Insurance Insights Q3 2024: Optimizing fixed income portfolios

In this case study we assess insurers’ exposure to broad investment-grade USD-denominated debt. For the purposes of this analysis the investable universe covered is the ICE BofAML US Corporate Master Index (ticker C0A0).

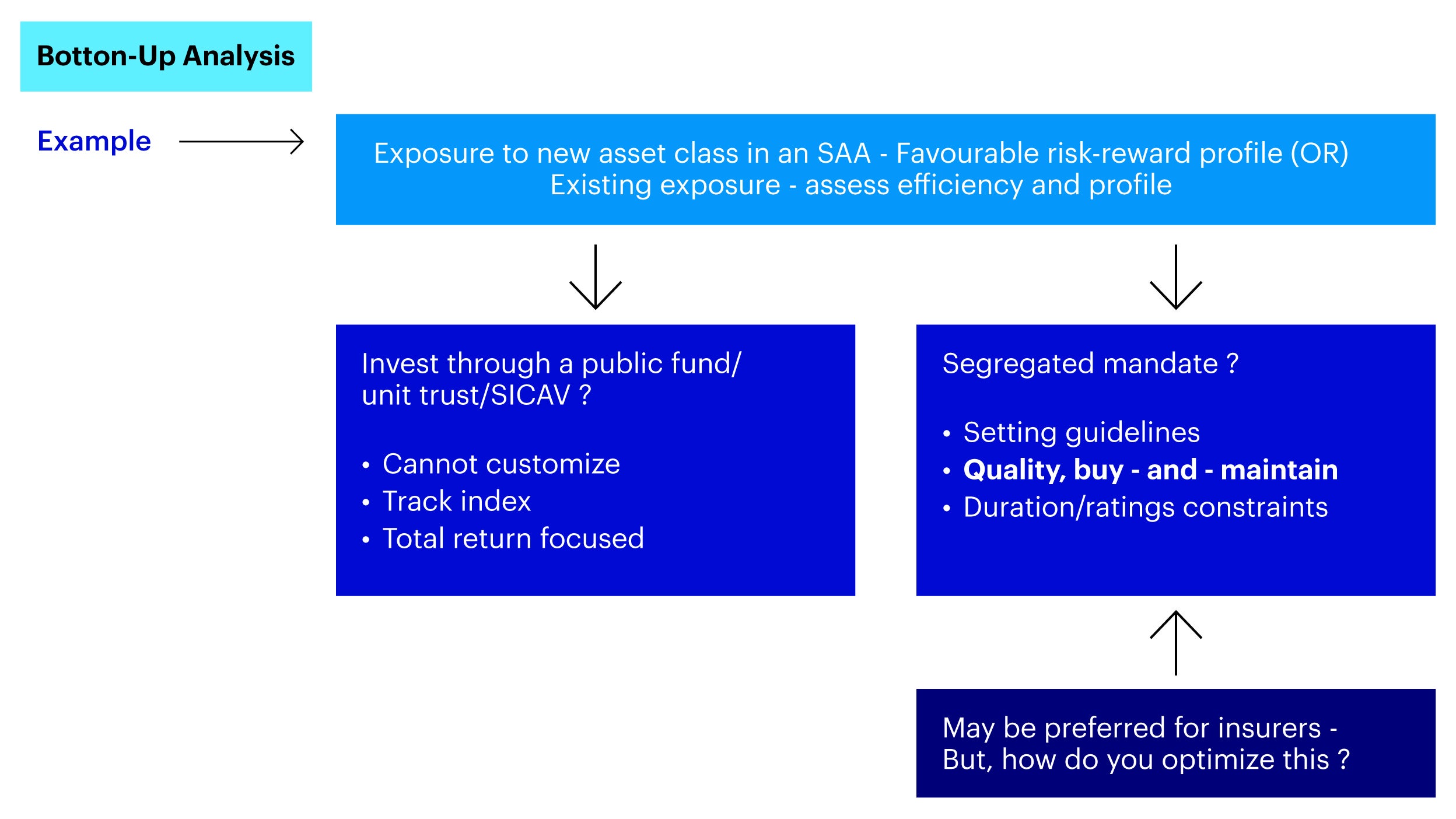

After an insurer has decided to invest in this asset class, the next step is to decide how to implement this. One way is to invest in a public fund, unit trust or ETF; another is via a segregated or separate account through a mandate given to an investment manager. Insurers generally favor the latter approach given the level of customization it offers (including, now, potential accounting considerations as well) which can then be managed as a primarily buy-and-maintain mandate (well-suited for core exposures). The guidelines or constraints around average/minimum ratings and duration etc. can also be controlled more effectively.

This analysis is illustrated below:

Source: Invesco. For illustrative purposes only.

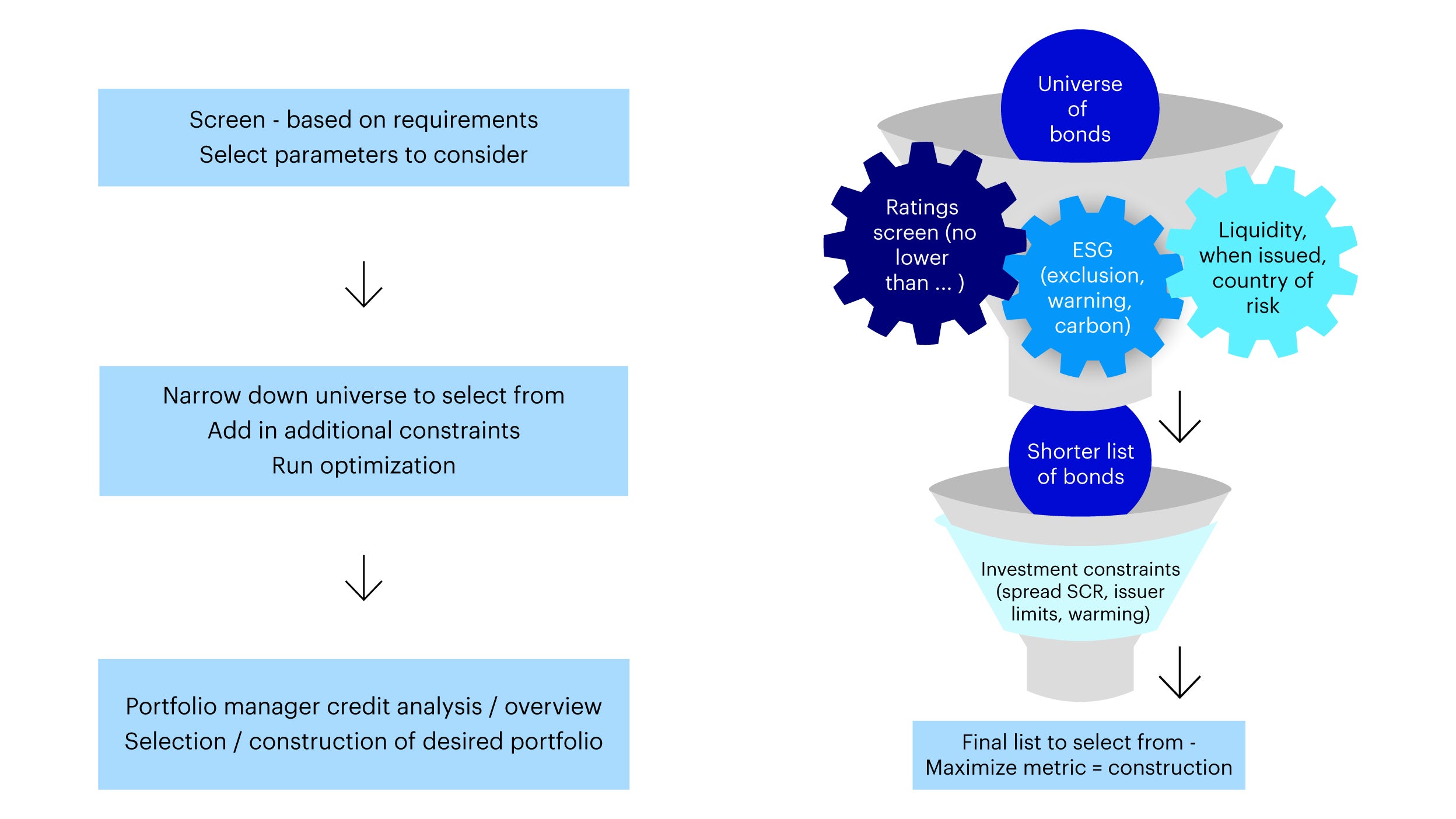

The next step is to screen from the thousands of available bonds and narrow down the universe from which to construct an appropriate portfolio. We showcase this process below:

Source: Invesco. For illustrative purposes only.

