US July CPI print updates

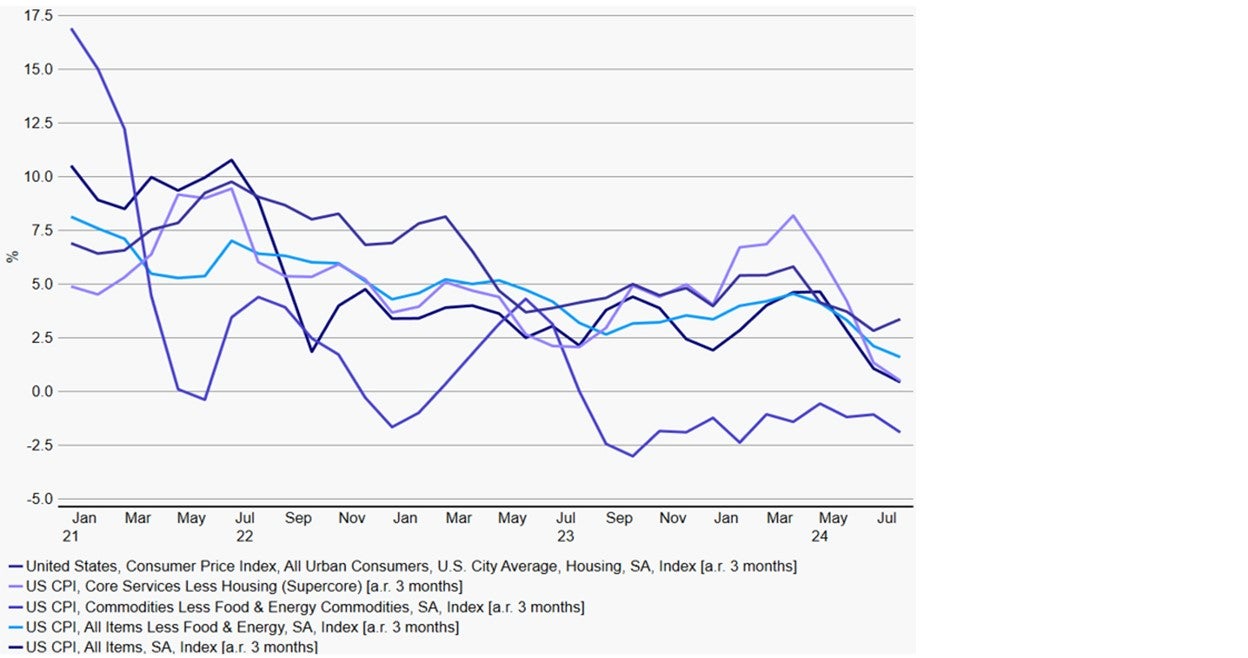

Consumer prices in the US for July show that the disinflationary trend is back in full swing and suggest that a September rate cut of 25bps is very much on the table.

Headline CPI for July grew at 2.9% y/y (vs consensus of 3.0%) and core inflation (ex food and energy) grew at 3.2% y/y1, inline with consensus and the same from the previous month.

Overall, the recent inflation data has been encouraging and suggests that the Q1 reacceleration was more of a head fake.

