Tactical Asset Allocation - March 2025

Synopsis

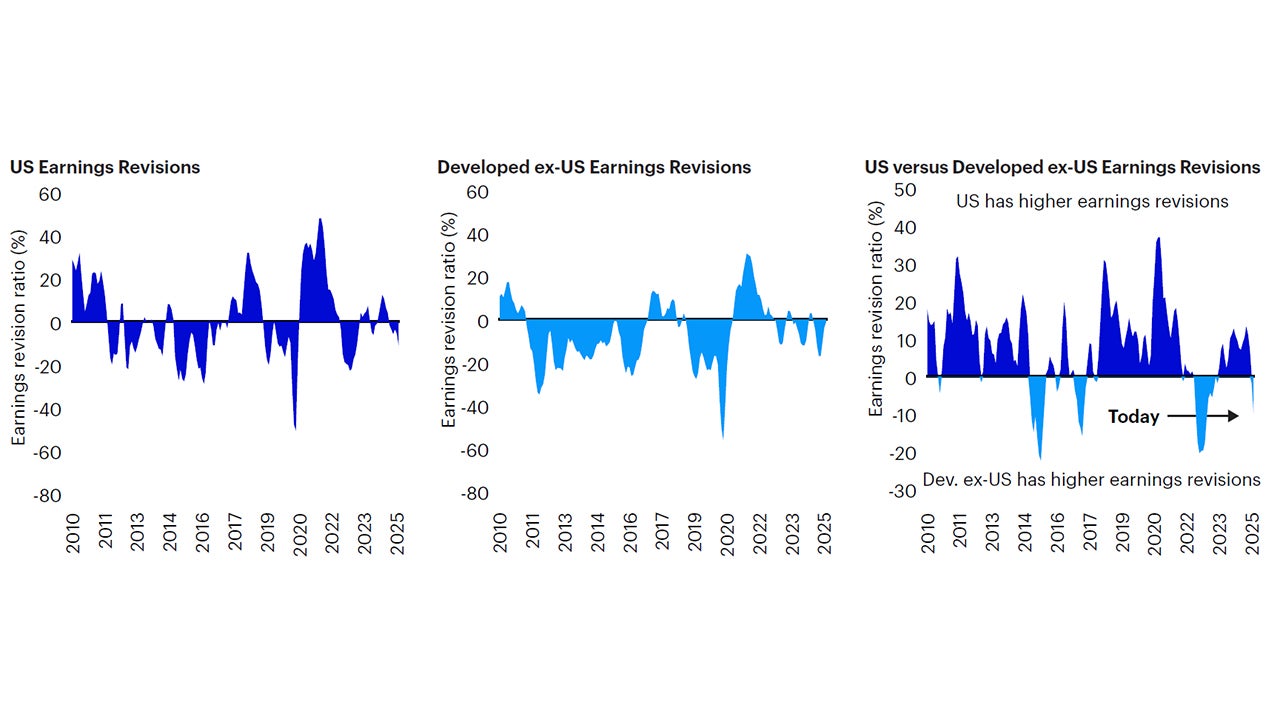

Shifting market dynamics leading to downward revisions in US earnings expectations, while Europe sees upward revisions in response to an expansionary fiscal impulse and defense spending plans. Downgrades in US earnings expectations could have important implications for global equities.

