Tactical Asset Allocation - April 2023

Synopsis

Despite higher equity markets, a more comprehensive read of global financial markets points to tightening credit conditions and declining risk appetite in a low growth environment. We remain positioned for a contractionary environment.

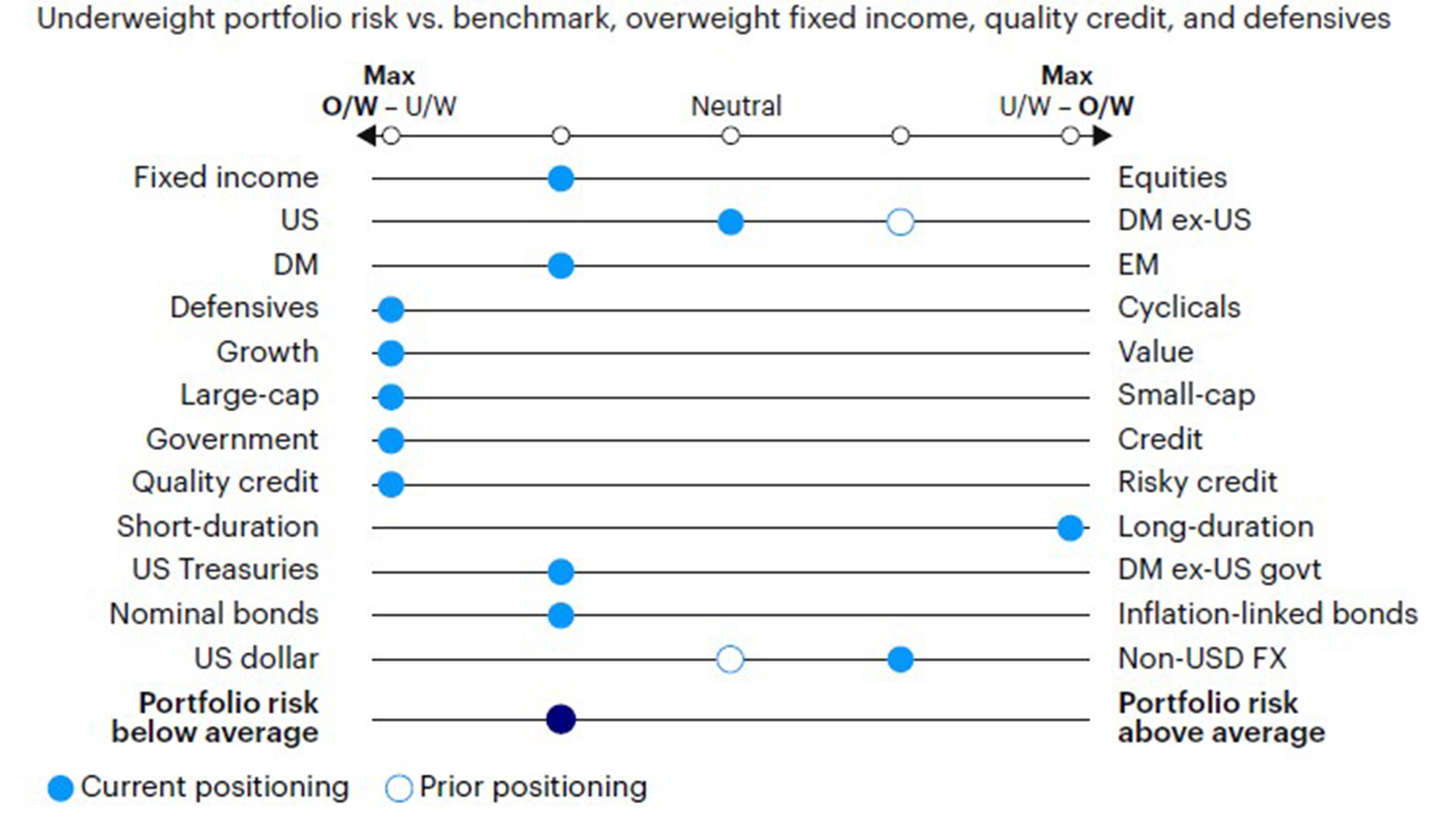

Underweight risk relative to benchmark in the Global Tactical Allocation Model1, favoring fixed income over equities, developed markets over emerging markets, defensive sectors and factors. We have neutralized the overweight in developed ex-US equities relative to US equities. We favor investment grade relative to high yield, loans, and emerging market debt.