Initial screening using Vision

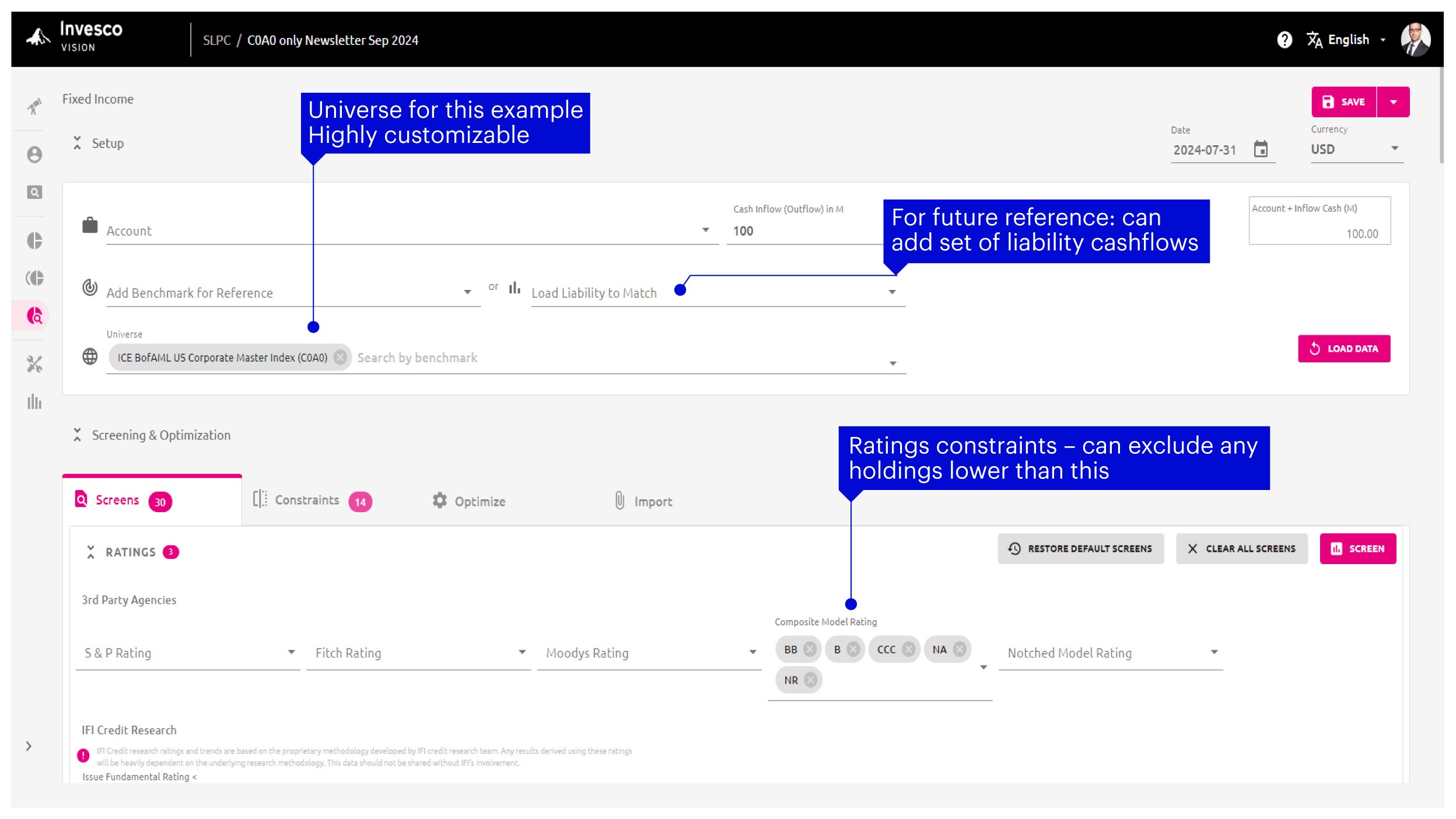

Now, we’ll show how we can use our portfolio management platform, Invesco Vision1, to identify a smaller set of bonds, from a larger universe, out of which we can construct an efficient portfolio.

We do this using a series of screens and then follow up by defining insurers’ constraints and objectives and determining how to optimize them. The first screen could be based on ratings and liquidity for example, or could exclude certain countries or regions (depending on an insurer’s internal guidelines and requirements). Once the universe has been screened on a broad level, we can then apply more granular constraints – across maturity, issuer limits, and ratings to name a few – or even a combination of one or more of these.

As illustrated earlier, in the example below, we have started with the ICE BofAML US Corporate Master Index. This universe covers the high-grade US market and forms a suitably large base from which to select relevant holdings.

We have then applied a simple ratings-based screen – to reiterate the importance of including only investment grade securities in the screened universe:

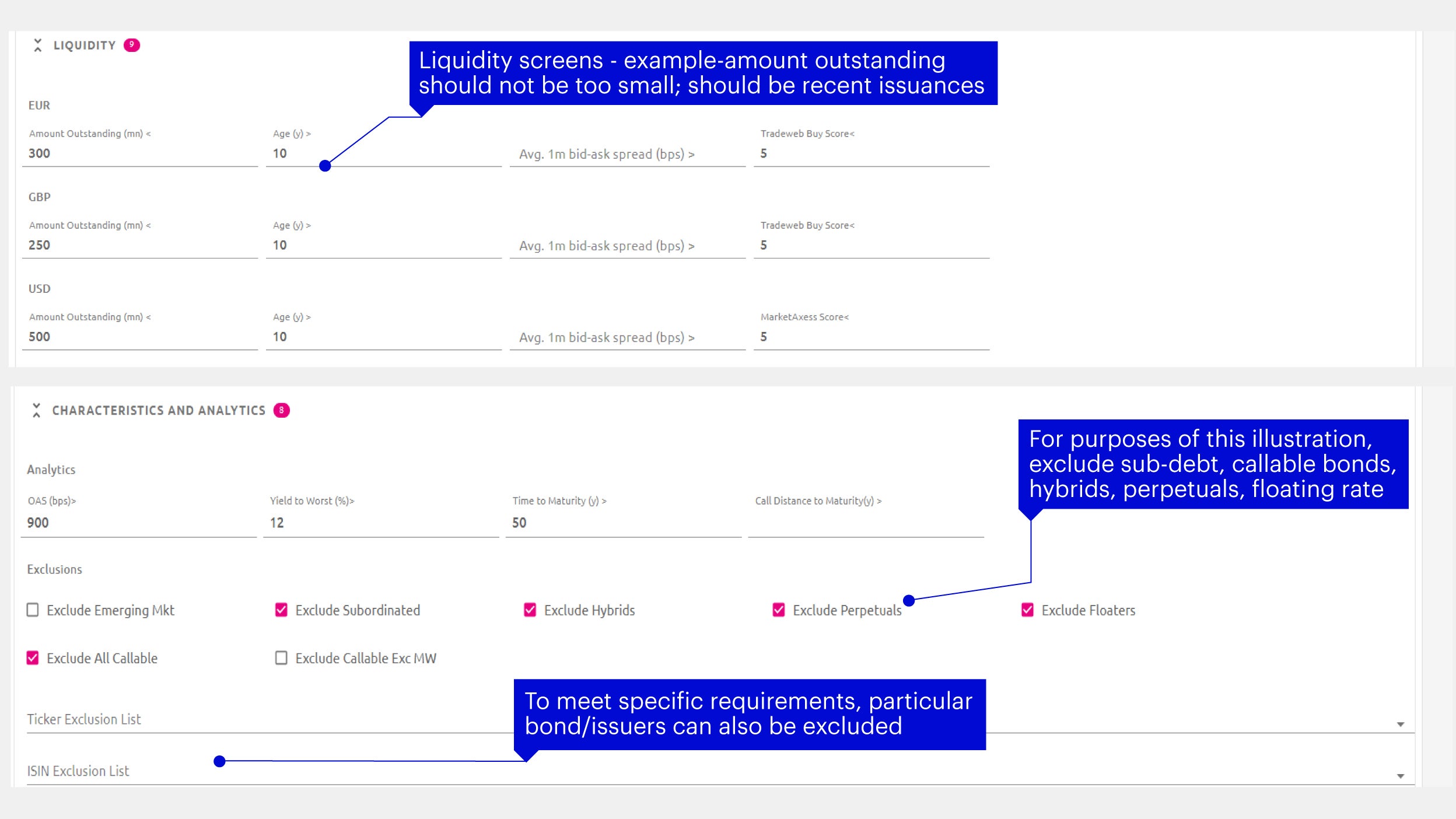

In addition, we are also able to screen the universe based on liquidity (for example, we could choose to exclude bonds that were issued several years ago) as well as exclude bonds with specific characteristics such as optionality (callable bonds), subordination, hybrids, perpetuals, etc., all with the aim of constructing a quality-tilted, stable portfolio:

