Uncommon truths: The Aristotle List: 10 improbable but possible outcomes for 2025

It is time to forget central scenarios and think about improbable but possible outcomes. The mixed market mood at the end of 2024 is reflected in our list of surprises (these hypothetical predictions are our views of what could happen even if they do not form part of our central scenario).

Aristotle said that “probable impossibilities are to be preferred to improbable possibilities”, meaning that we find it easier to believe in interesting impossibilities (B52s on the moon, say) than in unlikely possibilities. The aim of this document is to seek those unlikely possibilities -- out-of-consensus ideas for 2025 that I believe have at least a 30% chance of occurring. The concept was unashamedly borrowed from erstwhile colleague Byron Wien, who sadly passed away during 2023.

I believe the biggest returns are earned (or the biggest losses avoided) by successfully taking out-of-consensus positions. A year ago, the mood was optimistic as central bank easing approached. Hence, my improbable but possible ideas were biased to the negative side (“S&P 500 finishes the year lower than it started” and “Global government bonds outperform equities” were ideas that proved too bearish). The mood is now more mixed, so my list contains optimistic and pessimistic items – don’t look for internal consistency, as there is none.

1. US CPI inflation goes above 4.0% during 2025

Our central scenario is based on the idea that inflation continues falling towards central bank targets, thus allowing further rate cuts and healthy asset returns. However, US money supply growth has been on the rise, core CPI has remained stubbornly above 3.0% (and the monthly gains since the middle of 2024 have been consistent with a rate above 3.5%), energy prices have been rising and tariffs could boost US prices. Admittedly, house price inflation has been falling since mid-2024 but that may not feed through to the shelter component of the consumer price index until the latter part of 2025 (based on historical patterns). In my view, higher inflation could raise treasury yields and depress many asset prices.

2. President Macron steps down after new elections

Although the president of France, Emmanuel Macron, has said he will stay in office until the end of his term in April 2027, I fear that political turmoil and parliamentary stagnation will force him to resign this year. Mid-2024 parliamentary elections (called by the president) led to deadlock. As a result, France has had two technocratic governments and I think the second (under centrist Francois Bayrou) will also struggle to reconcile the conflicting demands of the three major parliamentary blocks (left, centre and right). New elections seem likely once the minimum 12-month period since the last election has passed, though perhaps not until September/October to avoid a clash with the holiday season. I doubt the far-left will enter another pact to block candidates of Marine Le Pen’s RN party and opinion polls suggest the RN will garner most seats (though not a majority). Further chaos could lead to more strident calls for the president to resign and I think there is a chance he will accede. Adding fuel to the fire, is the possibility that a 31 March court judgement could ban Marine Le Pen from public office.

