Tactical asset allocation - May 2024

Synopsis

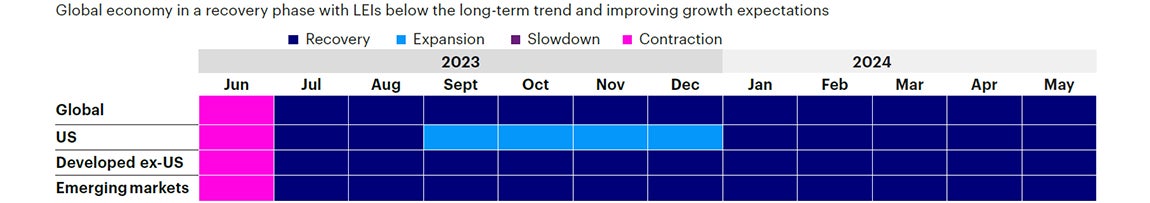

Recent underperformance in global equity and fixed income markets largely reflects higher discount yields and expectations for fewer rate cuts. Risk appetite and growth expectations, however, are improving.

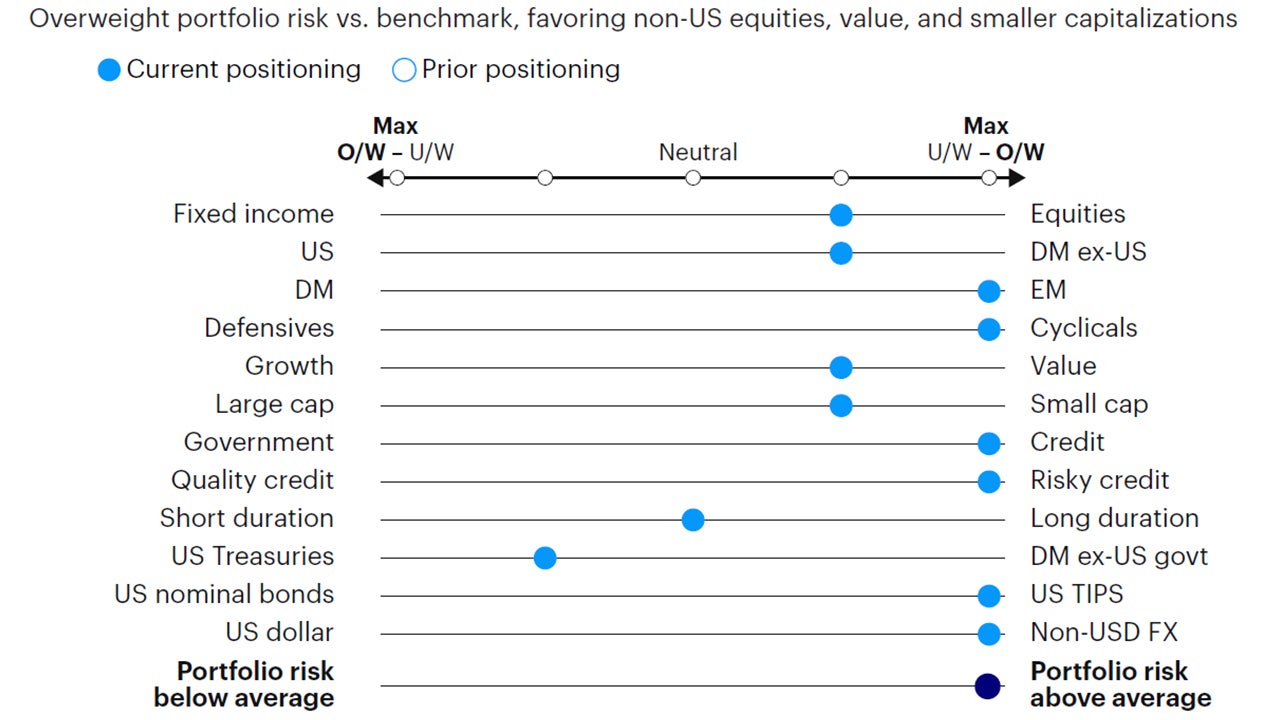

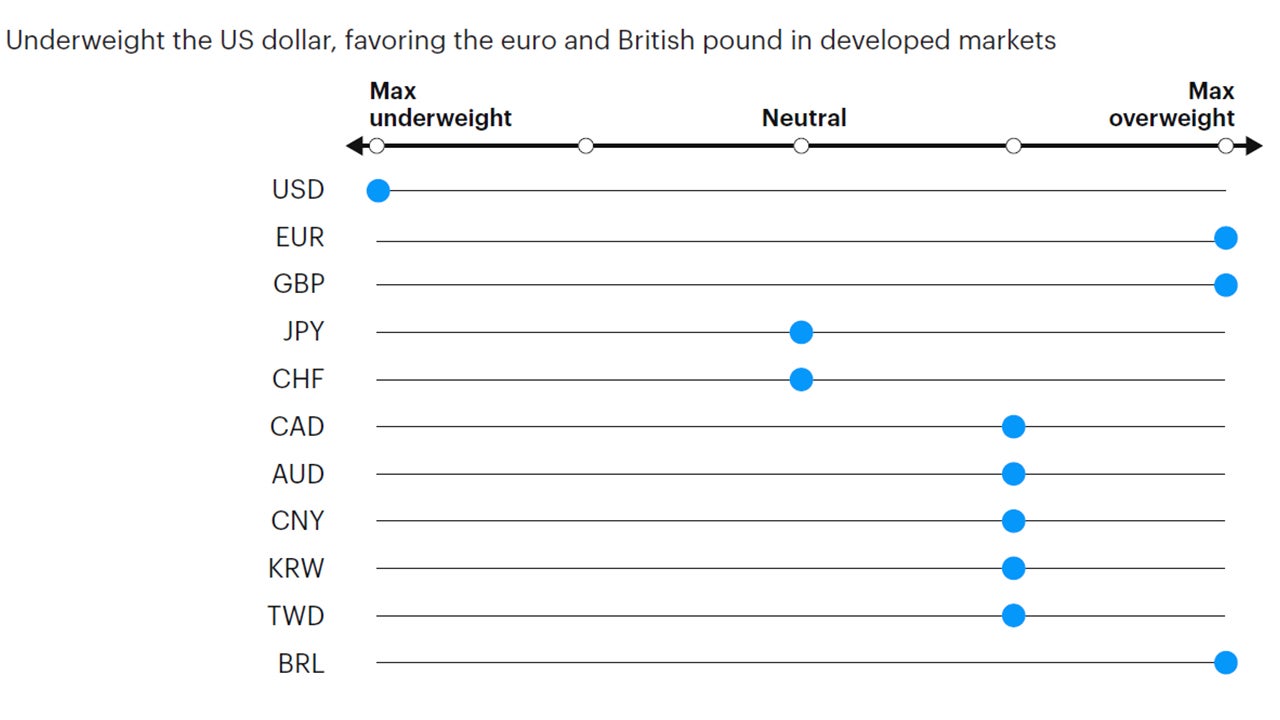

Overweight portfolio risk in the Global Tactical Asset Allocation model,1 favoring equities relative to fixed income, non-US equities, value, and smaller capitalizations. Overweight risky credit and neutral duration and underweight the US dollar.