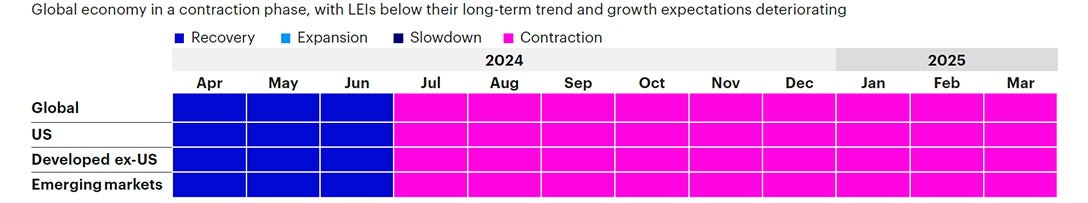

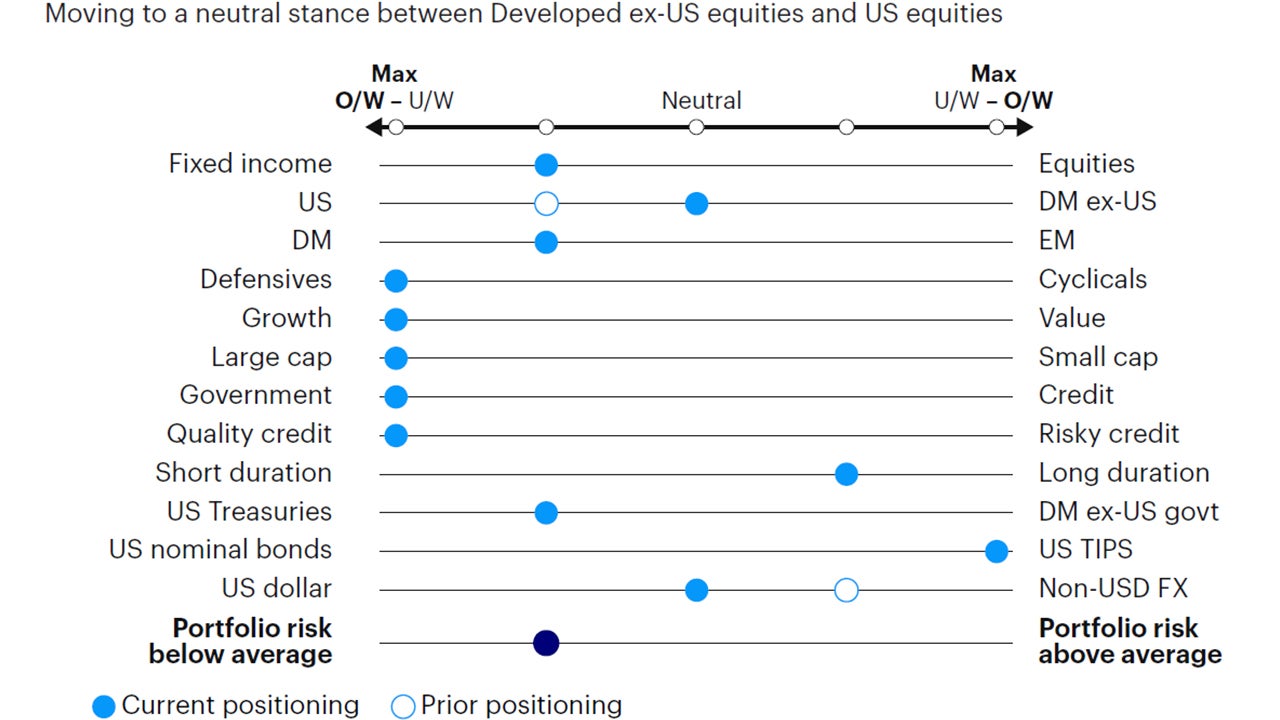

Our framework remains in a contraction regime. We maintain a cautious asset allocation versus benchmark, overweighting fixed income relative to equities. We upgrade developed ex-US equities to neutral versus US equities but remain underweight in emerging markets. Overweight duration via inflation-linked bonds and underweight credit risk.

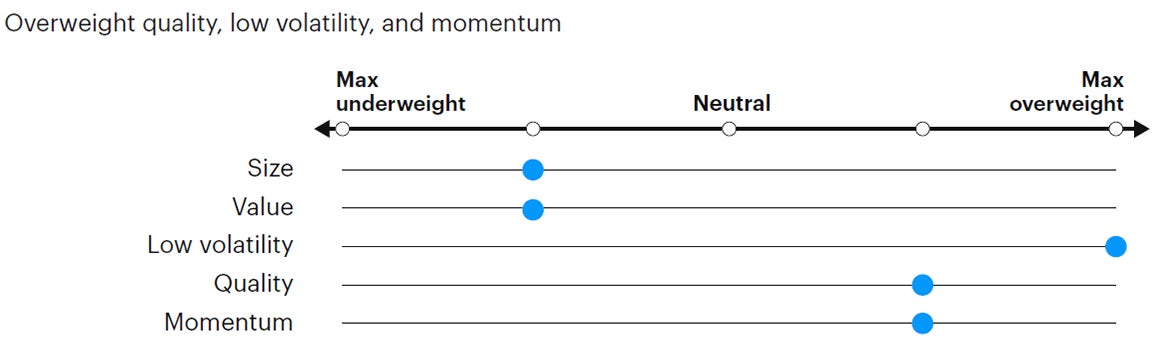

Maintaining defensive portfolio positioning, favoring fixed income over equities. Upgrading developed ex-US equities to neutral relative to US equities. Favoring defensive equities with low volatility and quality characteristics.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update

