Tactical asset allocation - March 2024

Synopsis

Market sentiment and growth expectations improved, supported by upward earnings revisions and tightening credit spreads.

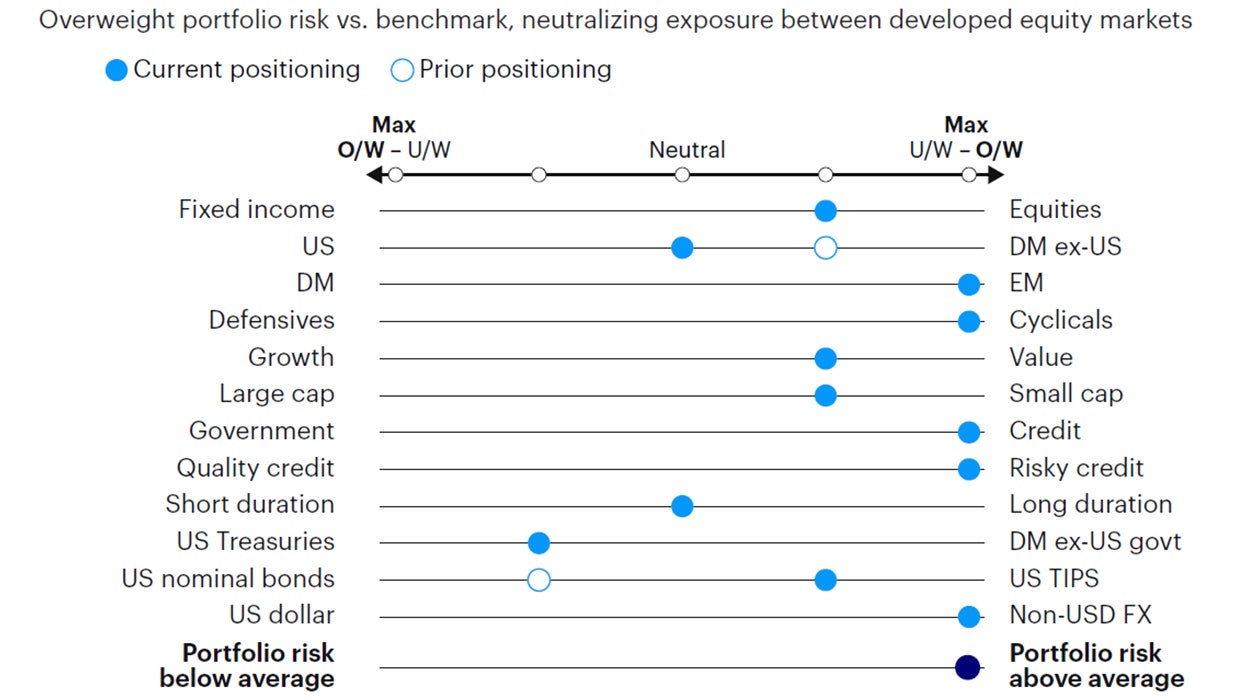

We remain overweight portfolio risk in the Global Tactical Asset Allocation model,1 favoring equities relative to fixed income, value, and smaller capitalizations. We move to neutral on developed ex-US equities. Overweight risky credit, neutral duration and underweight the US dollar. We are increasing exposure to inflation-linked bonds.

Overweight risk assets, cyclicals, and credit. Tightening credit spreads and resilient earnings suggest the economic recovery continues.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update

