Opportunities in Korea and Taiwan arising from the global AI boom

We believe that generative AI is a significant, powerful tool that is propelling the next wave of tech innovation and has created a breadth of investment opportunities.

Estimates are that generative AI could drive around USD 7trn in related global economic growth over the next 10 years, boosting productivity growth faster by around 1.5pp annually.1

We believe that investor interest is justified by this multi-year tailwind and it makes sense to position judiciously across the broader tech industry and related economies.

Korea and Taiwan markets as proxy plays

Even though AI and related stocks in the US have already seen significant upwards movement, I believe that there is still momentum left through proxy plays on the Korea and Taiwan markets given their meaningful market capitalization (market cap) weightings to AI-related companies.

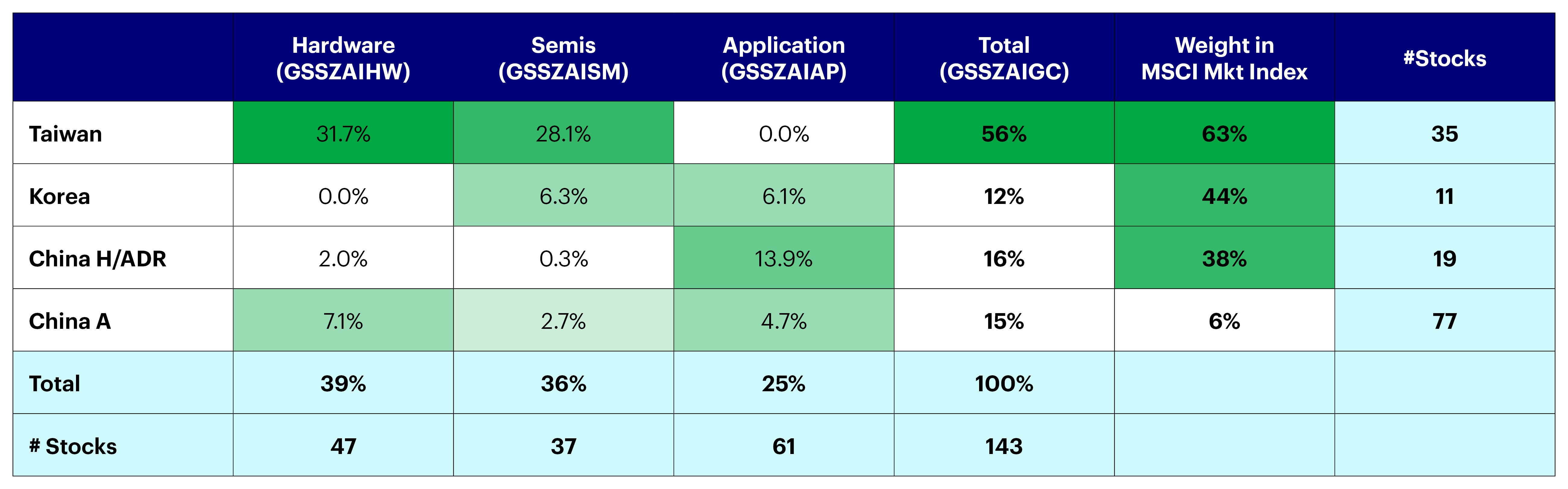

Around 63% of Taiwan’s market cap has some exposure to the AI theme, which is the largest in the APAC region, while Korea’s market cap comes in second, with around 44%.2 More so, generative AI stocks and related beneficiaries in Asia are trading at a discount relative to their US peers.3

Korea set to benefit from its strong correlation with the semi sales cycle

Korean equities are very attractive at these levels given their cyclical earnings recovery, AI upside and corporate governance reform.