Macro update

Financial markets over the past month can be described as tumultuous and confusing, to say the least. Numerous bank failures across US regional banks and large European financial institutions have wreaked havoc in the global banking system, prompting the intervention of global central banks with emergency liquidity assistance (i.e., Federal Reserve’s Bank Funding Assistance Program), deposit guarantees and bank mergers. The swift reaction of policy makers has been critical in stabilizing market sentiment and averting a more systemic sell-fulling contagion. Somewhat surprisingly, equity markets across regions have risen over the past month closing at higher levels than when the first headlines of bank failures emerged in early March. Is this positive equity market performance indicative of a resolved problem and pointing to improving growth prospects? We don’t think so.

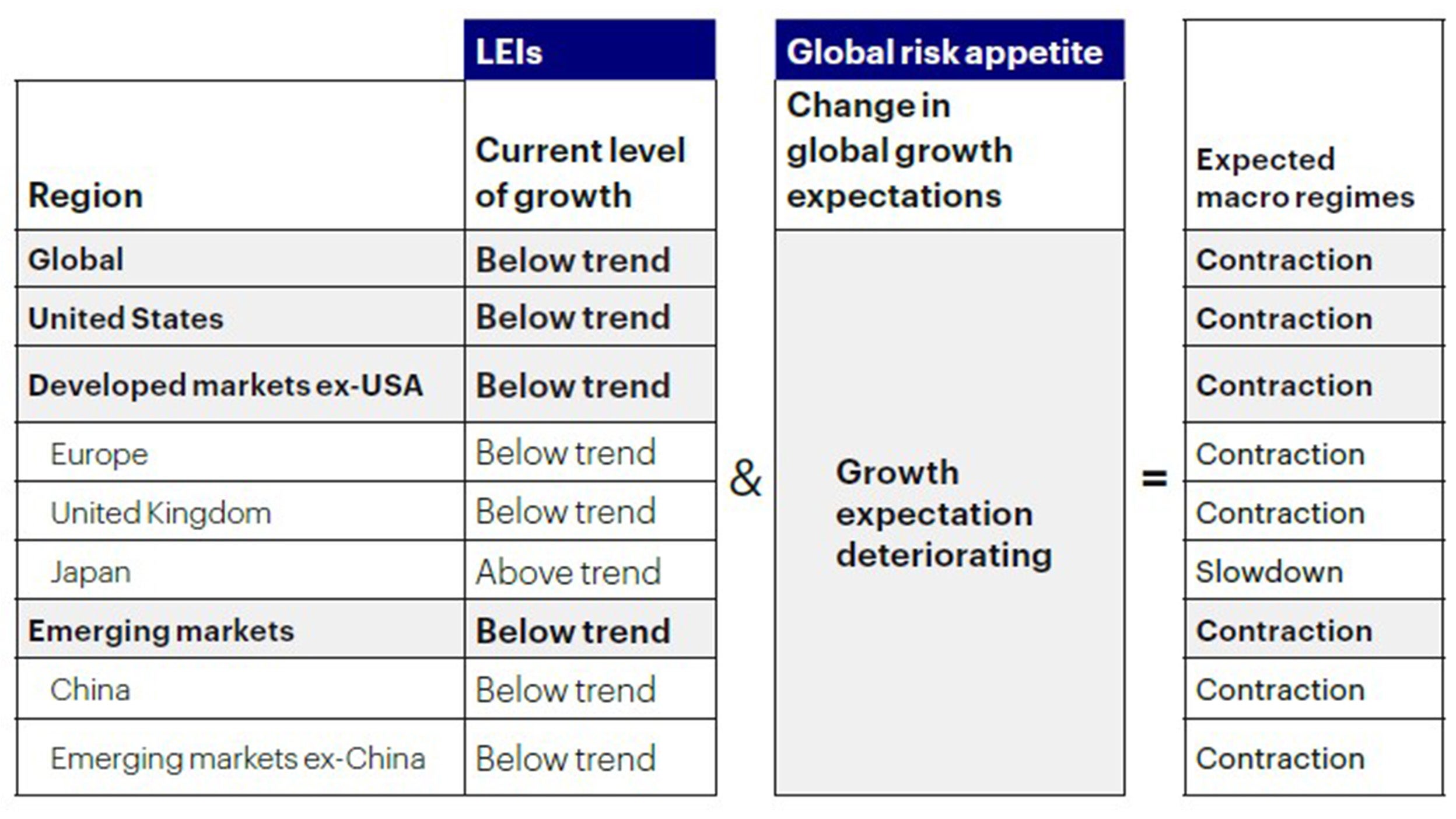

