Uncommon truths: The peaking of Eurozone inflation

Unusually, inflation in the Eurozone is well above that of the US. We believe that two important factors, dollar and European gas price strength, are already fading. Hence, we think Eurozone inflation may have peaked and expect it to fall below that of the US over the coming year or so.

Before turning to the main topic of this document, it is worth examining the US employment report for November that provided a slight setback for markets. Despite weak ADP employment (+127k, reported a few days earlier), a big rise in layoffs (Challenger Job Cuts were up 417% year-on-year) and a falling ISM Employment index (48.4), non-farm payrolls increased by 263k (all data for November). Though there has been a slowdown in job gains (an average of 272k in the last three months versus 374k in the previous three), these are respectable gains.

However, there were conflicting messages within the overall report. The Household Survey (from where unemployment is calculated) suggested a second consecutive monthly decline in employment (-138k in November after -328k in October). The only reason that unemployment remained stable at 3.7% is that there was also a decline in the labour force (-186k). Whatever the true employment picture, it is troubling that average hourly earnings growth seems to be picking up again, with a 0.6% monthly gain in November (after 0.5% in October) and a 5.1% year-on-year (yoy) increase, up from 4.9%. This suggests that whatever happens to headline data, core inflation could prove stickier than we had hoped.

This said, it is generally presumed that inflation has peaked in the US and that it will take longer for that to happen in Europe. However, data released in the last week gives hope that Eurozone inflation is now on a downward path. Most dramatically, it was reported that Eurozone producer price index (PPI) inflation fell to 30.8% in October from 41.9% in September and a peak of 43.4% in August. Yes, 30.8% is an improvement!

When it comes to consumer price index (CPI) inflation, there were declines reported in Belgium (from 12.3% in October to 10.6% in November), Germany (from 10.4% to 10.0%), the Netherlands (from 16.8% to 11.2%) and Spain (from 7.3% to 6.8%, having peaked at 10.8% in July). As for the Eurozone as a whole, CPI inflation eased from 10.6% to 10.0%.