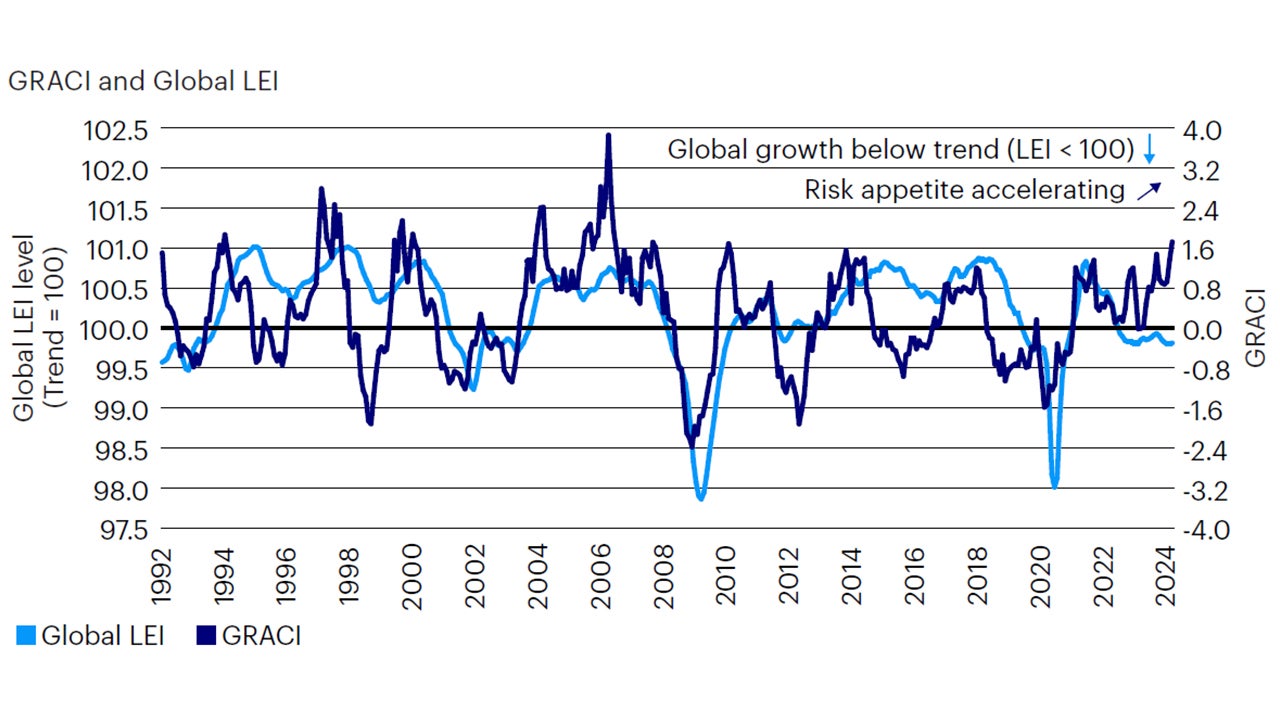

Risk appetite continues to increase, pushing above recent highs. Overweight equities, credit, cyclical factors, and international equities.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update

