What are the investment implications of the Trump-Zelensky fallout?

The live-broadcast breakdown in negotiations between Presidents Trump and Zelensky in the Oval Office confirmed that relations between the two nations have rapidly deteriorated.

Observers are now speculating over whether Trump will increase pressure on Zelensky to make concessions in a peace deal with Russia.

Such pressure indeed escalated on Monday, March 3, with the US temporarily suspending military aid to Ukraine.

At current writing, a potential minerals deal with the US is still possible, though the promise of a US security backstop in return appears elusive. Financing the ongoing Ukrainian war effort is now in question.

The Kiel Institute for the World Economy estimates that the US has committed about $119 billion to Ukraine, while aid from the whole of Europe is estimated at around $139 billion.1

Still, the direct dollar funding amounts understates the outsized role the US plays in terms of providing direct military equipment.

The Trump administration’s interests have rapidly changed from the previous administration.

The US is reticent to provide support to Ukraine

It’s clear that the US is increasingly reticent to provide financial and military support to Ukraine, which they view as potentially leading to greater geopolitical risks with nuclear-armed Russia.

With US foreign policy interests seemingly rotating increasingly to Asia, keeping a strong relationship with Europe may be a secondary priority.

Ultimately, despite recent developments, the major questions around the Ukraine conflict are more urgent than ever: whether the war finds a resolution this year, whether Russia can be reinstated into the global world order, and whether the EU can afford a new defence policy.

The EU is a key player in the conflict, but the bloc is in a very weak position.

While the UK and France are taking some of diplomatic initiative to agree and propose a peace deal, both nations have admitted that no deal is complete without US backing.

The urgency of further European integration is apparent

Current circumstances underscore how much Europe would benefit by further integration into a more united political and fiscal union.

This would allow for increased defence spending and a more harmonized security approach, although current interoperability and scale issues would need to be addressed.

The current EU framework is enough to keep the bloc broadly coordinated, but still too weak to engage in a unified front.

The urgency of further European integration is apparent when as Asia’s “middle powers” such as India, Japan, South Korea and Australia are increasingly important to US geopolitical strategy, with Europe less and less critical to US interests.

Despite the apparent benefits of further European political integration, any real progress is still unlikely for the foreseeable future, which means that trade and investment barriers will remain high and may even increase in the near term.

Investment Implications

Investors can expect inordinately high geopolitical risk premia as geoeconomics and geopolitical issues remain front and centre. In the current environment, the USD and US Treasuries should do better than otherwise.

The US long-dated bonds have recently rallied, though this “flight to safety” is also influenced by fears of a broad economic slowdown in the US and ongoing inflation risks influencing the Fed’s rate path.

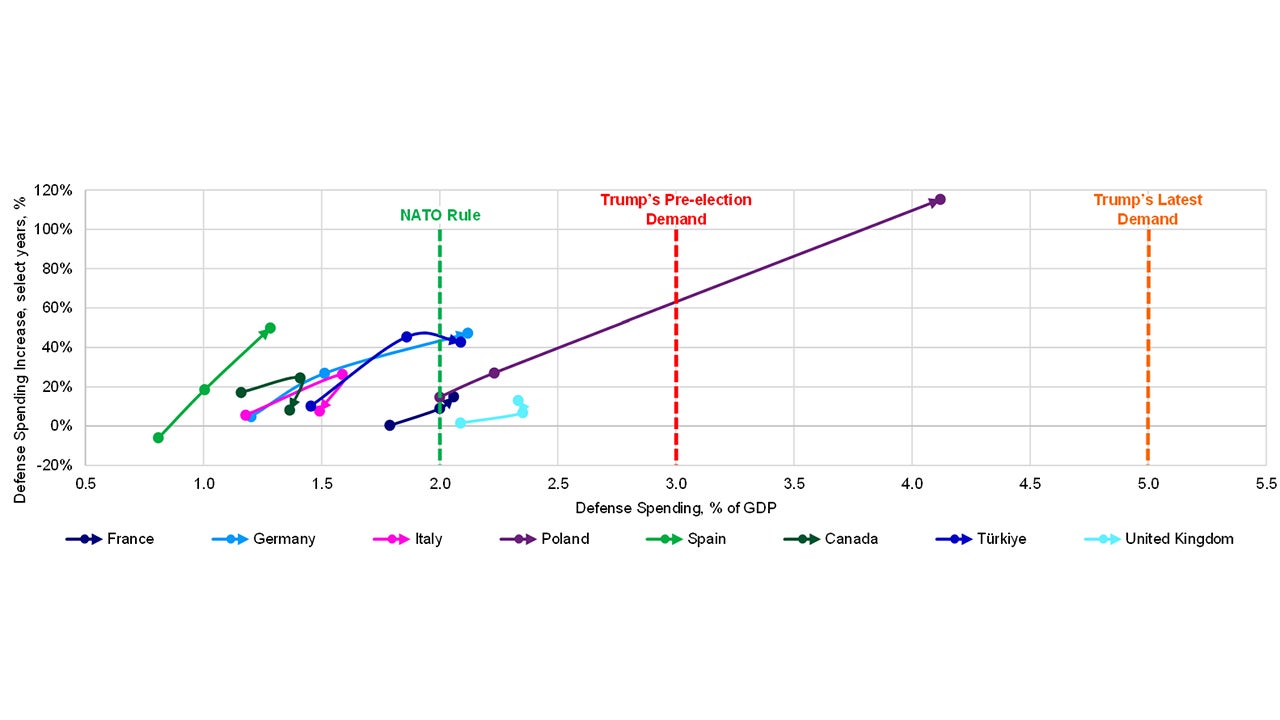

EU defence spending is also likely to go up significantly, which may constrain the major European central banks implying higher bond yields and somewhat weaker currencies.

Note: Change in defence spending (y-axis) vs. level of spending as a share of GDP. The left-most dot along each line indicates 2016 vs. 2014 (which is the year Russia annexed Crimea); the second left-most dot along each line indicates 2020 vs. 2016 (the years where Trump campaigned for and then his time in the presidency); and the final dot, indicated with an arrowhead, is the expected 2024 vs. 2020 spending figures. Sources: NATO, Invesco. Annual data as at 20 December 2024.

Defence stocks are already outperforming in the EU; it’s also likely that many US allies with significant US trade surpluses could announce commitments to recycle such surpluses back to the US in the form of weapons and assets.

Gold is also likely to continue its upward trend as a hedge against geopolitical uncertainty.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference

-

1

Source: Kiel Institute for the World Economy (IfW Kiel). Data as of Mar 4, 2025.