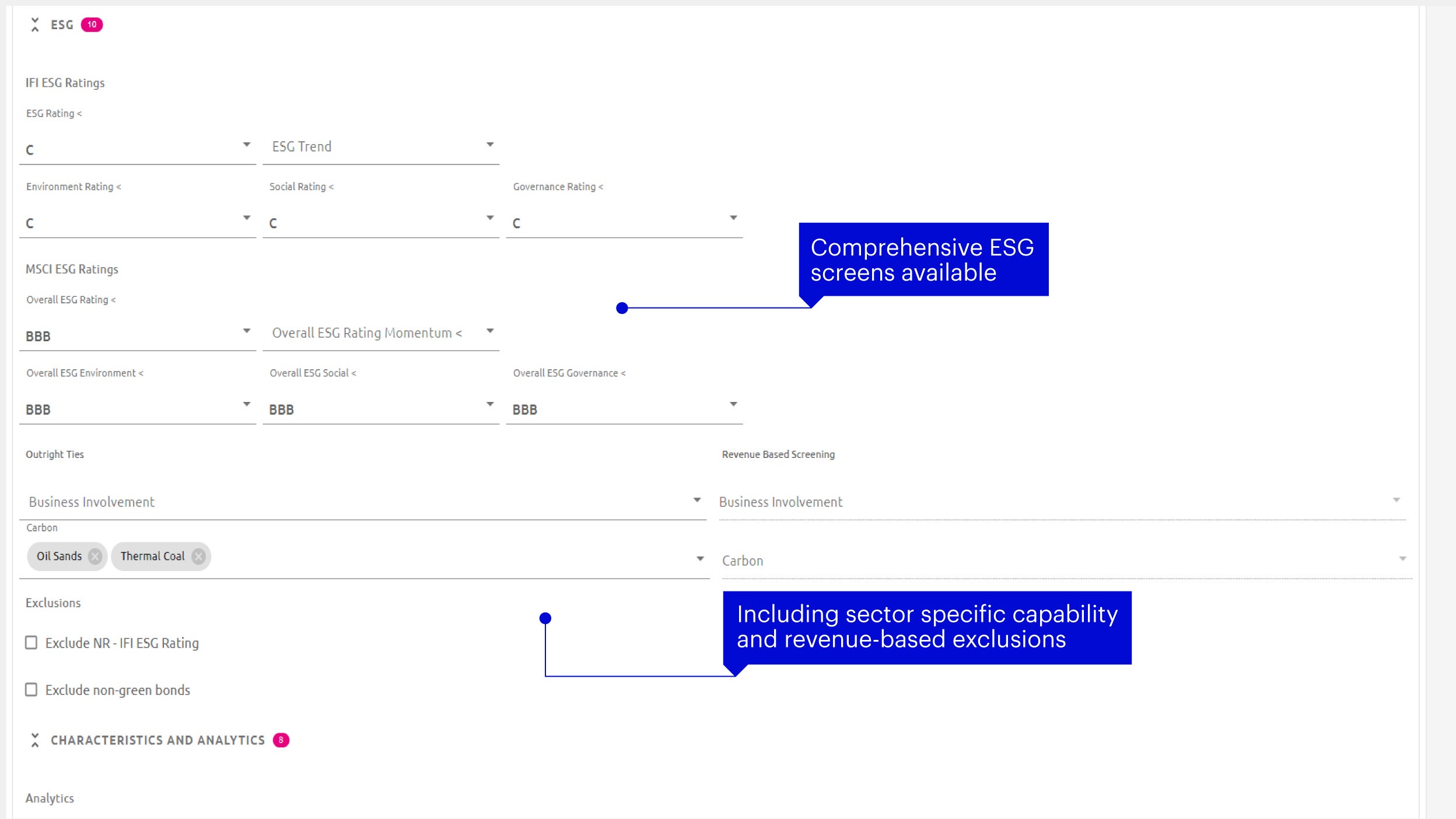

We can also screen the universe based on a comprehensive ESG-related criteria (such as overall ratings, business involvements, direct carbon involvement, etc.), as shown below:

Introducing constraints

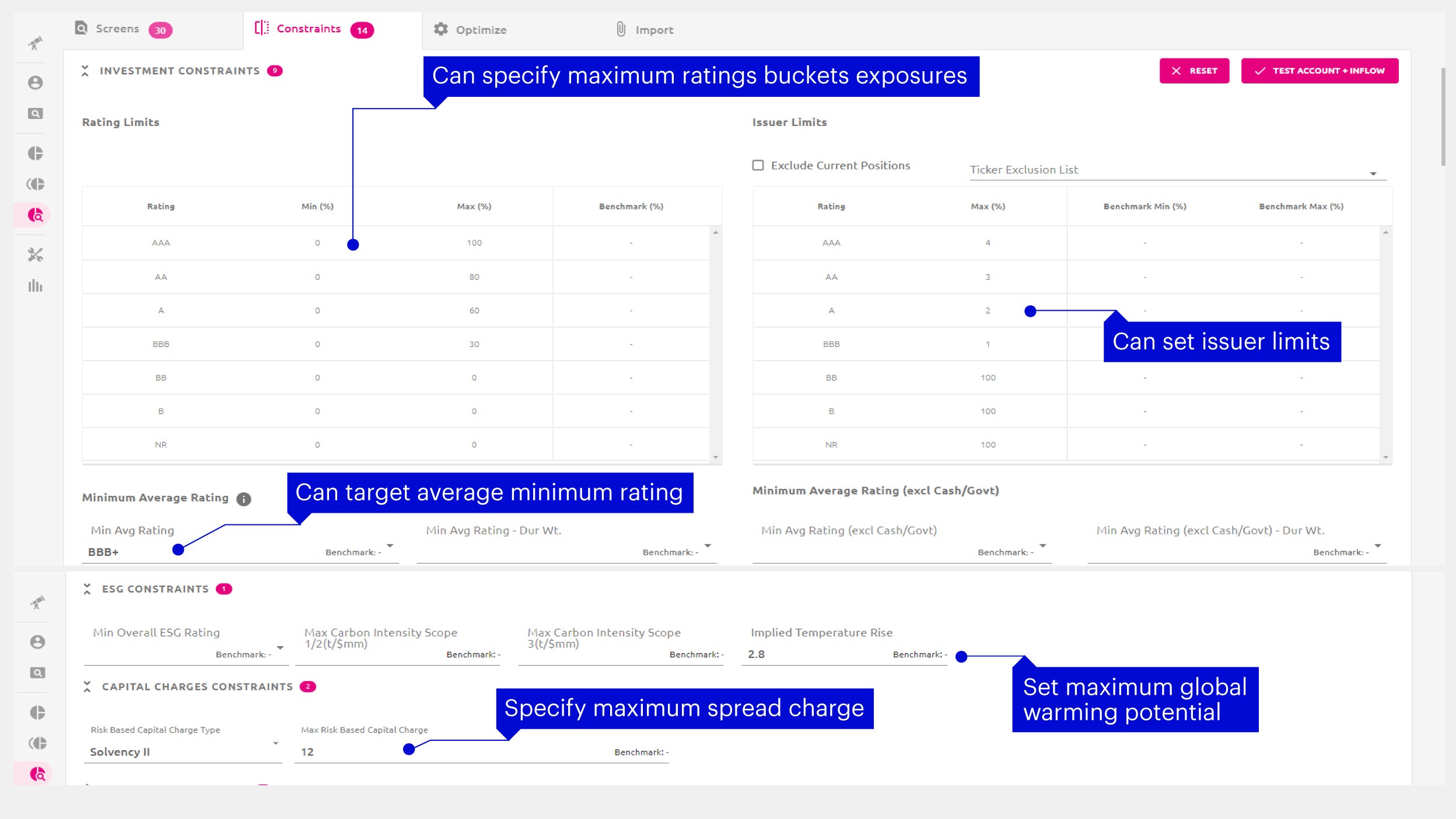

We are now able to move on to introducing constraints (i.e., active choices). As examples of this, we can set a desired minimum average rating (here set at BBB+) and introduce limits across single issuers (aggregate as well as individual), asset sub-types, sectors, etc.

