The Big Picture: Global asset allocation 2025 Q2

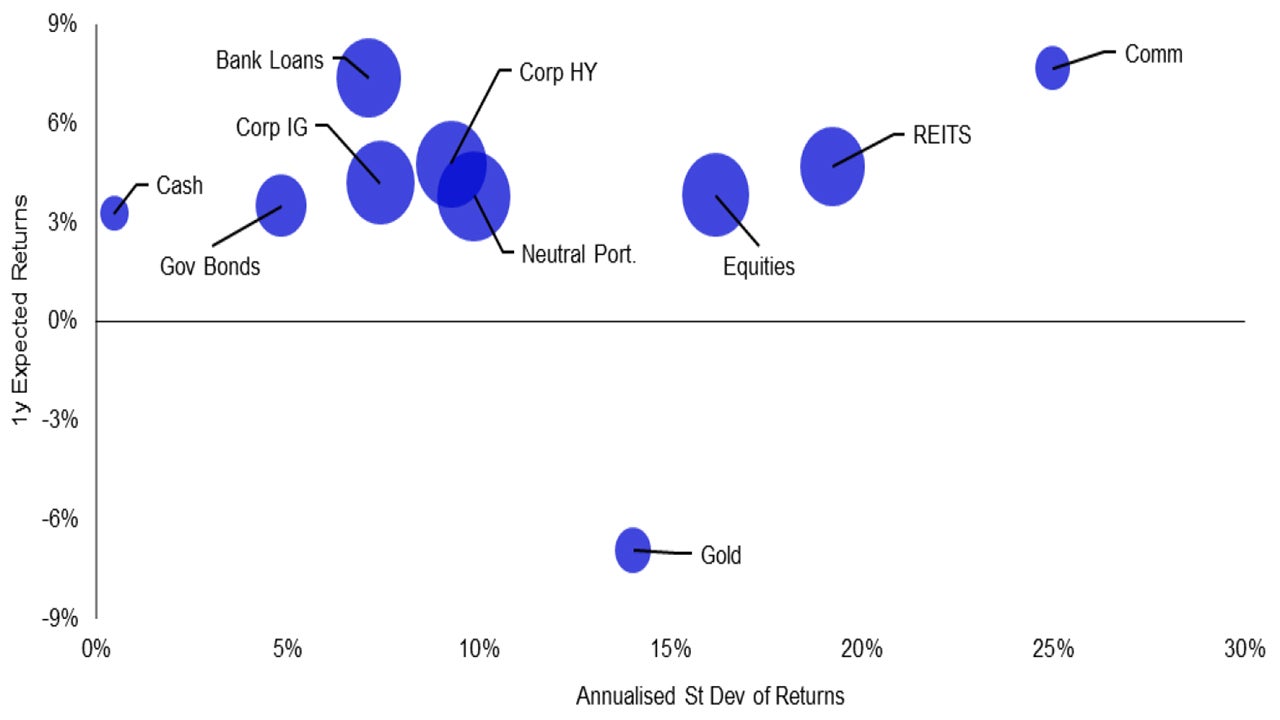

The world seems a less certain place but we think falling policy rates and rising real wages will boost global growth. We expect this to favour cyclical assets. Within our Model Asset Allocation we continue to favour commodities and boost REITS to the maximum allowed. We also raise equities to Neutral (Underweight the US and Overweight all other regions). For balance, we maintain the Maximum exposure to bank loans but reduce government bonds to Underweight and investment grade to Neutral. Across regions we prefer European and emerging market (EM) assets and continue to boost JPY exposure via hedges from USD.

Model asset allocation

In our view:

- Commodities should benefit as the global economy improves. We stay at the Maximum.

- Real estate (REITS) have underperformed and may benefit as rates fall. We boost to the Maximum allowed.

- Bank loans offer an attractive risk-reward trade-off. We stay at the Maximum.

- Equities could benefit from economic acceleration. We boost to Neutral (though remain Underweight the US).

- Corporate investment grade (IG) has a similar profile to government bonds. We reduce to Neutral.

- Government bonds are less attractive after the fall in US yields. We go Underweight.

- Corporate high yield (HY) spreads are too tight. We remain Underweight.

- Cash will be disadvantaged as the global economy accelerates. We remain at Zero.

- Gold may be helped by a weakening dollar and geopolitics, but is expensive. We remain at Zero.

- Regionally, we favour Europe and EM and seek JPY exposure.

- US dollar is likely to weaken and we maintain the partial hedge into JPY.

Our best-in-class assets (based on 12m projected returns)

- China equities

- Eurozone REITS

- European bank loans

Based on annualised local currency returns. Returns are projected but standard deviation of returns is based on 5-year historical data. Size of bubbles is in proportion to average 5-year pairwise correlation with other assets (hollow bubbles indicate negative correlation). Cash is an equally weighted mix of USD, EUR, GBP and JPY. Neutral portfolio weights shown in Figure 3. As of 12 March 2025. There is no guarantee that these views will come to pass. See Appendices for definitions, methodology and disclaimers.

Source: Credit Suisse/UBS, ICE BofA, MSCI, S&P GSCI, FTSE Russell, LSEG Datastream and Invesco Global Market Strategy Office