Dynamic Asset Allocation

Summary

Invesco Solutions' dynamic asset allocation investment process aims to deliver alpha by utilizing a time-tested process that is both scalable and customizable based on investor needs.

Asset classes move in and out of favor over the course of a business cycle and, our tactical asset allocation framework aims to exploit the opportunities these fluctuations present.

Combining strategic and tactical asset allocation views in a single asset allocation may help investors reach their goals by balancing near and long-term portfolio objectives.

Defining Invesco Solutions dynamic asset allocation investment process

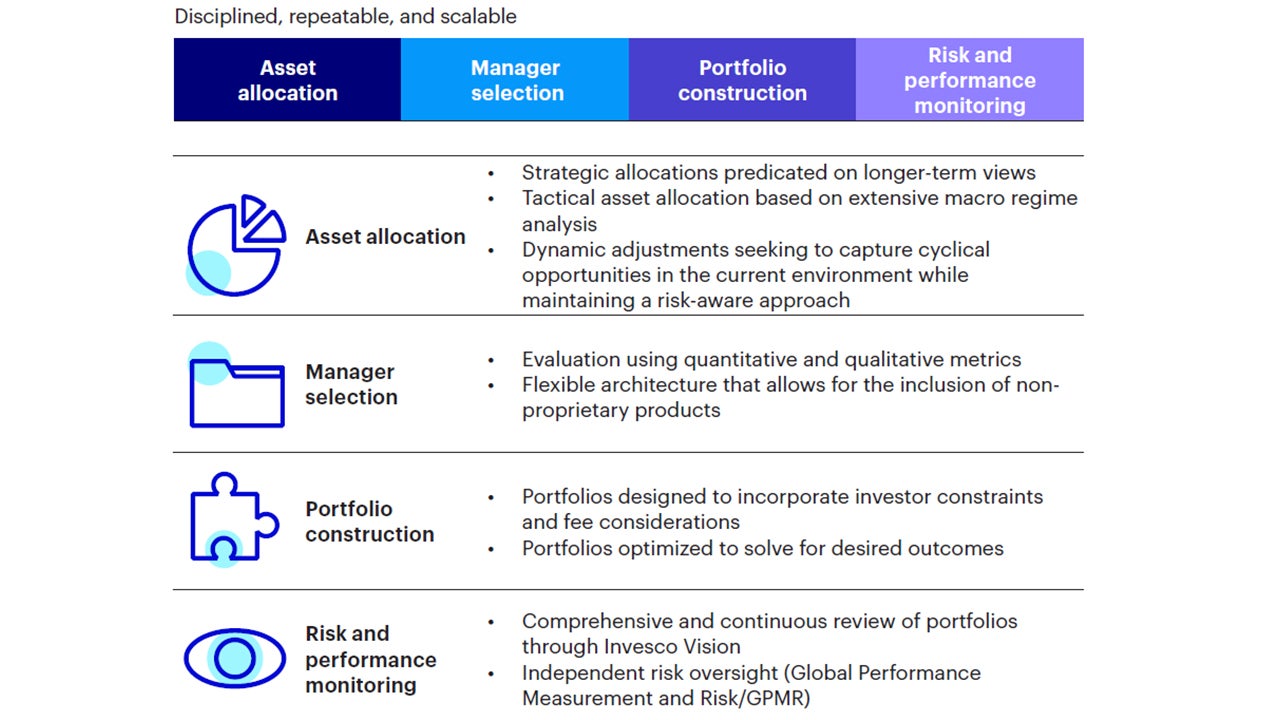

Invesco Solutions builds portfolios using a disciplined, repeatable, and scalable investment process, seeking to help investors in pursuit of their goals. Without a defined investment process, ever-shifting market conditions and a vast universe of investment options can cloud decision making, potentially deviating results from desired outcomes. Solutions' investment process takes the guesswork out of portfolio management. With a sound and tested approach covering asset allocation, manager selection, portfolio construction, and risk and performance monitoring, our team focuses on the key elements that drive investment alpha (Figure 1).

