The economic and investment outlook for Europe and UK

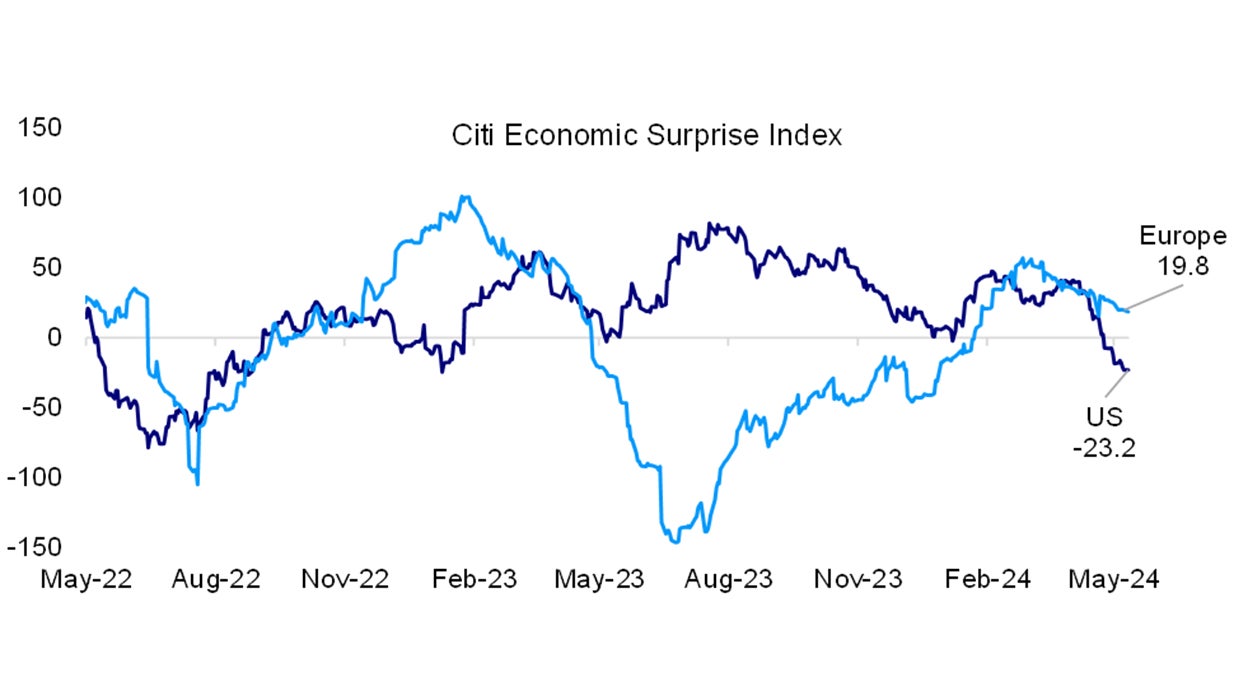

The economic chill has started to thaw in Europe. From a cyclical growth perspective, it seems that the US and the Euro Zone (EZ) / UK are pointing in opposite directions.

The US is most likely past its post-pandemic peak – often called “American Exceptionalism” - while the EZ / UK have been moving from below trend back towards trend growth, as exemplified by economic data since the start of the year.

The Citi Economic Surprise indices show the better growth vs expectations.

Source: Invesco, Bloomberg, as of May 20, 2024

For example, the UK economy grew +0.6% q/q in Q1, which came after a -0.3% slide in Q4.1 Likewise, the EZ grew by 0.3% q/q in Q1 with even Germany clocking in +0.2% q/q growth,1 after languishing in recessionary territory for most of last year.

Other major economies in the EZ, such as Spain and France have been doing a lot better than Germany.