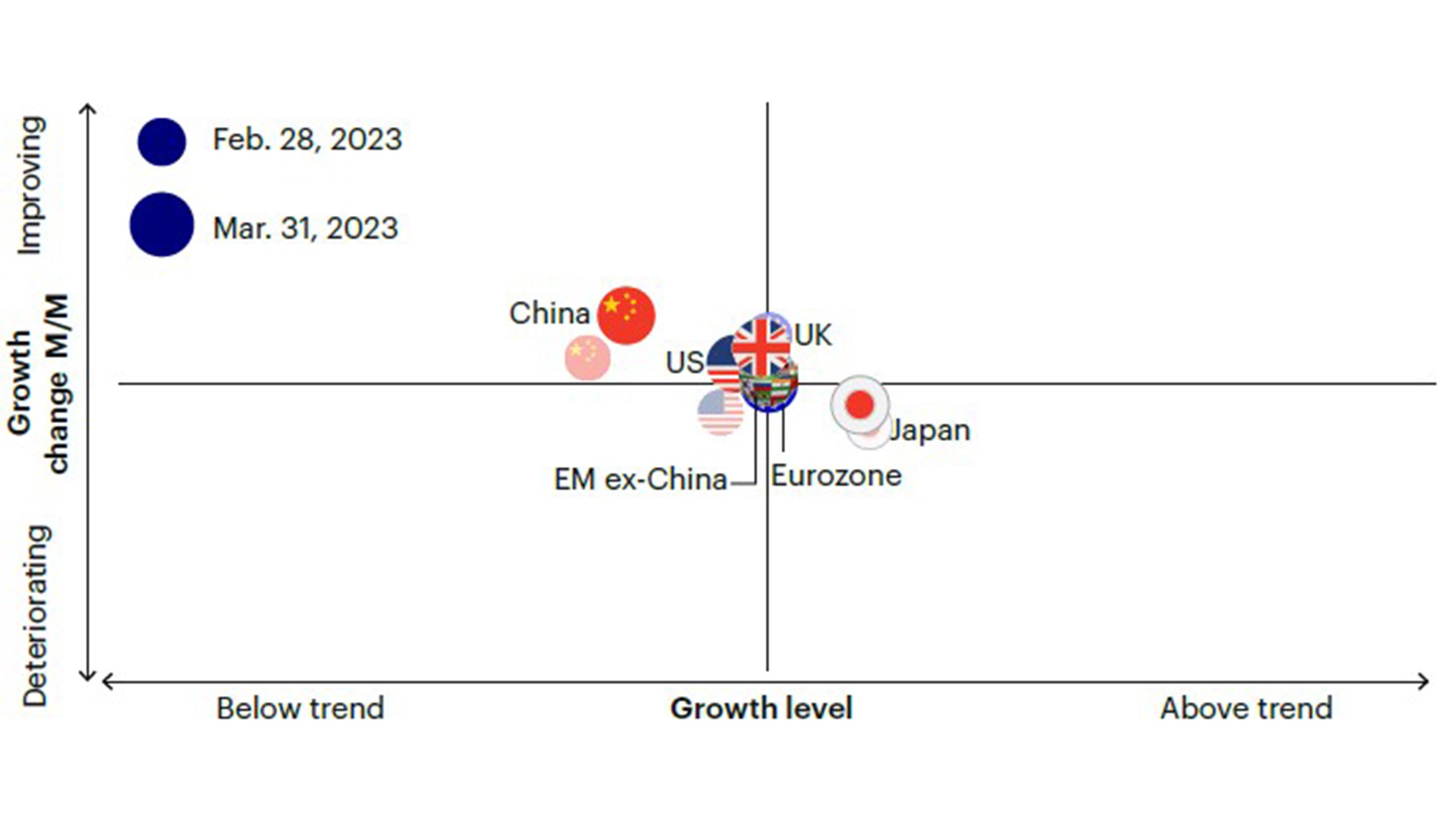

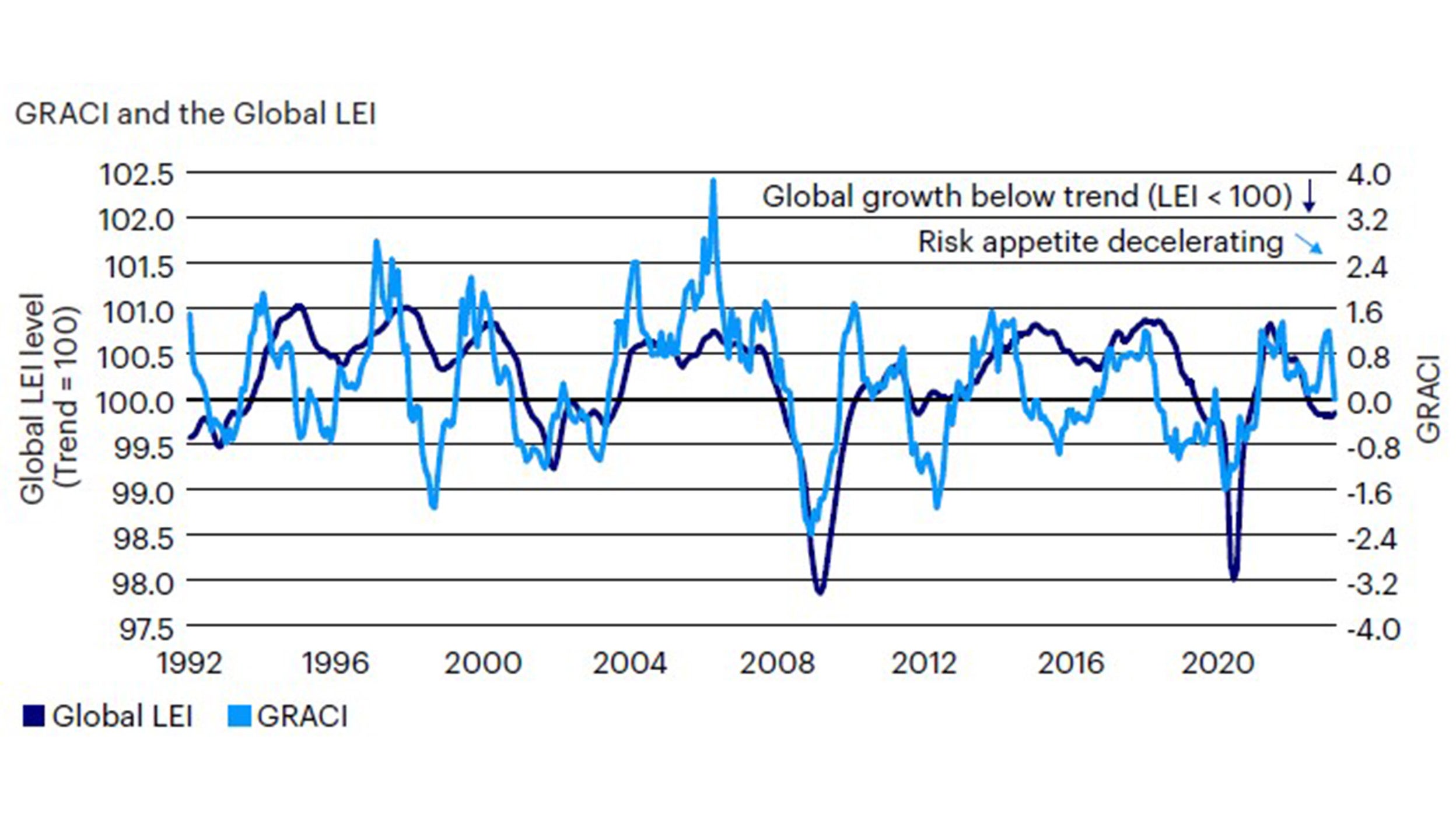

Looking underneath the surface, a comprehensive read of global capital markets reveals a more cautious investor landscape. Credit spreads have widened, albeit modestly, across regions and sectors, with corporate high yield and investment grade wider by approximately 40bps and 15bps, respectively, and emerging markets wider by about 30bps2. Similarly, global government bond markets have outperformed equity markets, an indication that the global equity rally was largely driven by lower discount yields rather than improving growth expectations. Consequently, our barometer of global investor risk appetite has deteriorated further over the past month which, in conjunction with leading economic indicators below their long-term average, keeps our macro framework in a contraction regime for the global economy (Figure 1 and Figure 2). While leading economic indicators have improved across regions over the past month, we believe this represents a lagged confirmation to the improving outlook we discussed at the beginning of the year (i.e., the “recovery” regime we anticipated between December 2022 – February 2023), but that has subsequently abated. We expect economic momentum to roll-over again given the deterioration in global risk appetite, tightening credit conditions and recent stresses in the banking system.

Sources: Bloomberg L.P., Macrobond. Invesco Investment Solutions research and calculations. Proprietary leading economic indicators of Invesco Investment Solutions. Macro regime data as of March 31, 2023. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Investment Solutions research and calculations, from Jan. 1, 1992 to Mar. 31, 2023. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk taking in global capital markets in the recent past. Past performance does not guarantee future results.

