Why European equities in the current macro environment?

Summary

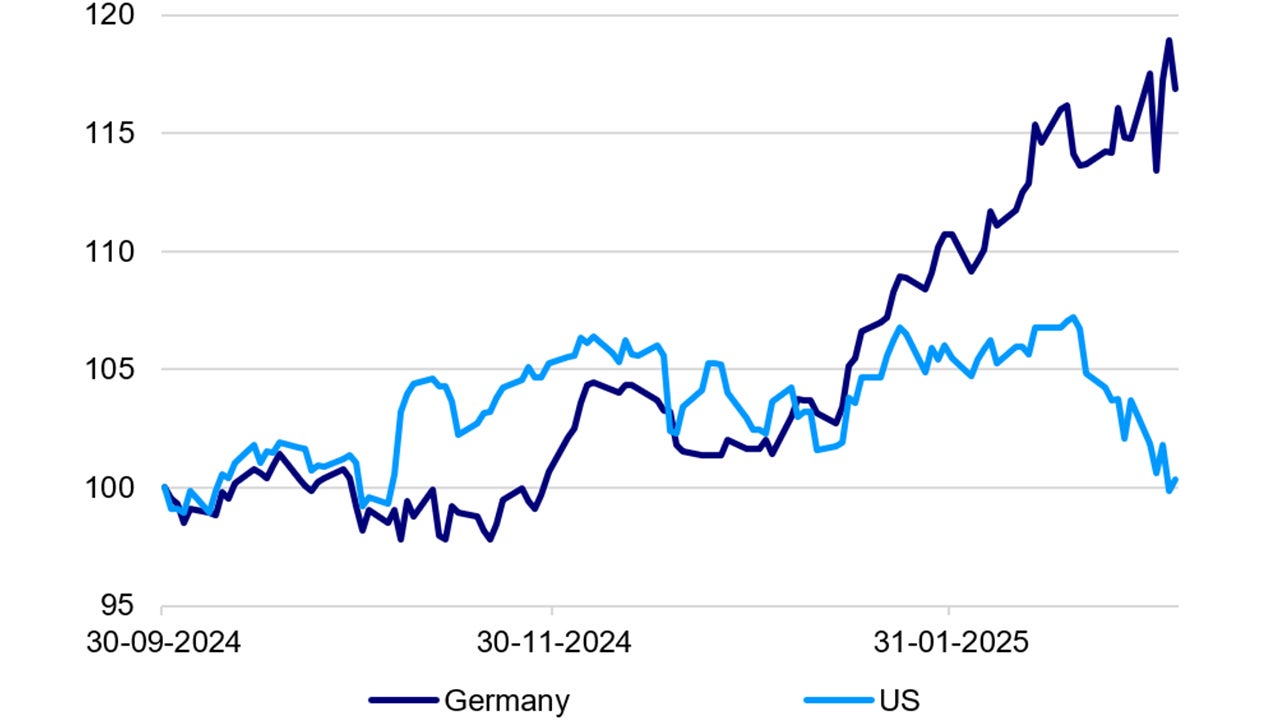

European stock indexes have seen strong relative returns so far this year after modest gains last year.

The most recent announcement coming out of Germany, showed that policymakers there have demonstrated a newfound willingness to meaningfully boost fiscal spending which is likely to reflate Europe’s largest economy through the next 5 years, pulling up the rest of the region with it.

The improved growth outlook should provide a multi-year boost to European stocks, push up European sovereign bond yields and support the EUR against the USD.

Past performance is no guarantee of future results. As of 7 March 2025. MSCI indices are in local currency and are daily from 30 September 2024 to 7 March 2025. Source: LSEG Datastream and Invesco Global Market Strategy Office.

Trump’s drastic moves against allies are seen around the world as a wake-up call and a call to arms, especially in Europe.

March may mark the end of the West: Allies feel they can no longer rely on the US. The €1 trillion1 in new fiscal and defense spending announced by the policymakers in Germany led to a 30bps2 jump in EZ bond yields while EZ stocks, EUR and GBP all rallied sharply.