3. US dollar weakens during 2025

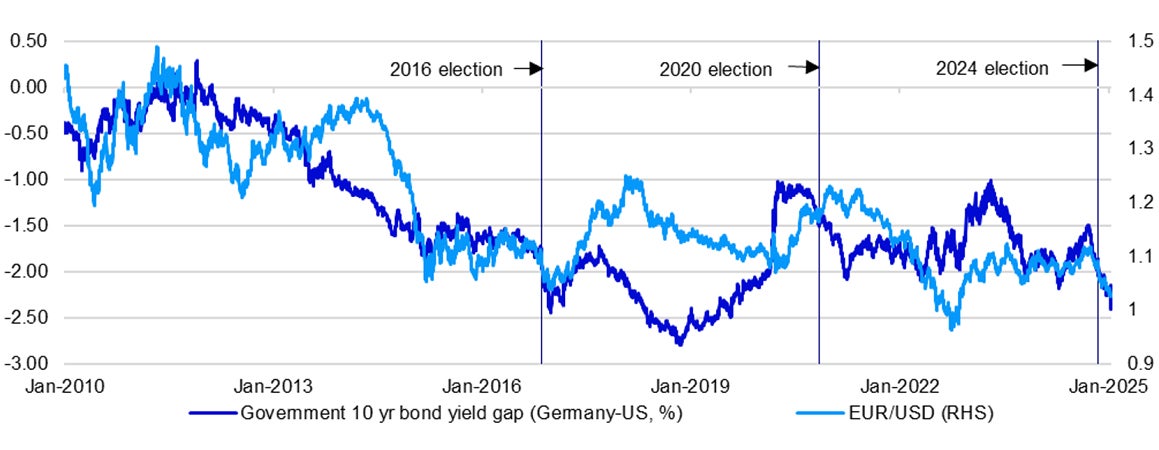

The US dollar appreciated by 7.1% during 2024, aided by a gain of 8.1% since 27 September, based on the ICE US Dollar (DXY) Index. I suspect this was in part due to the election victory of Donald Trump and brings to mind what happened after his victory in 2016 (see Figure 1). At that time it was commonly believed that a Trump White House would be dollar positive. But that was not the case and the DXY index fell by 10% in 2017. As seen in Figure 1, the same post-election pattern seems to have been repeated this time, with the bond yield spread versus Germany widening and the dollar strengthening versus the euro. It is easy to believe the momentum will continue but I suspect a number of factors will work against dollar: first, it is expensive and its fundamentals are poor (see FX Pulse); second, there could be a partial reversal of the upward shift in the market implied path of Fed policy rates since September and, finally, the policy environment may be erratic under the new president (and he seems to want a weaker dollar).

Note: Past performance is no guarantee of future results. Daily data from 1 January 2010 to 10 January 2025. Elections show date of US presidential elections. Source: LSEG Datastream and Invesco Global Market Strategy Office.

4. EU discord causes widening of spreads

It’s hard not to make this list all about president-elect Donald Trump but this is the closest I will get. His ability to provoke chaos is already having an effect on the EU via tariff threats and covetous remarks about Greenland. However, there is also a way for him to sow discord among EU members via his approach to Ukraine. For example, if “peace” is forced upon Ukraine on terms that are deemed advantageous to Russia, large parts of the EU would object (including Germany under what appears likely to be a CDU led coalition after upcoming elections). But some EU members would align with the US on Ukraine, including Hungary, Slovakia, Czechia (after elections due by October 2025), Romania (if Calin Georgescu is allowed to stand and win again after his shock presidential election first round victory was cancelled due to suspected support from Russia) and Austria (FPO leader Herbert Kickl was recently asked to form a government and he opposes aid to Ukraine). Further, if ANO leader (Andrej Babic) does become prime minister of Czechia, the founding members of the EU-sceptic Patriots for Europe group would be in power in Austria, Czechia and Hungary, perhaps making it difficult to maintain EU solidarity. This could see an increase in peripheral yield spreads versus Germany.