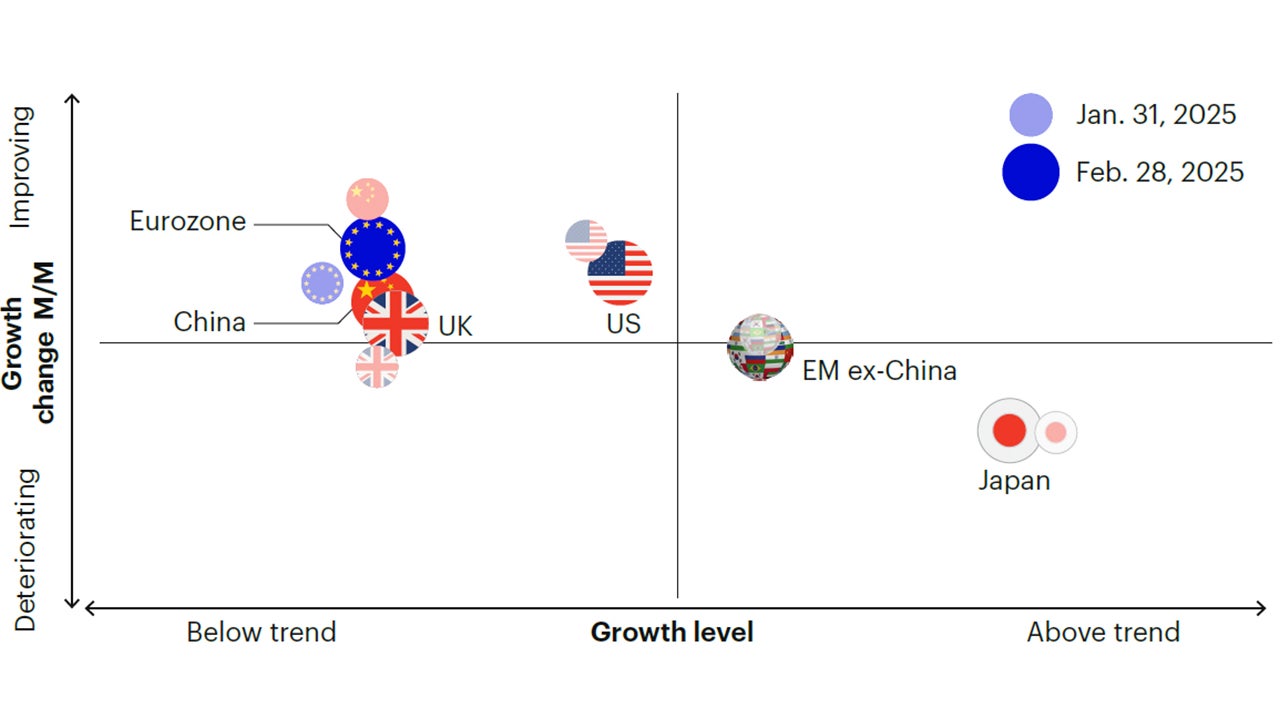

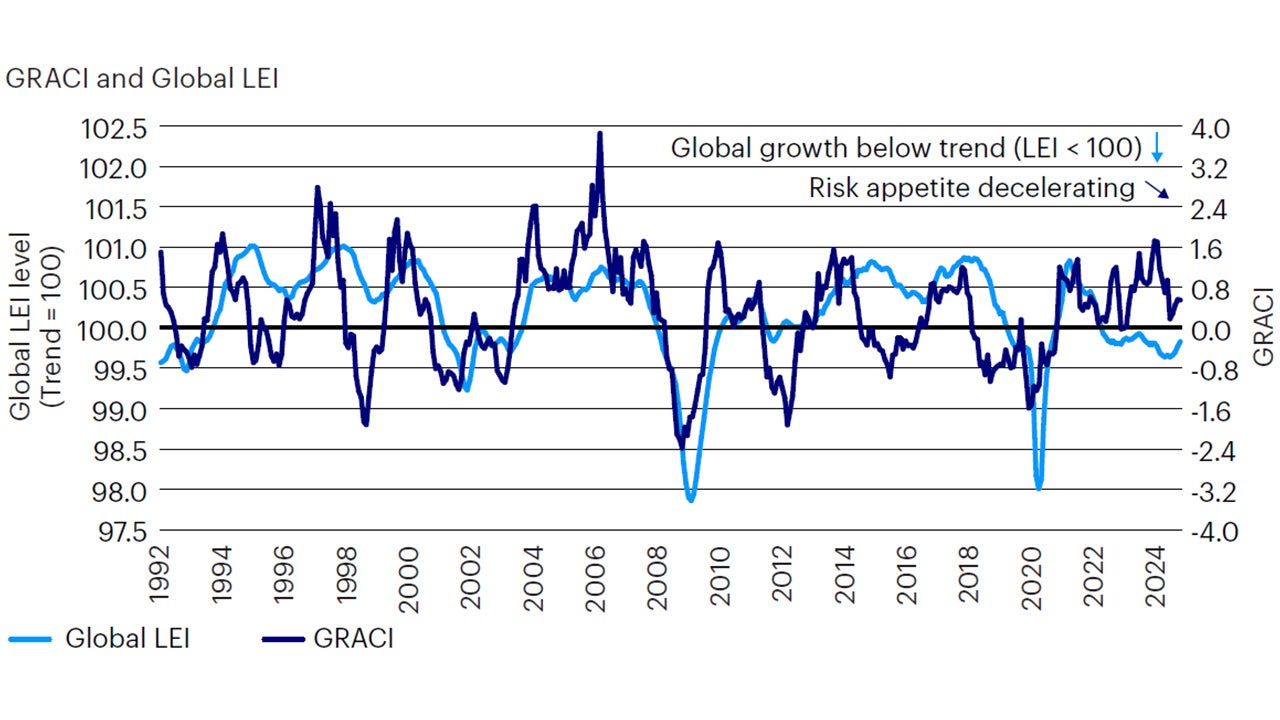

Leading economic indicators continue to register steady improvements across regions, led by the US and Eurozone. Weakness in consumer sentiment has been offset by a rebound in manufacturing business surveys, improving inventory cycle, and a steepening in global yield curves following cuts in policy rates. China remains stable, with modest but steady improvements in housing indicators, manufacturing orders and credit growth. However, after increasing for three consecutive months, our barometer of global market sentiment has resumed its decline, driven by uncertainty surrounding global trade policy and the announcement of new tariffs imposed by the US on major trading partners. We highlighted this theme as one of the key drivers of markets through 2025, with potential repercussions on inflation, earnings, and market volatility. The deterioration in diplomatic negotiations surrounding the Russia-Ukraine conflict could further complicate future trade policy in a series of retaliatory actions. Over the past month, global equities underperformed fixed income, global bond yields rallied, and credit spreads widened modestly across sectors, highlighting the moderate but consistent risk-off adjustment in markets. Our framework remains in a contraction regime of below-trend and decelerating growth for the ninth consecutive month (Figures 1 and 2).

US equities have led the decline, underperforming European equities and emerging markets. Earnings forecasts in the United States are reflecting increasing downward revisions, now at aggregate levels last seen during the bear market of 2022 (Figure 3). Three themes are likely driving this downward adjustment in US earnings revisions, namely trade policy uncertainty, increased global competition in the AI race, and concerns around federal budget cuts. Conversely, earnings outside the United States have stabilized after years of downward revisions, likely reflecting expectations for increased defense spending and an expansionary fiscal impulse in Europe. Following these developments, our framework for relative positioning between US and developed ex-US equities moves from moderately overweight US equities to neutral, the second consecutive monthly improvement towards non-US markets. From here, an overweight stance in Europe and Japan will require a more bearish outlook for the US dollar or a rebound in global risk appetite, beneficial to these cyclical and value-oriented markets. Conversely, earnings expectations in emerging markets continue to lag developed markets, leading to a moderate underweight exposure in our asset allocation.

