Tactical asset allocation - July 2024

Synopsis

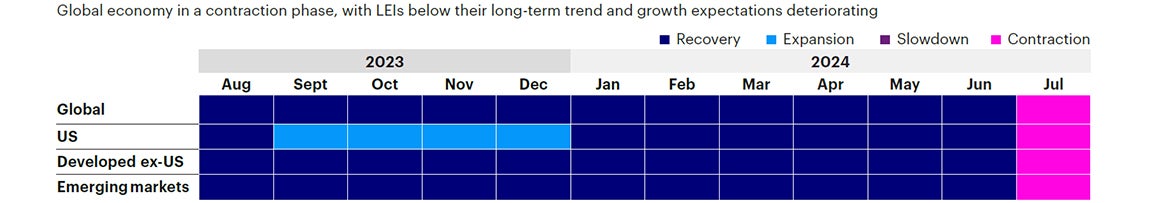

Slowing growth momentum and declining risk appetite signal downward revisions in growth expectations. Our macro framework moves back into a contraction regime for the global economy, signaling a convergence in performance between risky and safer asset classes.

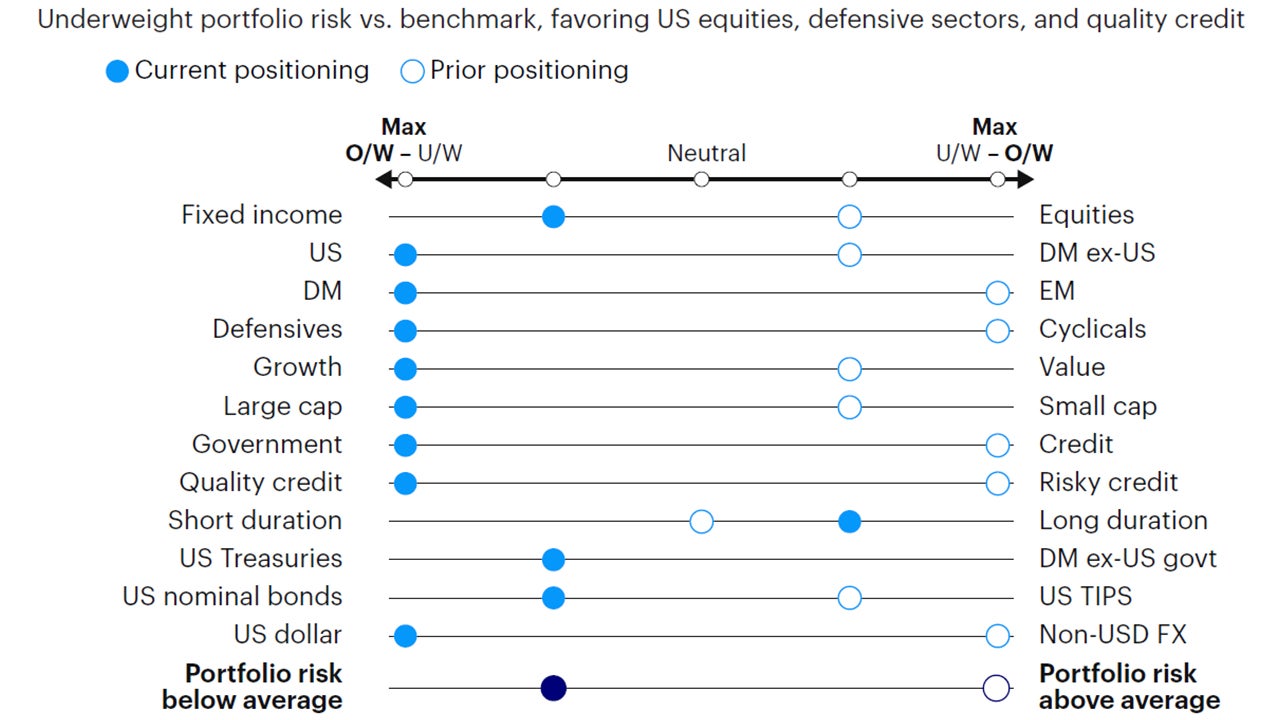

Underweight portfolio risk in the Global Tactical Asset Allocation model,1 underweighting equities versus fixed income, favoring US equities, quality, and low volatility. Underweight credit risk, overweight duration, and the US dollar.

