Part 2: How should investors position ahead of the Fed’s potential first rate cut?

In Part 1, I wrote about preferring a defensive posture and an overweight in fixed income over equities during this rate cutting cycle due to expected risk-adjusted returns and current valuations.

In Part 2, I examine other assets that could perform well during the Fed’s rate cutting cycle by looking at the previous cutting cycle. Namely put, within equities I believe that value and defensives such as healthcare and consumer staples are likely to perform well, similar to the previous rate cutting cycle.

I believe that the bear market for tech is likely to continue until further proof of the productivity gains from all things AI becomes apparent.

Recent economic data in the US and China indicate that both economies are heading towards a weaker economic backdrop – it makes sense to become more defensive and underweight cyclicals.

EM and international assets on the surface tend to benefit from the Fed’s rate cutting cycle though weakening growth in the world’s largest economies could negate the benefit from easing policies.

The Fed’s battle against persistent levels of inflation is ending though it now faces a new test, to prevent the economy from sliding into recession.

Recent employment data from July’s JOLTS (Job Openings and Labor Turnover Survey) and August payrolls from Automatic Data Processing, Inc.(ADP) and the monthly nonfarm payroll from the Bureau of Labor Statistics have been sobering and below expectations.

As the labor market falters after being strong for 3 years, so too has the US stock market with the S&P 500 index falling more than 4% last week while the US 10-yr Treasury yield ticked down 19bps to 3.72%, the lowest level since June 2023.1

The US could be able to avoid a recession

The recent market volatility reflects investor concerns about whether the Fed may be too little too late with its first interest rate cut in order to prevent a recession.

While I believe that it’s a foregone conclusion that the Fed is going to cut its benchmark rate next week, deteriorating labor market data could open the door for the Fed to cut rates by more than 25bps next week.

Still, I don’t believe that the Fed is going to cut rates by more than 25 bps next week because aggressive cuts between now and the US election date would lead to accusations that the Fed is trying to influence the election results and that it is behind the curve and should have cut rates earlier.

I still believe the US will be able to avoid a recession despite an aggressive tightening cycle.

Take reference of the 1995-1996 rate cut cycle

The last time the Fed was able to raise rates and avoid a recession was the tightening cycle of 1995.

While history doesn’t usually repeat itself, it often rhymes, so I’m hopeful there are lessons to be learned by studying what happened to markets as the Fed cut rates in 1996.

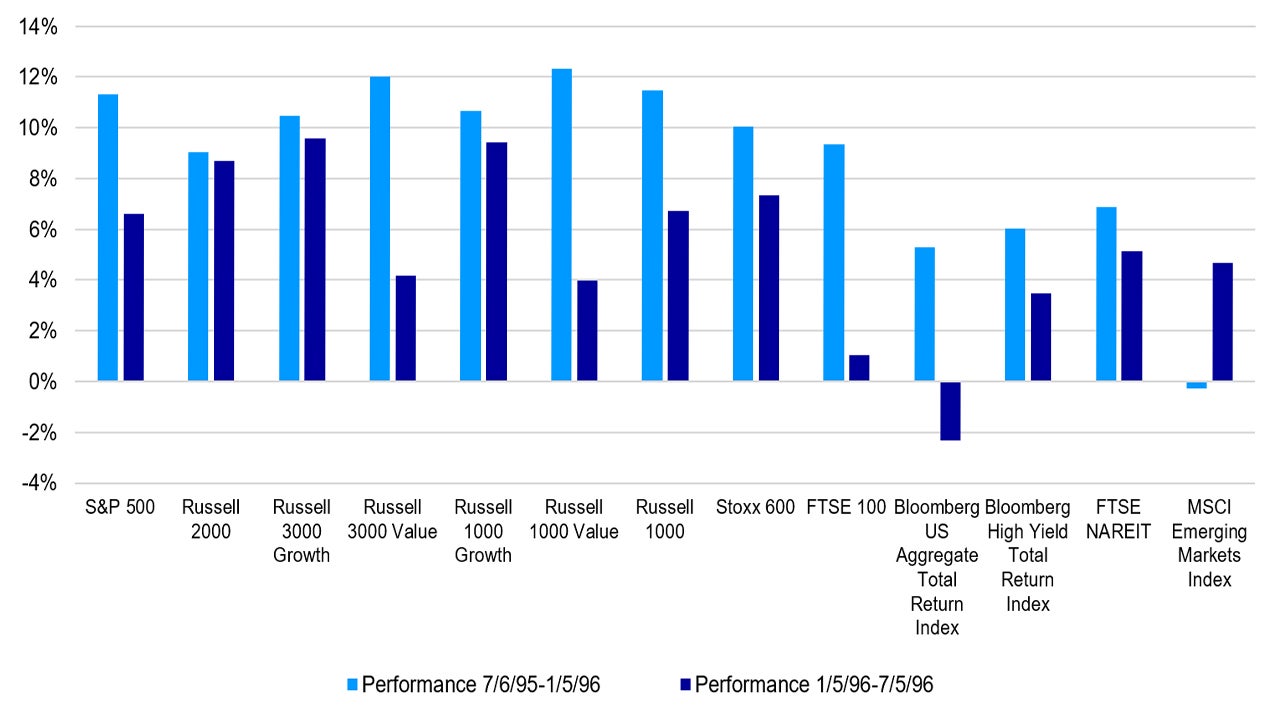

The S&P 500 gained 11.32% in the six months after the Fed began easing on July 6, 1995 (chart). Value modestly outperformed growth. Healthcare was the top performing sector.2

International stocks modestly underperformed US stocks and bonds posted solid gains for the six months after the Fed started easing.

In general, returns were more muted in the subsequent six-month period. That could be the result of a very short, shallow easing cycle of just 75 basis points.

Sources: Bloomberg, as of 3 September 2024.

Outlook – Defensives and value stocks could outperform growth during this easing cycle

US stocks are currently trading above their historical valuation averages perhaps discounting the soon-to-be rate cutting cycle and so I don’t believe that we will see outsized gains similar to the 1996 rate cutting cycle.

For equity investors, it makes sense to take a more defensive positioning in stocks as well. Similar to the 1995 cycle, I expect defensives such as healthcare and value stocks to outperform growth during this easing cycle as well.

The AI euphoria appears to have stalled despite strong earnings from the largest AI chip manufacturer which failed to give the market a boost.

Markets are likely to take a wait-and-see approach for all things AI – in particular whether a productivity breakthrough can be achieved or not.

While Fed cuts to the policy rate are a welcomed relief and should provide a boost to EM local currencies and risk assets, the positives could be cancelled out by weakening Chinese and US growth.

Overall, we expect the US economy to slow over the next couple of quarters though remain positive. And while the US cools, we don’t see other major economies taking up the growth baton.

This upcoming rate cutting cycle in the US is likely to be punctuated by disinflationary forces and weakening growth.

Successive rate cuts, mild energy prices and a softer dollar should prevent the US economy from sliding into a recession.

Still, policy uncertainty is likely to be rife, especially ahead of the US presidential election which could mean that businesses hold off on capital expenditures and investments.

In this environment, I continue to think that being defensively positioned makes sense.

With contribution from Kristina Hooper

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.