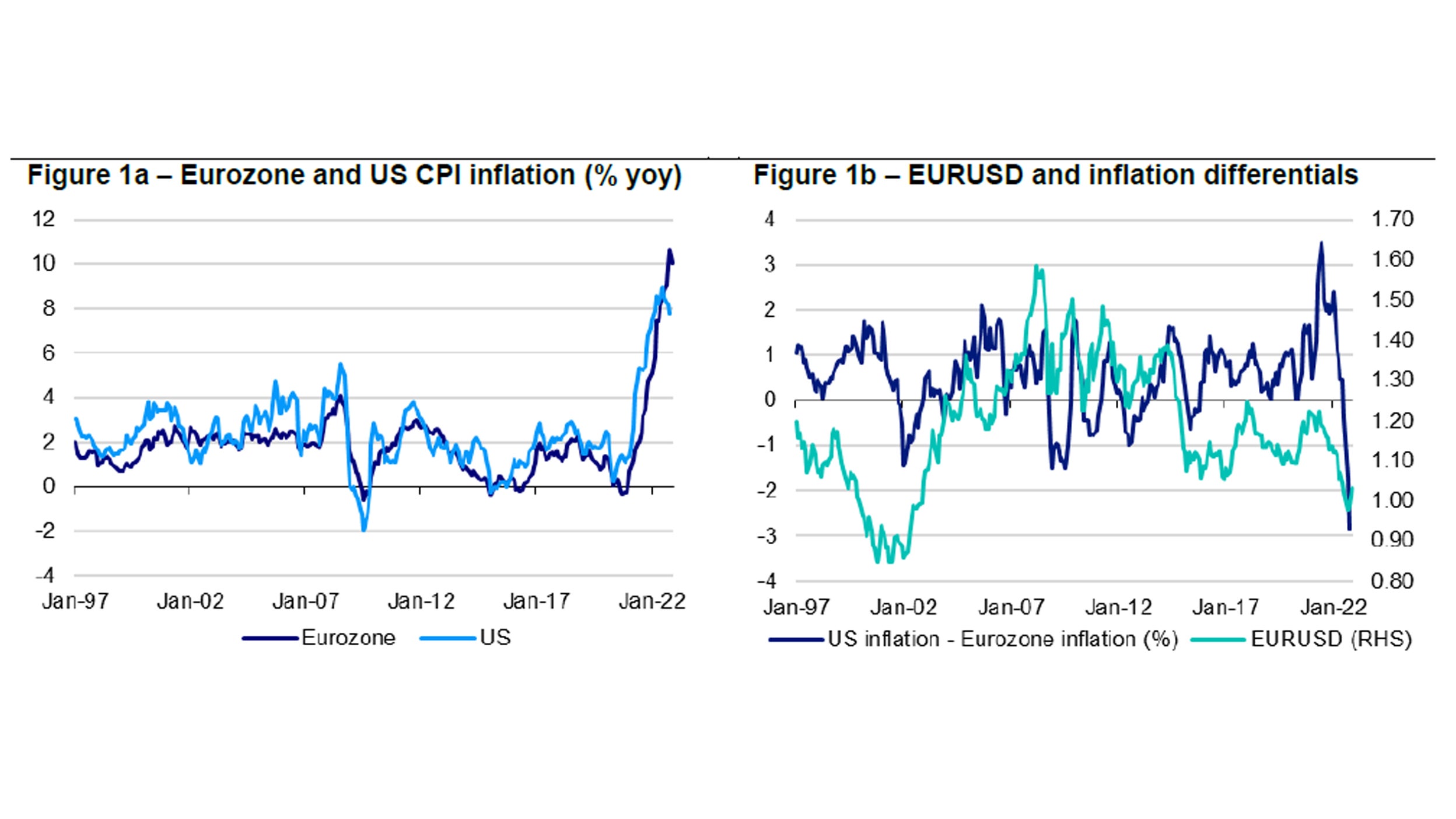

Figure 1a compares inflation in the Eurozone and the US. Inflation appears to have peaked first in the US (in June at 9.0%) but we can now hope that inflation in the Eurozone has passed its apex. Unusually, within the 26-year history shown in that chart, Eurozone inflationis now well above that of the US. Having been well below US inflation in December 2020 (-0.3% versus +1.3%), partly because of temporary cut in German VAT rates, Eurozone inflation has since climbed more rapidly and it finally exceeded that of the US in July ofthis year (10.6% in October versus 7.8%).

One factor that may have contributed to the increase in Eurozone inflation relative to the US is the strength of the dollar (or weakness of the euro) over the last 18 months. To the extent that goods imported into Europe are priced in US dollars (energy and other commodities, for example), dollar appreciation versus the euro should boost prices when converted to euros. Figure 1b points to a correlation between EUR USD and the difference between US and Eurozone inflation.

Notes: Past performance is no guarantee of future results. Figure 1a shows headline consumer price inflation from January 1997 to November 2022 (monthly data). Figure 1b is based on monthly data from January 1997 to November 2022 (as of 15 November 2022). “US inflation – Eurozone inflation” shows the difference between US and Eurozone headline consumer price inflation.

Source: Refinitiv Datastream and Invesco.

However, we believe the dollar has now peaked (as hinted in the chart) and we expect a reversal of that currency effect during 2023. If we are right, the gap between Eurozone and US inflationcould decline.

Another reason why inflation is higher in the Eurozone is shown in Figure 2a. The price of gasin Europe started to climb rapidly in the second half of 2021 as Russia limited supply (under the guise of maintenance work). It then surged in mid-2022 as Russia invaded Ukraine and limited the flow of gas once again to Europe. Energy had a CPI weighting of 11% in the Eurozone in 2021 (7% in the US) and gas accounted for around 25% of primary energy usage in 2021 (32% in the US). Hence, gas may have had a 2% - 3% weighting within Eurozone CPI (similar in the US), assuming the weighting of gas for households was the same as for the economy as a whole.

So, the five-fold increase in wholesale gas prices in the Eurozone in the year to mid-2022 (versus two-fold in the US), could easily explain the inflation differential. The energy components of the respective CPI’s give corroborating evidence. The energy component of US CPI was rising faster than its Eurozone counterpart until the start of 2022. In June 2021, the yoy gains were 26% in the US and 13% in the Eurozone but by January 2022 Eurozone energy inflation was higher (29% versus 27%). By October 2022, the gap had grown to 42% in the Eurozone versus 18% in the US.

Importantly, energy component inflation in the US appears to be on a downward path, having peaked at 42% in June. Based on the information shown in Figure 2a, we suspect that Eurozone inflation will also decline over the coming months and quarters, especially given that oil prices have also been falling and that we expect the dollar to weaken.

Even better, if European gas prices eventually decline towards US levels over the coming year or so (as Europe transitions away from reliance on gas from Russia), then we believe Eurozone headline inflation could fall below that of the US during 2023/24 (after all, core inflation islower inthe Eurozone).

On the topic of Europe’s reliance on Russian gas, it is impressive to what extent gas reserves have been filled in most countries. Figure 2b show gas reserves compared in November to the norms for that month since 2011. Use of storage capacity is close to the historical November peak for most countries, with the notable exceptions of Hungary and the Netherlands (Ukraine is obviously a case apart). That is not to say there cannot be shortages (if Russia cuts supply and the winter is cold) but most countries have put themselves in the best possible position (note that the numbers in parenthesis show current storage levels as days of 2021 consumption, assuming usage is spread evenly through the year, which it is not).

In conclusion, we think that Eurozone inflation may have peaked and believe it could fall below that of the US over the next year or so under the pressure of a weakening dollar and falling energy prices.

Unless stated otherwise, all data as of 2 December 2022.

Notes: Past performance is no guarantee of future results. Figure 2a is based on monthly data from August 2008 to November 2022 (as of 30 November 2022). Figure 2b is based on monthly data from January 2011 to November 2022 (as of 28 November 2022). “Current” shows the gas storage level in November 2022 as a percentage of storage capacity as reported by Gas Infrastructure Europe. “Min”, “Max” and “Average” show the minimum, maximum and average November levels from November 2011 to November 2022. The numbers in parenthesis show current gas storage as the number of days’ worth of gas consumption, based on 2021 consumption and assuming that consumption is spread equally throughout the year (which it is not). Gas consumption data is taken from the 2022 bp Statistical Review of World Energy. Source: bp, Bloomberg, Gas Infrastructure Europe, Refinitiv Datastream and Invesco.