Shifting to defensive portfolio positioning as our macro framework moves into a contraction regime.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update

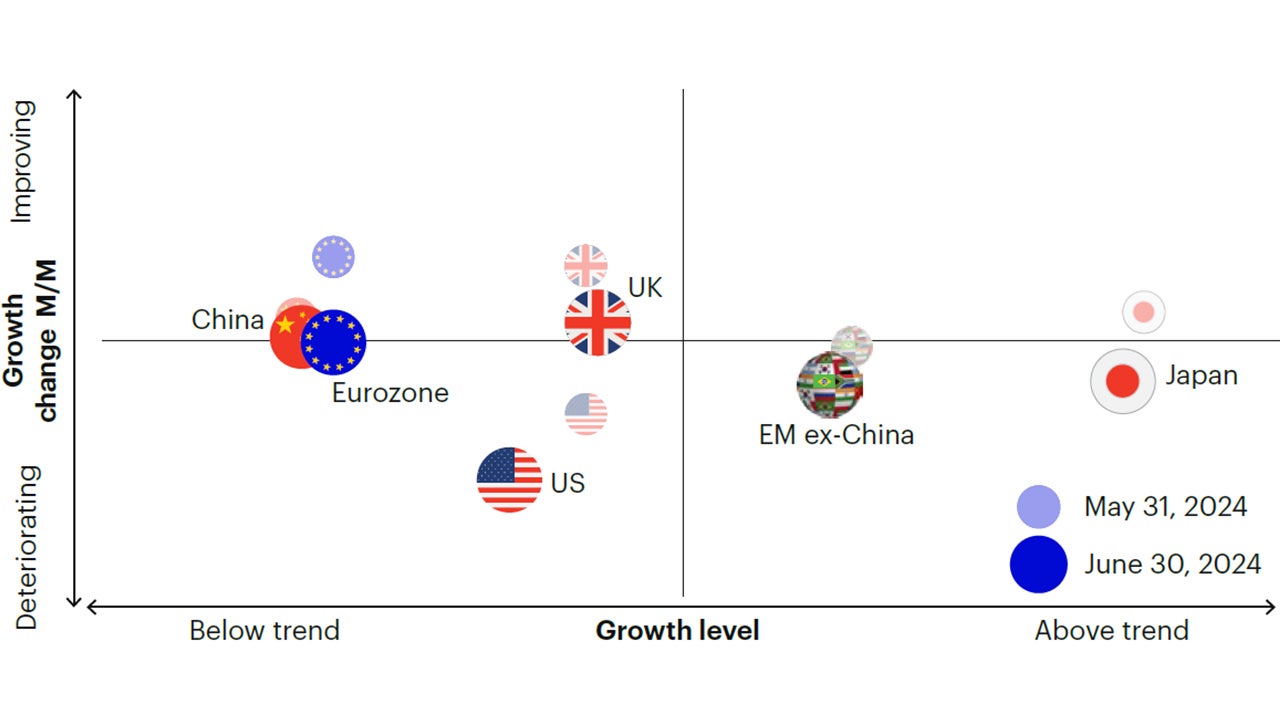

After several months of stability, economic data around the world are pointing to a softening in growth momentum, particularly in developed markets. The most noticeable decline is registered in US leading economic indicators, with the largest monthly decline since the summer of 2022, confirming a trend we have flagged for the past several months. The deceleration is broad-based across economic sectors, with weakening business and consumer surveys, housing indicators, and an ongoing tightening in monetary conditions due to lagged effects from past rate increases and yield curve inversion. As discussed in the past, we expect the lagged effects of monetary policy to exert a drag on our leading economic indicators for a few quarters. In addition, lagging indicators such as retail sales have also seen large downward revisions and negative surprises relative to consensus expectations, confirming the softer growth impulse in Q2 2024 relative to initial estimates. The rest of the developed world is also experiencing a modest deceleration, led by Japan, while the eurozone and the UK remain stable but below their long-term trend growth. Leading indicators for China and the rest of emerging markets confirm a stable and below-trend growth environment.