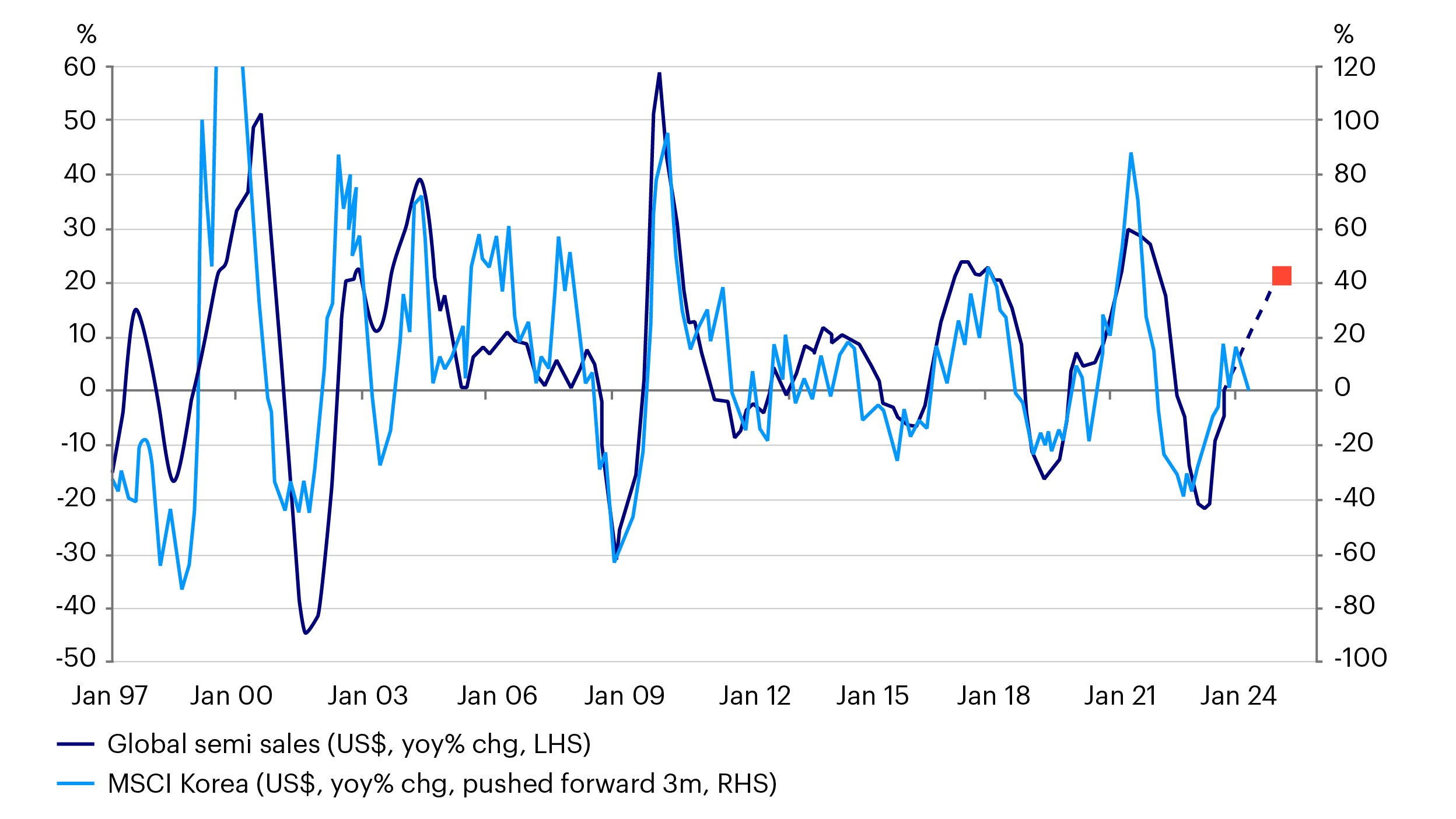

Despite the bumpy start in the year, I believe that investors can capitalize on the catch-up Korean stocks are likely to experience later this year. There has historically been a strong correlation between an improving semi sales cycle and returns in the MSCI Korea.

Following a strong inventory correction, global semiconductor sales contracted in 2023 similar to what we saw during 2001 and 2009, though estimates for 2024 show revenue growth of around 22% in 2024.6

Source: CLSA, MSCI

Korean stocks, along with Chinese stocks, are the cheapest in EM. Both are trading around a forward sector-adjusted P/E basis of 7.5x which is close to a 34% discount to EM peers. Korean equities have only traded at these levels for 3% of the time since 2001.7

Market rally in Taiwan may broaden to small to medium cap

I also favor Taiwanese stocks, but less than Korean stocks simply because valuations are higher (not just in absolute terms but relative to the market’s historical range).

Taiwan equities continue to hit all time highs due to the strong tech rally (+35% since Q4 2023). Taiwan’s largest semiconductor company has alone been responsible for around 80% of Taiwan’s YTD performance.8

To date, domestic funds and investors have been responsible for the upwards movement though we’re starting to see foreign fund flows. Still, foreign funds have only been around 25% of the funds sold during 2020-2022.9

Thus I still believe that there’s some room to go for foreign investor net-buying. Even though large cap, semiconductor and data center stocks have done well, the market rally in Taiwan has been very narrow.

The next leg up could be in the small to medium cap AI and related component stocks including power grids, electricity suppliers that fulfill the power demand surrounding AI manufacturing and application processing.

Semiconductor Upcycle in North Asia

The recent recovery of the semiconductor cycle, driven by investments in generative AI and an improving supply/demand dynamic, has started to become more visible in North Asian economies.

There have been two recently released data points that I can point to. Firstly, Korean tech exports have started to see sequential improvement in February despite sluggishness in overall goods exports.

Secondly, Taiwan’s industrial production for January saw a marked recovery in the electronics components sector.10

Robust Korean tech exports and a noticeable rebound in Taiwanese tech production suggest the start of North Asia’s semiconductor upcycle, driven by the recent AI boom.

Conclusion

EM and Asian equities have had uneven performance since the beginning of this year. Asian equities are now trading at quite a steep discount to US equities though more comparable with European stocks.

While I remain optimistic on EM equities, I believe that returns are likely to come in 2H of this year, as investors wait for clearer signals from the Fed and what kind of landing the US economy is likely to face.

Despite a strong quarterly earnings season in the US, there may be bumps along the way for the world’s largest economy, which could pose a headwind for EM.

From a positioning perspective, I believe that North Asian equities could be the top performers within EM this year, bolstered by the Fed’s rate cutting cycle and an improving tech cycle.

Reference:

-

1

Source: Jan Hatzius, March 26th, 2024.

-

2

Source: Invesco and Goldman Sachs estimates; March 8th, 2024.

-

3

Source: FactSet, AEJ AIGC Generative AI basket versus US AI adoption beneficiaries (NVDIA, GOOGL, MSFT).

-

4

Note: @ MSCO weight calculation is based on full stocks’ weights in MSCI index

-

5

Note: Stocks are weighted by free float and 6m ADVT, with a 20% adjustment factor applied to China A and a 20%-50% adjustment to non-tech/internet sectors.

-

6

Source: CLSA Report: Korea Technology Analyst, Sanjeev Rana, February 5th, 2024.

-

7

Source: CLSA, MSCI February 5th 2024.

-

8

Source: Bloomberg, March 7th, 2024.

-

9

Source: Goldman Sachs, March 9th 2024.

-

10

Source: CEIC, Barclays Research