The market evidently sees this as a turning point. Yet, could this be another false dawn? For example, German Chancellor Scholz’s “Zeitenwende” speech, days after Russia’s 2022 invasion of Ukraine, also claimed the world had changed, but did not change Europe much. Growth in the EZ, Germany, the UK all stagnated since, when compared to the US.

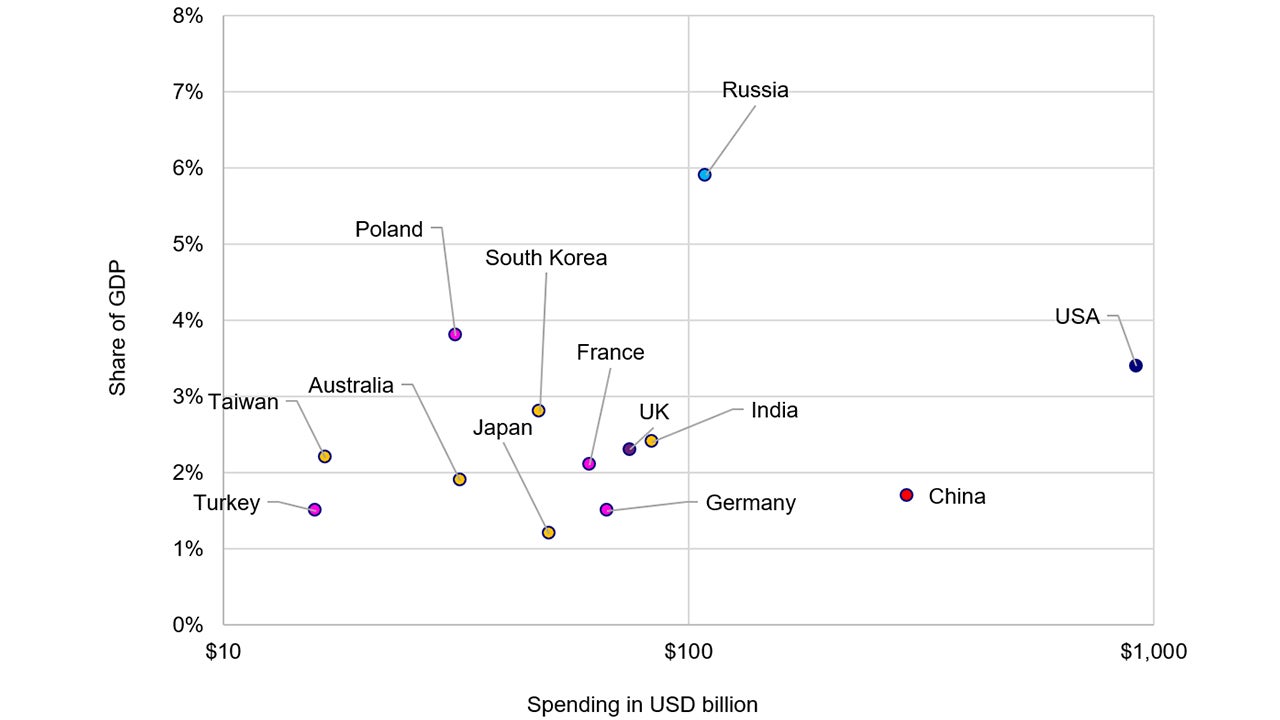

Defense spending in Europe is a key priority

The Trump administration has been insisting that its NATO allies in Europe more equitably share the cost of defense. Though with US commitment now in doubt, Europe needs their own deterrents from the East. Already, the EU and UK have made plans to raise defense and infrastructure spend by over US$1 trillion in the coming years.

Raising defense spending may be necessary, but we believe Europe must also integrate planning, procurement, operations, intelligence and boost productivity. Russia can mobilize for war more easily than Europe’s fractious democracies as its costs for men, materiel, munitions, energy are lower than Europe’s.

Ukraine’s defense spending is estimated to be around US$95 billion, equivalent to about 37% of GDP in full mobilization. Source: Stockholm International Peace Research Institute, Invesco. Annual data for 2024 as at 07 March 2025.