Sources: Bloomberg L.P., Macrobond. Asset Allocation research and calculations. Proprietary leading economic indicators of Asset Allocation. Macro regime data as of Feb. 28, 2025. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Asset Allocation as of Feb. 28, 2025.

Sources: Bloomberg L.P., Macrobond. Asset Allocation research and calculations. Proprietary leading economic indicators of Asset Allocation. Macro regime data as of Feb. 28, 2025. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Asset Allocation research and calculations, from Jan. 1, 1992 to Feb. 28, 2025. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

Source: JPMorgan. Asset Allocation calculations. As of Feb. 25, 2025.

US equities represented by the MSCI USA Index. Developed ex-U.S. equities represented by the MSCI World ex-U.S. Index.

Earnings Revisions Ratio defined as 3-month average of (# Upward Revisions - # Downward Revisions) / (# Total Revisions), using 12-month forward earnings.

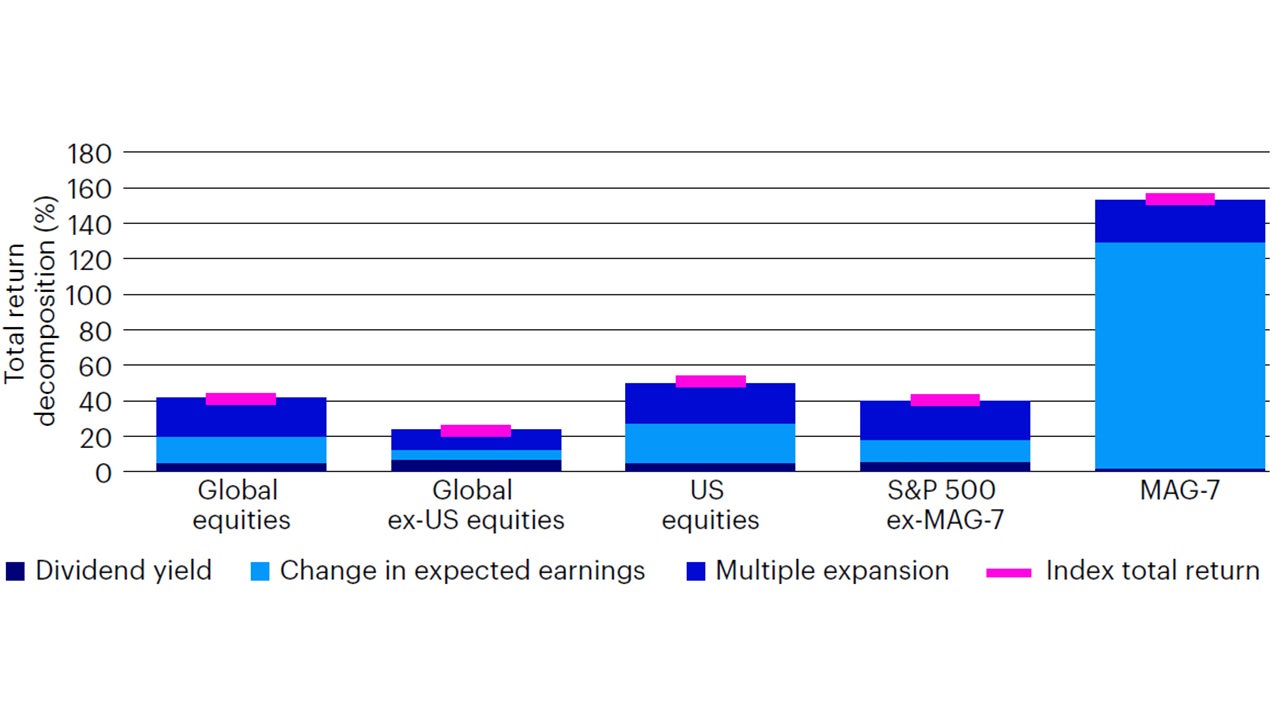

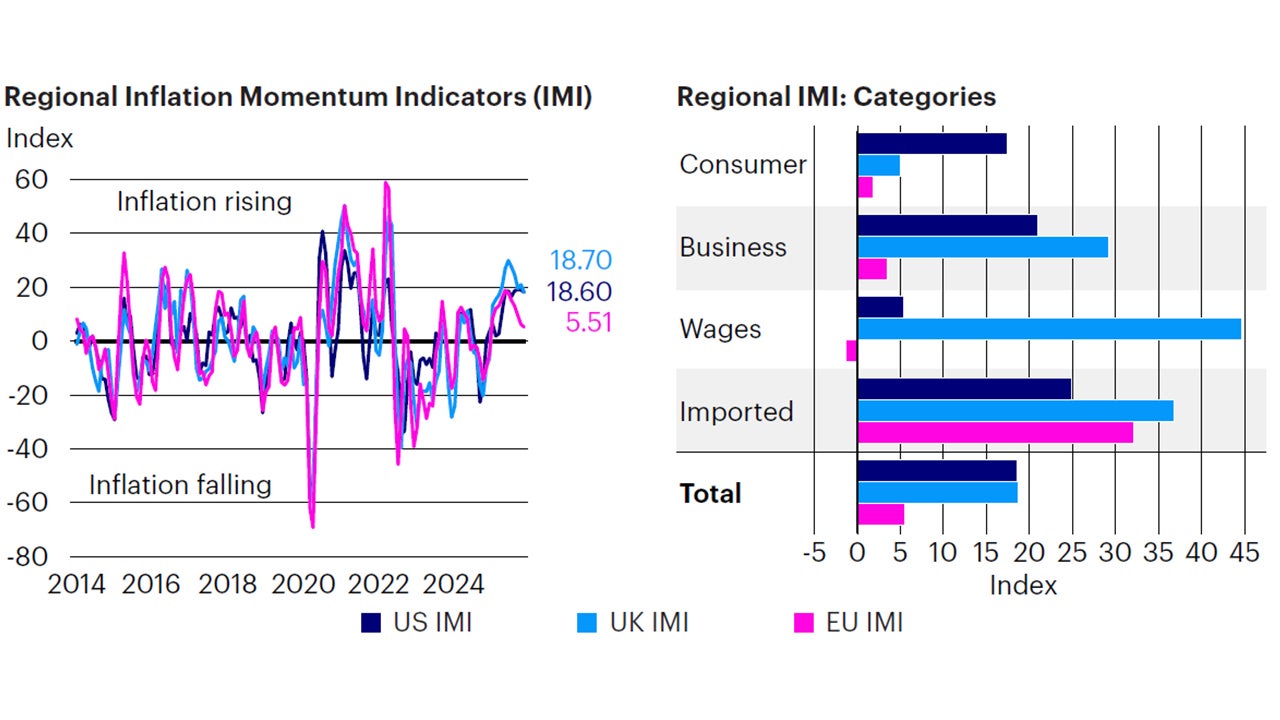

Aside from relative value considerations, the prospect of downward earnings revisions and the de-rating of US equity multiples could have negative implications for global equities overall. Following the market correction of 2022, the bull market of the past two years has been disproportionately driven by rising forward earnings expectations and multiple expansion in US equities, mainly the Magnificent 7, with the rest of the world seeing consistent but more modest contributions (Figure 4). Furthermore, rising inflation momentum in the US and Europe reduces the possibility of preemptive dovish central banks' actions ahead of more pronounced weakness in economic data (Figure 5). Through our systematic macro frameworks, we continue to monitor the evolution of these themes and the resulting impact on global market sentiment, inflation expectations, and growth expectations across regions, repositioning our asset allocation accordingly.

Source: Bloomberg L.P. Asset Allocation calculations, as of February 28, 2025. Consensus Bloomberg estimates using the mean of sell-side analyst estimates.

Global equities = MSCI ACWI Index. Global ex-US Equities = MSCI World ex-US Index. US equities = S&P 500 Index. Equity total return decomposition over the past 2-years, from February 2023 to February 2025.

