Taking stock of Japan’s institutional governance reform

Japan has been undergoing significant institutional governance reforms over the past few years, aimed at creating a more transparent, accountable, and dynamic corporate environment – and in turn fostering economic growth. This was kickstarted by the Stewardship Code for institutional investors enacted in 2014, encouraging investors to monitor companies, exercise voting rights and engage more energetically in corporate affairs.

A year later in 2015, the Corporate Governance Code followed and set out principles for listed companies to follow in order to achieve sustainable growth and increase corporate value over the mid- to long-term. The code emphasizes the importance of independent directors, board diversity, and the establishment of advisory committees.

The guidelines were a step in the right direction and marked a regime change from more traditional Japanese business practices. Notably, 98.1% of Prime Market listed companies on the Tokyo Stock Exchange now have independent outside directors comprising more than a third of the board.1 In 2023, the share of women on boards of the large publicly listed companies in the TOPIX 100 Index in Japan stood at around 16.9%.2

However, it was not definitive whether the measures improved corporate performance – and consequentially, stock returns. The Tokyo Stock Exchange (TSE) reforms in early 2023 looked to tackle exactly that, by focusing on boosting capital efficiency and share prices (corporate value). It essentially begun an upwards ratcheting of requirements on capital efficiency for companies to stay in the first section (prime section) of the exchange.

The TSE also launched a “name and shame” scheme, listing companies which met the bourses voluntary request to make plans for "action to implement management that is conscious of cost of capital and stock price". As of end 2024, over 90% of companies in the prime segment of the TSE have disclosed plans in compliance with the TSE request.3

What is clear is that the initiatives taken to boost governance and capital efficiency has driven much foreign investor enthusiasm, with the hope that Japanese stocks could experience a re-rating of multiples. 2023 in particular saw substantial inflows into Japanese stocks by foreign investors, though this was somewhat reversed in late 2024 due to JPY currency volatility and uncertainty over BOJ actions.

The pressure to reform has led to a dynamic where Japanese corporates are returning increasing amounts of cash to shareholders via share buybacks and dividends. Japanese corporates have historically had a tendency to hoard substantial cash cushions, which provides security for management but is detrimental from a shareholder perspective as it represents an inefficient use of capital. This has steadily been changing. In 2023, share buybacks hit 10 trillion JPY, a 5-fold increase from a decade ago.

An area of governance reform where progress has been slow has to do with the practice of cross-shareholdings, where companies hold shares in each other to cement business relationships. Investors have been scrutinizing the presence of strategic shareholders who are aligned with management, as they can shield them from having to address the concerns of minority shareholders. Reforms have aimed at reducing these holdings to improve corporate governance and reduce conflicts of interest. The ratio of strategic cross-shareholdings declined from 31.5% to 30.8% in 2023, suggesting much scope for unwinding.4