EZ / UK growth appears to be on firmer footing this year

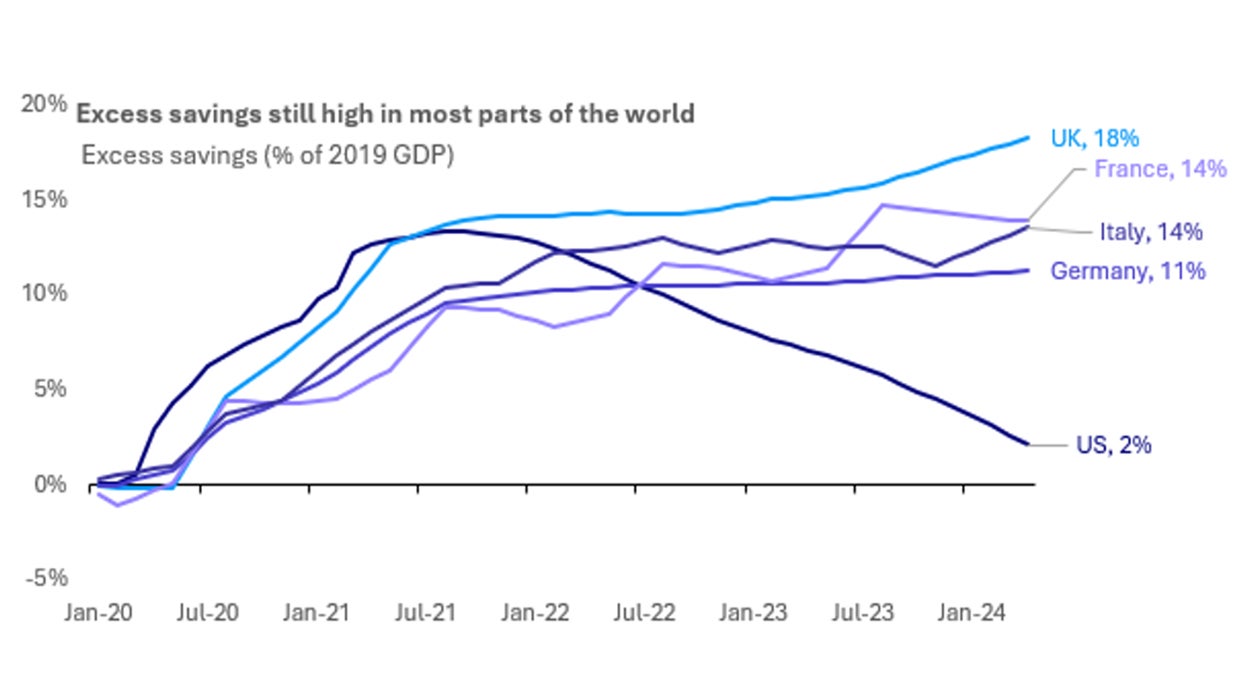

The European consumer has been more resilient than many had feared, because they have strong balance sheets and plenty of cash saved during the pandemic period. This gives them a cushion.

Retail sales have begun to improve suggesting Europeans are getting more comfortable spending again.

This is reflected in corporate earnings data, which while still lower y/y, are higher q/q and surprised comfortably to the upside in Q1.

Source: Invesco, Macrobond, Bloomberg, as of 11 May24

Still, growth is expected to be somewhat erratic on both sides of the channel, similar to what we’ve seen over the past year: small growth in one quarter followed by possibly shrinkage in the next.

But overall, EZ / UK growth does appear to be on firmer footing this year.

Potential rate cut by European Central Bank

From an inflation perspective, EZ inflation is heading in the right direction. CPI came in at +2.4% y/y in April and core CPI at +2.7% y/y.2

The European Central Bank (ECB) has given every indication that it will cut interest rates during its 20th June meeting and I believe there will be additional 1 - 2 cuts this year.

Lower gas prices have helped to ease inflation pressures in Europe. Two warm winters, efficiency gains and strong imports have left storage levels well above normal levels for this time of year meaning there is less risk of an energy shock returning this winter.

Much of this is anticipated by markets and the realization that the ECB and Bank of England (BOE) will start cutting rates ahead of the Fed.

I would also point to ECB’s head, Christine Lagarde’s recent comments – “we are data dependent, not Fed dependent” as a sign that the ECB is very happy to cut before the Fed.

More so, the Swiss National Bank (SNB) and the Riskbank have already started to cut rates. Though recent growth data has surprised positively there is enough weakness in the data still for the ECB to justify cuts.

