Uncommon truths: Who will suffer most from US tariffs? Not China or the EU!

Chinese and European stock indices have easily outperformed US counterparts since the start of the year, despite the threat of tariffs. Perhaps this is because their respective trade surpluses with the US are small compared to their economies.

When President Trump won the 2016 election, the price of gold moved to a $230 premium to the fair value suggested by my econometric model (based on the US 10-year TIPS yield, the US 10-year inflation breakeven and the trade weighted value of the US dollar). At the time I supposed it was due to concerns about the geopolitical implications of a Trump presidency.

Well, we seem to be seeing a rerun, with gold around $2900. That is up nearly $400 since the end of August 2024, which is a gain of 15%, despite the rise in treasury yields and the dollar over the same period. I use the end of August as the reference date as that was when the opinion poll lead of Kamala Harris was peaking. Once again, I think that geopolitical tensions are behind the subsequent rise in gold, with trade disputes, rising tensions in the Middle East and Europe despairing at the approach to Ukraine (not to mention the possible annexation of Canada and Greenland!).

In the midst of all this, Germany is about to hold elections (on 23 February). Opinion polls suggest to me that a change of Chancellor is the most likely outcome (to Friedrich Merz of the CDU/CSU Union). However, with recent opinion polls putting the CDU/CSU alliance on 29%-32% of the vote, I think they will need to partner with the SPD party that leads the outgoing coalition (12%-18% of the vote in opinion polls). However, it is also possible that another party will have to be included in the coalition to give the government a parliamentary majority. Even worse, the FDP (the natural partner for the CDU/CSU) may fail to achieve the 5% of votes needed to sit in parliament, in which case Merz will face the uncomfortable choice between the Greens and one of the left-wing die Linke and BSW parties as the final coalition partner. This of course assumes that the AfD (around 20% of votes) remains unwelcome in any government.

So, Germany faces a change of Chancellor. However, the need for a coalition with unnatural partners may limit the scope for radical change. I think the two big issues for the new government will be reform of the debt brake and the approach to Ukraine (including the ramping up of defence spending). These issues are intimately linked (big spending programmes may require a change in laws concerning fiscal rules) but making progress could pave the way for a stronger German economy, especially if new military equipment is sourced locally (as I think it will increasingly be). Perhaps this is why German stocks have been so strong since the US election (outperforming US stocks by some margin, based on MSCI indices).

