Unpacking the investment implications of China's latest monetary stimulus

China fired off a meaningful monetary stimulus salvo this morning, ushering in trillions in RMB of liquidity to the market.1

- Existing mortgage rate cut by 50bps

- The reserve requirement ratio (RRR) to be cut to 9.5% from 10.0%

- The 7-day reverse repurchase rate to be cut to 1.5% from 1.7%

- Downpayment ratio on 2nd homes to be cut to 15% from 25%

The coordinated press conference afterwards with three main regulatory bodies underscores the policymaker efforts to right-size the economy.

These measures send a strong signal that the government is responding to some of the economy’s headwinds.

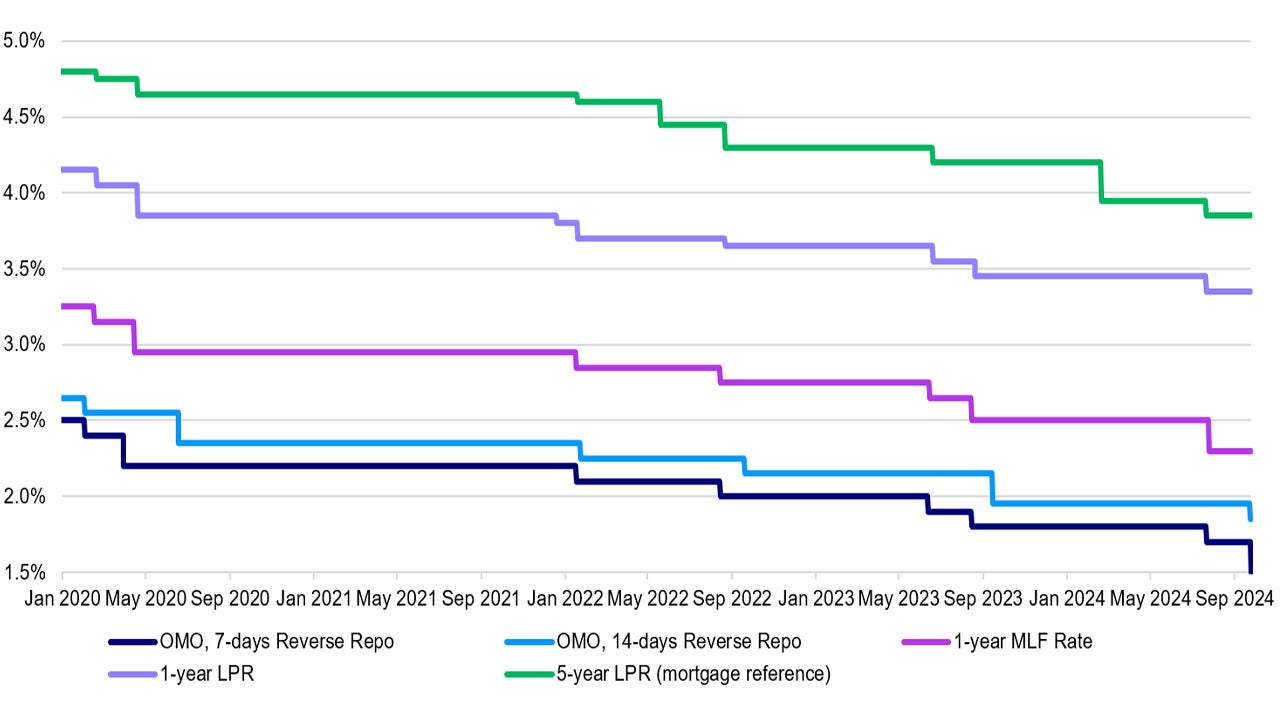

Future rate cuts are on the table

I believe that today’s stimulus measures squarely puts China’s growth target of 5% back on track. The most important rate cut, is the one for existing mortgages.

According to PBOC Governor Pan, cutting the outstanding mortgage rate is expected to lead to 150bn RMB in interest expense savings, much of this could lead to consumption and investment.

Pan also said that future rate cuts are on the table, which is a forward guidance tidbit.

Source: People's Bank of China (PBoC). Data as of 24 September 2024.

There were other initiatives as well.

For example, the PBOC will set up a swap facility that will allow banks and brokers to borrow money from the PBOC to purchase stocks to the tune of around RMB 500bn.

Pan also announced that the PBOC is examining a stabilization fund for stocks though details are forthcoming.

In addition, the PBOC announced enhanced measures for its housing rescue package to better support regional SOEs to purchase uncompleted units at a reasonable price.