There are several other sections in the Vision platform, such as:

- ESG – We can set maximum carbon intensity levels (Scope 1, 2, 3) as well as a maximum global warming potential (here set at 2.8 degrees Celsius, for illustrative purposes only);

- Solvency II credit spread SCR – We can specify a maximum spread risk charge;

- Duration constraints (including by duration buckets) – We can pinpoint duration constraints to be able to better match liabilities (here set between 5 and 15, for illustrative purposes only);

- Liability cashflows – If required, portfolio construction can be done relative to a set of defined/best-estimate liabilities

There is also provision to incorporate custom constraints by specifying logical conditions and setting limits based on these.

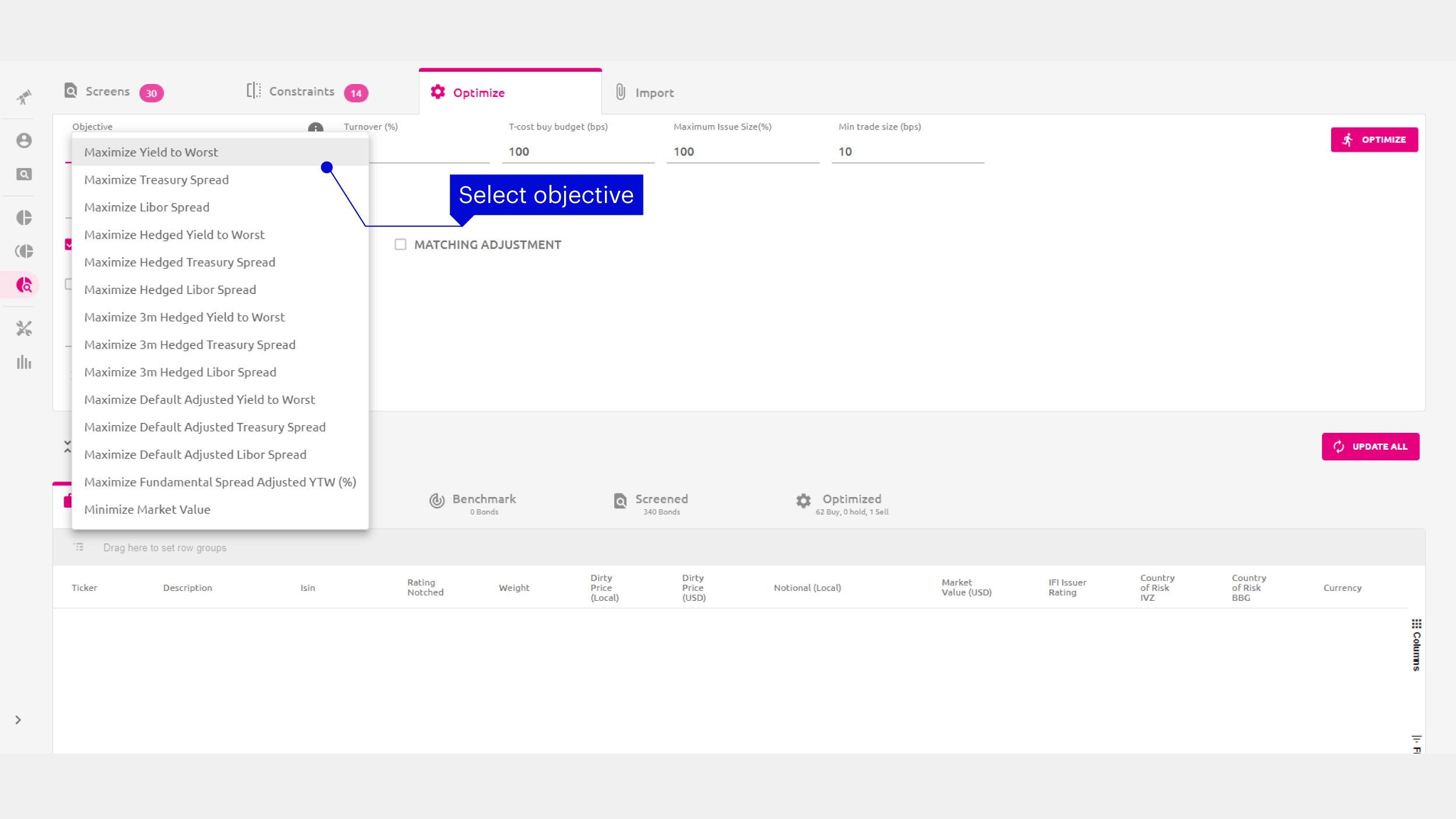

Once the desired constraints are parameterized, the final step is to run an optimization process – selecting a portfolio metric that we wish to optimize for.

In this example, we select the objective of maximizing the yield to worst:

With this, we are now ready to run the optimization and assess the results.