For illustrative purposes only. There can be no assurance that any investment process or strategy will achieve its investment objective.

As the starting point for any portfolio, our investment process begins with an asset allocation that is aligned with the risk tolerance and goals of an investor based on their investing time horizon. Importantly, we believe opportunities to create alpha exist over the long and short term and that portfolios can be constructed to capture these strategic and tactical opportunities. It is critical to note that the drivers of risk and return vary over different time horizons, and what may appear attractive over the long term may be out of favor in the near term and vice versa. We think investors can potentially achieve stronger risk-adjusted returns by starting with a strategic asset allocation and tactically adjusting to take advantage of near-term opportunities.

Strategic asset allocation: Investing through the business cycle

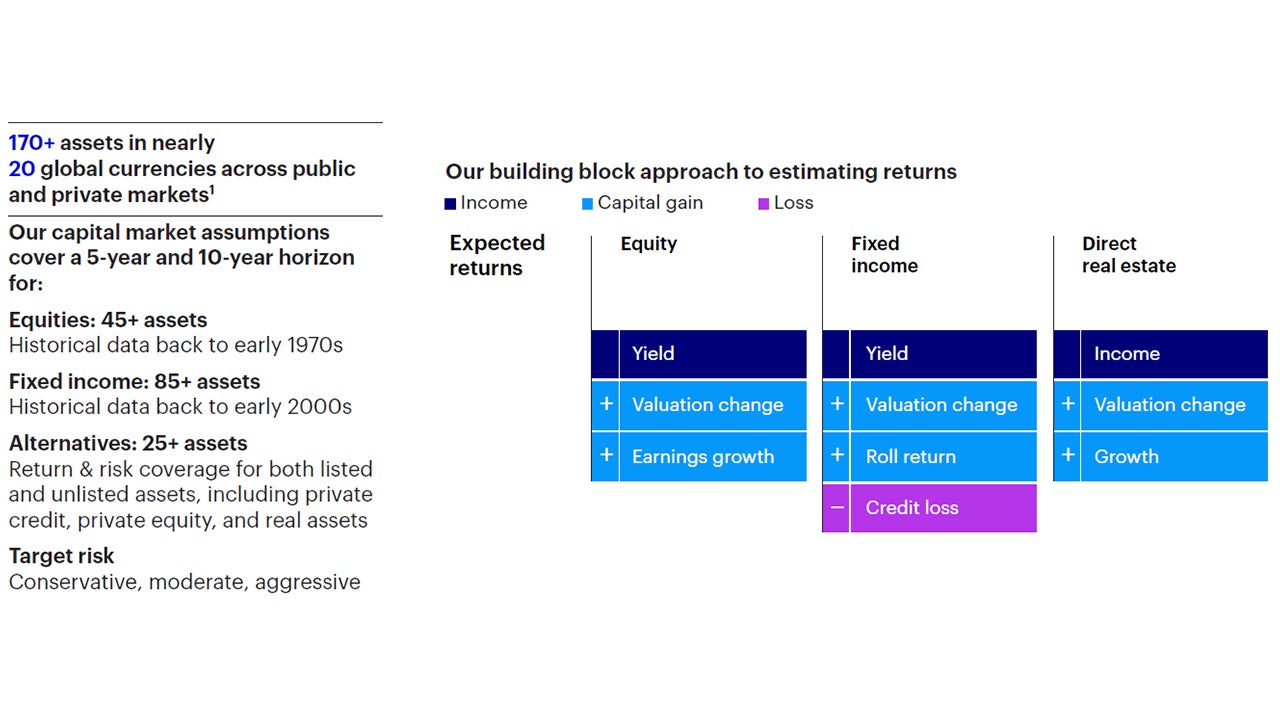

One of the key tenets of our investment process is that the past is not prologue. Therefore, we develop portfolios designed to strategically navigate a variety of market environments through the business cycle. For example, if one were to invest solely based on past performance within equities, one would overweight the most overvalued recent winners while underweighting the overlooked parts of the market, which are often trading at large discounts. As we have learned from prior periods of market stress, this style of investing often leads to bubbles that deflate when the cycle ends, sometimes taking a decade or longer to return to market leadership, if ever. As such, for the basis of our strategic allocations, we attempt to estimate the forward-looking risk, return, and correlation of asset classes through a set of capital market assumptions (CMAs). These CMAs are comprised of a standard set of building blocks that translate to the more than 170 public and private assets we cover (Figure 2). For example, expected returns on equities might consider dividend yield, earnings growth, and expectations for changes in valuation relative to some mean level, while fixed income estimates observe current and future yields, credit spreads and estimated losses, and the shapes of its various yield curves.