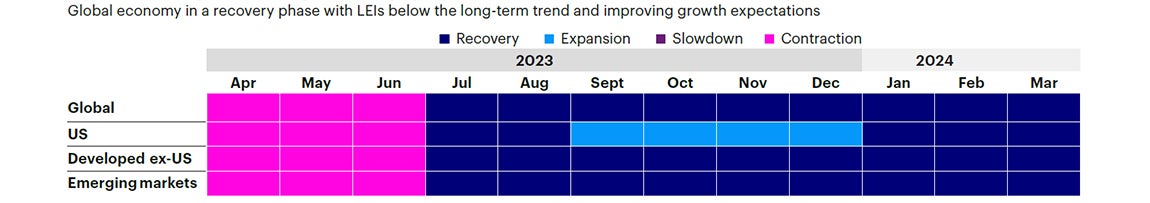

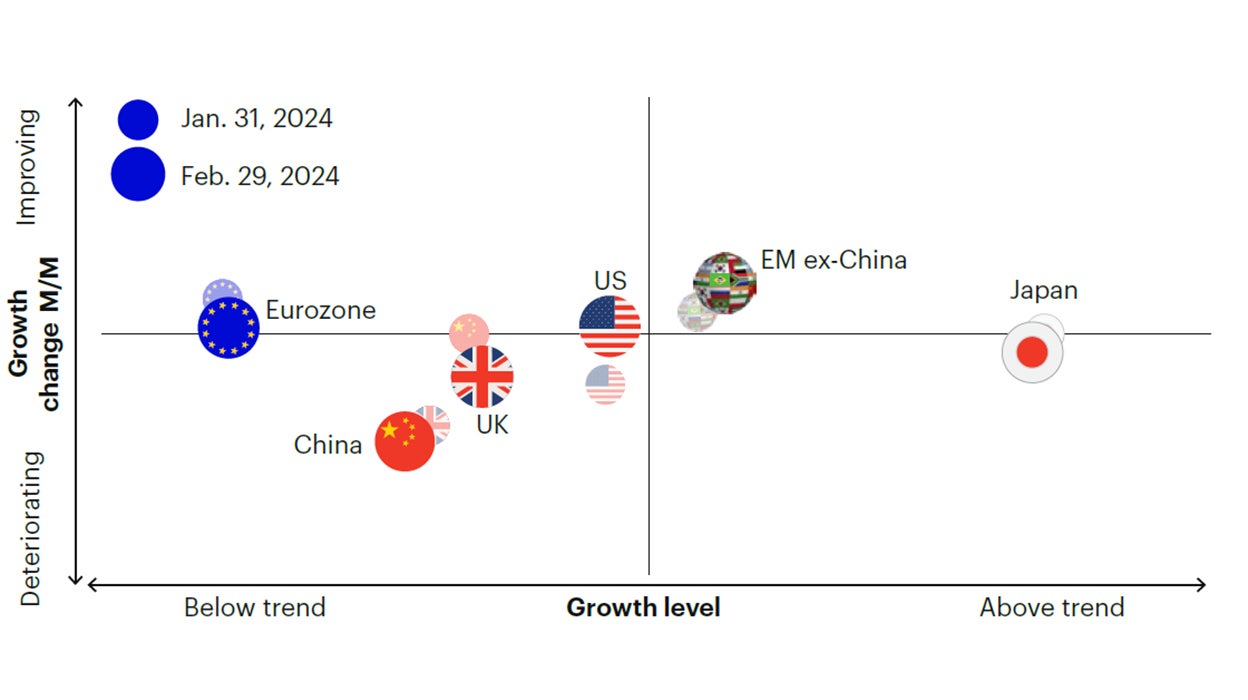

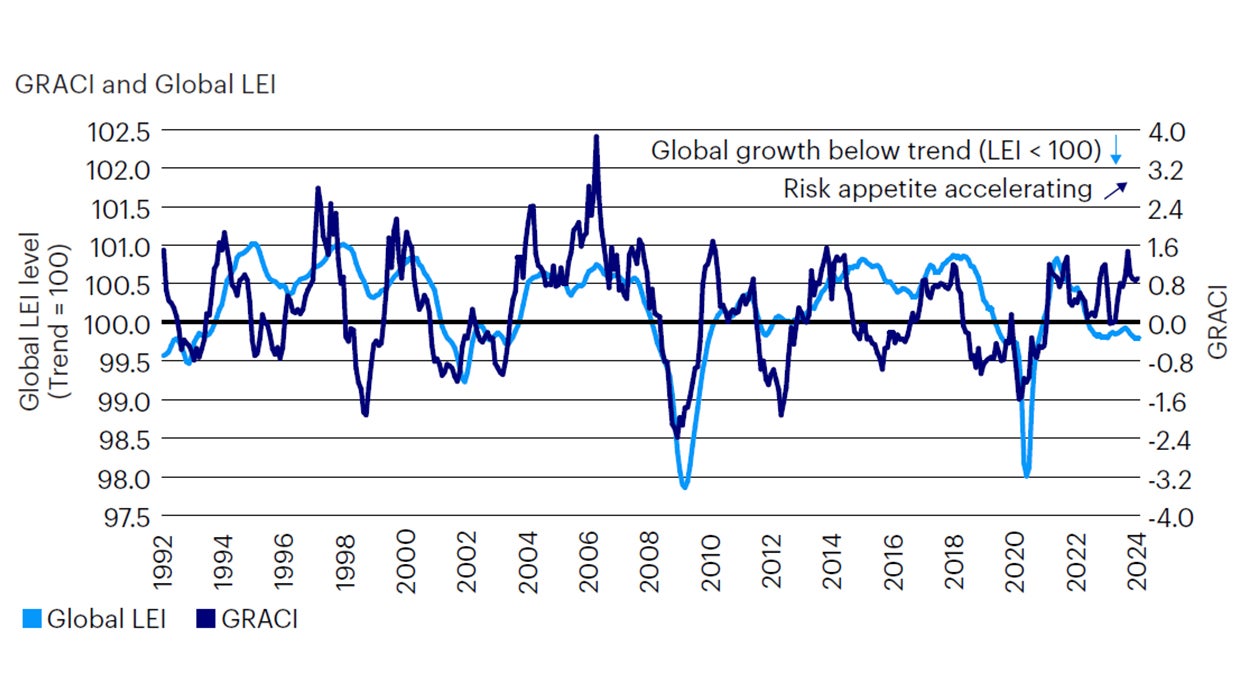

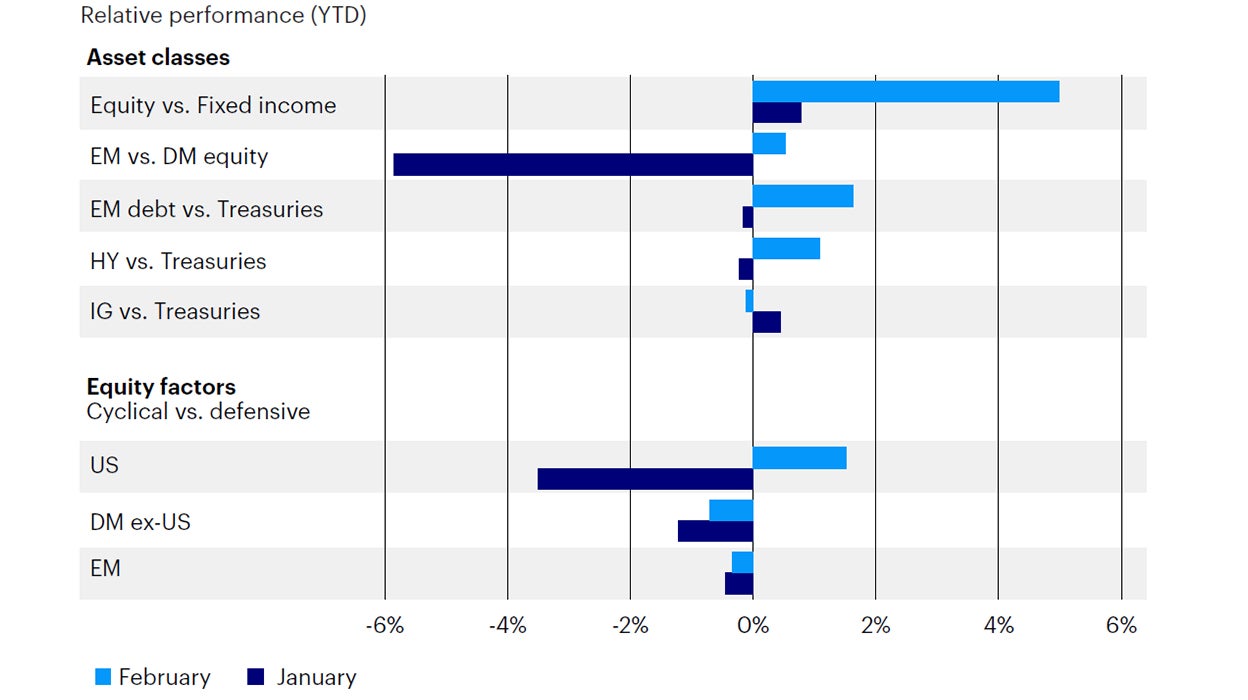

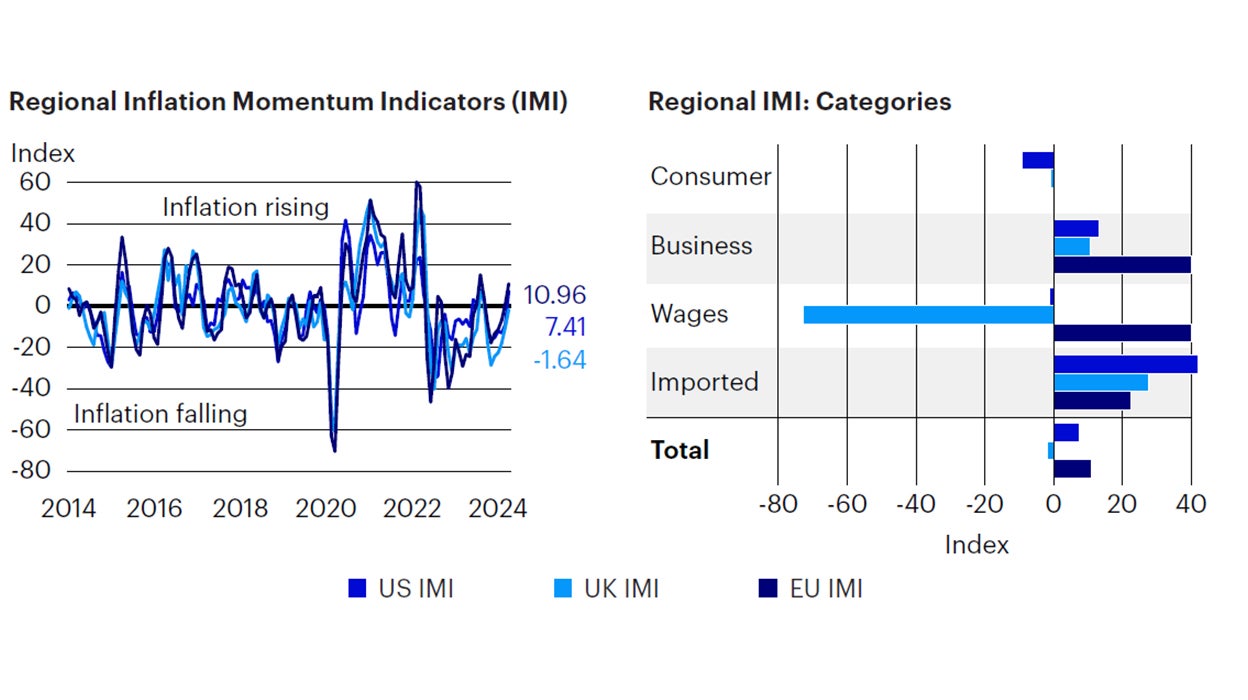

Markets took a more noticeable pro-risk turn in February, following a mixed and volatile start in January. Global equities outperformed fixed income, with emerging markets matching US equities and outperforming other developed markets. Credit markets outperformed sovereign fixed income, with credit spreads tightening to cycle lows. The renewed increase in risk appetite was supported by a broadly favorable earnings season, with the US, Japan, and emerging markets ex-China still leading the way with upward revisions in earnings expectations, while the eurozone, UK, and China disappointed. Global earnings momentum, while uneven, remains stable with early signs of a cyclical trough. A similar picture is evident in our panel of leading economic indicators, also