Uncommon truths 2024: a year in review

The central bank easing cycle started in 2024, helping to make the year rewarding for many investors. If only the same could be said for my Aristotle List of 10 surprises.

A year ago, we were expecting less economic growth but the belief that central banks would start easing led to optimism about market outcomes (see 2023 in review). Central banks did ease and assets did well.

The best performing global assets in 2024 were precious metals and equities (see Figure 3). The only global asset class to generate negative returns (in USD) was government bonds. The 13.6% USD total return on our Neutral portfolio in 2023 (13.3% in local currency) was followed by 7.9% in 2024 (11.1% in local currency). The Neutral portfolio is a static mix of global cash, fixed income, equity, real estate and commodity assets (see Figure 6 for weightings).

As a reminder of events, here are Bloomberg’s most-read articles during 2024 (paraphrased):

- Harris urges peaceful transfer of power (Nov 6)

- UnitedHealth executive fatally shot in NYC (Dec 4)

- Dollar to fall as traders anticipate Fed cuts (Aug 5)

- Stock meltdown puts S&P 500 on brink of correction (Aug 6)

- How a 46-year hedge fund went bankrupt (May 14)

- Stocks hit by biggest sell-off since August (Sep 3)

- Fed confronts up to million jobs vanishing (Aug 20)

- South Korea’s Yoon declares martial law (Dec 3)

- Fed cuts rates by half point… (Sep 18)

- Donald Trump becomes first former US president guilty of crimes (May 30)

As usual, bad news sells and the majority of the most-read stories were on the negative side. The various ongoing conflicts did not make the list and US elections appeared only in odd ways (at #1 and #10). The dominant event was the early August volatility inspired by weak US jobs data and the rise of the yen (and the knock-on 50 basis point Fed rate cut). Below the top-10, there was interest in Israel/Gaza, Iran and Ukraine. Tariffs make an appearance but not until item 24.

The positive market outcomes suggest to me a willingness to look through geopolitics (except for the rise in gold) and to focus on rate cuts, fiscal activism and a potential pick-up in growth. There have also been a range of idiosyncratic factors that have driven various assets (AI and hoped for post-election US deregulation, for example). Bonds may be back, but the lack of recession helped equities again outperform government bonds by a wide margin (see Figure 3). Though emerging market (EM) bonds did well (relative to elsewhere), EM stocks did even better.

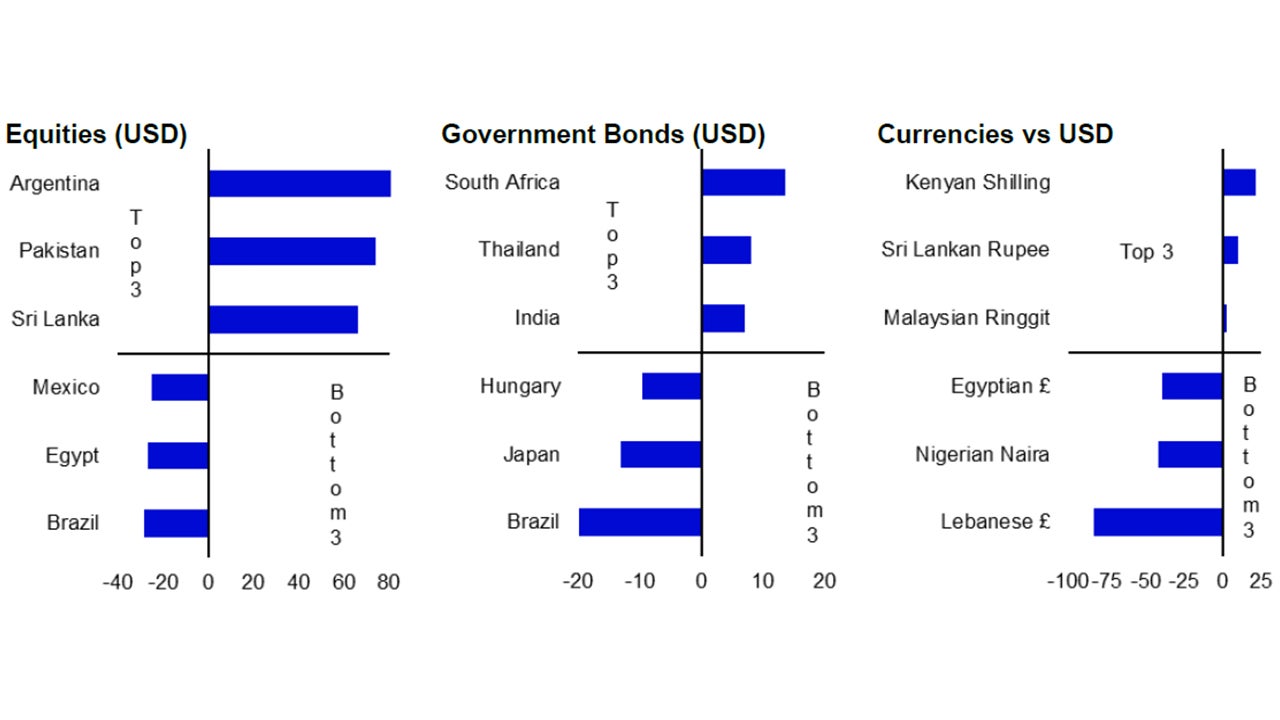

Figure 1 shows the results of our annual ranking within asset groups. As is often the case, emerging markets dominate both ends of the spectrum, though Japanese government bonds again appear in the bottom three whether in local currency or in US dollars. Argentina topped the equity league table, on both a local and a common currency basis. Otherwise, India’s bonds ranked better than its equities (the latter were also outperformed by Chinese stocks!). Also of note is that its neighbouring stock markets (Pakistan and Sri Lanka) were in the top three. Finally, the 21% decline in the Brazilian real (versus USD) pushed its bond and equity performance to last place (in USD).