Analysis of results

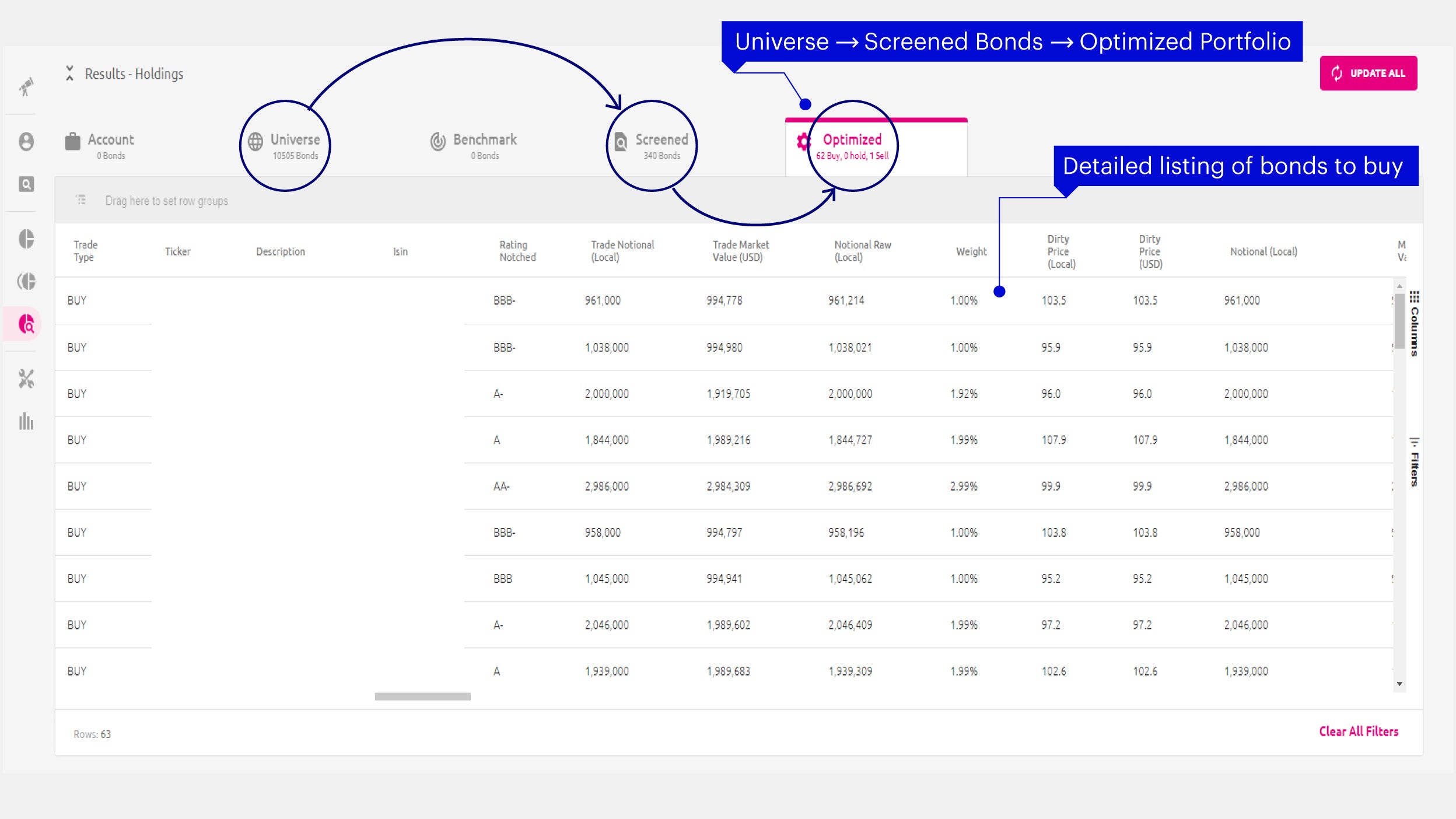

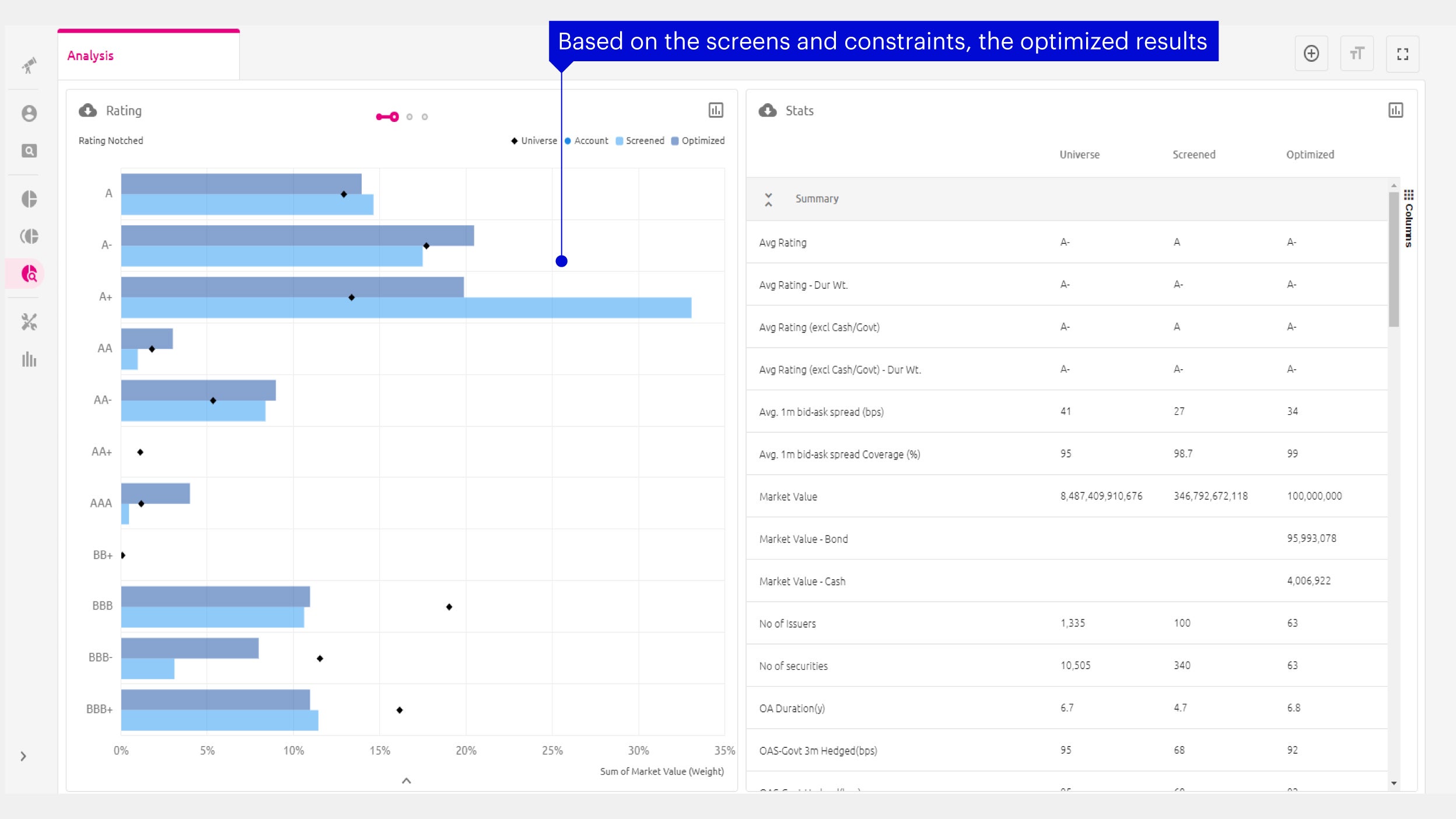

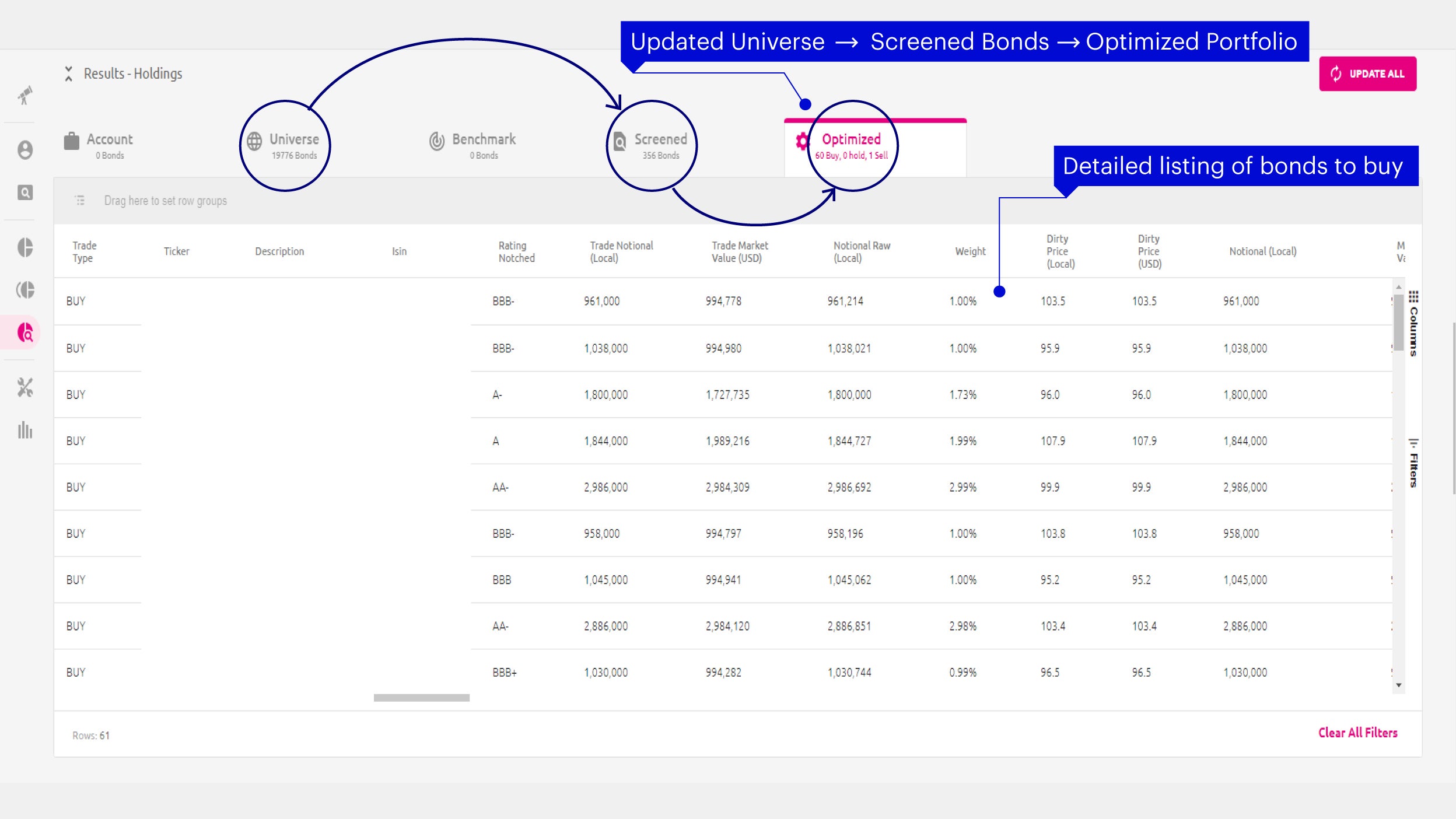

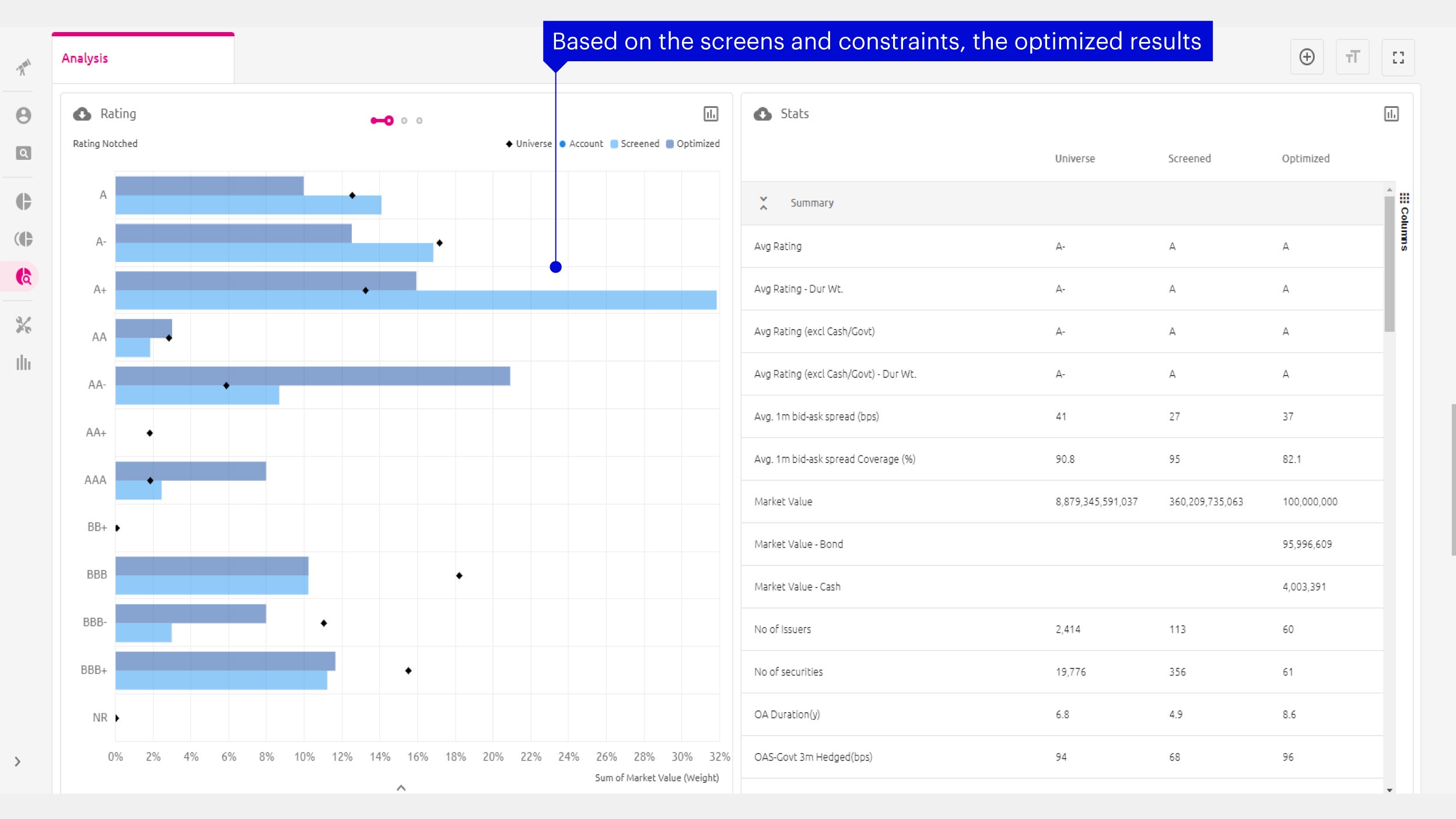

The following shows the optimized result of the screens and constraints. As we can see, the initial list of more than ten thousand bonds was narrowed down based on our screening criteria and a final list of bonds was selected to achieve the desired parameters. The suggested bonds are shown below and can be used as the basis for constructing an appropriate portfolio:

We can also compare and assess the broad characteristics of the potential portfolio relative to the starting universe:

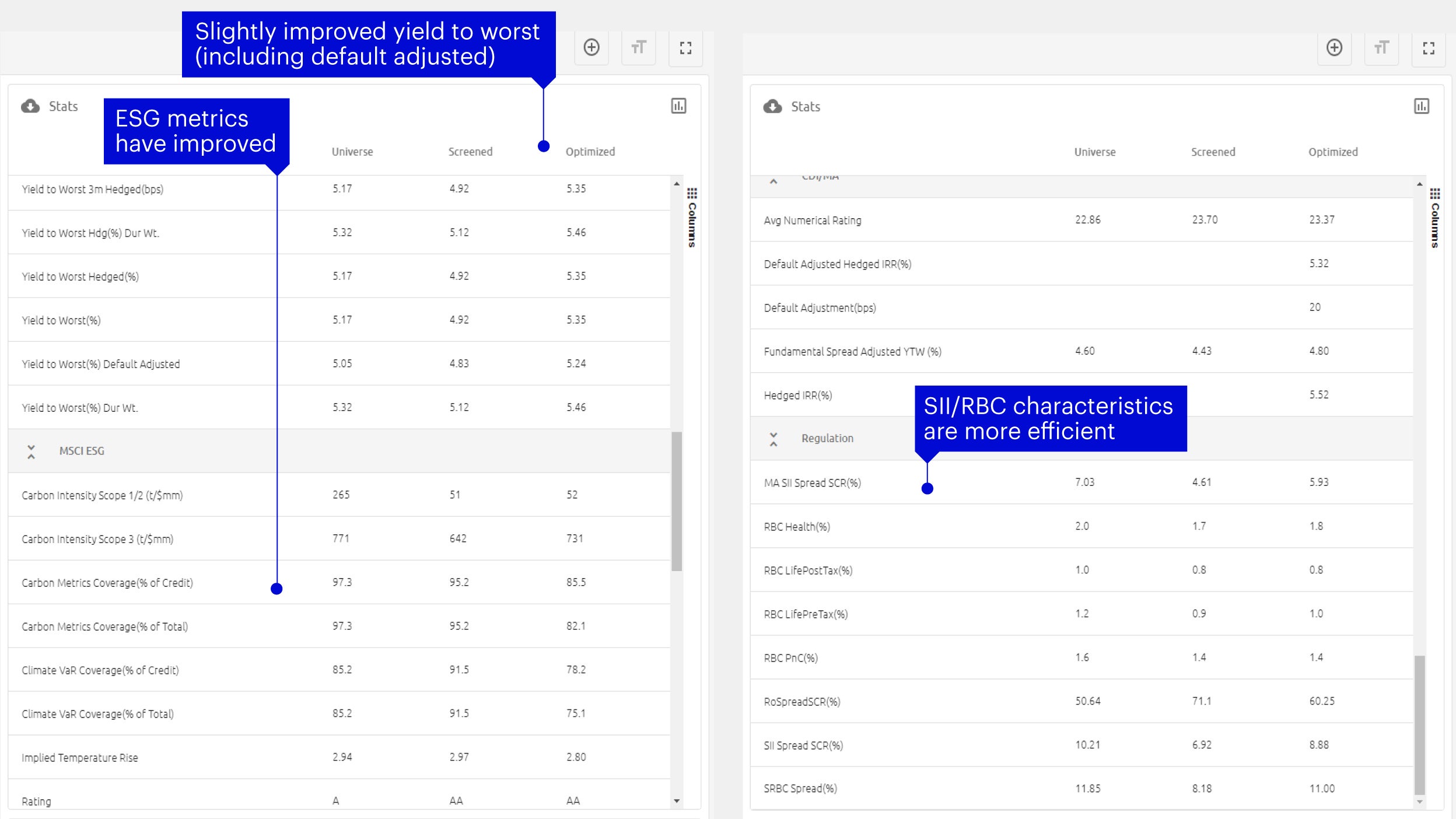

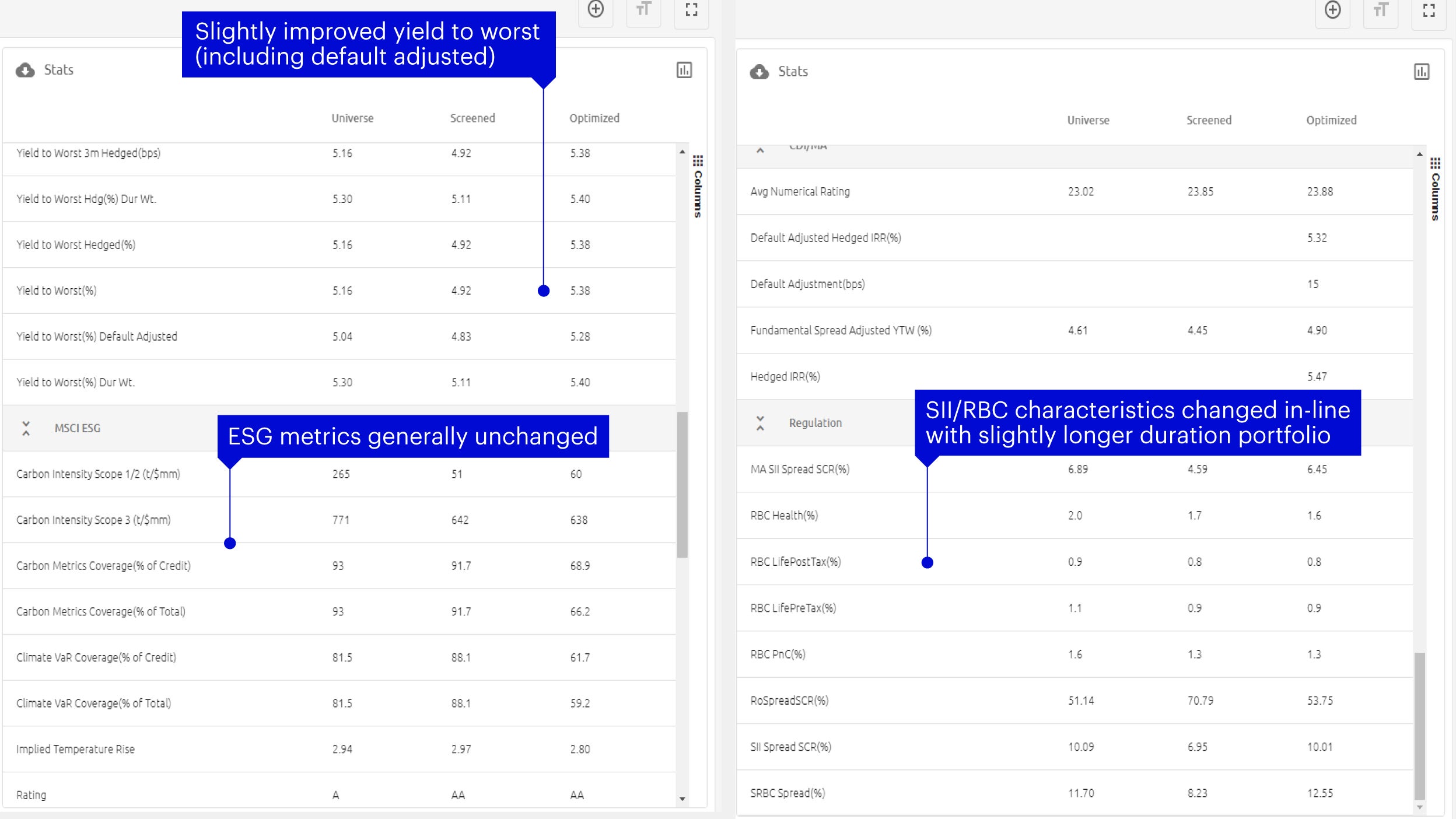

Detailed statistics allow for a deeper comparison across the various metrics of interest (rating, duration, yield, spread charge, ESG scores, etc.) to assess improvements or enhancements:

Through an iterative process, the portfolio can be modified (by changing screening or constraints criteria) to fine-tune any of the desired characteristics.

Matching adjustment consideration can also be incorporated while constructing and optimizing these portfolios. A set of liability cashflows can be used as part of the security selection process with constraints around asset-liability gaps.