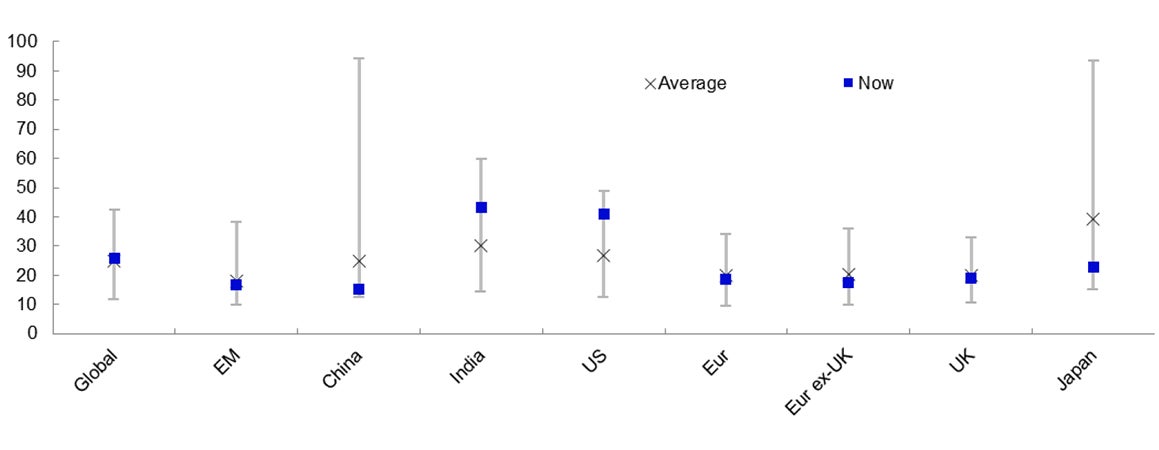

5. US stocks underperform global indices

I believe the US election result contributed to a strong 2024 for US stocks (see Figure 4). However, the market has struggled in the early part of 2025. I think valuations suggest there is a lot of good news in the price of US stocks compared to other markets (see Figure 2). The cyclically adjusted PE ratio of the US market was 41.1 at end-2024, versus a historical average of 26.7. Among the markets we monitor, only India appears more expensive and that market lagged in 2024. At the other extreme is China with a CAPE of 15.1, well below the historical average of 24.7. Bullish investors seem to predict a cut in US corporate taxation and the imposition of tariffs on other countries. But I find no historical relationship between corporate tax rates and future US equity returns, while I doubt the US can avoid the fallout from trade wars. Finally, I think erratic policy and rising treasury yields could damage US stocks, while an accelerating global economy may favour other markets (for example MSCI Germany has outperformed MSCI USA since the election).

6. Turkish govt. bonds outperform global indices

Turkey was the best performing government bond market in 2024 among the 35 that we follow (in local currency terms and based on ICE BofA government bond indices). We suspect it will outperform global indices again (in both local currency and in US dollars). South African and Indian markets provided competition in 2024 (with South Africa the top performer when measured in USD) but I suspect Mexico and Brazil could provide the main competition in 2025 (they were at the bottom of our USD performance league table in 2024 and 10-year yields are above 10% and 14%, respectively). The Turkish 10-year government yield was around 27% at the start of 2025 and the 2-year yield was around 37%. Currency depreciation is the big risk but inflation is falling (44% in December, down from the peak of 75% in May), and I think the lira is cheap in real terms, so the worst may be behind us.

Note: Cyclically adjusted price/earnings ratio uses a 10-year moving average of earnings. Based on daily data from 3 January 1983 (except for China from 1 April 2004, India from 31 December 1999 and EM from 3 January 2005), using Datastream indices. “EM” is emerging markets. “Eur” is Europe. As of 31 December 2024. Source: LSEG Datastream and Invesco Global Market Strategy office.

7. EU carbon price goes above €90 per tonne

I believe climate change is the biggest externality we face and that making the polluter pay is the most efficient way to deal with it. The EU’s Emissions Trading System tries to set appropriate pricing signals by systematically reducing the volume of CO2 emission allowances. The rate of reduction in the allowances cap has been doubled from 2.2% per year in the 2021-23 period to 4.3% from 2024 to 2027, which should support the price of allowances (carbon price). However, EU economies have been weak over recent years, thus reducing the demand for allowances, which I think is why the carbon price failed to stay above €100 and has been in the €60-€80 range for much of the last year. An upturn in global growth (which I expect), should help the EU economy and boost demand for allowances, just as supply falls more rapidly. I think that could push the EU carbon price above €90.

8. Kenyan stocks outperform major indices

In my search for exotic stock market opportunities, I usually look for the holy grail of a dividend yield that exceeds the price/earnings ratio. The options are very limited this year, Kenya being the only market I can find that meets the above criteria. The Nairobi All Share index has a current P/E ratio of 6.3 and a dividend yield of 7.8%, even after a 34% price gain in 2024 (as of 10 January 2025, according to Bloomberg). Usually, whenever valuation metrics are at such levels it signifies either that a big opportunity has presented itself or that something is about to go very wrong. Bloomberg consensus estimates suggest that both earnings and dividends are expected to rise in 2025. So, no problem there. Also, the usual macro metrics (growth, inflation and economic balances) do not signal problems and in 2024 the shilling was the strongest currency among the 94 we follow (see also our analysis in Africa 2024). The drawback is that market capitalisation of the index is only around $14bn.