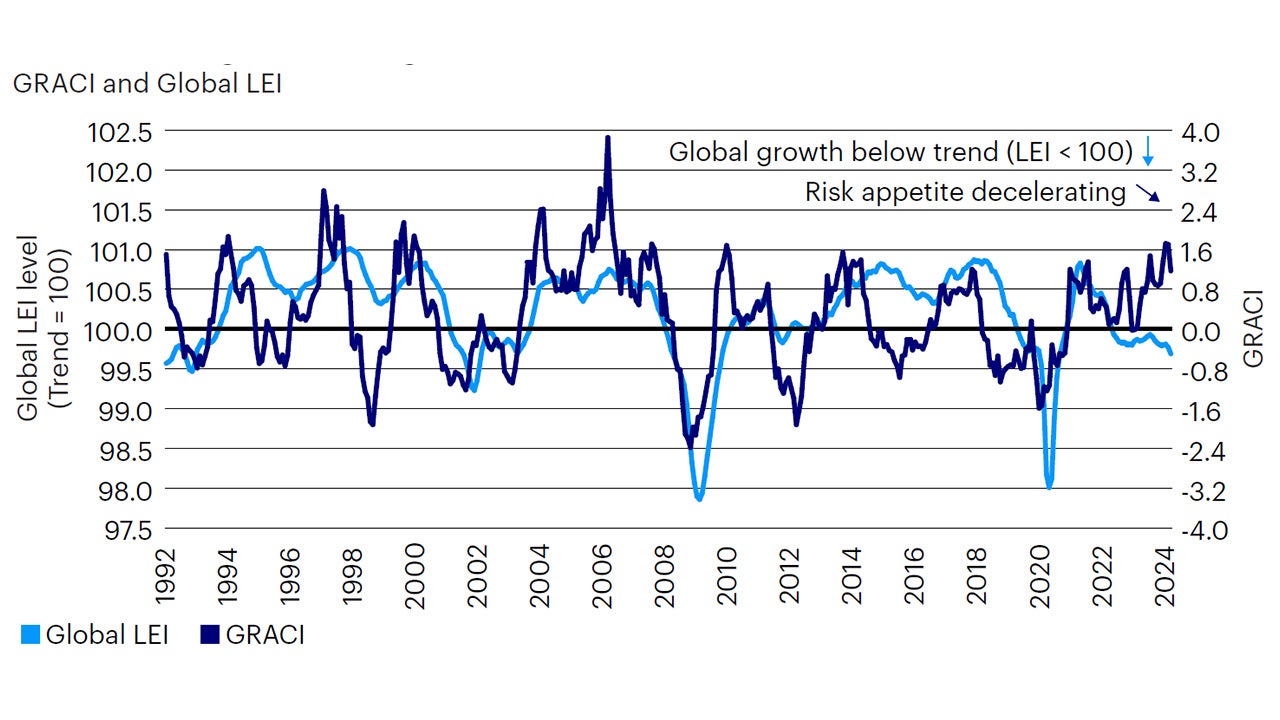

Moving to financial markets, after 12 months of steady improvements, our barometer of global risk appetite is signaling a significant downshift in market sentiment, likely reflecting a combination of softer global growth momentum and a peak in future growth expectations. As a result, our macro regime framework moves back into a contraction regime, last recorded in Q2 2023, signaling an environment of below-trend and decelerating growth expectations across all major regions (Figures 1a-c and 2).