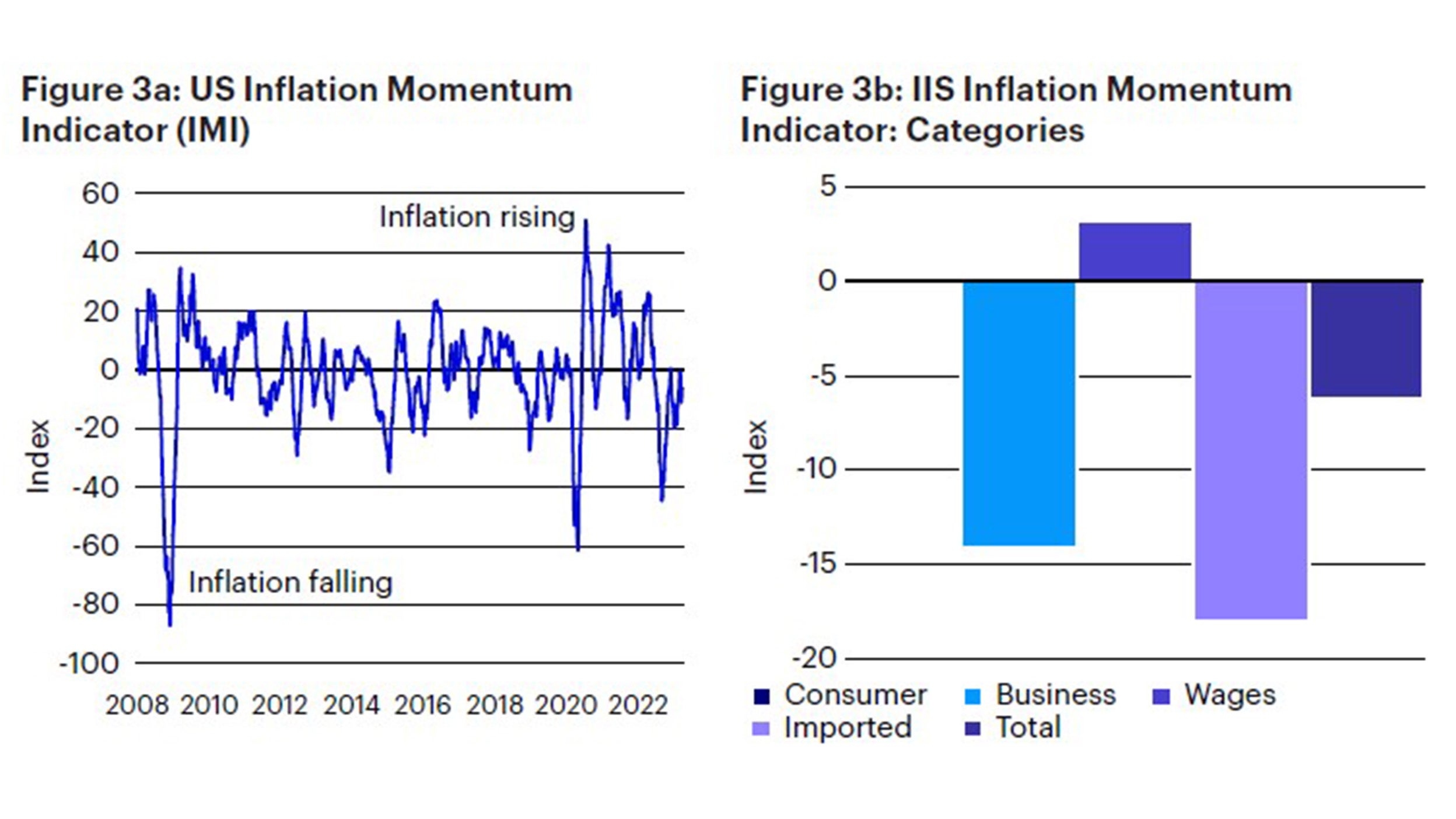

While the recent turmoil was driven by idiosyncratic bank failures, these developments should be seen as a manifestation of tighter credit conditions more broadly, and a reminder that monetary policy impacts the economy with a lag, and its effects have just started making their way into the system. As noted in several comments by Fed officials, capital markets have largely been closed in the past few weeks in terms of bond issuance, and the resulting tightening in credit conditions can be seen as equivalent or a substitute to rate hikes. We expect the Federal Reserve to end its tightening cycle soon, while the European Central Bank (ECB) will likely continue raising rates. Inflation should gradually decline, albeit not as quickly as desired. Our barometer of US inflation momentum still points to falling inflationary pressures (Figure 3).

Overall, growth remains low, and the odds of a deterioration in global growth are rising. Our asset allocation framework indicates downside risks to cyclical assets are not fully priced.

Sources: Bloomberg L.P. data as of March 31, 2023, Invesco Investment Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

We maintain a defensive positioning, with an underweight risk stance relative to benchmark in the Global Tactical Allocation Model, favoring fixed income over equities, defensive sectors and factors, and underweighting emerging market equities relative to developed markets. We underweight credit risk and overweight duration, favoring investment grade and government bonds relative to high yield, loans, and emerging market debt (Figure 4, 5, 6, 7).