A deep dive into the CPI print

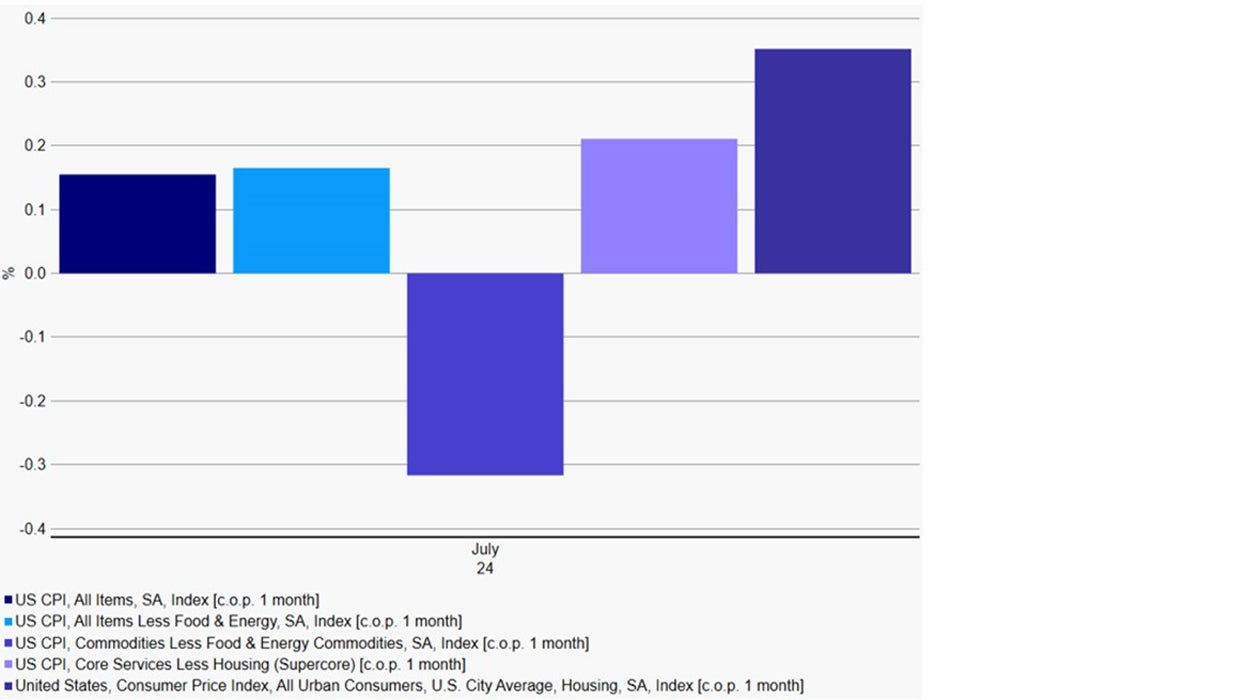

While the headline figures looked good, the details of the CPI weren’t desirable.

Services inflation saw a reacceleration, and the housing component (rent) is back to being an upside contributor.

The latter is especially disappointing since we saw a sharp slowdown in the tenant rent index in the previous month and expected the weaker gains to be the norm.

Still, the 3-month housing run rate may have ticked up but the annualised 3-month run rate is at 3.6%, which is well below the reported 4.4% y/y rate1.

There could be some one-time rental distortions for July so we will have to see how the trend plays out in the coming months.

That said, the overall trend for housing/shelter components continues to be heading in the right direction.

Source: Bloomberg, as of August 14, 2024.

All eyes are already on the next datapoints

All that said, nothing in the July report was particularly bad as the bigger gains in the rental component were offset by used car prices, airfare and medical services.

We still have another inflation print to go before the September Federal Open Market Committee (FOMC) meeting, and there will also be the August jobs report. I believe that markets are a do-nothing on this report and all eyes are already on to the next datapoints.

In contrast to the market, the Federal Reserve (Fed) is NOT data point driven, it is data driven and it’s looking at the trend. The trend is that disinflation continues, despite the blemishes in this report.

Keep in mind wage growth is at 3.6% y/y2 and on Monday we got NY Fed inflation expectations that continued to be tame – in fact, the 3-year-ahead inflation expectations dropped significantly.

Outlook for Fed rate cuts

Source: Bloomberg, as of August 14, 2024.

The graph above shows that consumer prices in the US are moving in the right direction. Plus, wage growth continues to ease as unemployment is expected to rise which suggests a further downtrend in core inflation for the rest of the year.

The totality of data tells us disinflation is continuing and the Fed is almost certain to cut rates in September by 25bps. But I do believe that the July inflation report diminishes the chances of a super-size cut, though this was never in the cards.

With contributions from Kristina Hooper, Ashley Oerth and Paul Jackson.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.