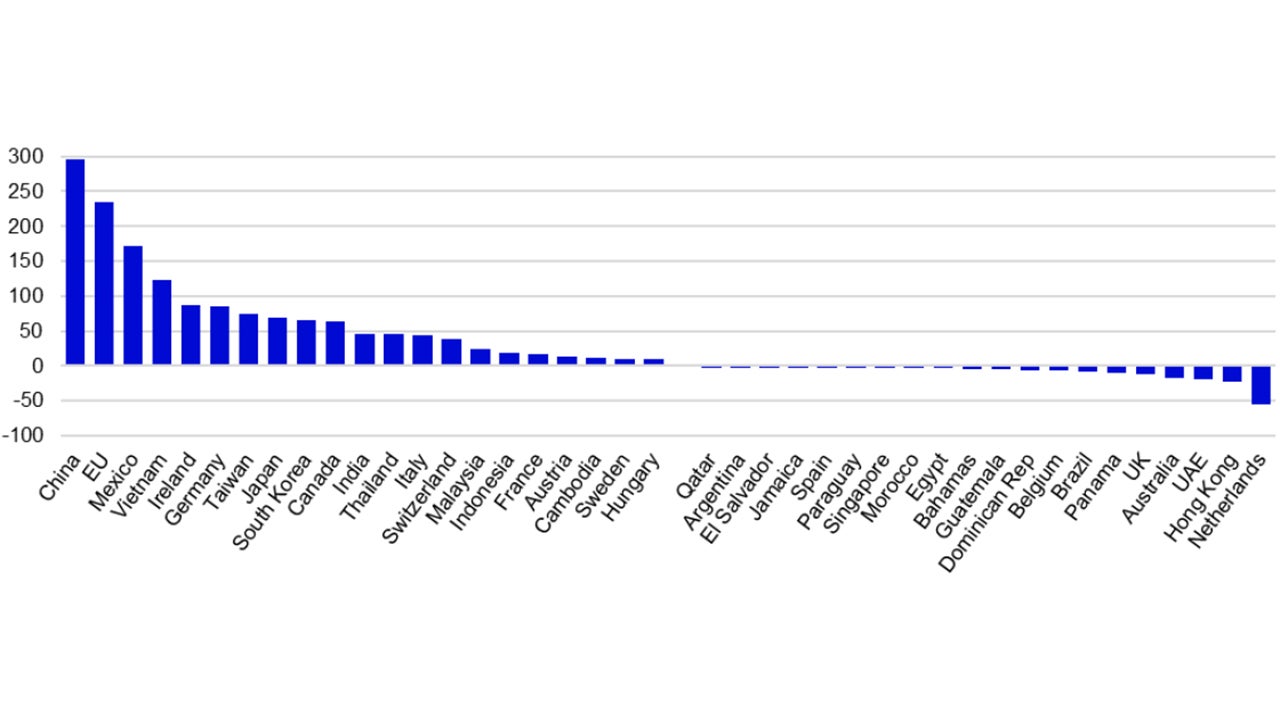

Turning to trade, it would appear that the threat of tariffs has not overly impacted European stock markets, which have outperformed US stocks over recent months (see Figure 3). This is interesting given that the EU seems to be in the firing line of President Trump (now with the bizarre suggestion that EU VAT is a form of tariff, despite applying to domestic as well as imported goods and services). Figure 1 suggests that the EU’s surplus in the trade of goods with the US is not far behind that of China, which explains the fixation by those in the US. Among EU countries, Germany has a large surplus with the US, which is no surprise. More interesting is that Ireland had an even bigger surplus in 2024.

Note: The chart shows the balance of trade in goods with the United States of America in 2024. The countries shown are the 20 (plus the EU) with the largest surplus with the US and the 20 with the largest deficit.

Source: US Census Bureau, LSEG Datastream and Invesco Global Market Strategy Office

Figure 1 shows those countries with the largest surpluses with the US and those with the largest deficits (the latter includes the Netherlands and the UK). There are a similar number of countries that have deficits to those that have surpluses but the latter tend to have larger imbalances, which is why the US had an overall deficit of around US$1.2trn in 2024.