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of June 30, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions, as of June 30, 2024.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of June 30, 2024. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from Jan. 1, 1992 to June 30, 2024. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

What is the likelihood of a recession in the next 12 months?

In our framework, a contraction regime is defined as an environment of below-trend and decelerating growth. As of today, growth is solidly in positive territory on a global basis, with developed markets growing between 1-2% and consensus expectations signaling similar growth rates over the next two years. However, as illustrated in Figure 2, risk sentiment in financial markets has already discounted a meaningful cyclical rebound over the past year, supported by expectations for rate cuts and solid labor market growth. Based on the latest developments in our indicators, we expect downward revisions in growth expectations over the next few months and global risk appetite to peak and revert towards its long-term average, leading to a convergence in performance between riskier and safer asset classes. In our opinion, this macro backdrop is consistent with an incoming deceleration but not indicative of imminent recession risks given broadly stable consumption, limited volatility in financial markets, and low and stable credit spreads. Nonetheless, the cyclical peak in market sentiment, coupled with a low growth environment, warrants a more defensive portfolio positioning relative to the pro-cyclical posture of the past 12 months.

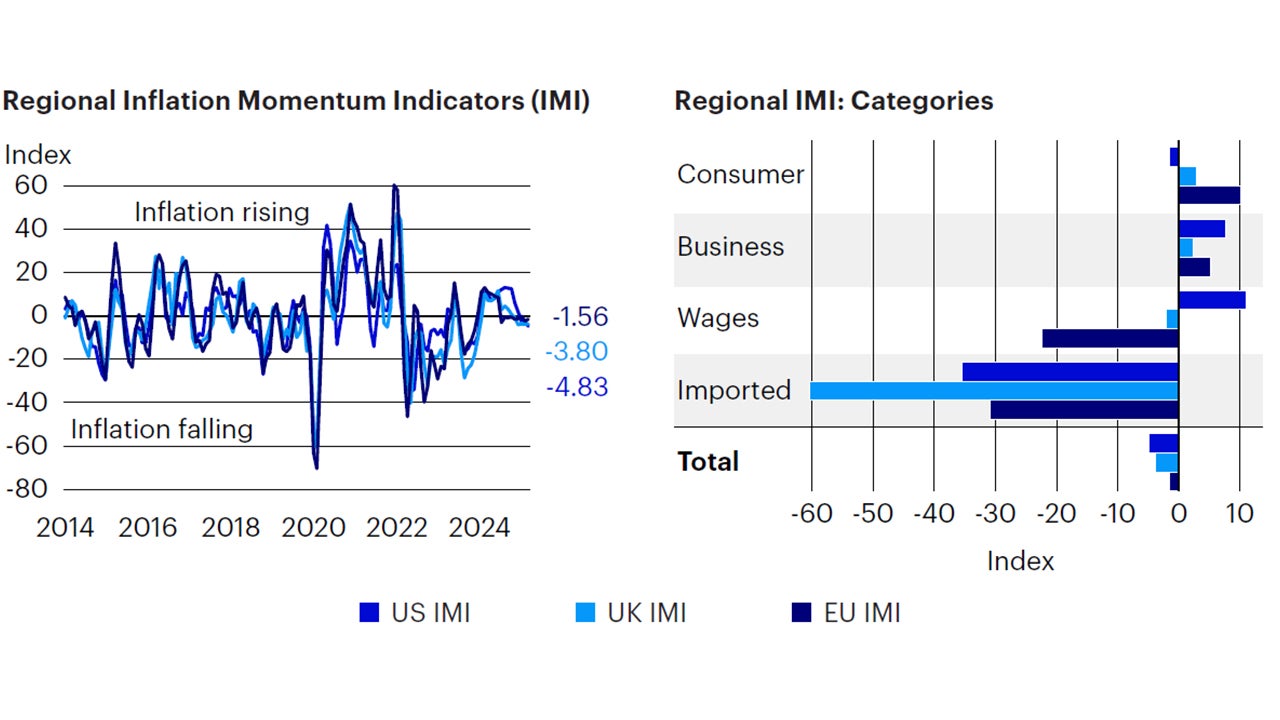

Sources: Bloomberg L.P. data as of June 30, 2024, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