1 Due to private market assets requiring longer investment horizons, only 10-year assumptions are developed.

Source: Invesco Solutions, as of Sept. 30, 2023. For illustrative purposes only. Refer to capital market assumptions (CMAs) disclosures for additional CMA information.

Additional resources for our CMA and TAA methodologies

We employ a fundamentally based “building block” approach to estimating asset class returns. Estimates for income and capital gain components of returns for each asset class are informed by fundamental and historical data. Components are then combined to establish estimated returns (Figure 2). Here, we provide a summary of key elements of the methodology used to produce our long-term (10-year) estimates. Five-year assumptions are also available upon request. Please see Invesco’s capital market assumption methodology whitepaper for more detail.

For more information on the Invesco Solutions approach to dynamically allocating across factors, sectors, regions and asset classes, please review our white papers: "Dynamic Asset Allocation Through the Business Cycle" by Alessio de Longis, CFA®, "Market Sentiment and the Business Cycle", by Alessio de Longis, CFA®, "Invesco's Dynamic Multifactor Strategies - A Macro Regime Approach" Parts 1 and 2, by Alessio de Longis, CFA® and Mo Haghbin, CFA®, CAIA.

Weights for our long-term strategic asset allocation (SAA) are then derived through an optimization process that starts with an appropriate benchmark based on risk tolerance and investment objectives and takes on active risk according to our views within a given tracking error budget. The optimization methods are intended to maximize desired outcomes, such as return or yield while minimizing risk and balancing for uncertainty within a set of constraints. To note, this process enhances diversification by trading off assets that have similar features. For example, as equities increase in the portfolio, the fixed income portion will begin to favor negatively correlated assets with longer duration instead of credit instruments. Our strategic allocations are fully customizable and are curated to shift long-term investors towards the opportunities to capture alpha that exist in their investment universe.