In particular:

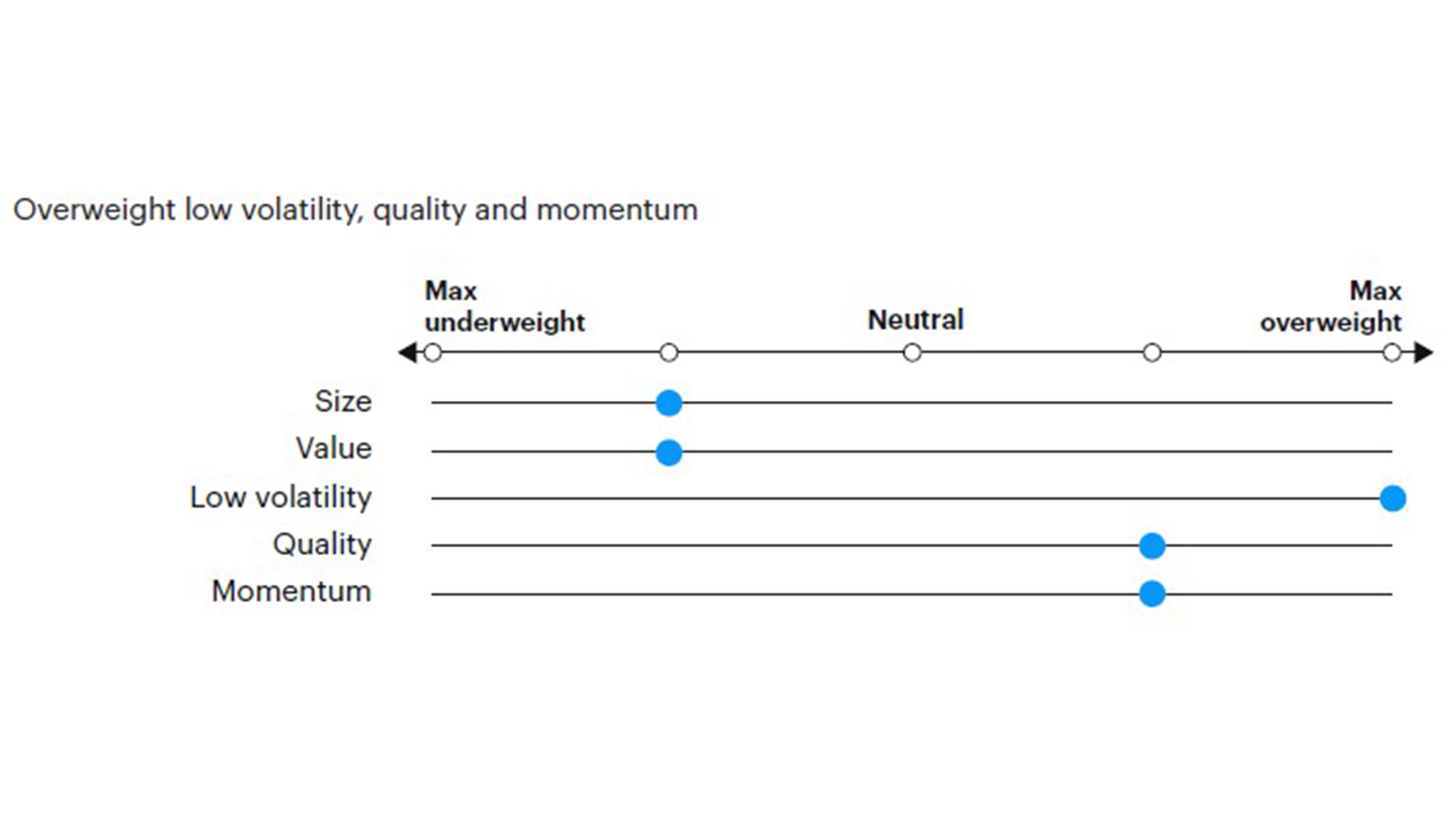

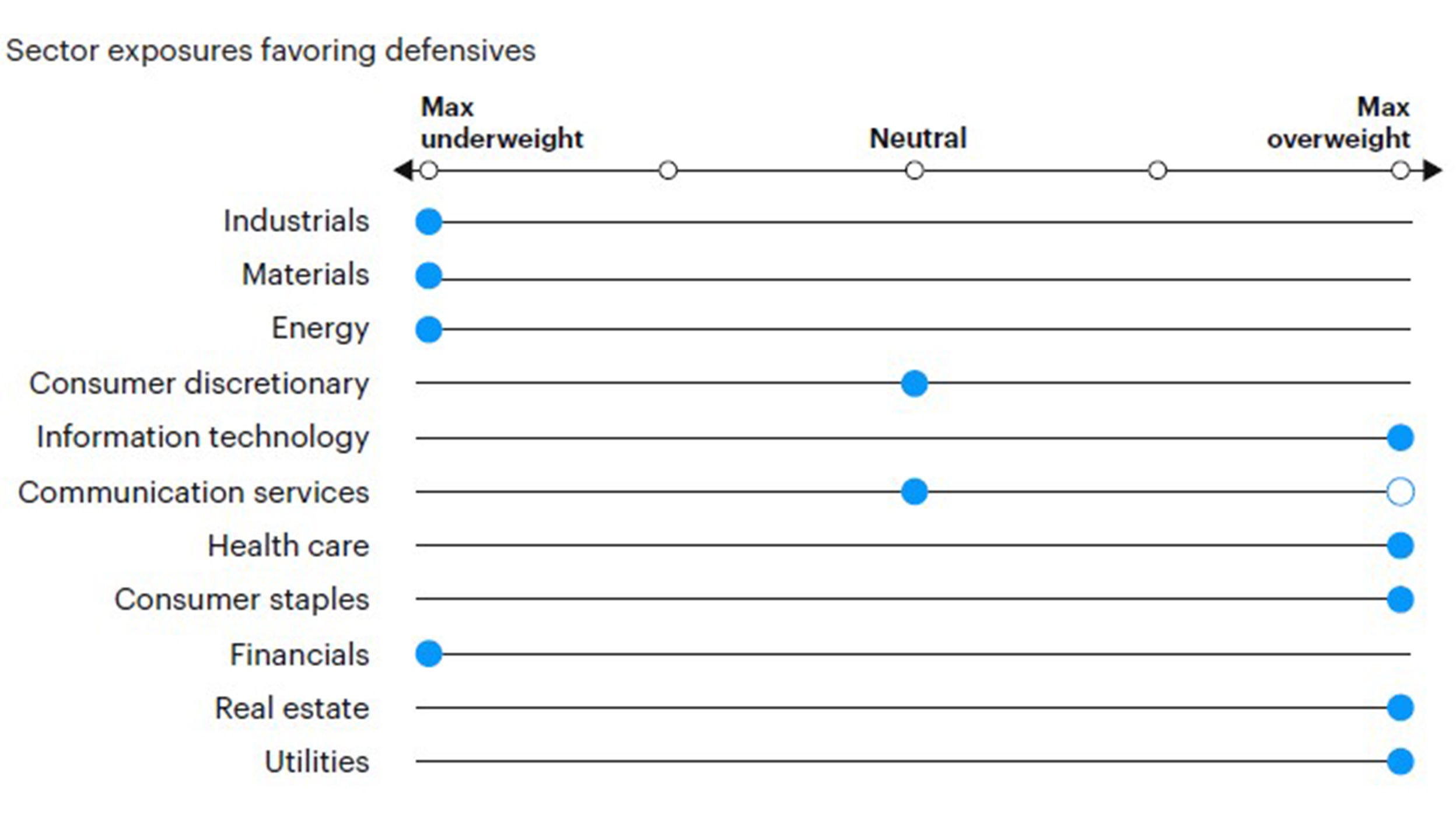

- Within equities we favor defensive factors with low operating leverage and lower exposure to economic risk such as quality and low volatility, at the expense of cyclical exposures such as value and small/mid-caps. Similarly, we favor defensive sectors such as health care, staples, utilities, and technology, at the expense of financials, industrials, materials, and energy. From a regional perspective, we continue to underweight emerging markets given the headwinds from declining risk appetite and neutralize the overweight to developed markets outside the US after holding an overweight position for the past four months. While currency valuations continue to favor non-US equities, the cyclical outperformance in European leading indicators has stalled, moving us to a neutral stance.

- In fixed income, we underweight credit risk3 and overweight duration, favoring investment grade credit and government bonds, underweighting riskier sectors such as loans, high yield, and emerging markets debt. However, income strategies remain attractive in a multi-asset context, especially relative to equities, given the higher level of real and nominal yields, and spreads at historical long-term averages. We continue to favor nominal treasuries relative to inflation-linked bonds given declining inflationary pressures.