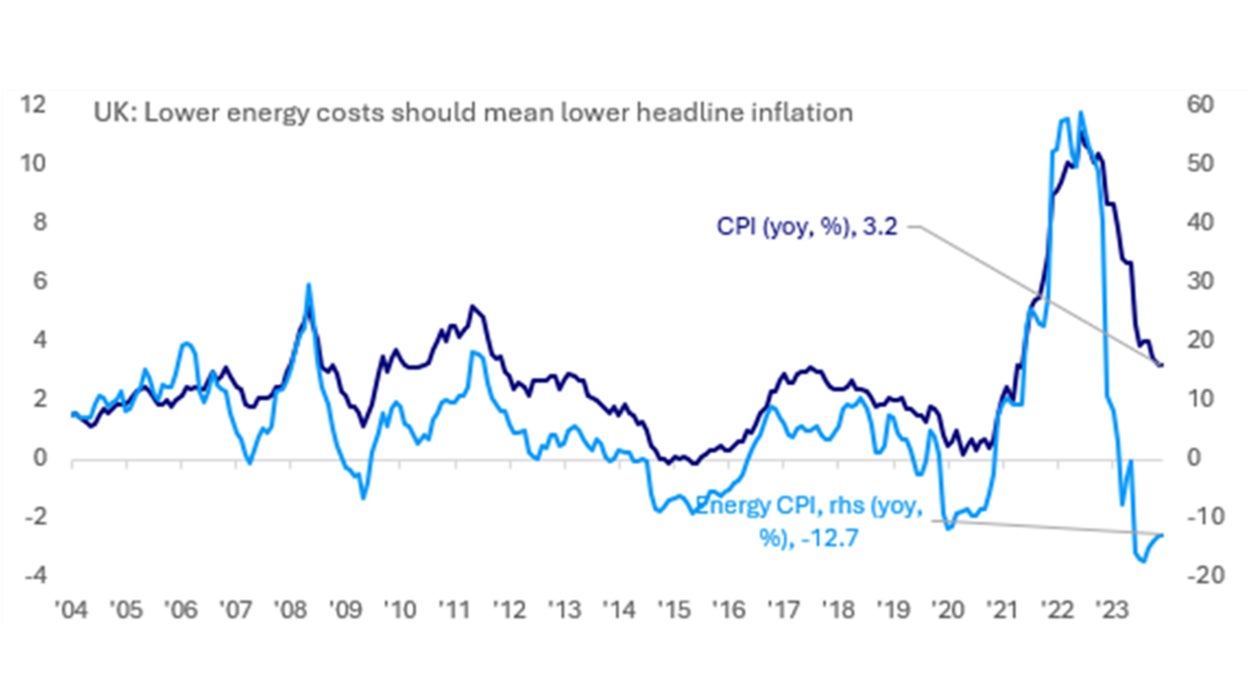

Wage inflation remains sticky in UK

UK inflation on the other hand is a bit higher: CPI +3.2% y/y in March and core CPI +4.2% y/y. 3

Source: UK Office for National Statistics (ONS). Data as of March 2024

Wage inflation remains sticky - weekly earnings (ex-bonus) were +6.0% in March.3 However, inflation may be heading in the right direction. This is likely to continue as energy prices come down.

Prices are likely to fall quickly with the April reading as the fall in the energy price cap and base effects will push the inflation print lower.

The problem the BOE has is services inflation remains sticky.

But cracks in the labour market shows that there is enough reason for the BOE to look through this stickiness.

The BOE may cut rates at their 20th June meeting, as per recent comments from the BOE’s Monetary Policy Committee, but they may delay the first cut until their 1st August meeting.

It would make sense that the BOE waits for the ECB to move first, and I expect a total of 2 - 3 cuts this year.

Investment Implications – Fixed Income

We favour UK and European rates over US rates at present.

With higher rates in the UK, the carry is better on UK bonds but we wouldn’t expect big capital gains at the longer end of European markets. For choice, we would prefer UK versus Eurozone bonds.

