Key takeaways from Bank of Japan’s decision

In a move towards greater monetary policy normalization, the Bank of Japan (BOJ) made two distinctly important decisions at its July meeting.

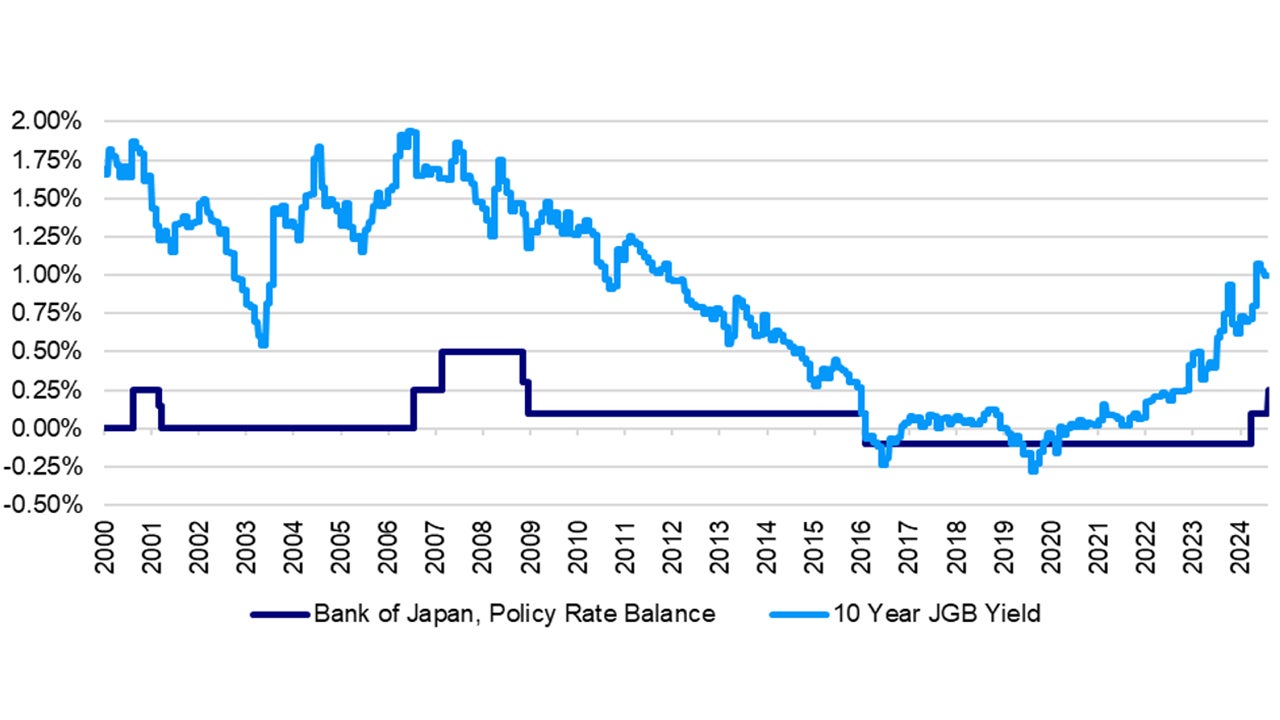

The targeted uncollateralized overnight call rate (key policy rate) was raised to around 0.25% from a range of 0% to 0.1%.1

This came as somewhat of a surprise, as Bloomberg surveys suggest only 30% of economists expected a rate hike.2

While the key policy rate remains just marginally off the zero bound and well lower relative to global peers, it is the highest it’s been in over 15 years. Still, in real terms rates remain significantly negative.

Secondly, the BOJ decided to reduce its monthly gross purchase amount of long-term Japanese Government Bonds (JGBs) by about 400 billion yen every quarter until Q1 2026.1

By the end of this period, monthly bond purchases would roughly equate to 3 trillion yen per month.

This tapering announcement is in effect an implementation of a quantitative tightening policy and would shrink the size of the BOJs balance sheet – as the current scale of monthly purchases of 6 trillion yen is only enough to match maturities.