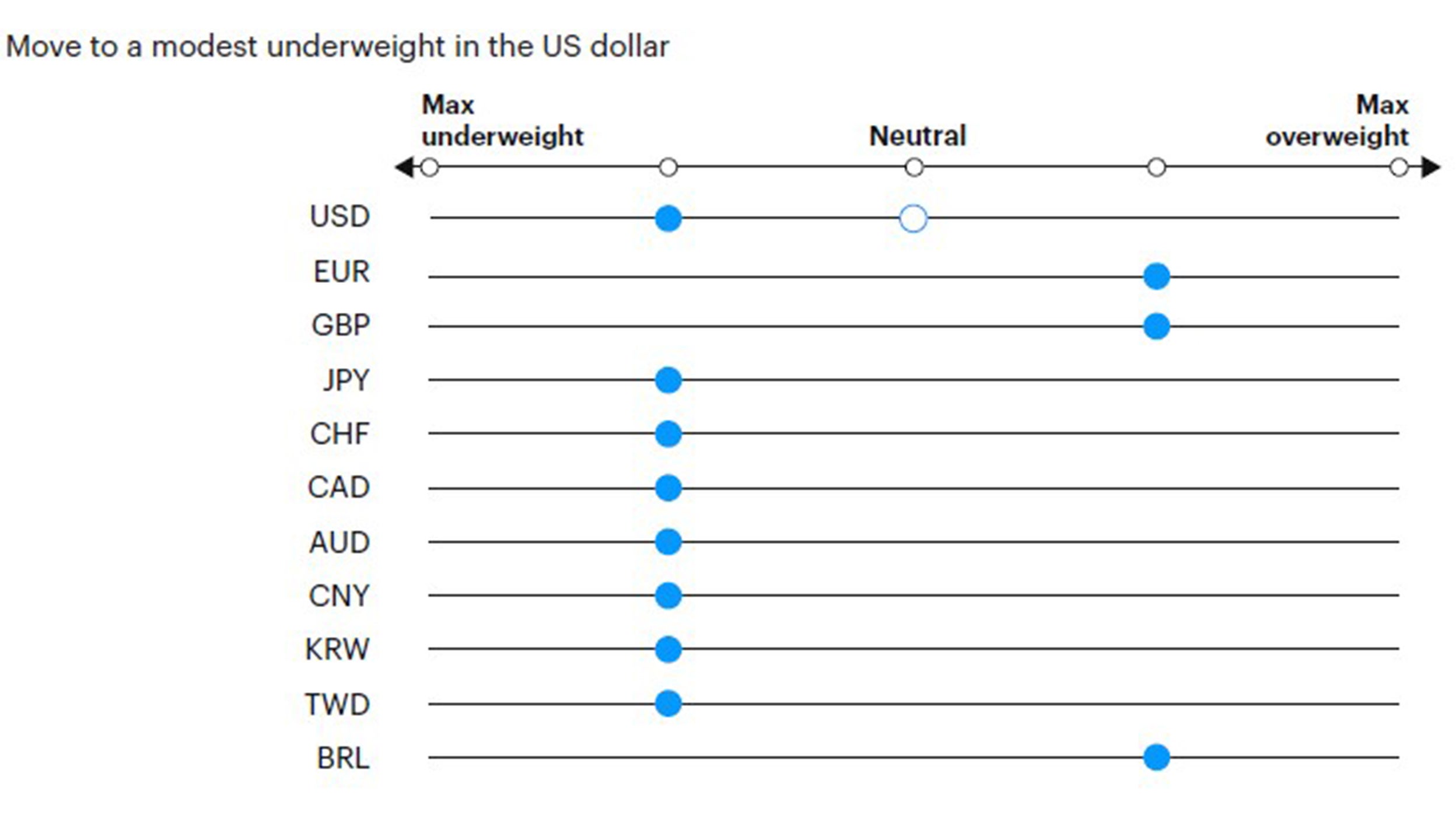

- In currency markets we reestablish an underweight exposure to the US dollar as the US rate differential versus the rest of the world begins to decline. Within developed market currencies we favor the euro, the British pound, Norwegian kroner, and Swedish krona relative to the Swiss Franc, Japanese yen, Australian and Canadian dollars. In EM we favor high yielders with attractive valuations as the Colombian peso and Brazilian real, relative to low yielding currencies as the Korean won and Chinese renminbi.

Source: Invesco Investment Solutions, April 1, 2023. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index.

For illustrative purposes only.

Source: Invesco Investment Solutions, April 1, 2023. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Investment Solutions, April 1, 2023. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of November 30th, 2022, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, communication services, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Investment Solutions, April 1, 2023. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations

FOOTNOTES

-

1

Benchmark is 60% MSCI All Country World Index and 40% Bloomberg Global Aggregate Index (Hedged).

-

2

Reference indices are Bloomberg US Corporate High Yield Index, Bloomberg US Corporate Index and Bloomberg EM USD Aggregated Index.

-

3

Credit risk measured as DTS (duration times spread).