Strategic Sector Selector - A strategist’s nightmare

Global equities have finally succumbed to increasing levels of uncertainty, delivering negative 2025 Q1 returns as the Trump presidency has revved up. Market leadership changed again with the underperformance of technology and autos leading to broad-based outperformance by rate-sensitive and defensive sectors. We think the probability of US recession has increased, while we assume that inflation will remain sticky and could rise. We think equity markets will likely remain volatile until policy uncertainty decreases. With that in mind, among other changes, we slightly increase our allocation to defensive sectors by upgrading utilities and telecommunications, while we keep our exposure to consumer staples by reducing food, beverage & tobacco, while adding to personal care, drug & grocery stores. We also raise our exposure to sectors we expect to do well if inflation stays elevated by upgrading real estate to Overweight.

Changes in allocations:

- Upgrades: chemicals, personal care, drug & grocery stores, real estate (N to OW), telecommunications (UW to N), utilities (UW to OW)

- Downgrades: food, beverage & tobacco (OW to N), industrial goods & services (N to UW), financial services (OW to UW)

| Most favoured | Least favoured |

| US retailers | US autos |

| US banks | European financial services |

Sectors where we expect the best returns:

- Retailers: well-diversified sector, exposure to growth factor, historically resilient in periods of volatility

- Banks: steepening yield curve, attractive valuations, exposure to potential financial deregulation

- Utilities: high yield, defensive sector, low exposure to rising tariffs

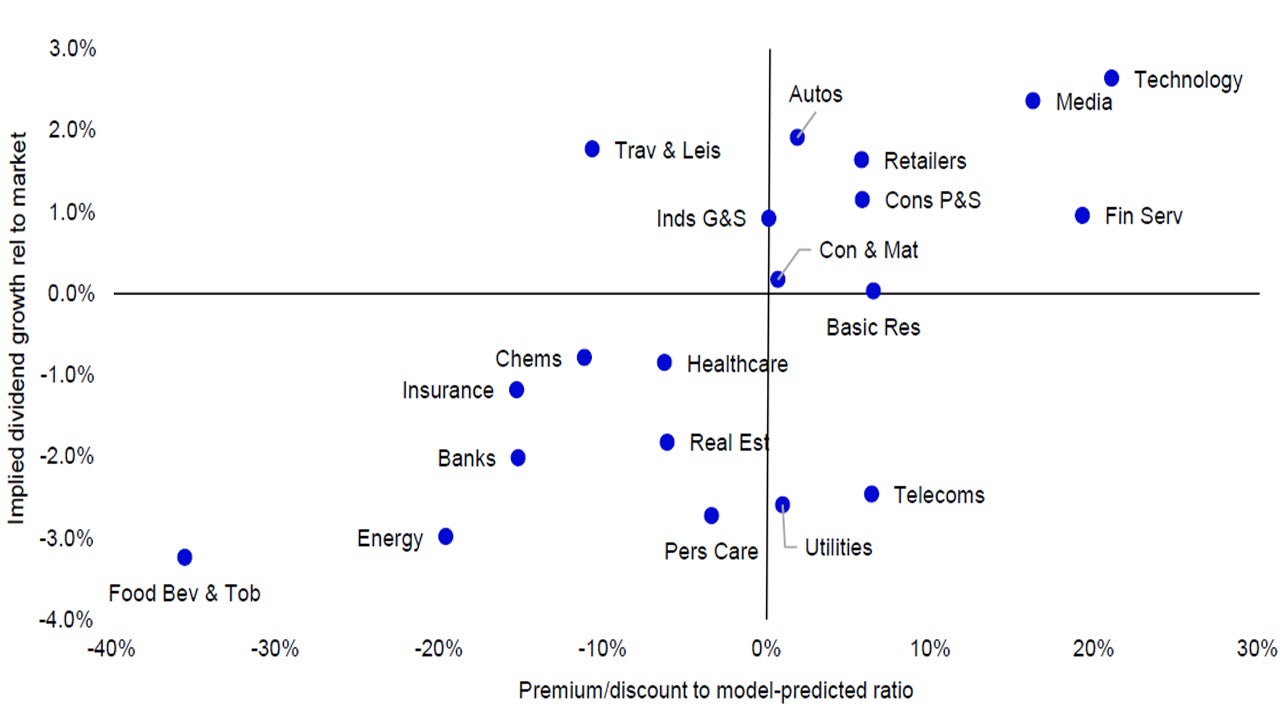

Notes: Data as of 31 March 2025. On the horizontal axis, we show how far a sector’s valuation is above/below that implied by our multiple regression model (dividend yield relative to market). The vertical axis shows the perpetual real growth in dividends required to justify current prices relative to that implied for the market. We consider the sectors in the top right quadrant expensive on both measures, and those in the bottom left are considered cheap. See appendices for methodology and disclaimers.

Source: LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.