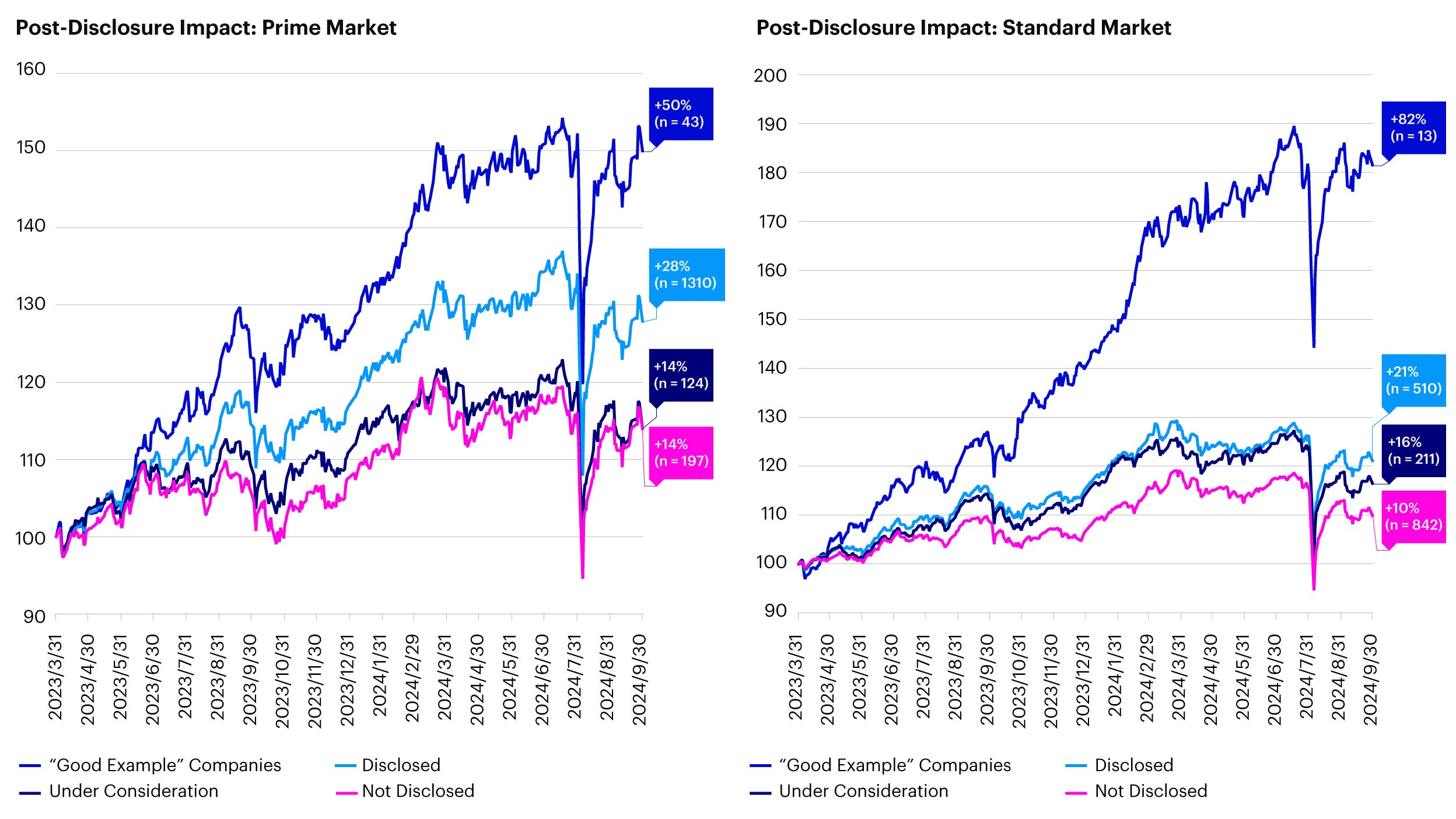

What is less clear is whether the push for better governance has resulted in better profitability and shareholder returns. TSE’s analysis highlighted that “good example” companies have seen improved valuations across Prime Market and Standard Market.5

Source: Japan Exchange Group, stock prices after request. Data as of Nov 2024. Note: Estimations of stock price trends for each category (equal weighting) where prices as of March 31, 2023 are converted to 100. Disclosure status is as of Sep 30, 2024.

However, across the broader market, our analysis shows the return on common equity ratio of the TOPIX sits just above 9%, which is an improvement over a year ago but not higher than pre-pandemic highs. Valuation multiples as measured by price to book have not re-rated meaningfully, sitting at 1.4x and the overall Japanese equity still looks relatively cheap. It seems the “Japan governance discount” has not been fully dismissed.