suggesting earlier optimism for a rebound in European cyclical indicators requires a pause at this stage. Our macro framework continues to suggest a recovery regime for the global economy and its major regional blocks, with growth below trend and improving market sentiment (Figures 1 to 2). While this cyclical repricing has been broadly consistent across asset classes, the relative performance between equity styles and factors year-to-date is still at odds with this picture, in our opinion, as evidenced by the pronounced underperformance in riskier, more cyclical segments such as value and smaller capitalization, affected by the strong momentum in quality and mega-cap technology companies (Figure 3). We remain confident that the recent resiliency in economic data, earnings, and credit conditions should eventually translate into a more cyclical repricing across equity sectors, styles, and factors in the medium term. Consequently, based on our framework, we expect some mean reversion in the recent outperformance of growth equities. Meanwhile, recent economic strength seems to be confirmed by a pause in the disinflation trend of the past year. Our inflation momentum indicators point to marginally rising price pressures in Europe and the US, led by commodity prices, likely to shave off expectations for rate cuts in the near future (Figure 4). Overall, our rules-based process continues to suggest a recovery scenario for markets at this stage. We maintain a portfolio positioning consistent with this scenario while waiting for incoming information to adjust the course as needed.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of February 29, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions as of February 29, 2024.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of February 29, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from January 1, 1992, to February 29, 2024. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