Investment Implications – Equities

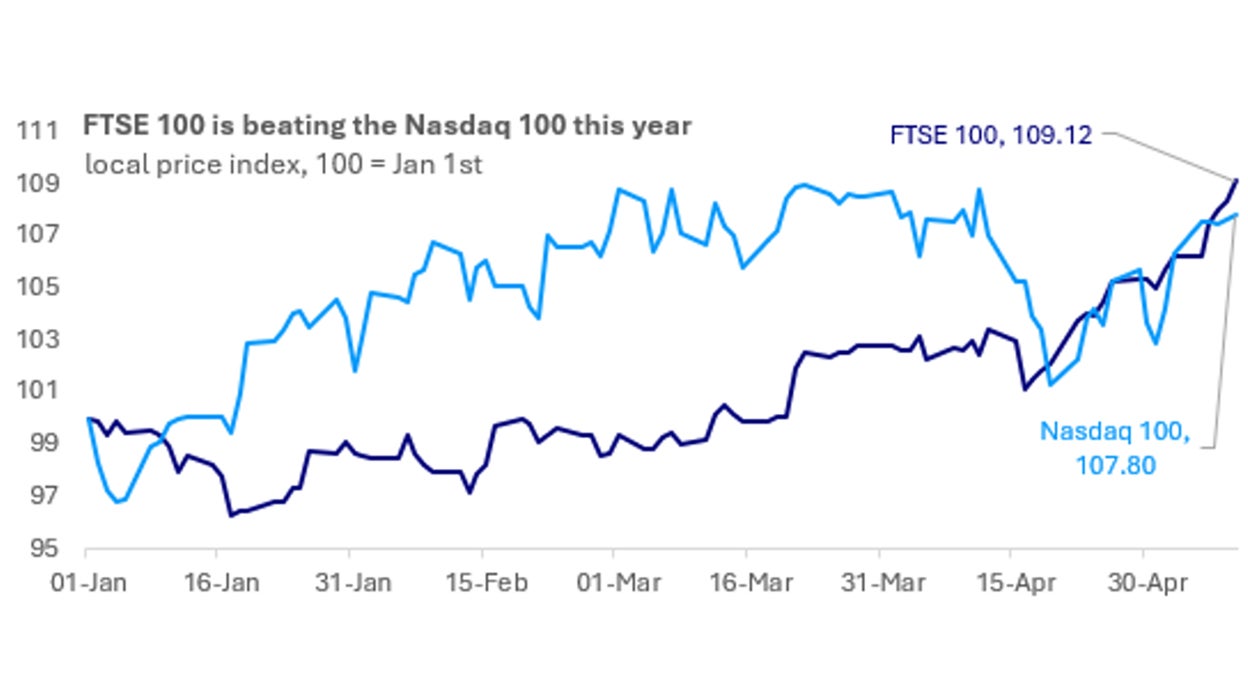

We believe both European and UK equity markets look attractive. The valuation case is well known, and momentum is turning now. The FTSE 100 has outperformed the Nasdaq 100 year to date which is quite the turnaround in fortunes.

On valuations, both the UK and Europe ex-UK markets appear reasonable versus the US and versus their own history.

Source: Invesco, Bloomberg, as of 10 May 24

European equities have more value stocks compared to the US; this characteristic tends to benefit when economies are recovering. Also, banks are more important in Europe, which could help European indices as yield curves steepen.

Finally, the UK has a good weighting in resource related stocks (energy and miners) and that should help if commodities benefit from economic recovery.

Q1 earnings season has shown more companies beat earnings expectations and Q/Q earnings have started to grow in Europe.

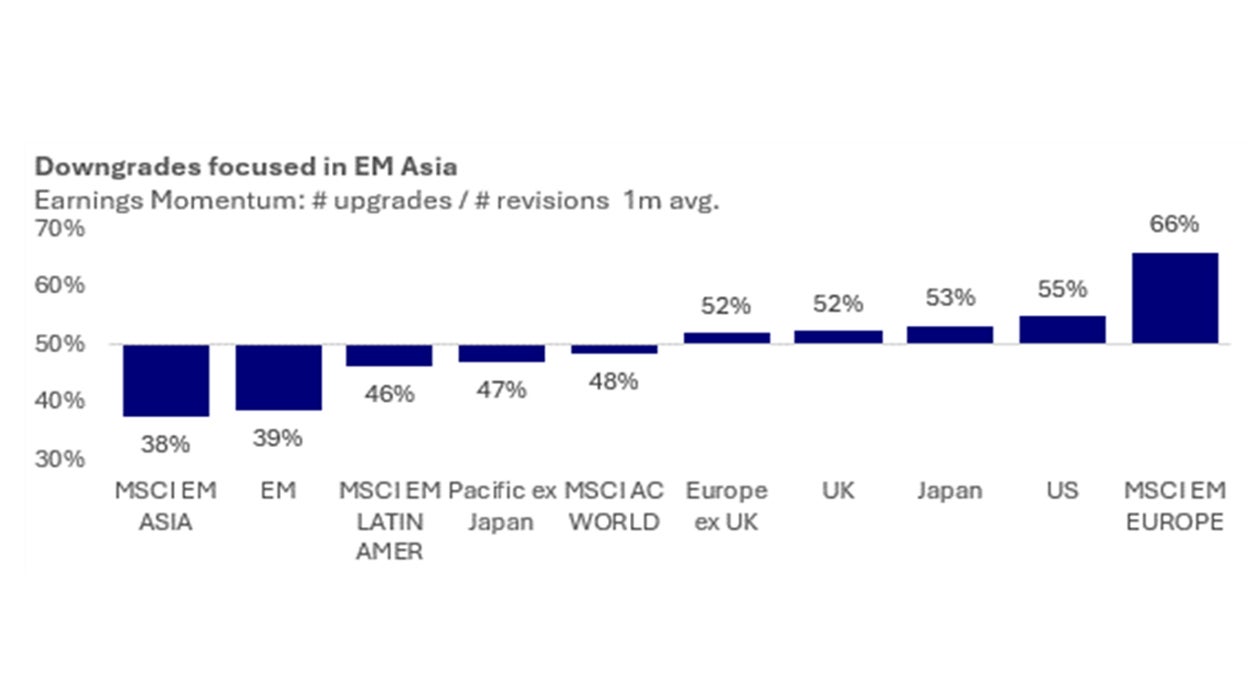

Analyst earnings momentum has improved and is stronger in the UK and Europe ex UK compared to MSCI AC World. At the margin this supports further outperformance by these markets.

Overall, I believe that the case for European equities (versus the US) is clearer than for European bonds.

With contribution from Paul Jackson, Arnab Das, Benjamin Jones and Thomas Wu.

Source: Bloomberg. Data as of 20 May 2024.

Reference:

-

1

Source: Bloomberg. Data as of 15 May 2024.

-

2

Source: Bloomberg. Data as of 15 May 2024.

-

3

Source: UK Office for National Statistics (ONS). Data as of March 2024