The BOJ stressed that this interim plan could be subject to modification as necessary.

Our key takeaways

This decisive move by the BOJ, alongside the abolishment of yield curve control (YCC) in March earlier this year, signals that the central bank sees a higher probability of sustained 2% inflation and views future Japanese economic activity from a more optimistic perspective.

The year-on-year change in import prices has turned positive again, and the BOJ noted upside risks to domestic prices.

Greater monetary policy normalization also makes sense in light of Japan’s ongoing structural transformation, which remains firmly intact.

The economy is shifting towards higher domestic demand underpinned by a significantly higher pace of wage growth versus recent history.

Improved manufacturing output and fiscal stimulus should also help economic activity to rebound.

There is a reasonable chance that the BOJ will hike again towards end-2024 as the economy is expected to improve moderately.

The BOJ highlighted in its Outlook Report (Outlook for Economic Activity and Prices) that “Japan's economy is likely to keep growing at a pace above its potential growth rate, with overseas economies continuing to grow moderately and as a virtuous cycle from income to spending gradually intensifies”.

Although private consumption activities currently remain at subdued levels, they are expected to pick up in the near term as various supporting factors kick in including a further rise in wage growth due to Shunto, an increase in summer bonuses, a tax cut of 40,000 yen per worker, a restoration of fuel subsidies from August and positive wealth effects.

BOJ Governor Ueda indicated in the BOJ’s previous press conferences that he expects the short-term interest rate to move up to a neutral interest rate level sometime during the second half of BOJ’s forecasting period (i.e. October 2025 to March 2027 period).

As recent BOJ’s analysis suggests a range of various nominal neutral rate estimate spanning from 1.0% to 2.5%, the short-term policy rate is likely to be raised gradually in the medium term as Japan moves towards a sustained, 2% inflation path.

As the BOJ needs to carefully monitor impacts of actual rate hikes and QT policy on economic activities and the markets, the earliest timing of the additional rate hike seems to be at its October 30-31 meeting.

Source: Macrobond. Data as at 31 July 2024.

Investment implications

The JPY prolonged its appreciating trajectory and is meaningfully stronger than the lows of this year when it came close to hitting the 162 USD/JPY mark.2

The more aggressive than anticipated JGB tapering announcement led to 10-year JGB bond yields topping 1%.2

Japan’s major equity indices rebounded marginally despite a decline in US stock prices in the previous day. It appears that the BOJ’s move was not judged to be too hawkish by markets and that the policy uncertainty overhang has been removed.

As private consumption growth looks to pick up, we see investment opportunities in domestic demand-oriented Japanese stocks. The potential for further tightening in BOJ policy could lend support to the stocks of banks and insurance companies.

As far as the JPY is concerned, the currency is likely to appreciate moderately against the US dollar, given the prospect of multiple rate cuts by the Fed towards end-2024.

On Japan’s bond market, the reduction of BOJ’s JGB purchase announced today likely exert moderate upward pressures on long-term JGB yield.

Key risks to our view

Despite the BOJ being careful to gauge bond investor interest before announcing their JGB tapering plans, it’s still uncertain whether the market can move in to plug the JGB demand gap in full.

This risks the possibility of higher upward pressure on JGB yields than the BOJ may be anticipating. If this risk materializes, the BOJ is likely to make additional spot purchases of JGBs to stabilize the market.

But it is expected to conduct such stabilizing operations only when the JGB yield makes extreme movements, given their current policy to let the market determine long-term rates.

Another risk is that continued consumption weakness could prevent the BOJ from making further tightening move.

From a global perspective, Japan’s market will continue to be influenced by US financial developments. Namely, an intensification of a “Trump trade” could weaken appreciating pressures on the yen.

Furthermore, going forward the USD/JPY outlook is likely to be more dependent on the Fed’s monetary path rather than incremental actions from Japanese policymakers given that the scope for US rates to fall is much greater than Japanese rates to rise.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.