Key takeaways from China’s May economic data and the policy outlook

The market optimism that greeted China’s abrupt end to the pandemic earlier seems to have been replaced by pessimism after a slew of disappointing economic data releases.

Investors may be disappointed on China’s cyclical recovery as household and private investment sentiment wane. China’s National Bureau of Statistics released economic data for May that missed expectations and points to a further slowdown in the reopening impulse.

Its apparent that growth momentum is tracking sequentially weaker. Encouragingly, the government has recently signaled its intention to actively do more to stimulate the economy through both monetary and fiscal measures in order to prop up growth and give the economy a boost.

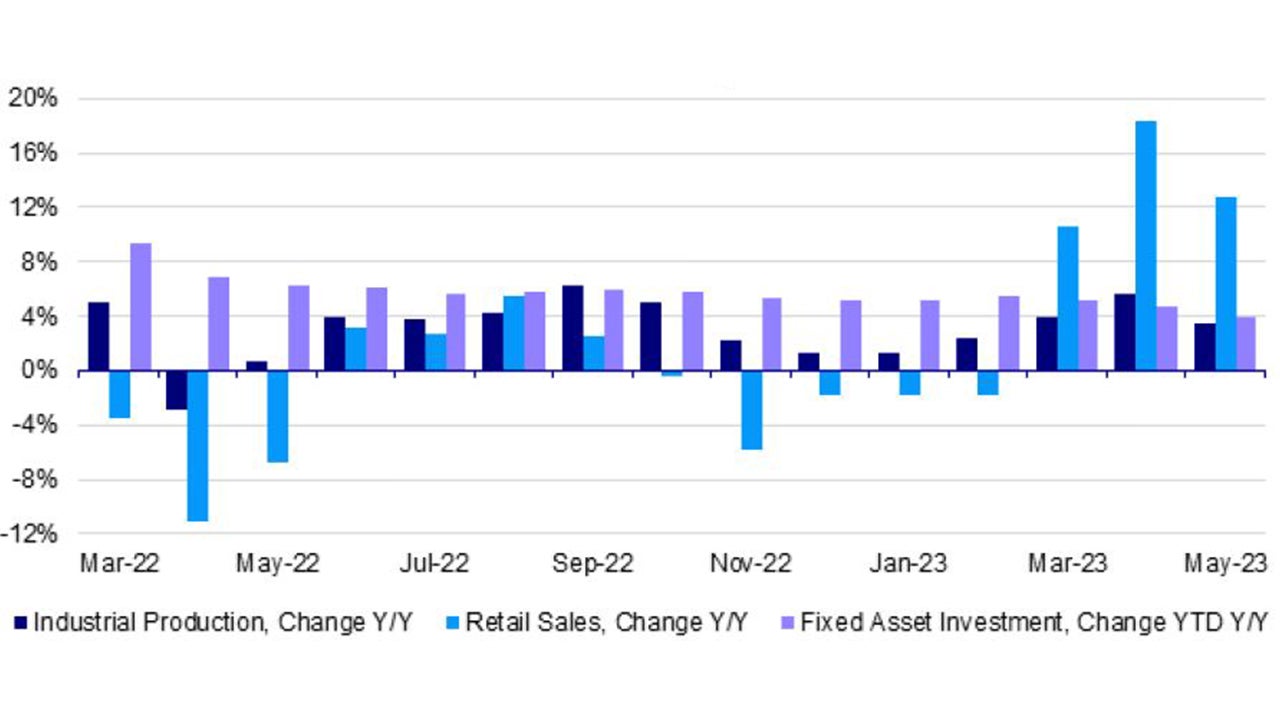

Source: China National Bureau of Statistics (NBS). Data as of May 2023.

Fixed asset investments (FAI) came in at +4.0% YTD y/y (vs cons 4.4%).1 The miss was largely due to weaker private sector investment, reflecting a hesitancy to deploy capital amidst a hazy economic outlook.

The still ailing real estate sector meant that the property investment contraction deepened in May. Other segments were more mixed, with infrastructure investment up slightly and manufacturing investment somewhat stable.

On the domestic demand side, retail sales were up +12.7% y/y (vs cons 13.7%).2 The low base comparisons on an annual basis are falling off, with both COVID sensitive sectors of restaurant and auto sales decelerating meaningfully. Housing related goods remains the most subdued part of retail sales.

Industrial production was the only figure that was in line with expectations at +3.5% y/y.3 This is broadly in line with earlier industrial power usage of +4.1%y/y.4

The impact of the global goods demand slump has been evident for some time in China’s declining export numbers, which is dragging on production.

Electronics (such as smartphones and PCs) continues to be hit hardest, which is hardly surprising given the frontloading in production of these goods during the pandemic.

Recent policy actions

Overall, the disappointingly softer dataset reflects the numerous headwinds that the Chinese economy continues to face, the most obvious and critical one being the stressed property sector.

Weak business and consumer confidence as well as a generally unfavorable global demand environment also continues to weigh on the economy.

We have seen policymakers actively back in the driver’s seat recently, steering policies towards further easing. We believe this makes sense in order to nip deteriorating sentiment in the bud.