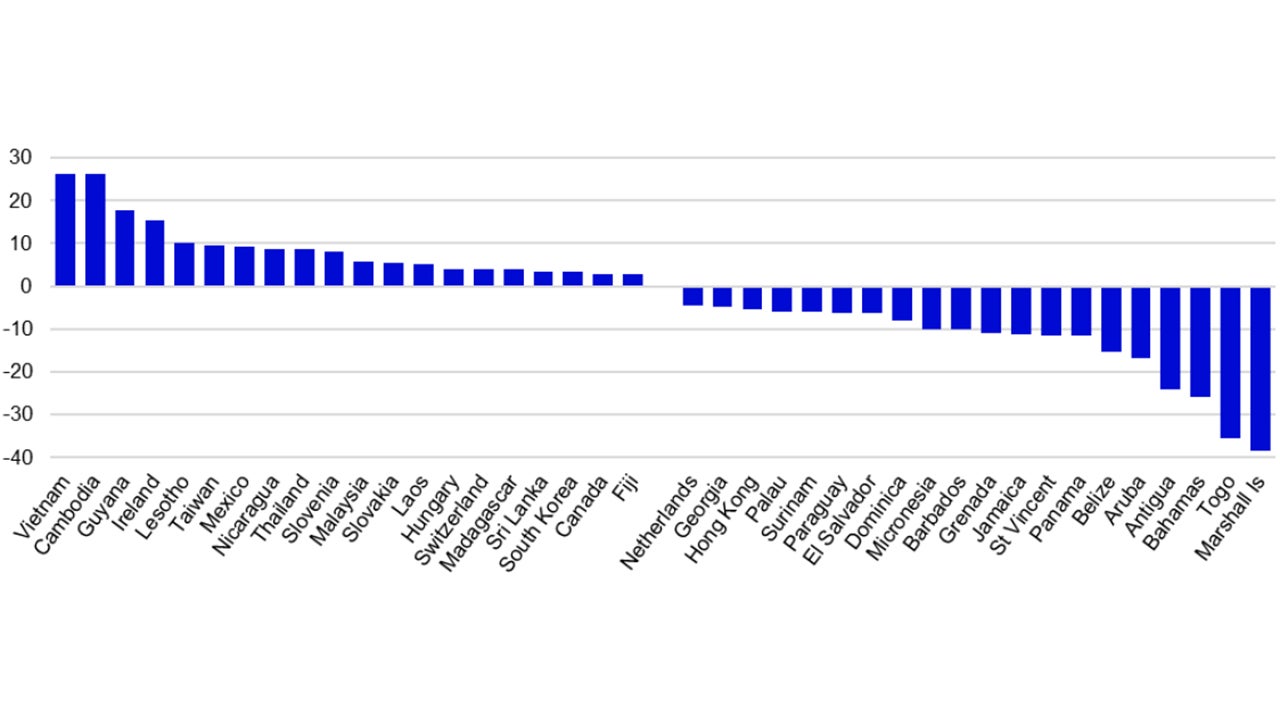

However, when it comes to the pain potentially felt by trading partners that are subject to trade restrictions (including tariffs), Figure 1 gives a distorted view since it doesn’t allow for the size of the economies concerned. I think a better guide comes from dividing the trade imbalance by GDP, which is what is shown in Figure 2. Again the focus is on the 20 largest surpluses and deficits but this time as a share of GDP.

Though China, the EU and Germany may be targeted by the Trump administration, they disappear from the top 20 surplus list when the size of economies is considered. It would appear that the economies of Vietnam and Cambodia are most at threat if tariffs are applied across the board (their goods trade surpluses with the US amounted to 26% of their respective GDPs in 2024). After Guyana, Ireland is next in line at 15%, which again may come as a surprise. By way of comparison, Germany’s goods trade surplus with the US to GDP ratio was 1.8% in 2024, while that of China was 1.6% and that of the EU 1.2%. This may also help explain why Chinese stocks have done so well of late (see Figure 3)

Figure 2 also suggests that some countries could gain from a “fairer” trade relationship with the US, if it leads to a smaller trade deficit. First in line would be the Marshall Islands (trade deficit with the US equal to 38% of GDP), while Hong Kong and the Netherlands are also in the top 20 deficit/GDP countries.

Of course, there are a number of problems with any such analysis. First, it assumes that tariffs are applied across all goods and countries in equal measure. Second, it ignores the fact that exports sent from a country such as Vietnam may be produced by foreign companies using it as a production base (including Chinese and US companies). Third, it ignores retaliation by trading partners and also second round effects (such as diversion of goods to other markets). Finally, it ignores trade in services in which the US tends to run a surplus ($293bn in 2024, compared to a goods deficit of $1,211bn). Strangely, the new administration never talks about services but it can make a big difference to the analysis of bilateral balances. For example, Ireland runs a big goods surplus with the US ($66bn in 2023) that is almost balanced by its deficit in services ($58bn in 2023, the latest full year available). Likewise Switzerland.

There is of course another big problem with this sort of analysis: it assumes the US runs a deficit because of unfair competition. However, from a national income accounting perspective, the current account balance is the difference between investment and savings. In 2024, the IMF estimates that US investment spending was 21.8% of GDP, close to the 21.4% in the EU. The big difference was in the rate of savings (18.2% of GDP in the US and 24.7% in the EU). Hence, the US ran a current account deficit, while the EU ran a surplus. The US current account imbalance cannot be eliminated unless the gap between savings and investment is closed (a rise in savings and/or less investment). That suggests the route to balance of payments equilibrium may involve a smaller US economy but don’t say that too loudly! There isn’t a lot that other countries can do about that.

All data as of 14 February 2025, unless stated otherwise.

Note: The chart shows the balance of trade in goods with the United States of America in 2024 compared to the size of each country’s GDP. The countries shown are the 20 with the largest surplus/GDP with the US and the 20 with the largest deficit/GDP. The GDP data for Sri Lanka is as of 2022.

Source: US Census Bureau, IMF World Economic Outlook, LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.