Sources: Bloomberg L.P. data as of Feb. 28, 2025, Asset Allocation calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

We implemented minor changes to our asset allocation this month in the Global Tactical Allocation Model,1 bringing the developed ex-US equities allocation to neutral relative to US equities. We remain underweight risk relative to benchmark, underweighting equities relative to fixed income, primarily via an underweight to emerging markets versus developed markets. We maintain an overweight in defensive sectors with quality and low volatility characteristics. In fixed income, we underweight credit risk2 relative to benchmark and overweight duration via inflation-linked bonds at the expense of nominal Treasuries (Figures 6 to 9). In particular:

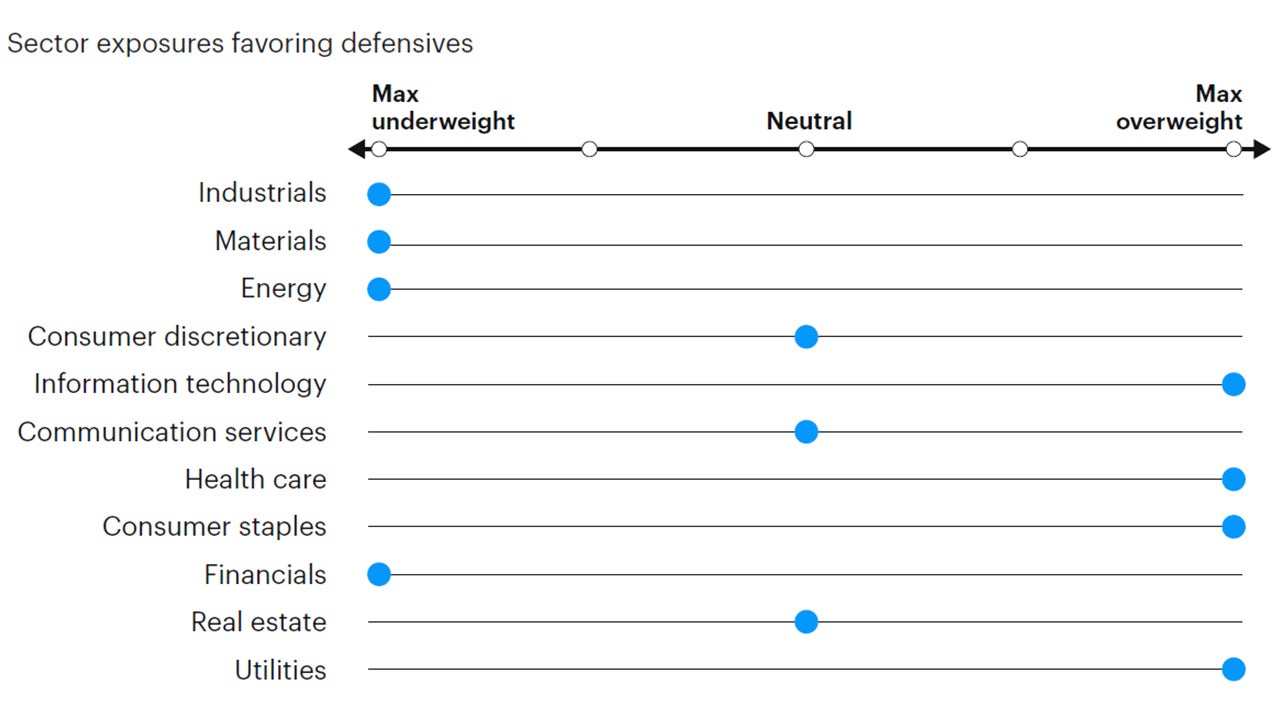

- In equities, we have neutralized the relative allocation between US and developed ex-US equities following downward earnings revisions in the former and improving revisions in the latter. Our neutral stance on the US dollar also supports this position. Going forward, a bearish outlook for the US dollar or a rebound in global risk appetite would be necessary for our framework to trigger an overweight to developed markets outside the US. We maintain a moderate underweight in emerging market equities relative to developed markets and still favor defensive sectors with quality and low volatility characteristics, tilting towards larger capitalizations at the expense of value, mid and small caps. As expected, low volatility equities have delivered favorable downside protection in the recent round of equity volatility. Hence, we favor exposures to defensive sectors such as health care, staples, utilities, and technology at the expense of cyclical sectors such as financials, industrials, materials, and energy.

- In fixed income, we underweight credit risk and overweight duration, favoring investment grade and sovereign fixed income relative to high yield. Given the decelerating growth environment and credit spreads at cycle lows, we believe the risk-reward in this position is attractive. In sovereigns, we maintain a maximum overweight exposure to inflation-linked bonds relative to nominal Treasuries, given rising inflation momentum across regions (Figure 5).