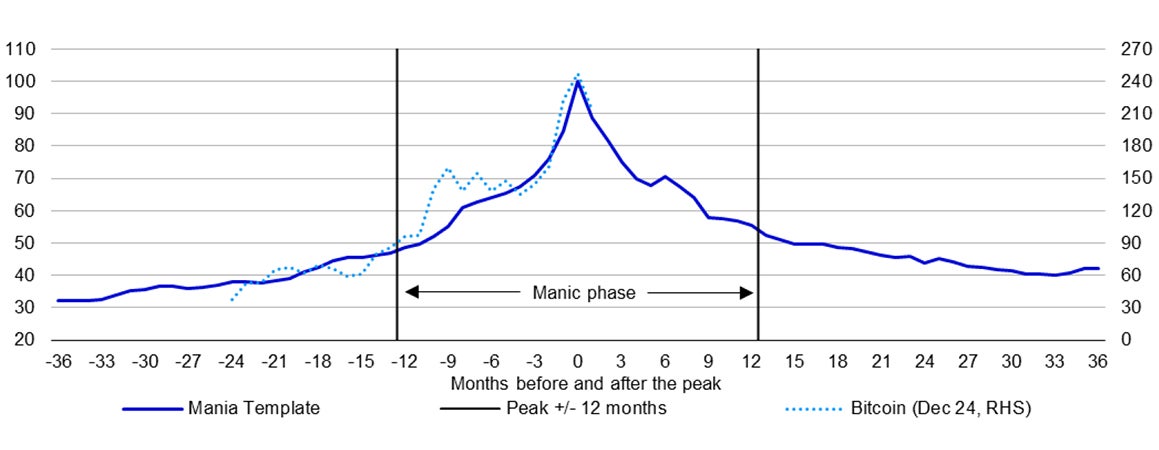

9. Bitcoin falls below $50,000

Cryptocurrencies have gained a lot since the US election (I have no idea what drives them). The largest remains Bitcoin, and, after a price gain of around 120%in 2024, its market capitalisation briefly went above $2 trillion (for comparison, that of the S&P 500 is currently around $50 trillion and the value of above-ground gold is around $20 trillion). What I can say about Bitcoin is that it has gone through one bubble after another, with ever higher peaks (so far). Figure 3 suggests it has recently performed in line with my mania template (the average price path during 15 historical manias). If the 17 December 2024 price of $108,250 was the peak of this cycle (which I think it may have been), then the descent could be rapid (the mania template suggests a price well below $50,000 by the end of 2025).

10. Europe wins Ryder Cup on US soil

The biennial golf tournament between Europe and the USA takes place on 26-28 September at Bethpage Black Course in New York. Europe has not won on US soil since the “Miracle at Medinah” in 2012, since when the home team has won each tournament (the USA won the last match on home soil by a massive 19-9 margin). Also, 11 of the world’s top-20 players are from the US, versus six from Europe (according to Official World Golf Ranking). However, I think Europe will win. First, team USA was widely tipped to win the 2023 edition (in Italy) because of the ranking mismatch, but Europe had better team spirit and was more motivated and won easily (by 161/2 to 111/2). I wonder if the payments to USA players (for the first time), will motivate European players even more.

As a gift for the new year, we offer Figures 4, 5 and 6 which show long term performance data across assets, sectors and factors.

Unless stated otherwise, all data as of 10 January 2025

Note: Past performance is no guide to future returns. Based on monthly data. See appendix for construction methodology of “Mania template”. “Bitcoin” is constructed using the hypothesis that the 17 December 2024 level was the peak (month zero) and the final datapoint is for January 2025 (as of 8 January 2025). Source: LSEG Datastream and Invesco Global Market Strategy office.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.