Path ahead: a playbook towards improving cost of capital and stock price

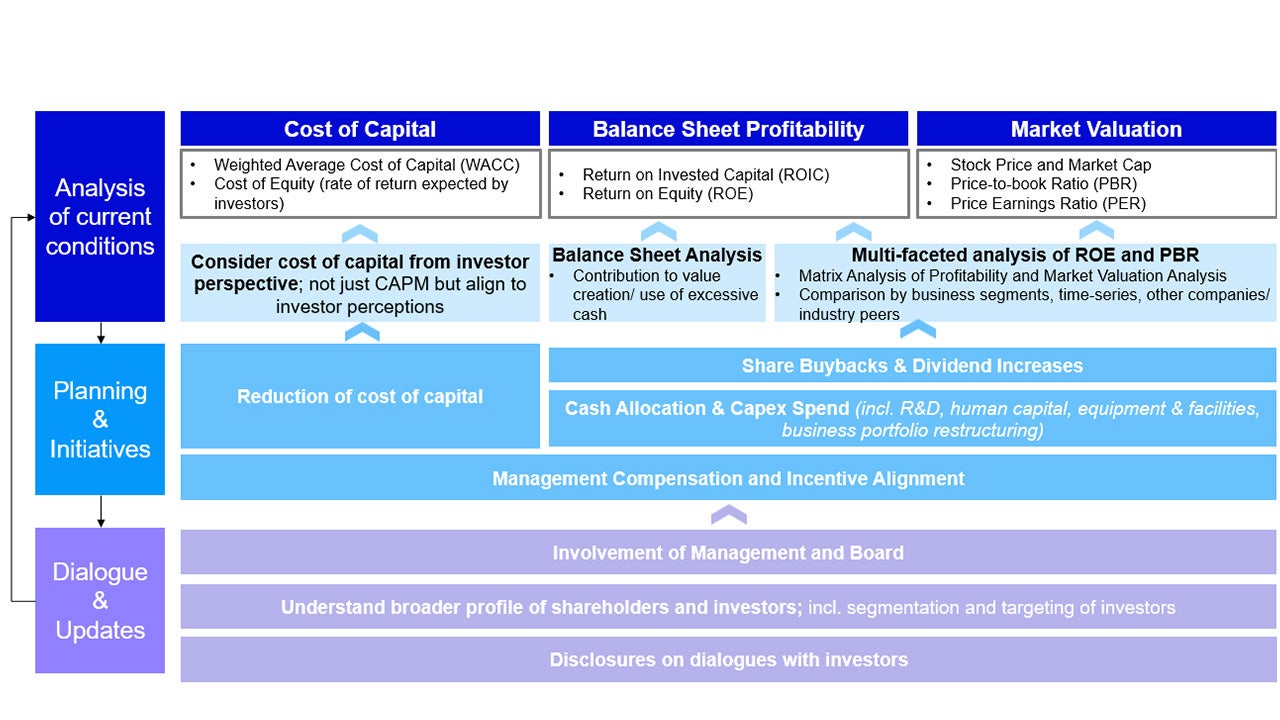

As mentioned above, most companies to-date have focused on share buybacks and dividends. Yet, companies can be considering a much broader set of initiatives and levers to drive return on equity and improve cost of capital. To that end, the Tokyo Stock Exchange released further guidance in November 2024 on best practices and case studies that encourage companies to take a more holistic approach to cost of capital management.6

Source: Japan Exchange Group. Note: Key points considering the investor’s point of view. Data as of Nov 2024.

In particular, companies are encouraged to conduct deeper analysis of current conditions be it understanding investors’ perceptions on cost of capital, analysis of how cash allocation and capex spend can improve balance sheet profitability and broader measures to improve management alignment to shareholder returns and enhancing discussions and collaborations with investors.

Ultimately, the governance and capital efficiency reforms undertaken aim to make Japan a more attractive and competitive market environment for investors. It is also a slow-moving process which will take time to vest. The pledged commitments from Japanese corporates to the TSE are ongoing and will take time to implement. In our view, the shift to place increasing priority on shareholder value will create longer term returns, but investors may need to be more patient than initially anticipated.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.