Tactical asset allocation: Tilting within the business cycle

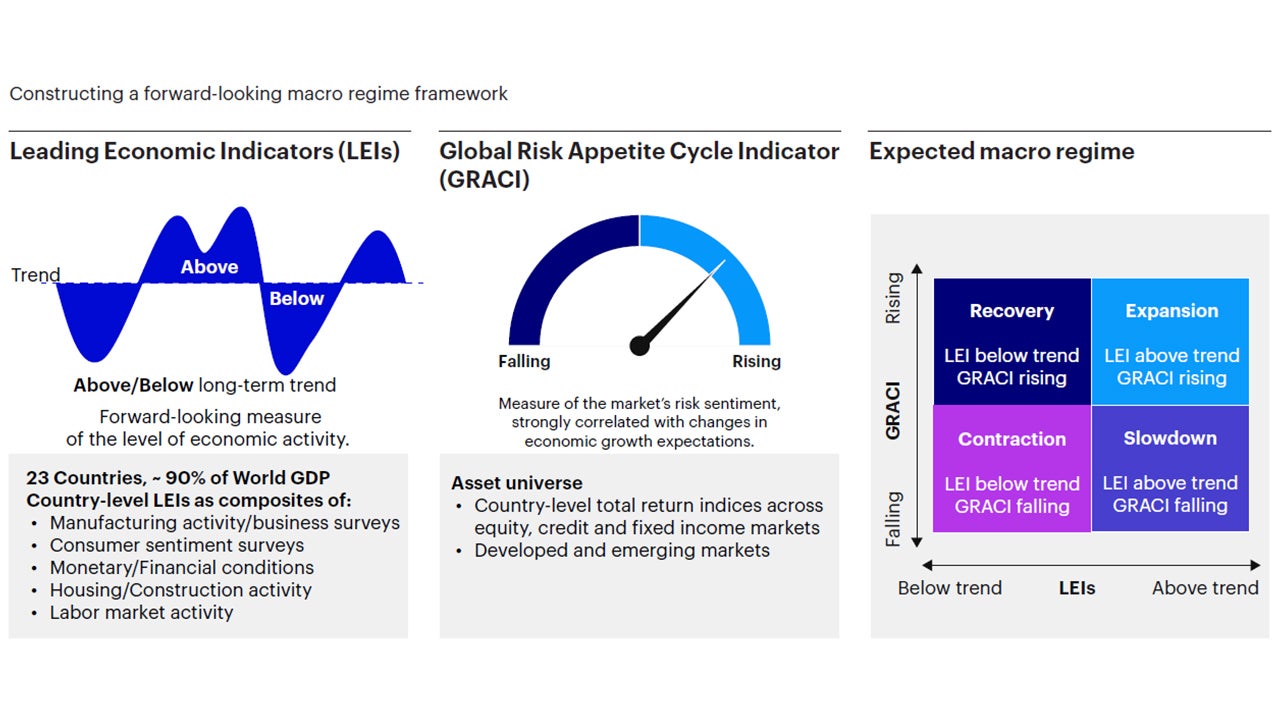

While most investors have a long-term investment horizon, they often care about performance and risks over the near-to-medium term, as these results may alter financial plans, affect behavioral investment biases, and influence future investment decisions. This has become more prominent in recent decades due to more pronounced market fluctuations, larger economic shocks, and meaningful economic policy responses, and tactical asset allocation (TAA) solutions aim to capitalize on the opportunities these present. Within Invesco Solutions, our tactical approach to investing utilizes a regime-based framework built from extensive research on how macroeconomic and market events affect asset class performance. To identify a regime for a given economy or region, we utilize proprietary leading economic indicators (LEI) to establish a trend growth rate and a faster-moving, market-based, global risk appetite composite indicator (GRACI) to determine whether the economy will accelerate or decelerate (Figures 3). Within this framework, the business cycle is comprised of four distinct regimes, namely:

- Recovery: Growth below trend and accelerating (~15% of observations)

- Expansion: Growth above trend and accelerating (~35% of observations)

- Slowdown: Growth above trend and decelerating (~35% of observations)

- Contraction: Growth below trend and decelerating (~15% of observations)

Sources: Invesco Solutions as of Sept. 30, 2023. de Longis, Alessio, “Dynamic Asset Allocation Through the Business Cycle: A Macro Regime Approach," Invesco Solutions Manuscript (2019). de Longis, Alessio and Dianne Ellis, “Market Sentiment and the Business Cycle: Identifying Macro Regimes Through Investor Risk Appetite," Invesco Solutions Manuscript (2019). Polk, Haghbin, de Longis. “Time-Series Variation in Factor Premia: The Influence of the Business Cycle.” Journal of Investment Management 18, no. 1 (2020): 69–89. For illustrative purposes only.

