What are the investment implications of the Liberation Day tariff announcement?

Summary

US President Trump announced tariffs to be applied on imports from a variety of countries. These tariffs were worse than most had expected.

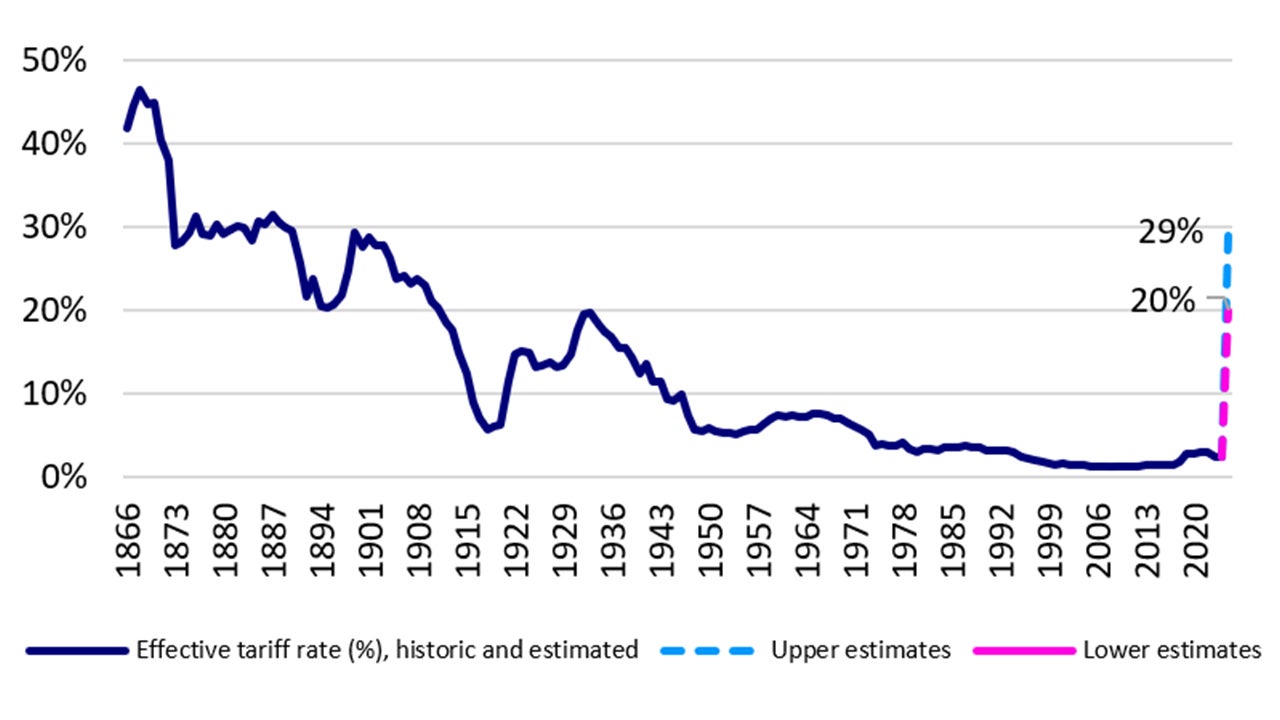

In hindsight, this worst case scenario where the US effective tariff rate more than doubles – to above 20% – should have been expected. This is the Trump team firing off the first salvo in this global trade conflict, and indeed it makes sense that their opening bid would be a maximalist one.

Source: Lombard Odier, ING, Capital Economics. Notes: Estimates are non-comprehensive. "Effective tariff rate" = customs duty revenue as a proportion of goods imports. Data as of 2 Apr 2025.

This is however, not the final tariff curtain as we expect countries to begin negotiating in earnest with the White House to reduce the tariffs in return for some concessions.

Even though today marks what can be described as peak tariff risk, uncertainties are likely to linger. The longer the tariff uncertainty, the bigger the impact on sentiment – which would affect capex spending in Asia and household consumption in the US.