Investment strategy

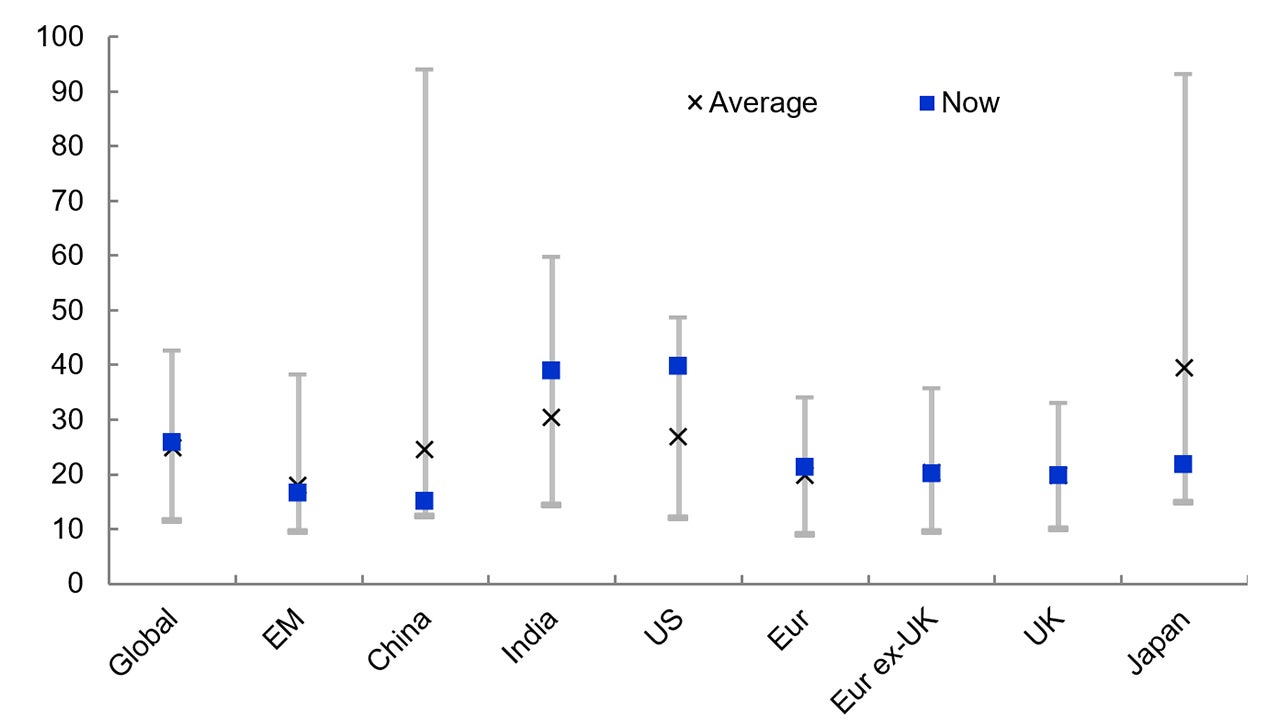

The newly expected economic boost from raised defense spending is further helping European markets. The good news is that they remain relatively attractive (based on cyclically adjusted PEs).

In our 2025 Invesco Investment Outlook, we have already been overweight European stocks given how cheap they were relative to US stocks, and in the belief that European markets are more cyclical than that of the US. This is useful if there is an economic upswing.

CAPE” is Cyclically Adjusted Price/Earnings and uses a 10-year moving average of earnings. Based on daily data from 3 January 1983 (except for China from 1 April 2004, India from 31 December 1999 and EM from 3 January 2005), using Datastream indices. Source: LSEG Datastream and Invesco Global Market Strategy Office

In addition to the potential for more existential changes involving regulatory competitiveness and national security, three forces appear to have contributed to the outperformance of European equities in recent months:

First - monetary policy in the Eurozone has been much more accommodative when compared to other developed markets.

Second - the Eurozone has started to see positive surprises in its economic data.

Third - although corporate earnings revisions in Europe are still negative, earnings momentum has been trending higher.

European equities could warrant greater attention with secular and structural trends appearing to take shape. This includes the end of US exceptionalism, greater European integration, Europe's willingness to deploy pro-growth stimulus over the next few years, if not decades, and Germany's newfound embrace of fiscal stimulus.

With contribution from Arnab Das, Kristina Hooper, Paul Jackson, James Anania

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.