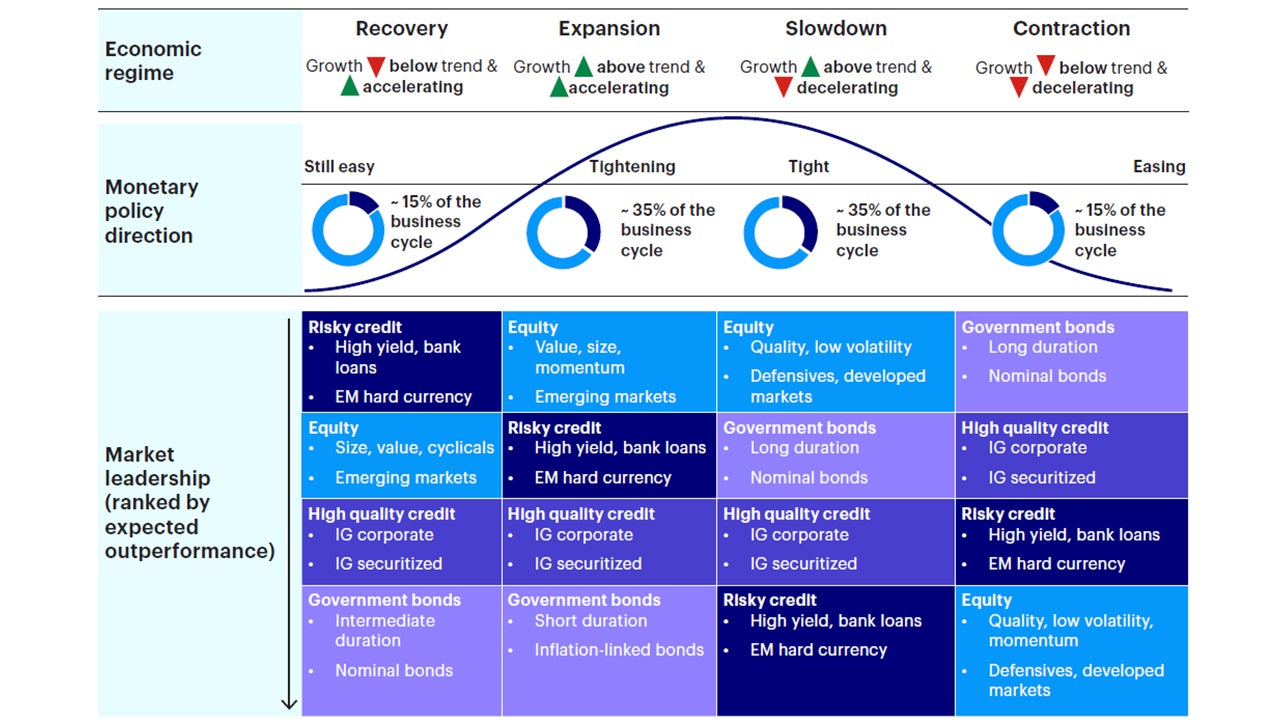

A given regime tends to last around six months, with the next most likely transition being the current regime. Within this framework, regimes can move both forward and backward based on how the business cycle unfolds. When the identified regime shifts, the tactical portion of the portfolio reacts by tilting towards the assets with characteristics that tend to perform best in that regime.

Asset classes move in and out of favor over the course of a business cycle and our TAA framework aims to identify how certain asset classes perform in these different stages. These are the levers we pull when deciding where to tilt our portfolios. Our macro process drives TAA decisions, seeking return opportunities between asset classes (i.e., equity, credit, government bonds, and alternatives), regions, and factors. For example, when growth improves, equities have outperformed fixed income, and within fixed income, credit has outperformed government bonds with similar duration. As growth slows, longer-duration government bonds tend to outperform all other asset classes (Figure 4). Within equities, our signals identify both regions and factors that are expected to outperform. Within fixed income, we allocate between government bonds, quality credit, and riskier credit assets while targeting an overall profile of duration and credit risk, depending on the prevailing macro regime. Our research has shown that long-only investors can potentially harvest these tactical sources of returns by following a disciplined investment process.

For illustrative purposes only. We define policy easing as the US Federal Reserve lowering interest rates and/or expanding its balance sheet. Still, easing suggests that the US Federal Reserve is maintaining the lower interest rate policy and/or continuing its bond-buying program. Tightening suggests that the US Federal Reserve is tapering asset purchases and/or beginning to raise interest rates. Tight policy suggests that the US Federal Reserve is raising rates in an effort to ease inflation concerns.