Insurance Insights Q4 2023: Enhancing insurance portfolio allocations

Capital implications are always a key element of insurance portfolios, and portfolio design necessarily needs to look at optimizing capital charges vis-à-vis expected returns. For insurers, regulations governing capital are generally varied and subject to change as regulators continue to update them with a view to making them more robust and fit-for-purpose (whether this means introducing forms of risk-based capital or updating existing frameworks). Given the progressive adoption of International Financial Reporting Standards, IFRS 9/17, an additional focus among insurers is on trying to ensure some degree of harmonization between such standards and capital frameworks.

The objectives for insurance portfolios generally remain to enhance expected returns while reducing capital implications – whether through better asset and liability management (ALM) practices or carefully selecting asset types that are more efficient from this perspective.

In the macro outlook section, we highlight our 2024 outlook for select asset classes that we feel remain very well suited for insurance portfolios. With yields at attractive levels, public fixed income has come back into favor. Public debt typically remains the core foundation of insurance portfolios and can now play an important role in helping increase overall portfolio yields. This, coupled with relative lower capital charges (primarily spread risk for credit) and the ability to construct a customized portfolio for better cash flow matching to help improve solvency (through matching adjustment) makes this a compelling asset class at this time. We have covered, in some detail in our previous newsletter, how such a bottom-up portfolio can be constructed.

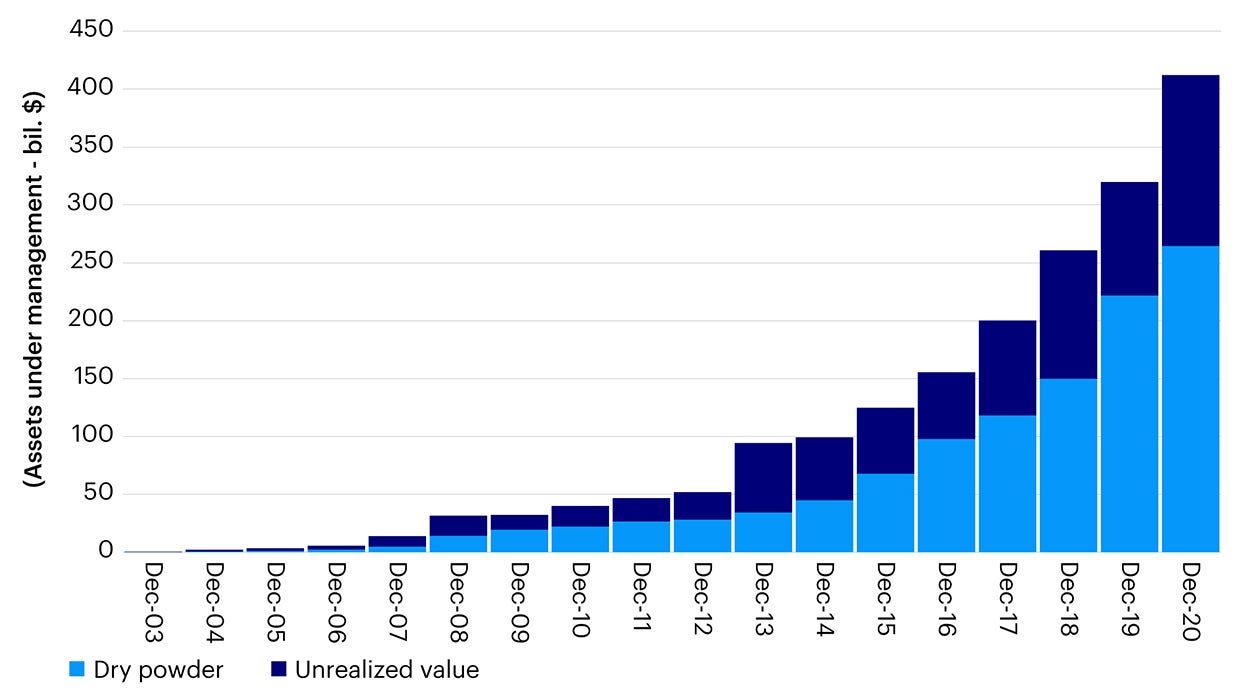

The outlook for private markets also remains robust (Figure 1). We feel with the repricing of such asset classes in the current environment, these remain very viable candidates to add value to insurance portfolios and help make them more efficient. Private market assets remain well suited in complementing existing public market exposures to help bring about diversification and a better expected-return-to-capital-charge profile in most cases. Of course, careful selection of funds, managers and instruments remain key considerations with such asset classes and insurers need to ensure they can manage the liquidity risks that may arise as well as be well placed to work through operational considerations. We have shown in a prior edition how private asset classes can be incorporated into portfolios – including the viability of a multi-alternatives approach.

Source: S&P Global Ratings Research, Preqin. Note: Assets under management for funds primarily focused on direct lending.

As always, we feel that a disciplined asset allocation analysis performed on a regular basis coupled with identifying areas of efficiencies within portfolios and implementing new strategies within a robust framework remains key to managing such portfolios. This also extends to assessing how synthetic strategies and overlays may effectively hedge specific risks (such as duration, currency, equity) to make portfolios more resilient to external shocks.