Sources: Bloomberg L.P., Invesco, February 29, 2024. Equity = MSCI ACWI Net Return USD Index, Fixed Income = Bloomberg Global Aggregate USD Hedged. Emerging Equity = MSCI Emerging Markets TR Index , Developed Equity = MSCI World TR Index. Investment Grade vs. Treasury = Bloomberg US Corporate Excess Return Index. High Yield vs. Treasury = Bloomberg US High Yield Excess Return Index. Cyclical factors = Russell 2XSize/2XValue 5% capped total return index, Defensive factors = Russell 1000 2XQuality/2XLow Volatility 5% capped total return index, and equivalent indices for FTSE Developed ex USA and FTSE Emerging Indices.

Sources: Bloomberg L.P. data as of February 29, 2024, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

We remain overweight risk relative to the benchmark in the Global Tactical Allocation Model, overweight equities over fixed income, favoring emerging markets, cyclical sectors, value, and smaller capitalizations. We neutralized the active exposure between the US and developed ex-US equities but remain underweight the US dollar. In fixed income, we continue to overweight credit risk via lower quality sectors, maintaining a neutral duration posture while increasing exposure to TIPS versus nominal bonds. (Figures 5 to 8). In particular:

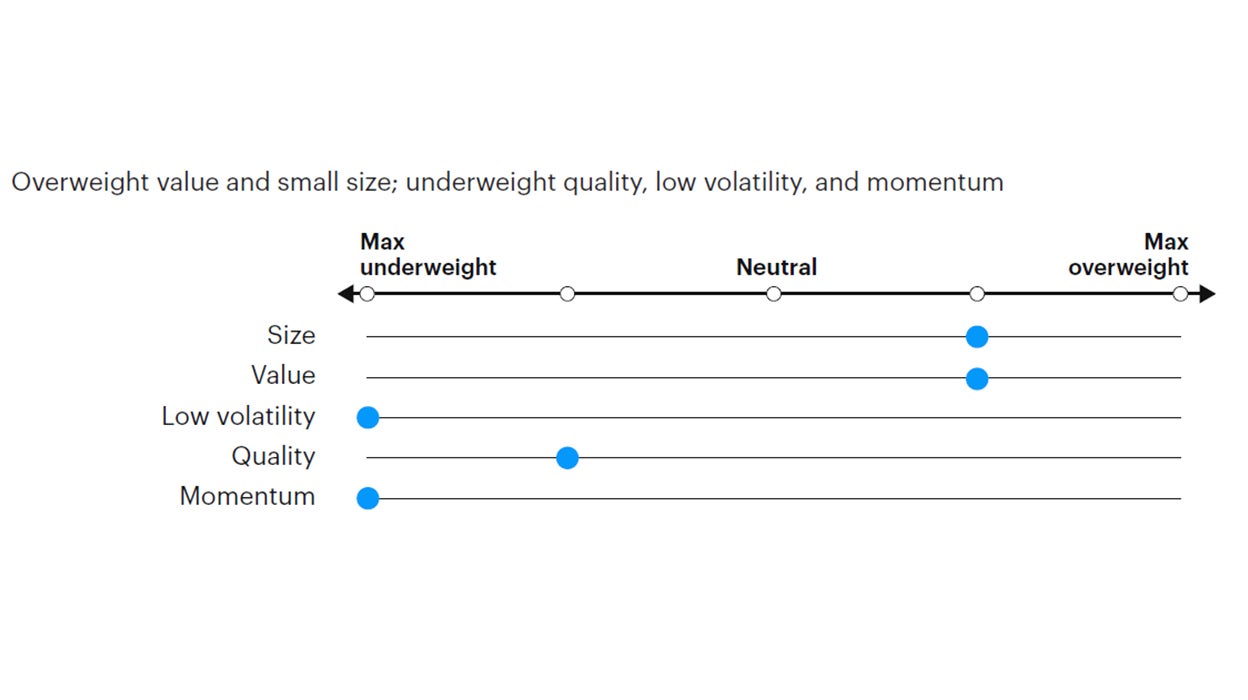

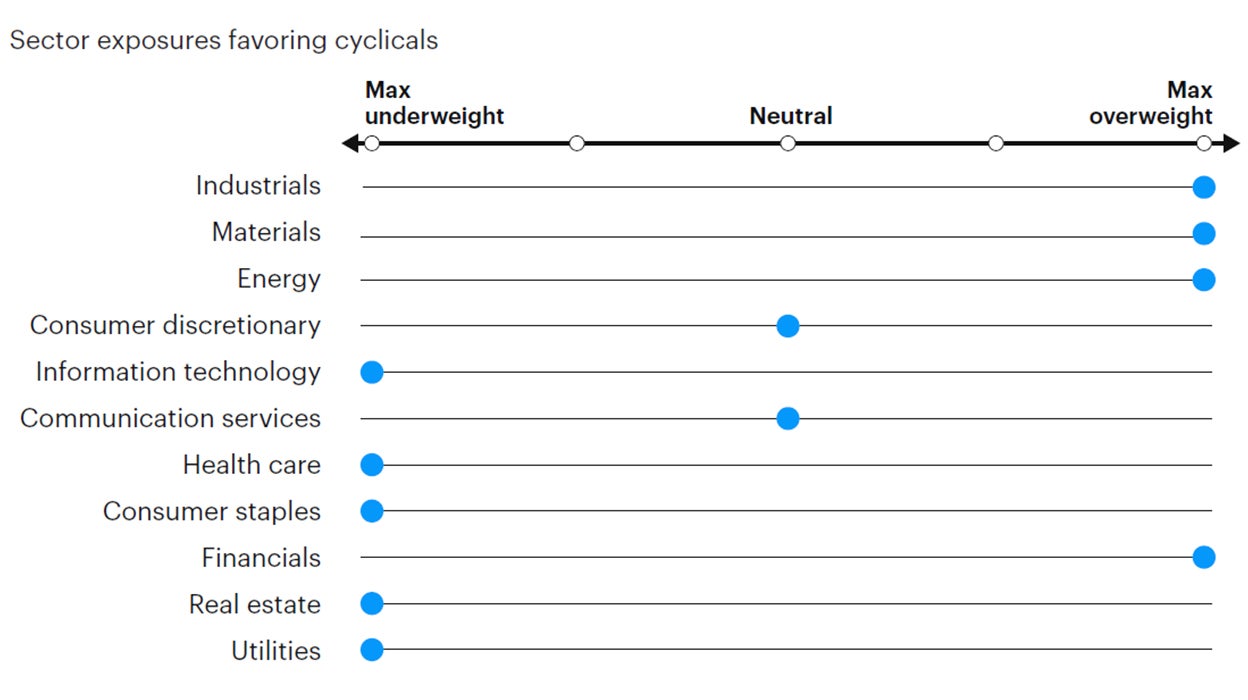

- In equities, despite the noticeable underperformance of mid-cap, small-cap, and value equities since the start of the year, we continue to overweight these factor characteristics at the expense of quality, low volatility, and momentum. Recent economic data and broader cross-asset performance still point toward resilient growth, improving risk appetite and growth expectations. This macro backdrop historically favors cyclical factors with high operating leverage and a higher sensitivity to a rebound in growth expectations, such as value and smaller capitalizations. Similarly, we favor exposures to cyclical sectors such as financials, industrials, materials, and energy at the expense of health care, staples, utilities, and technology. From a regional perspective, we remain overweight emerging markets, supported by improving risk appetite and expectations for US dollar depreciation. However, we have neutralized the overweight exposure of the past three months in developed ex-US equities versus US equities, as previous indications of cyclical divergence have abated.