Past performance is no guarantee of future results. As of 31 December 2024. Equity data is based on Datastream indices; government bond indices are supplied by ICE BofA; currencies are based on WM/Refinitiv exchange rates. Source: LSEG Datastream and Invesco Global Market Strategy Office.

The long awaited easing by the Fed finally came in September. By the time the Fed cut rates for the first time, more than 40 other central banks had already eased. The dramatic 50 basis point first move by the Fed suggested that its decision makers were worried they had waited too long, a concern no doubt stoked by the weaker than expected non-farm payroll data for July (published in early August). That data provoked volatility in a broad range of assets but it turned out to be partly the result of residual seasonality (July is usually one of the weaker payroll months of the year).

The Fed has continued to ease but at a more leisurely pace. Fed Funds Futures now imply there will be two 25 bp rate cuts by the end of 2025 (at most), bringing the upper end of the Fed’s policy range to 4.00%, versus the below 3.00% rate implied at the time of the first cut. In that time, the 10-year treasury yield has risen from 3.62% to 4.57%.

In any case, the US avoided the recession I predicted in item #1 on my list of 10 surprises for 2024 (published on 7 January 2024 - see The Aristotle List). Unfortunately, the rest of the list didn’t fare much better, as shown below (with my self-evaluation in blue):

- US experiences short recession (No)

- S&P 500 finishes year lower than it started (No)

- USDJPY falls below 125 (No)

- Democrats win at least two of three major races(No)

- ANC loses sole control of South Africa (Yes)

- Global government bonds outperform equities (No)

- Geopolitics push Brent/gold above $100/$2350 (No and Yes)

- Colombian stocks outperform major indices (No)

- Chinese stocks to outperform the US (No)

- France wins Euro 2024 (No)

Remember, this list does not represent my central scenario but is rather an attempt to identify non-consensus ideas that I believe have a reasonable chance of occurring (thereby surprising most investors). They must therefore be put in the context of the prevailing sentiment at the start of the year (optimism about US stocks and a Republican clean sweep).

2024 was a bad year for the Aristotle List, as was 2023 (after a successful 2022), which reminds me of the words of Rudyard Kipling: “If you can meet success and failure and treat them both as impostors, then you are a balanced man...”. That is good to remember in good times and in bad.

I will publish the selections for 2025 on 12 January. I have met many investors over recent months which helps to judge the prevailing mood. I am hoping the Christmas and New Year break has provided more inspiration than last year.

I continue to believe the main driver of returns will be economic and policy cycles. Central banks are now easing and I expect the global economy to accelerate as real incomes expand and financial conditions improve. As outlined in Big Picture 2025 Outlook, that leads me to be relatively optimistic about multi-asset returns during 2025. However, strong gains for some assets during 2024 leave me expecting lower returns than I did a year ago. I believe the big questions facing investors are whether duration will be rewarded (I am not convinced) and whether there will be a change of market leadership (US large caps have to underperform at some stage, in my opinion).

On that note, all that remains is for Andras and I to wish you a happy and prosperous 2025.

Unless stated otherwise, all data as of 31 December 2024.

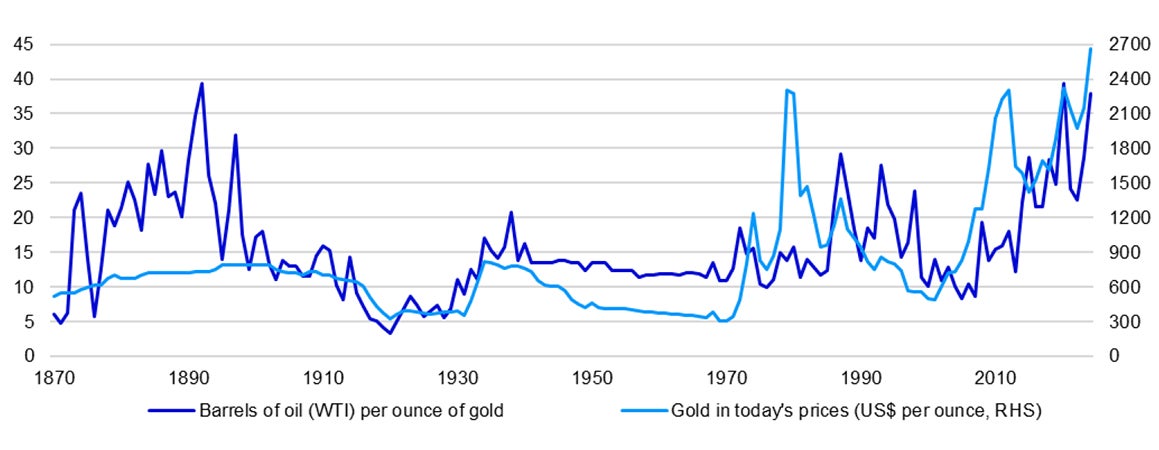

Notes: past performance is no guarantee of future results. Based on annual data from 1870 to 2024 (as of 13 December 2024). The chart shows the real price of gold, both deflated by US CPI and showing how many barrels of oil can be bought with an ounce of gold. Source: Global Financial Data, LSEG Datastream and Invesco Global Market Strategy Office.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.