Outlook for US equities following the recent selloff

US stocks dropped very significantly last week as investors worried about a growth scare as well as the potential for serious tariff wars.

Notably, the Nasdaq is now in full correction mode, around -13% since making a record high at the end of 2024 and has broken down through its 300-day moving average.1

At the start of the year, our Invesco 2025 investment outlook favored developed market non-US equities such as European and Japanese stocks due to rich valuations in the US and policy uncertainties from an incoming US administration.

Is the selloff a buy-the-dip opportunity?

Still, could the recent downdraft in US growth stocks offer investors a potential buy the dip opportunity, a strategy that has worked well for the past two decades?

It’s less clear this time around. Even with the recent downward movement, US stocks and the USD remain expensively priced. Investors have historically paid up for growth, though growth in both the economy and in US corporate earnings appear to be slowing.

While the odds of a recession have greatly increased, we don’t have enough information to know whether or not the US economy will go into recession. Much will depend on the extent of government spending cuts going forward.

There are also other considerations, such as the impacts from the tariff war, federal employee layoffs and mass immigrant deportations. It’s no wonder investors are starting to look elsewhere as the glow of US exceptionalism appears to have lost its sheen.

Investors are starting to look elsewhere

Take for example, Chinese assets, which are starting to look a lot more attractive as the economic growth outlook improves.

China policymakers may announce more monetary and fiscal stimulus to boost consumption spending in order to hit their 5% GDP growth target for 2025.

DeepSeek’s debut has also shown that Chinese technology companies can continue to innovate despite export restrictions of US semiconductor chips.

European indexes have seen strong relative returns so far this year after modest gains last year. For example, the MSCI France Index, which actually had a negative return last year, has posted a double-digit gain so far this year.

Monetary policy in the eurozone is expected to be more accommodative than monetary policy in the US going forward.

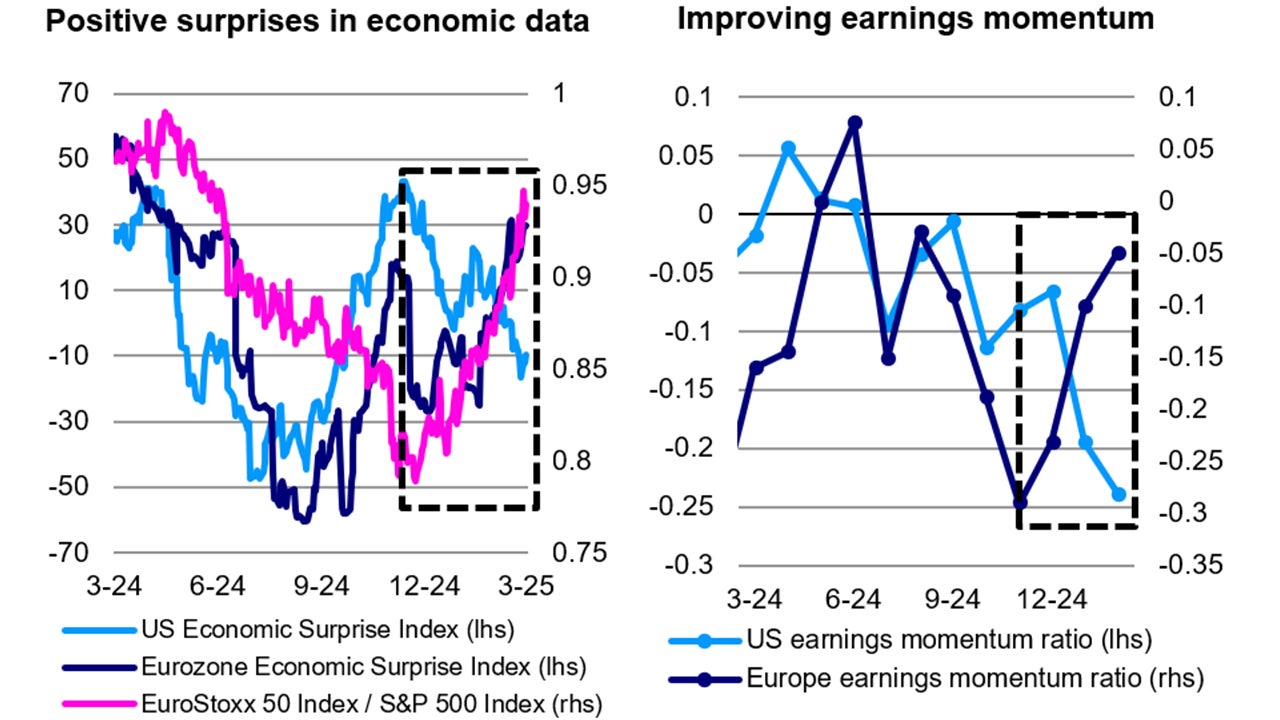

Although corporate earnings revisions in Europe are still negative, earnings momentum has been trending higher. More so, the fiscal impulse in Europe is set to significantly increase as European countries start to increase spending.

This could mean both higher European government bond yields and a stronger Euro this year.

Source: Bloomberg, as of 7 March 2025. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. The EuroStoxx 50 is an index of Europe’s 50 leading blue-chip stocks from 11 countries across the Eurozone. An Economic Surprise Index measures data surprises relative to market expectations. A positive reading means that data releases have been stronger than expected and a negative reading means that data releases have been worse than expected. Earnings momentum ratio is calculated as the ((number of stocks in a particular market with forward 12-month earnings per share revised up - the number of stocks in that market with forward 12-months earnings per shared revised down) / total number of stocks in that market with earnings per share revisions). European Central Bank (ECB). X-axis of charts #2 & #3 uses a month/year convention. An investment cannot be made directly into an index.

In Japan, the BOJ continues to be on a tightening policy as growth normalizes which has caused the JPY to appreciate. With higher interest rates back home, Japanese domestic investors could be swayed to repatriate their savings to domestic bonds and the local equity market.

What catalysts could galvanize US market to move back up?

Thus, where are we now with the US market and what catalysts could galvanize the market to move back up? A few things:

1) if the Federal Reserve cuts rates. More so, if the Fed cuts rates aggressively and successively. The probability of this happening appears much more likely than at the start of the year.

2) if US corporate earnings improve and estimates go up. This is probably less likely. US earnings momentum has been trending lower and gone are the days of AI market euphoria, when Magnificent 7 stocks soared to new heights at the promise of AI productivity gains.

DeepSeek and other Chinese large language models may ultimately prove that the enormous sums of capital already invested in AI may not have been worth it.

3) if the US economic outlook brightens. But that’s also less likely; the Atlanta Fed GDPNow indicator is showing an alarming pullback in US economic growth for the first quarter, now expected to be -2.8% (although it will certainly be revised many more times before the end of the quarter).2

Government spending cuts are already having an impact on employment. Challenger, Gray & Christmas announced last week that job cuts from US employers increased 245% in February to 172,017 — the highest level since July 2020 when America was in throes of the COVID-19 shutdown.3

Conclusion

To sum, the US stock market has had an incredible bull run from 2009 – 2024.

The recent sell-off could imply further market volatility ahead as investors contend with more policy uncertainty from the White House but also more attractively valued assets elsewhere.

We continue to favor Asian and European assets as they are likely to continue outperforming US assets this year.

With contribution from Kristina Hooper and James Anania

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.