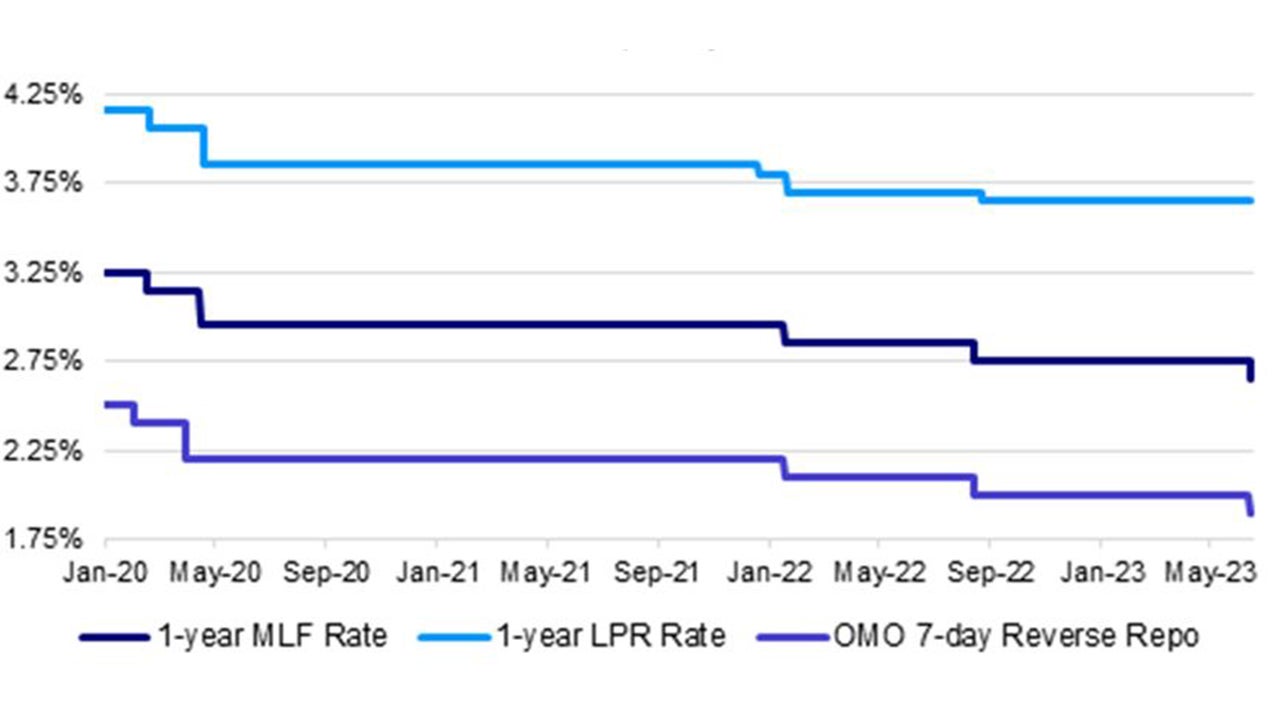

A slew of rate cuts were announced by the PBoC prior to the data release, including a cut to the 1-year medium-term lending facility (MLF) rate by 10bps to 2.65%.5 This came right on the heels of a cut to the overnight market operations (OMO) 7-day repo rate to 1.9% from 2.0%.6

Source: People’s Bank of China (PBoC). Data as of 15 June 2023.

Traditionally, cuts to the MLF and OMO rates mean that we can expect a similar sized cut to the bank prime loan rate (LPR) relatively soon.

However, the biggest risk is that rate cuts can be ineffective when households and businesses are excessively conservative, busy deleveraging and paying off debt. We have seen some evidence of this in households accelerating payments on existing mortgages. Credit demand - rather than supply - seems to be the issue now.

Thus, we expect policymakers to shortly roll out additional more targeted fiscal and stimulus measures, perhaps shortly after the July Politburo meeting, such as targeted support and subsidies for EVs, credit extension to troubled firms, easing property measures for 2nd homes and tax cuts to high-tech manufacturers.

Chinese equities were down initially, but investor focus quickly shifted to the additional easing measures we can likely expect. The HSI ended the day +2.17% while the CSI 300 was up +1.59%.7

We note that a lot of negative sentiment is likely priced into Chinese equities already, and they are trading at the low end of their historical valuation range.

We believe that the job market and consumption rebound still has another leg up especially if policymakers adopt a more pro-growth stance. Further monetary and fiscal stimulus are likely to boost infrastructure investments that should fuel employment and job growth.

Despite the near-term gloom, we believe it's still possible that both household and market sentiment could start to improve over the summer through a broader recovery in consumption that could transition from COVID-hit services to mass-market good consumption later on in the year.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Reference:

-

1

Source: China National Bureau of Statistics (NBS). Data as of May 2023.

-

2

Source: China National Bureau of Statistics (NBS). Data as of May 2023.

-

3

Source: China National Bureau of Statistics (NBS). Data as of May 2023.

-

4

Source: China National Bureau of Statistics (NBS). Data as of May 2023.

-

5

Source: People’s Bank of China (PBoC). Data as of 15 June 2023.

-

6

Source: People’s Bank of China (PBoC). Data as of 15 June 2023.

-

7

Bloomberg. Data as of 15 June 2023.