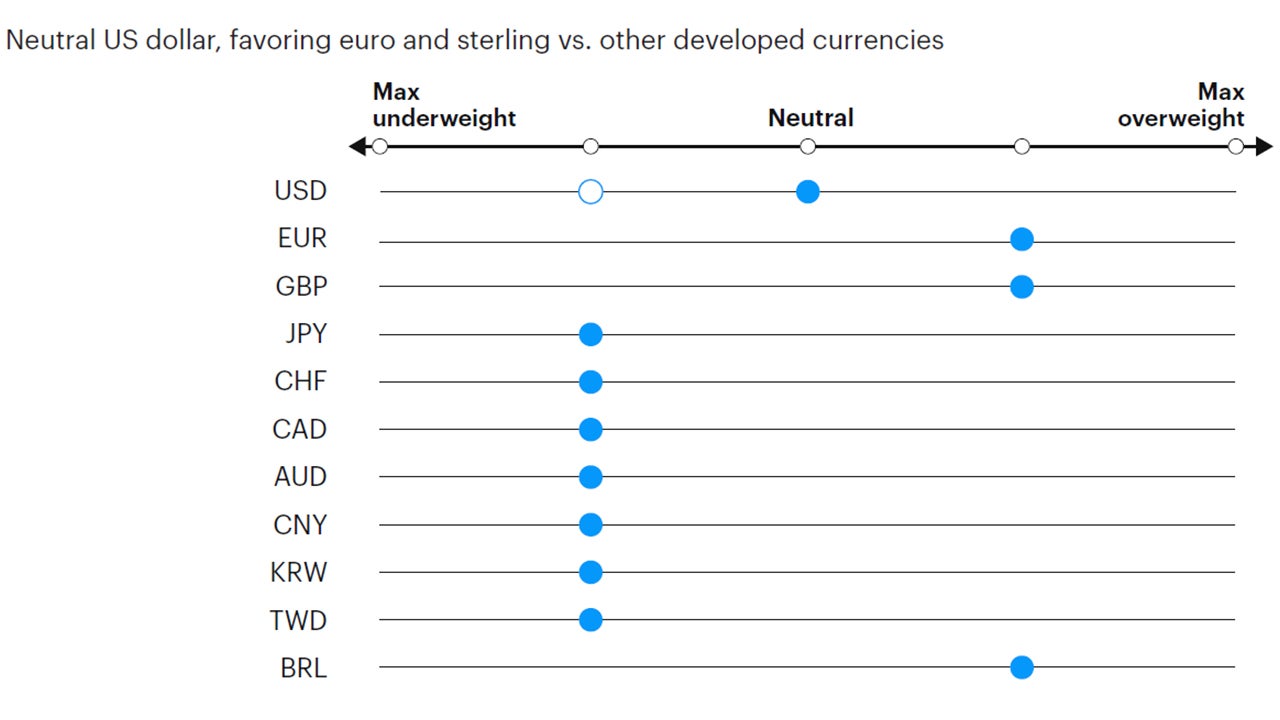

- In currency markets, we move back to a neutral stance on the US dollar after the brief underweight exposure over the past month. While economic data outside the US are still surprising to the upside, wider yield differentials towards the greenback lead our models to a neutral position in aggregate. Within developed markets, we favor the euro, the British pound, Norwegian kroner, Swedish krona, and Singapore dollar relative to the Swiss franc, Japanese yen, Australian and Canadian dollars. In EM, we favor high yielders with attractive valuations, such as the Colombian peso, Brazilian real, Indian rupee, Indonesian rupiah, and Mexican peso, relative to low yielding and more expensive currencies, such as the Korean won, Taiwan dollar, Philippines peso, and Chinese renminbi.

Source: Asset Allocation, Mar. 1, 2025. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Asset Allocation, Mar. 1, 2025. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Asset Allocation, Mar. 1, 2025. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Asset Allocation, Mar. 1, 2025. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Footnotes

-

1

Reference benchmark 60% MSCI ACWI, 40% Bloomberg Global Aggregate Hedged Index.

-

2

Credit risk defined as duration times spread (DTS).