US presidential election update: What could Kamala Harris mean for Asia?

Who would have predicted a month ago that this week’s Democratic National Convention would kick off with delegates bidding farewell to Joe Biden and welcoming Kamala Harris as their nominee for president?

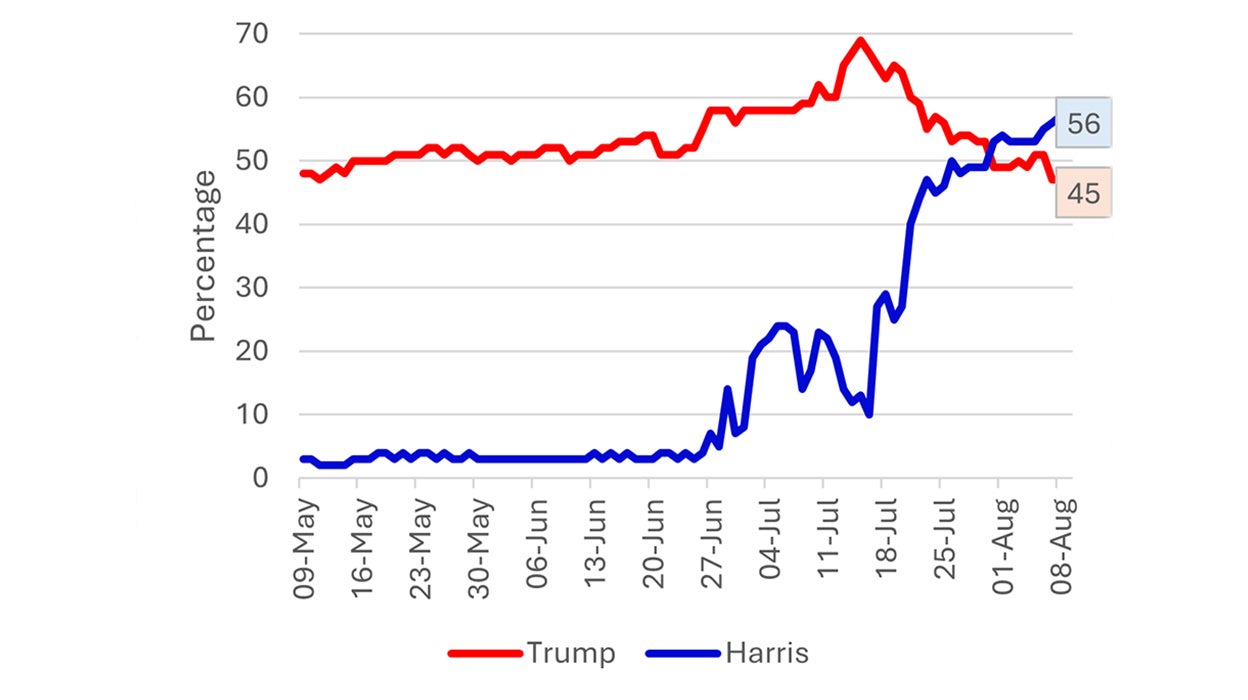

Ever since the first presidential debate earlier this year, markets had been convinced of a Trump victory in the race for the Oval Office. This only intensified following division among Democrats calling for Biden to drop out of the race and the shock of an assassination attempt. However, the tables have turned after Kamala Harris, current vice-president of the United States, emerged as the expected Democratic presidential nominee and substantially narrowed the polls. Now, it is a nail-biting contest where voters are struggling to pick a favorite – yet another challenge for candidates and investors across the globe.

Note: Graph shows implied probability of each candidate’s win.

Source: PredictIt, Bloomberg, Invesco. Data as of 9 August 2024.

While potential implications of Trump 2.0 have already been meticulously analyzed and even priced-in through so-called “Trump trades”, there is little we can find on what Harris would bring to the table, especially with regards to Asia. A mixed vice-presidential record and her pick of Walz as a running mate hint at Harris’ geopolitical stance, but her economic agenda has not yet been clearly defined.

Although I don’t think Beijing has an ultimate favorite in this race, Harris could be somewhat preferable given her campaign’s increased focus on domestic matters rather than foreign policy. Since emerging at the top of the Democratic ticket, Harris has seldom mentioned her stance on China relations. But I believe her choice of Walz, a man of the people, as vice-president was her way of silently yet adeptly communicating not only her will to “build up the middle class” but also her support of Biden’s rhetoric that the US must maintain “contact with China” despite stringent trade policies.

The Biden administration has long pushed the idea that what they are seeking with China is “competition not conflict”. Plans by the new democratic duo to maintain collaboration with China while keeping national security risks at bay will be a complex balancing act. Still, I do not see any negative surprises for China should Harris be elected as I expect her to continue Biden’s legacy of a multilateral approach to foreign policy.