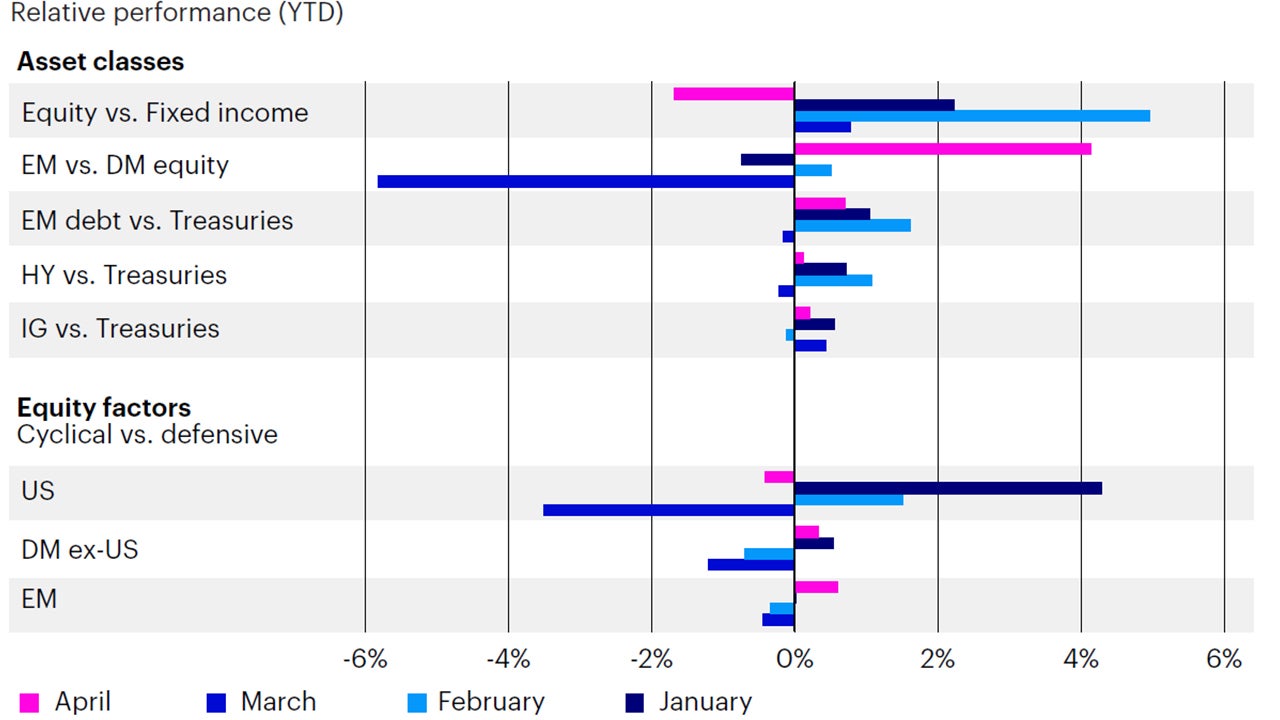

Rising bond yields over the past month were accompanied by modest negative returns across global equity and fixed income markets, on average. Asset prices adjusted to higher discount yields and the prospect of fewer policy rate cuts than anticipated at the beginning of the year. Our framework, however, suggests investor risk appetite and growth expectations are actually improving, as indicated by the global repricing of the relative performance between asset classes. Credit spreads across sectors and regions continue to tighten to cycle lows, exhibiting very low volatility.

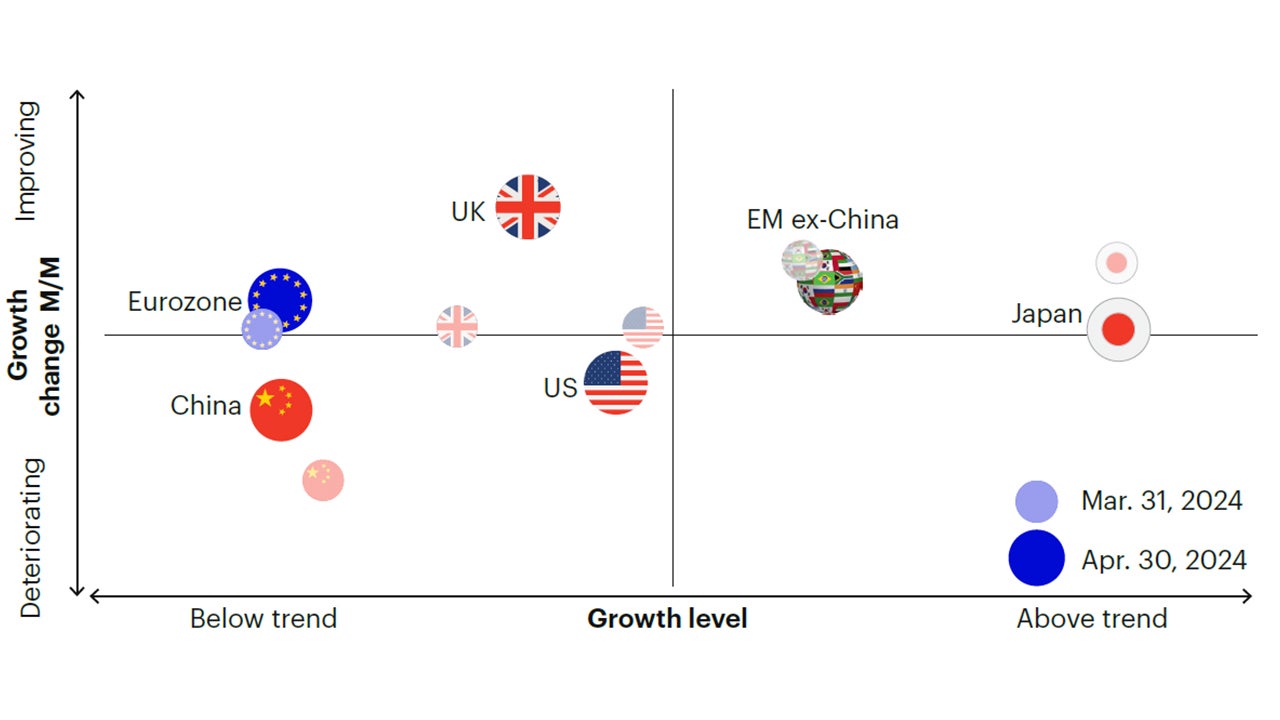

Emerging market equities have outperformed developed markets over the past three months, recouping almost all the underperformance year to date. The recent convergence in performance between equity sectors and styles (value versus growth) provides some evidence of widening market participation. Performance is moving from concentrated mega-cap quality technology names to more cyclical segments of the market, which are typically more levered to rising growth expectations (Figures 1, 2, and 3).

