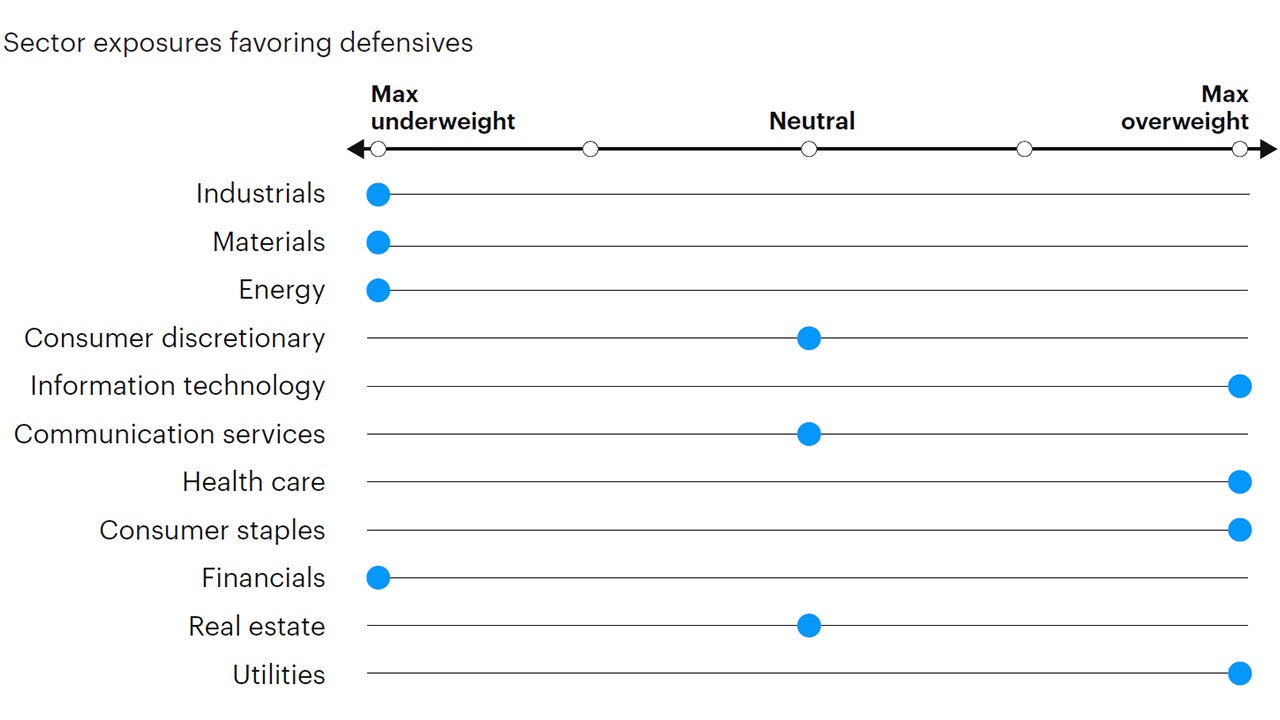

- In equities, we overweight defensive sectors with quality and low volatility characteristics, tilting towards larger capitalizations at the expense of value, mid and small caps. Despite the extended positioning in mega-cap quality names, we expect a combination of quality and low volatility characteristics to outperform and provide downside risk mitigation in a scenario of falling growth expectations, falling bond yields, and weaker equity markets. Hence, we favor exposures to defensive sectors such as health care, staples, utilities, and technology at the expense of cyclical sectors such as financials, industrials, materials, and energy. From a regional perspective, we maintain an overweight position in US equities relative to other developed markets and emerging markets, driven by declining global risk appetite, stronger US earnings revisions vs. the rest of the world, and a still favorable outlook for the US dollar.

- In fixed income, we underweight credit risk and overweight duration, favoring investment grade and sovereign fixed income relative to high yield. Credit spreads tightened further over the past month, clearly signaling resilience in credit markets. While the current backdrop does not suggest a major risk for credit spreads, downward revisions to growth expectations are likely to be accompanied by marginally wider spreads from cycle lows and lower bond yields, favoring higher quality and higher duration assets. In sovereigns, we have moved to a modest overweight in inflation-protected securities versus nominal bonds as the recent disinflation trend has faded (Figure 3).