- In fixed income, we remain overweight in risky credit2 via high yield, bank loans, and emerging markets hard currency debt. Credit spreads have tightened further, now hovering around historical lows in most sectors. However, we expect volatility to remain subdued and credit markets to offer stable yields in a stable macro backdrop. The case for credit assets remains limited to their income advantage over government bonds rather than capital appreciation. In sovereigns, we have increased exposure to Treasury inflation protected securities (TIPS) at the expense of nominal Treasury bonds in the US and Europe, driven by early signs of renewed positive momentum in inflation.

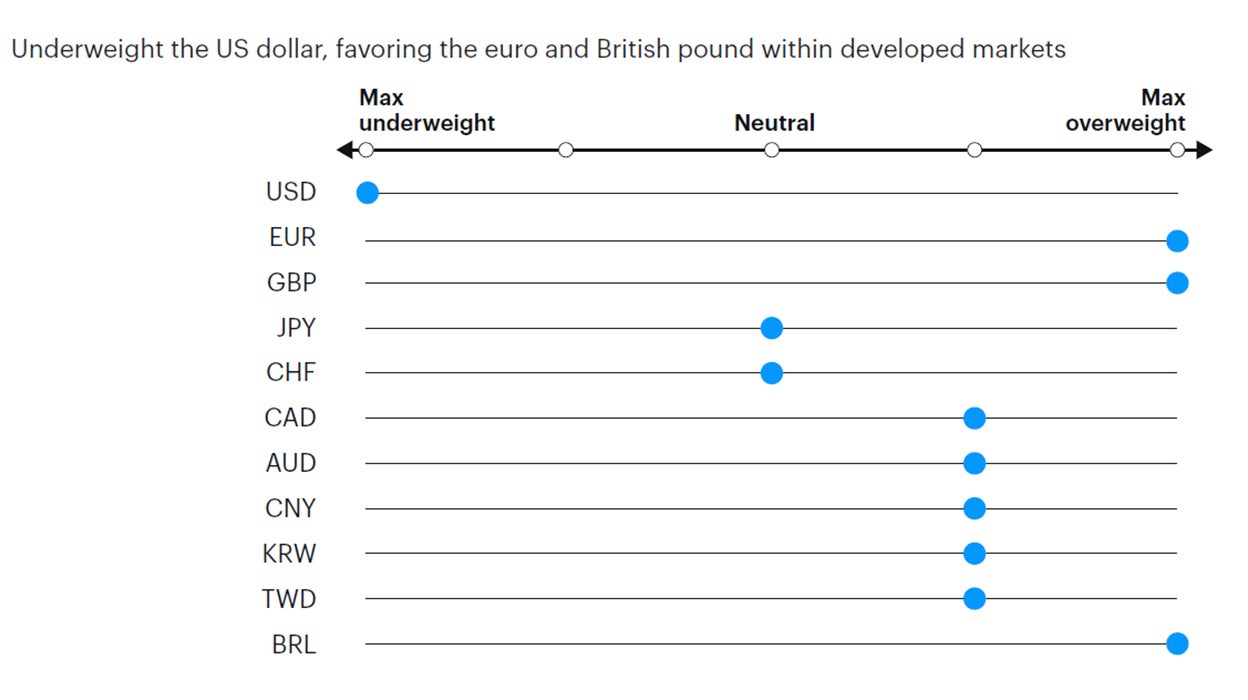

- In currency markets, we underweight the US dollar, as regimes of cyclical recoveries are typically accompanied by strong reflationary flows into non-US assets. Within developed markets, we favor the euro, the British pound, the Norwegian kroner, the Swedish krona, and the Singapore dollar relative to the Swiss Franc, the Japanese yen, and the Australian and Canadian dollars. In EM, we favor high yielders with attractive valuations, such as the Colombian peso, the Brazilian real, the South African rand, and the Indonesian Rupiah relative to low yielding and more expensive currencies, such as the Korean won, the Chilean peso, the Thai baht, and the Chinese renminbi, but still expect these currencies to do well in a US dollar depreciation scenario.

Source: Invesco Solutions, March 1, 2024. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, March 1, 2024. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, March 1, 2024. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Solutions, March 1, 2024. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Footnotes

-

1

Global 60/40 benchmark (60% MSCI ACWI, 40% Bloomberg Global Aggregate USD Hedged).

-

2

Credit risk defined as duration times spread (DTS).

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.