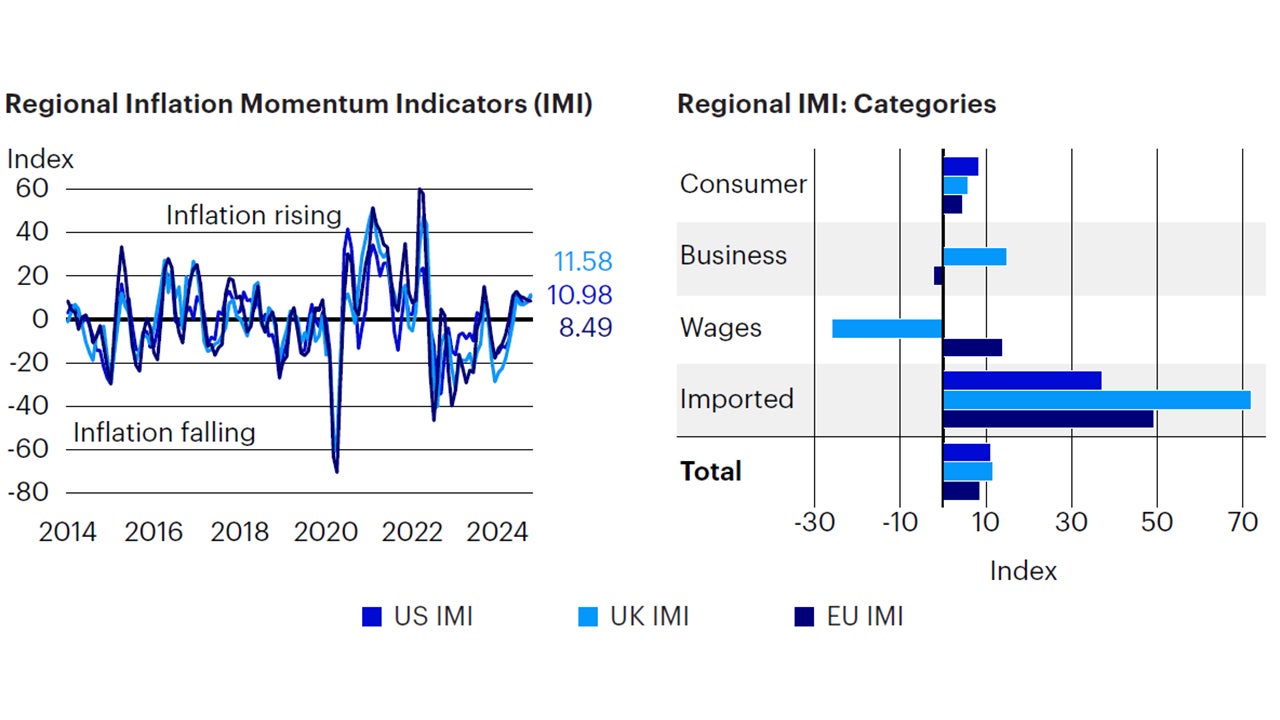

The recent upturn in inflation is a symptom of resilient demand and strong employment (Figure 4). While markets have reacted negatively to the rise in global bond yields, this was to be expected as future cash flows are discounted at higher rates.

We believe the big picture has not changed from a monetary policy perspective.

The tightening cycle has peaked, and the most likely scenario is one of rate cuts at some point in the future, maybe not in 2024. Overall, our macro framework confirms a favorable outlook with low but stable global growth with rising risk appetite — a backdrop that has historically compensated investors for risk-taking.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of April 30, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions as of April 30, 2024.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of April 30, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from Jan. 1, 1992 to April 30, 2024. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

Source: Bloomberg L.P., Invesco, April 30, 2024. Equity = MSCI ACWI Net Return USD Index, Fixed Income = Bloomberg Global Aggregate USD Hedged. Emerging Equity = MSCI Emerging Markets TR Index , Developed Equity = MSCI World TR Index. Investment Grade vs. Treasury = Bloomberg US Corporate Excess Return Index. High Yield vs. Treasury = Bloomberg US High Yield Excess Return Index. Size & value = Russell 2XSize/2XValue 5% capped total return index, Quality & Low Vol = Russell 1000 2XQuality/2XLow Volatility 5% capped total return index, and equivalent indices for FTSE Developed ex USA and FTSE Emerging Indices.