More stimulus may be required, both on the supply and demand-side

With the US Fed cutting its policy rate by a jumbo 50bps, this opens the doors for other central banks such as the PBOC to cut interest rate as well.

Expectations are for a wave of new easing measures around the APAC region as the risk for capital flight and currency headwinds recede.

Though monetary stimulus is helpful as it reduces borrowing costs, there is only so much that supply-side stimulus can do to stimulate demand.

For sentiment to change and the economy to reflate again, significantly more stimulus may be required, both on the supply and demand-side.

Fiscal support is likely around the corner, which could help reflate the economy and drive a turn-around.

Government spending is likely to pick up for the rest of the year.

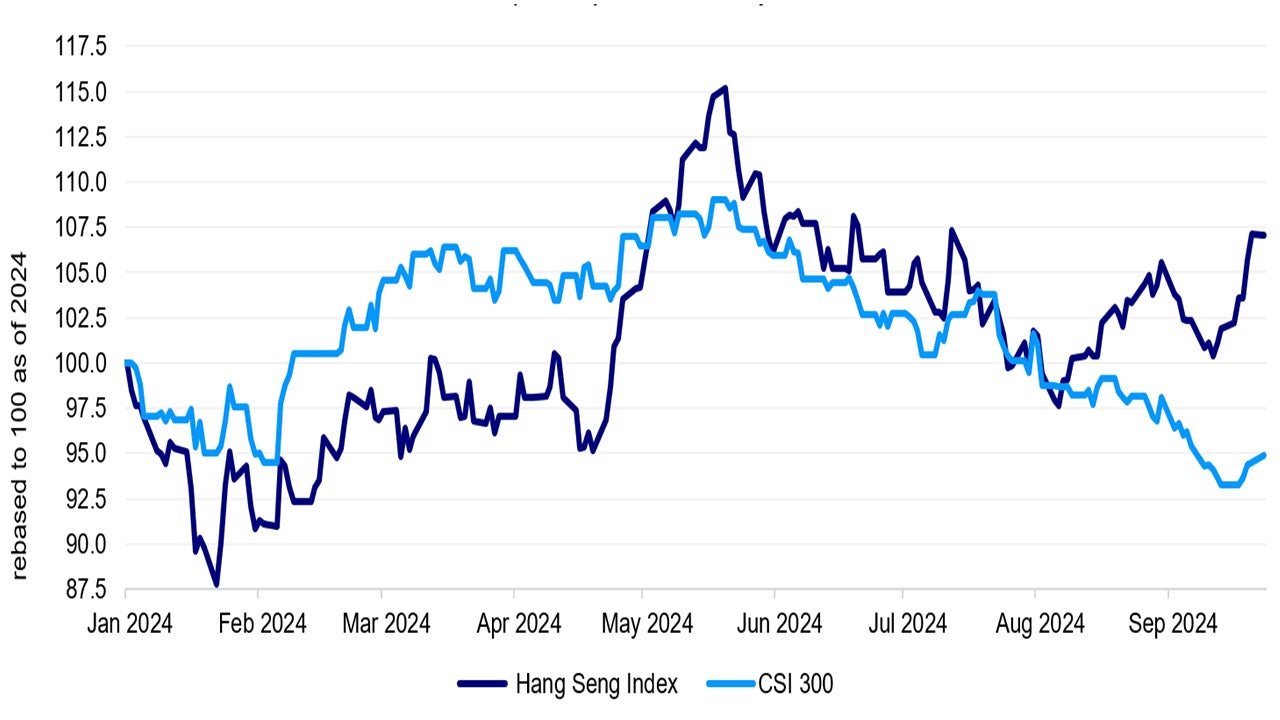

Chinese stocks rose, both the Hang Seng index and CSI 300 cheered the monetary stimulus news.

Investment implications – Chinese stocks

I believe that this may be good time to re-visit Chinese stocks. The dividend yield for Chinese stocks is higher than the government bond yields, with the spread at the widest it has been for a long time.

This suggests that investors expect a significant cut in corporate dividends, which I don’t think is likely.

I believe that investors may pick up Chinese shares at these levels, in front of the stabilization fund that was recently announced and more government support.

Source: Macrobond. Data as of 23 September 2024.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Reference:

-

1

Source: A joint press conference between the People’s Bank of China (PBOC), National Financial Regulatory Administration (NFRA) and China Securities Regulatory Commission (CSRC) announced a number of economic measures, September 24th 2024