I believe that all this means that we will see a more dovish tilt by Asian central banks, and quick. Asian central banks from China to Korea to Taiwan and Malaysia, are likely to cut rates more aggressively than previously anticipated in order to buttress growth fundamentals and shield their domestic economies.

| Economy | Reciprocal Tariff (%) | Economy | Reciprocal Tariff (%) | Economy | Reciprocal Tariff (%) |

| Lesotho | 50 | Bosnia and Herz | 35 | Japan | 24 |

| Cambodia | 49 | China | 34 | Brunei | 24 |

| Laos | 48 | Fiji | 32 | Malaysia | 24 |

| Madagascar | 47 | Taiwan | 32 | Namibia | 21 |

| Vietnam | 46 | Indonesia | 32 | European Union | 20 |

| Sri Lanka | 44 | Switzerland | 31 | Jordan | 20 |

| Mauritius | 40 | Algeria | 30 | Nicaragua | 18 |

| Guyana | 38 | South Africa | 30 | Israel | 17 |

| Liechtenstein | 37 | Pakistan | 29 | Philippines | 17 |

| Bangladesh | 37 | Tunisia | 28 | Venezuela | 15 |

| Serbia | 37 | Kazakhstan | 27 | Norway | 15 |

| Botswana | 37 | India | 26 | Nigeria | 14 |

| Thailand | 36 | South Korea | 25 | Everyone Else | 10 |

Source: Office of the United States Trade Representative. Data as of 2 Apr 2025.

How have markets reacted?

Asian stocks have sold off significantly given that the APAC region appears to be the hardest hit with some of the highest tariffs being announced when compared to other economies under Trump’s reciprocal tariffs.

And I believe that markets are likely to interpret this as kind of a double whammy because Asian economies also on average rely more on exports and trade to the US than most other economies.

What is our regional outlook on the situation?

In Asia, China and Vietnam saw some of the largest tariffs, while Canada and Mexico received far lower tariffs. The European Union and Japan were somewhere in between.

Most notably, the US' effective tariff rate on China increased to at least 54% with today’s announcement. This is an extremely high level that will cause large price increases for American consumers. It is estimated that about 85% of goods sold at the US’ largest retailer are imported from China1. It was also announced that the ‘de minimis’ tariff exemption for packages under $800 in value from China and Hong Kong will end on May 2nd.

The tariffs on China are so high as to be almost restrictive for US-China trade. This suggests it is unlikely they will be long-term in nature, although we could see an escalation of tariff wars in the short term. Keep in mind that it has been reported that China, South Korea and Japan will have a coordinated retaliatory response to the US tariffs.

From a regional perspective, other Asian exporters have not escaped steep prohibitive tariffs. Many trade diversion routes to access the US market – Vietnam, Cambodia, Laos, Thailand, Indonesia – have been penalized.

The impact across the globe

If the tariffs on Asian countries are not revised downwards, a rebalancing would mean that the rest of the world could see a surge in goods that were originally bound for the US.

The good news, if there’s any, is that these reciprocal tariffs do not stack on top of the already announced tariffs including the ones on autos, steel and aluminum. But this doesn’t mean that we won’t see additional tariffs being imposed on other industries and sectors such as pharmaceuticals and semiconductors (which have been exempted so far).

These tariffs place a high burden on US consumers and businesses, which are likely to be hit hardest. While prices will rise in the near term, then aggregate demand is likely to fall as consumers reduce spending in response to the tariffs.

This certainly increases the risk of stagflation in the US for every day that these high tariffs are in force. We anticipate significant volatility and downward pressure on risk assets in the near term.

We also must recognize that earnings uncertainty increases for each day that these high tariffs are in force.

We also must recognize that earnings uncertainty increases for each day that these high tariffs are in force.

What is our resulting investment view?

For those with a short time horizon, it would be prudent to be risk off. Safety assets such as gold and other precious metals, US Treasuries and other developed market government bonds are likely to fare well as investors seek cover. So too would alternative investments that are shielded from public market gyrations.

Asian currencies could face headwinds from a stronger USD, we now expect Asian central banks to cut policy rates before the US this year.

For those with a longer time horizon, investors could benefit from taking advantage of sell-offs in order to increase their exposure to risk assets, taking cash off the sidelines. Investors with long time horizons should remain well diversified.

What are the risks to that view?

The risk is that the tariffs remain in place for a lengthier period of time and are met with additional tariffs from other countries, which remain in place, creating a global recession.

Another risk is that continued uncertainty about rapidly changing tariff policy results in a chilling effect on business investment and hiring in the US.

With contribution from Kristina Hooper and Thomas Wu

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference

-

1

Source: https://learningenglish.voanews.com/a/walmart-shifts-to-india-cuts-china-imports/7377475.html