Sources: Bloomberg L.P. data as of April 30, 2024, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

There are no changes in portfolio positioning this month. We overweight risk relative to the benchmark in the Global Tactical Allocation model, overweighting equities over fixed income, favoring non-US equities, cyclical sectors, value, and smaller capitalizations, and remain underweight the US dollar. In fixed income, we maintain an overweight to credit risk2 via lower quality sectors, maintaining a neutral duration posture, favoring Treasury Inflation-Protected Securities (TIPS) over nominal bonds. (Figures 5 to 8). In particular:

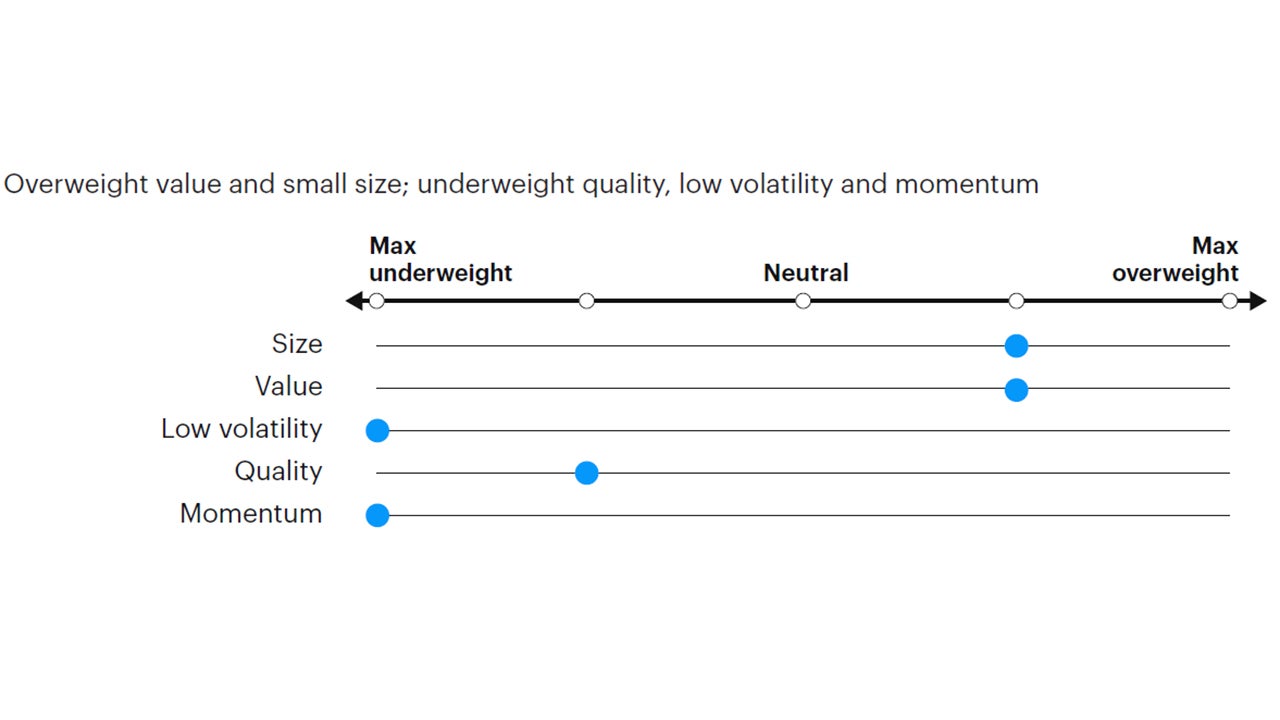

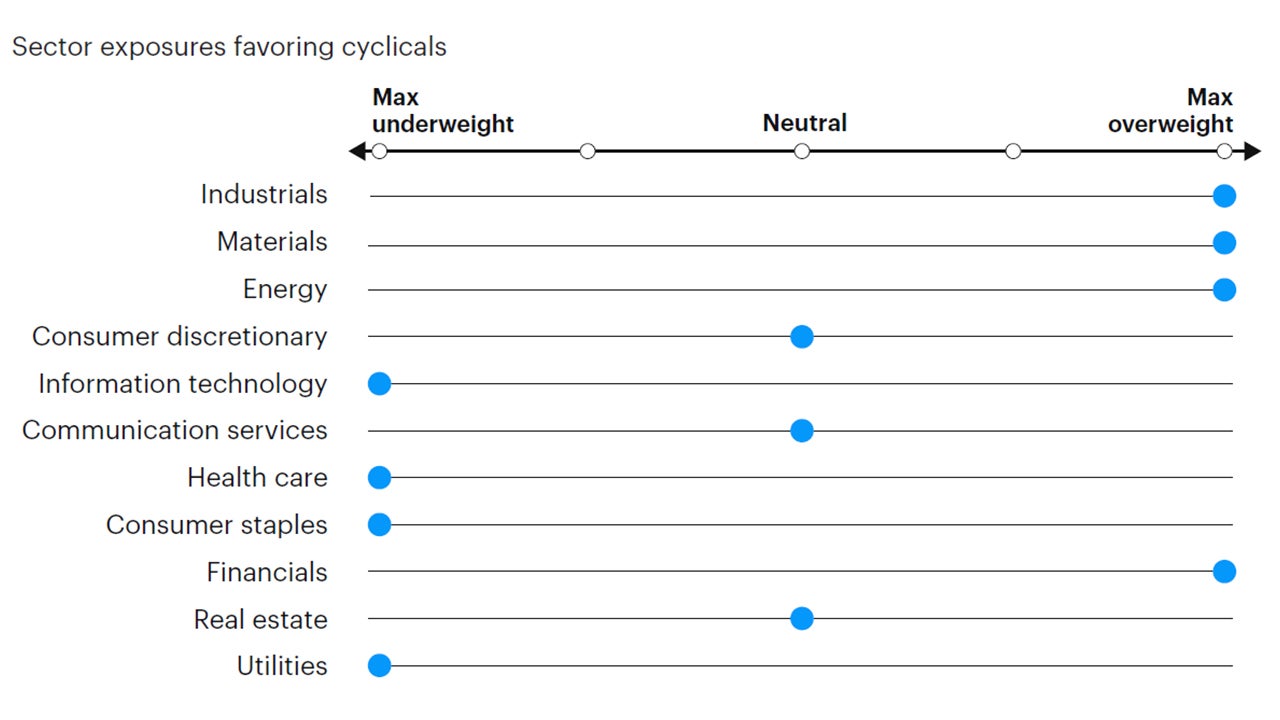

- In equities, we continue to overweight value, mid, and small caps at the expense of quality, low volatility, and momentum factors. Growth is stable, just below its long-term trend, while global risk appetite continues to improve, signaling improving growth expectations. This backdrop has historically favored cyclical factors with high operating leverage and a higher sensitivity to a rebound in growth expectations, such as value and smaller capitalizations. Also, we are beginning to see early signs of broadening equity market participation, with recent performance convergence between styles/factors. We favor exposures to cyclical sectors such as financials, industrials, materials, and energy at the expense of health care, staples, utilities, and technology. From a regional perspective, we overweight emerging markets and developed ex-US equities, supported by improving risk appetite, expectations for US dollar depreciation, and improving leading indicators of European growth.