Enhancing the investable universe

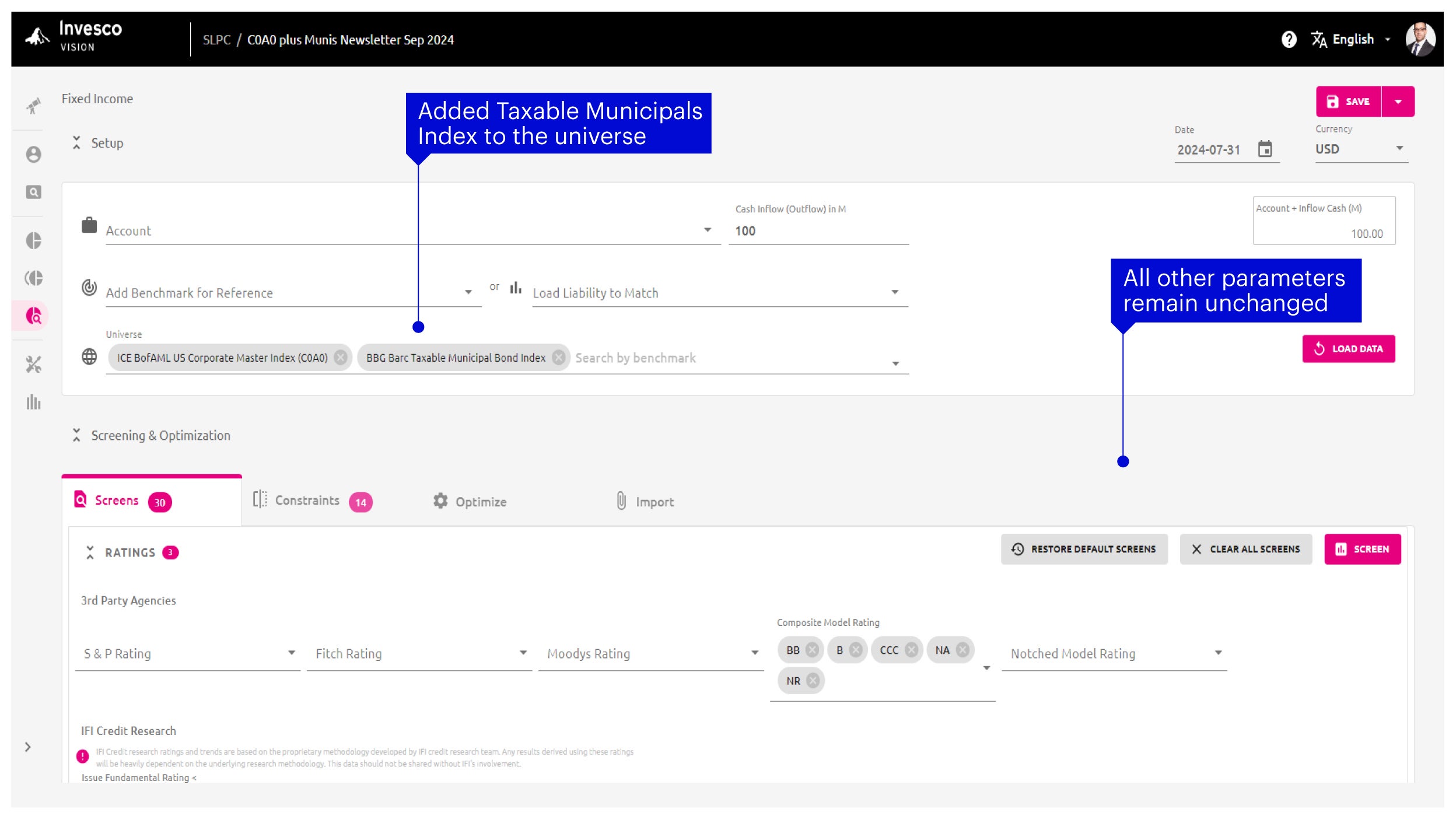

Keen readers of the Insurance Insights articles may have come across an article we put out earlier this year on using taxable municipal bonds within an insurance portfolio. The main thesis underlying this was that US munis could be a source of potential diversification within existing credit portfolios given the high quality and long duration nature of this sub-sector. Further, they can offer attractive yields with a history of lower default rates and higher recovery rates.

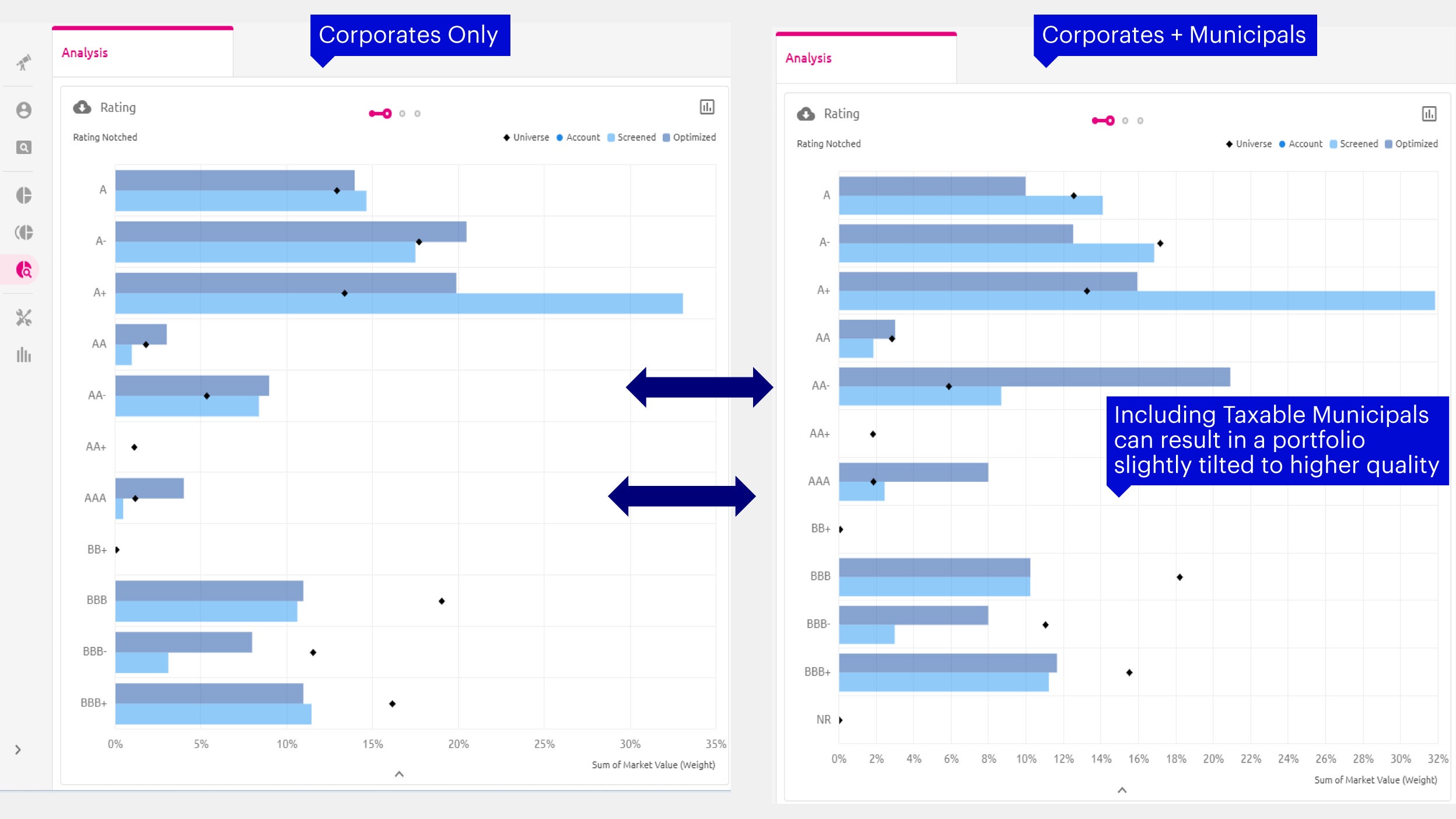

We can easily assess the implications of adding municipal bonds to the initial universe of our optimized portfolio illustrated above. We simply add in another representative index and let Vision do all the hard work:

We use the same screens and constraints with the same objective and can quickly obtain the updated results and bond listing:

Again, these can be used as the basis for constructing an appropriate portfolio.

A snapshot of some of the portfolio characteristics are as follows:

We see that there is a slight improvement in the portfolio’s overall rating (not unexpected as taxable municipals tend to have higher ratings) as well as achievable yield, while the risk-based parameters are in-line with a portfolio that is of a slightly higher duration.

Comparing the two portfolios across ratings distribution (just as an example) shows this slight tilt to quality:

Summary

The process detailed above demonstrates the utility of analyzing a portfolio on a security-by-security basis to optimize certain parameters. This is an effective way to narrow down a universe of thousands of bonds to a subset that is more manageable and can form the basis of portfolio construction. This approach also shows the benefits of selectively expanding the universe to design a portfolio that might be more appropriate and robust – of course, this requires a careful and calibrated approach.

This process can be applied when constructing a portfolio based on a new asset class, or indeed, even while assessing how best to deploy new funds into an existing asset class. On a semi-annual or annual basis, the process can be used to assess how the portfolio metrics are trending and if any significant deviations are being observed – necessary actions can then be taken to bring the portfolio back to the desired characteristics.

Key takeaways

We intend the series of Insights to be taken as a whole – and to demonstrate the benefit of a stepwise, disciplined approach to constructing appropriate insurance portfolios.

We trust you will find this approach and the information provided through the case study format of use. The aim is to combine the top-down and bottom-up approaches to construct a resilient portfolio, but also stressing the need of a regular analysis of any such portfolio – always looking to generate efficiencies.

Please feel free to reach out to us for a more interactive and customized analysis.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Diversification and asset allocation do not guarantee a profit or eliminate the risk of loss.

Invesco Solutions (IS) develops Capital Market Assumptions (CMAs) that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors. The assumptions, which are based on 5- and 10-year investment time horizon, are intended to guide these strategic asset class allocations. For each selected asset class, IS develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes. Estimated returns are subject to uncertainty and error and can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.

Footnotes

-

1

Vision

Invesco Vision is a decision support system that combines analytical and diagnostic capabilities to foster better portfolio management decision-making. Invesco Vision incorporates CMAs, proprietary risk forecasts, and robust optimization techniques to help guide our portfolio construction and rebalancing processes. By helping investors and researchers better understand portfolio risks and trade-offs, it helps to identify potential solutions best aligned with their specific preferences and objectives.

The Invesco Vision tool can be used in practice to develop solutions across a range of challenges encountered in the marketplace. The analysis output and insights shown in the document does not take into account any individual investor’s investment objectives, financial situation or particular needs. The insights are not intended as a recommendation to invest in a specific asset class or strategy, or as a promise of future performance. For additional information on our methodology, please refer to our CMA and Invesco Vision papers.