We implement noticeable changes in portfolio positioning given the transition from a recovery to a contraction regime, expressing a more defensive posture. We underweight risk relative to the benchmark in the Global Tactical Allocation model, underweighting equities relative to fixed income, favoring US equities and defensive sectors with quality and low volatility characteristics. In fixed income, we reduce credit risk2 to underweight relative to the benchmark, overweighting duration via investment grade credit and sovereign fixed income at the expense of lower quality credit sectors. (Figures 4 to 7). In particular:

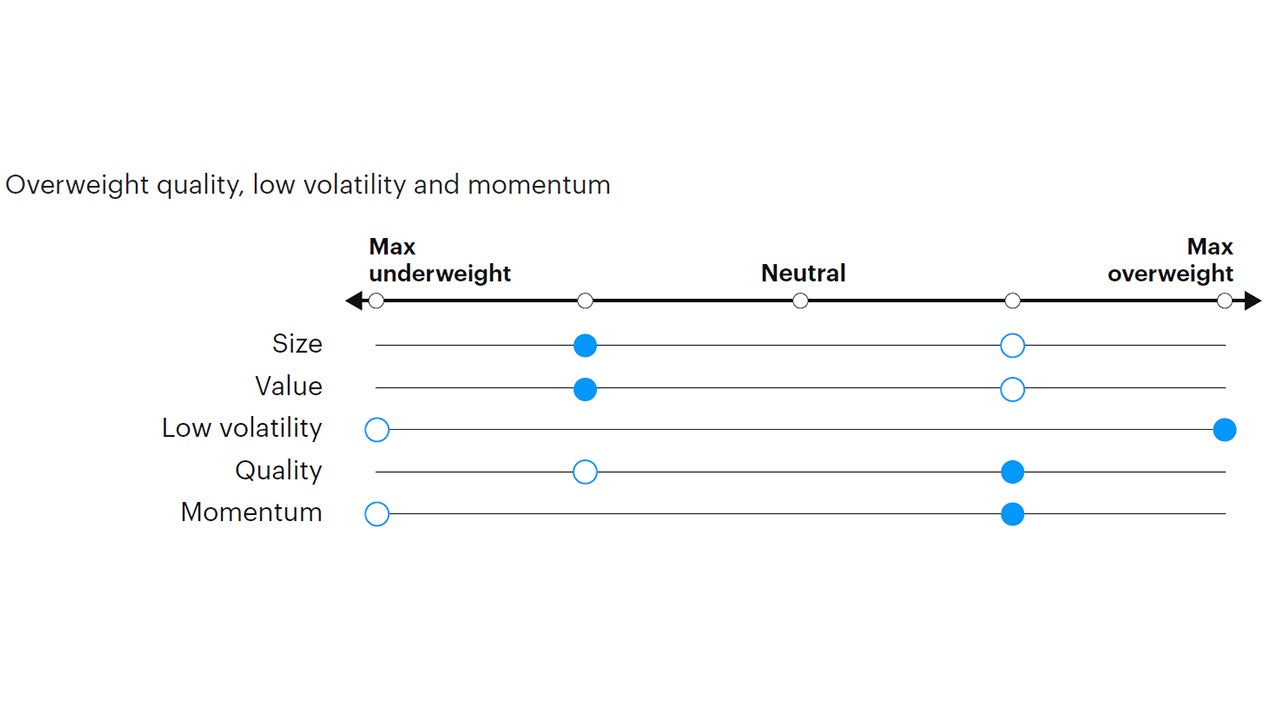

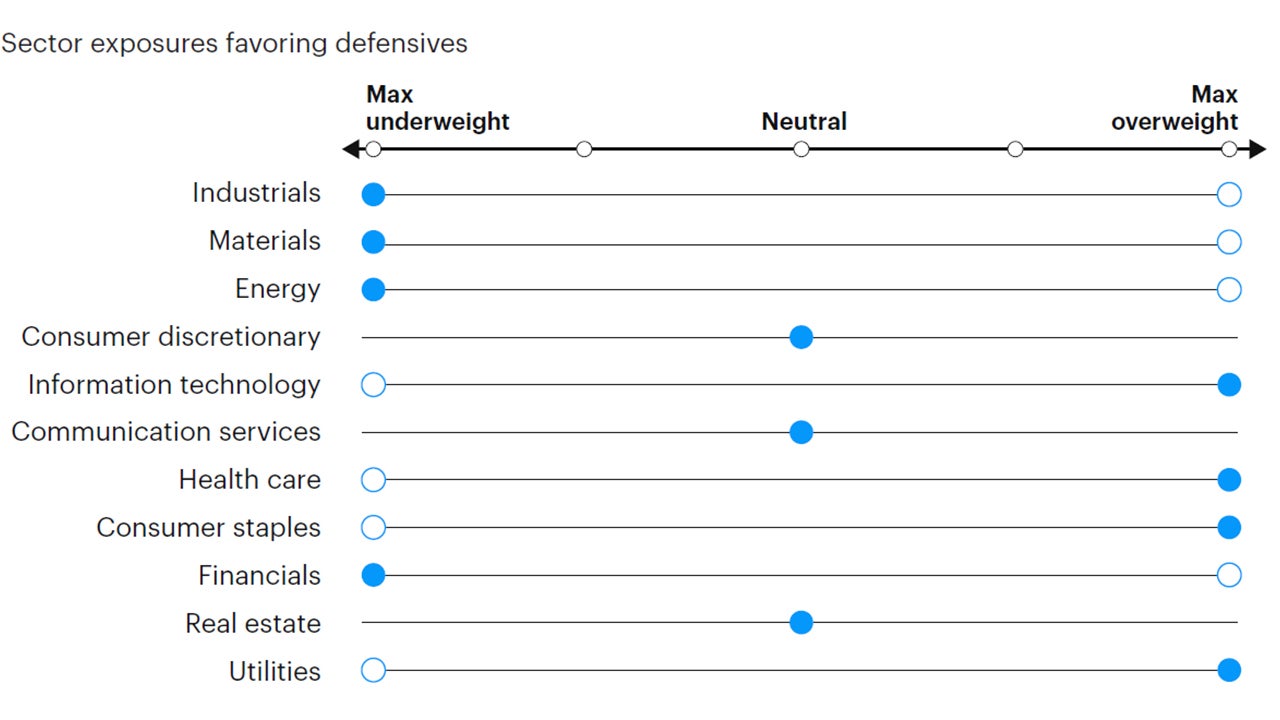

- In equities, we overweight defensive sectors with quality and low volatility characteristics, tilting towards larger capitalizations at the expense of value, mid and small caps. Despite the high market concentration and extended positioning in mega-cap quality names, we expect a combination of quality and low volatility characteristics to provide downside risk mitigation in a mean reversion scenario for equity markets. Hence, we favor exposures to defensive sectors, such as health care, staples, utilities, and technology, at the expense of cyclical sectors, such as financials, industrials, materials, and energy. From a regional perspective, we move to an overweight stance in US equities relative to other developed markets and emerging markets, driven by a downshift in global risk appetite and an improving outlook for the US dollar, supported by negative surprises in global growth and tightening monetary policy relative to the rest of the world.

- In fixed income, we underweight credit risk and overweight duration, favoring investment grade and sovereign fixed income relative to high yield. While the current backdrop does not suggest a major risk for credit spreads, downward revisions to growth expectations are likely to be accompanied by marginally wider spreads from cycle lows and lower bond yields, favoring higher quality and higher duration assets. In sovereigns, we favor nominal bonds over inflation-protected securities, given the recent deceleration in global inflation.