- In fixed income, we overweight credit risk via high yield, bank loans, and emerging markets hard currency debt. Credit spreads continue to gradually tighten. Subdued volatility is offering a stable yield advantage over government bonds in a supportive macro backdrop with rising risk appetite and reach for yield. In sovereigns, we favor TIPS at the expense of nominal Treasury bonds in the US and Europe, given resilient inflation and upward pressure from commodity prices.

- In currency markets, we underweight the US dollar, as cyclical recovery regimes are typically accompanied by strong reflationary flows into non-US assets. Within developed markets, we favor the euro, the British pound, Norwegian kroner, Swedish krona, and Singapore dollar relative to the Swiss franc, the Japanese yen, and the Australian and Canadian dollars. In emerging markets, we favor high yielders with attractive valuations, such as the Colombian peso, the Brazilian real, the South African rand, and the Indonesian rupiah, relative to low yielding and more expensive currencies, such as the Korean won, the Mexican peso, the Philippines peso, and the Chinese renminbi. However, we still expect these currencies to do well in a US dollar depreciation scenario.

Source: Invesco Solutions, May 1, 2024. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, May 1, 2024. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, May 1, 2024. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, cyclicals: Energy, financials, industrials, materials; defensives: Consumer staples, health care, information technology, real estate, utilities; neutral: Consumer discretionary and communication services.

Source: Invesco Solutions, May 1, 2024. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Footnotes

-

1

Global 60/40 benchmark (60% MSCI ACWI, 40% Bloomberg Global Aggregate USD Hedged).

-

2

Credit risk defined as duration times spread (DTS).

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.