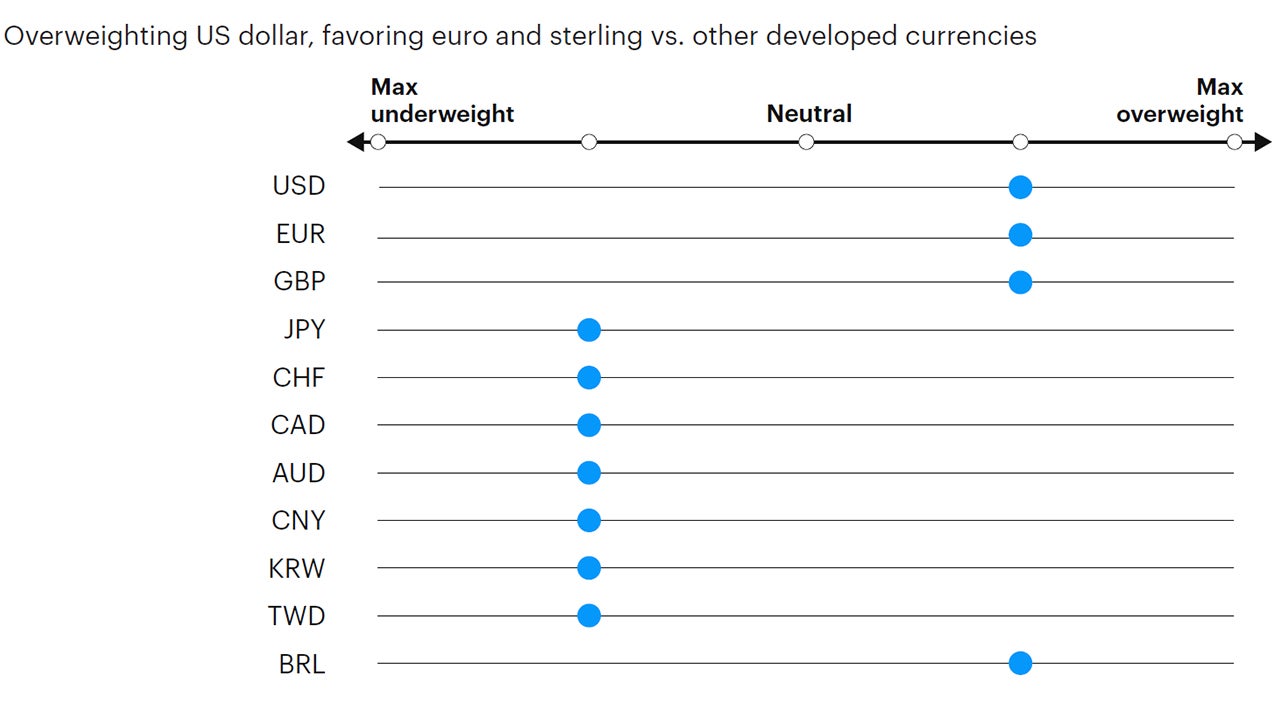

- In currency markets, we maintain a moderate overweight in the US dollar, as yield differentials with major foreign currencies are narrowing. However, overall higher yields and negative surprises in global growth still inform our position in favor of the greenback. Within developed markets, we favor the euro, the British pound, Norwegian kroner, Swedish krona, and Singapore dollar relative to the Swiss Franc, Japanese yen, Australian and Canadian dollars. In EM, we favor high yielders with attractive valuations, such as the Colombian peso, Brazilian real, Indian Rupee, Indonesian Rupiah, and Mexican peso, relative to low yielding and more expensive currencies, such as the Korean won, Taiwan dollar, Philippines peso, and Chinese renminbi.

Source: Invesco Solutions, Nov. 1, 2024. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, Nov. 1, 2024. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, Nov. 1, 2024. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Solutions, Nov. 1, 2024. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Footnotes

-

1

Reference benchmark 60% MSCI ACWI, 40% Bloomberg Global Aggregate Hedged Index.

-

2

Credit risk defined as duration times spread (DTS).