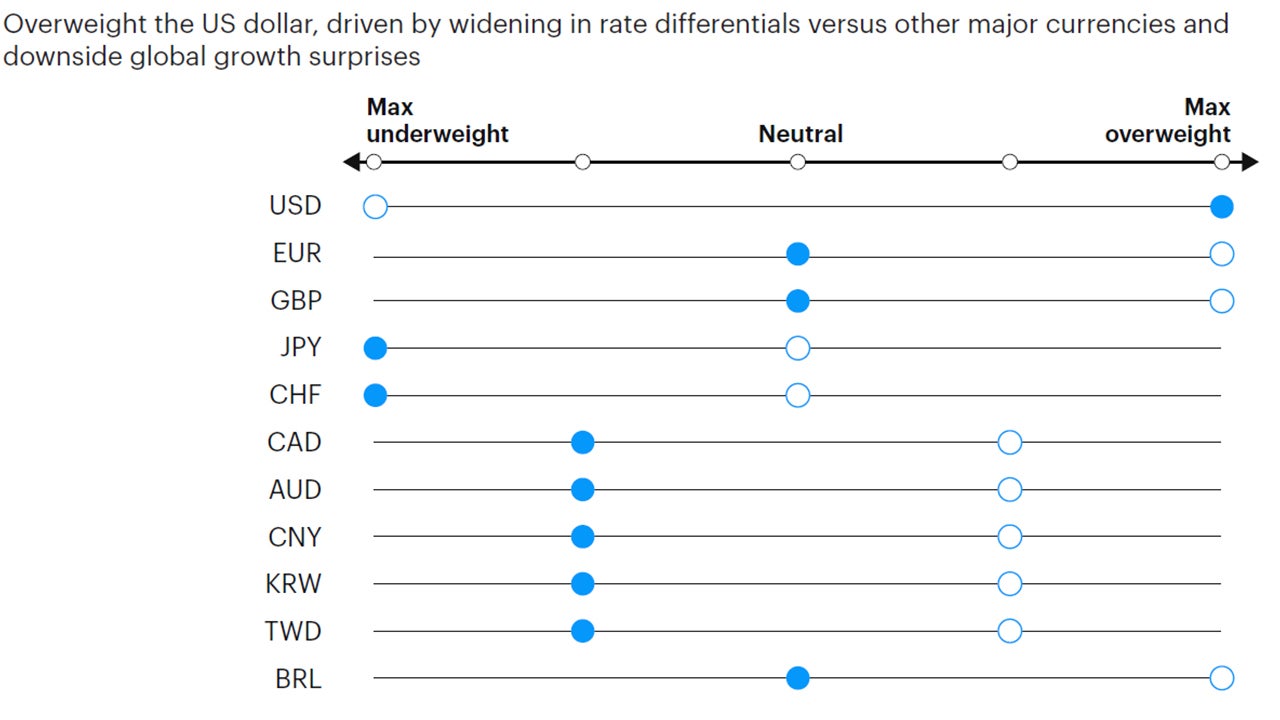

- In currency markets, we overweight the US dollar, driven by renewed widening in rate differentials versus other major currencies and global growth surprising to the downside relative to consensus expectations. Within developed markets, we favor the euro, the British pound, the Norwegian kroner, the Swedish krona, and Singapore dollar relative to the Swiss Franc, the Japanese yen, and the Australian and Canadian dollars. In EM, we favor high yielders with attractive valuations, such as the Colombian peso, the Brazilian real, the South African rand, and the Indonesian Rupiah, relative to low yielding and more expensive currencies, such as the Korean won, the Mexican peso, the Philippines peso, and the Chinese renminbi.

Source: Invesco Solutions, July 1, 2024. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, July 1, 2024. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, July 1, 2024. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Solutions, July 1, 2024. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.