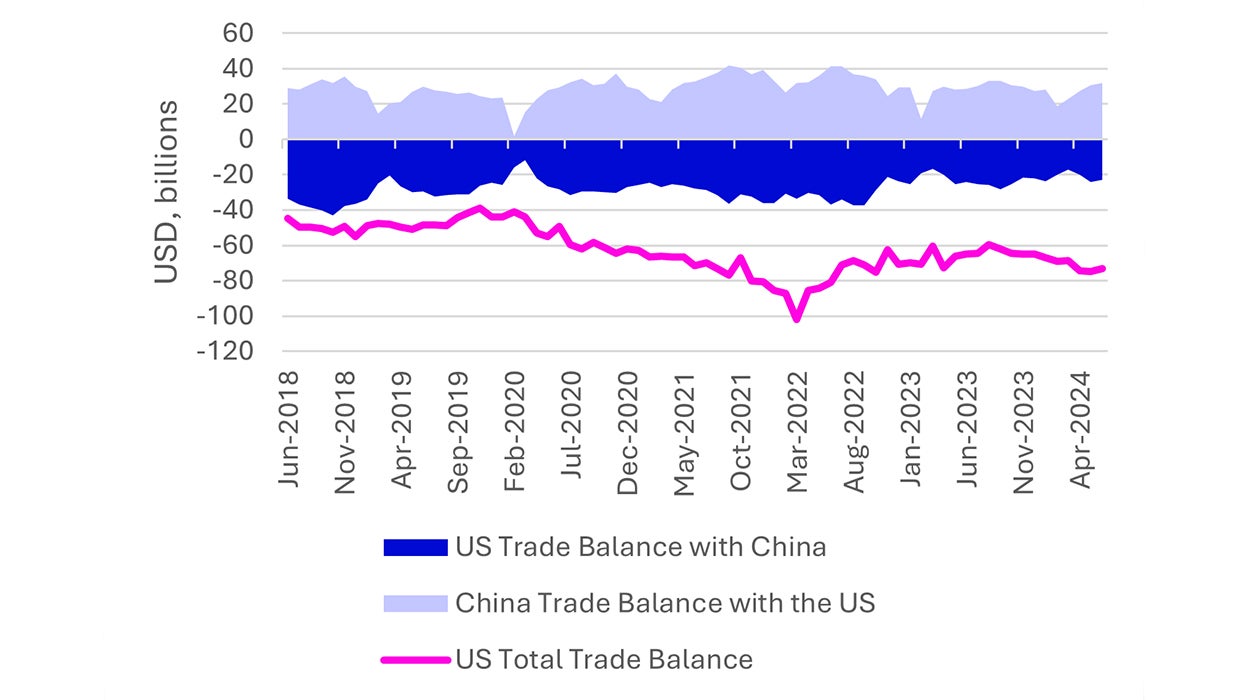

On the other hand, Trump’s stance is more alarming for Asia as he continuously reinvigorates the “America First” narrative by accusing China of being responsible for the US’ economic issues and threatening to impose record high tariffs. Aware of indirect imports of Chinese goods through third-party countries that prevented the US’ total trade deficit from declining during the trade war of Trump’s term in office, his team proposed 10% tariffs across the board on all its trade partners. There is a hidden layer to this way of handling trade policy that many voters might not understand – that tariffs are anti-consumerist in nature. They are paid not by foreign exporters but by US importers, who then pass these costs onto domestic consumers in the form of elevated prices. Yet, the Republican party needs those tariffs to offset planned reductions in corporate taxes, propelling businesses and spurring inflation at the same time.

Source: U.S. Census Bureau, Bloomberg, Invesco. Data as of 30 June 2024.

The two parties seem to agree on the essentiality of protectionism, but not on the extent. Harris has previously criticized Trump’s excessive tariffs as “nonsensical and anti-consumerist” and rejected the prospect of across-the-board tariffs under her leadership. I therefore believe there are fewer downside risks to the US’ growth and China’s reflationary path under a prospective Harris administration. In addition, I see the US as still having a chance for a soft landing despite increased recession risks. Long-awaited Fed rate cuts should narrow the policy gap, setting Asian markets for a rebound in the coming year. As Democrats’ policy focus turns inwards, I expect this recovery in the region to continue regardless of the divide in Congress. I would also note that while Republicans were quick to label the latest market correction as a “Kamala Crash” and accuse her of tighter than ever financial conditions, we should not forget that she is not the incumbent, and there were many factors contributing to the selloff.

From a more targeted perspective, the fate of Chinese exporters and Asian tech equities with exposure to the US and AI is the main concern. Harris has recently received significant funding from US tech companies, signaling that some industry representatives favor the stability offered by the Democratic party to the looser economic policy of the Republicans. Risks of Trump reining in “reckless Big Tech companies” seem to have outweighed the potential benefits of tax cuts on tech earnings in the eyes of the industry. If such a narrative is to proceed and Harris is elected, investors should regain confidence in North Asian and Taiwanese tech, which would moderately uplift regional stocks.

I would brace for a period of increased volatility in Asian tech until the overhang of political uncertainty is removed in November but restrain from taking a complete risk-off approach. After all, it is important to keep in mind that a slowed pace of progress does not mean it will not happen at all.

Other possible “Kamala trades” to consider positioning in could be ESG-themed securities. She has long shown her commitment to environmental issues, going as far as rejecting the United States–Mexico–Canada Agreement (USMCA) over its view of the climate change agenda. I would also warn of uncertainty around US energy sector equities following Harris’ history of opposing popular oil and gas drilling methods.

Overall, I think protectionism is bipartisan, yet its risks of escalating into a second trade war would be far higher should Trump govern the country. Harris’ plans for the economy are yet to take shape, but her governance approach would almost certainly be more constructive for the evolving US-China relationship.

This article was authored with contributions from Nuray Smatova, Summer Analyst.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.