June FOMC Meeting and US May CPI

Weak Core CPI print since August 2021, a less hawkish FOMC and dovish comments by Chair Powell lend upside to US markets. The Fed left rates unchanged today, as expected, though signaled only one rate cut this year, down from the three in the March dot plot.

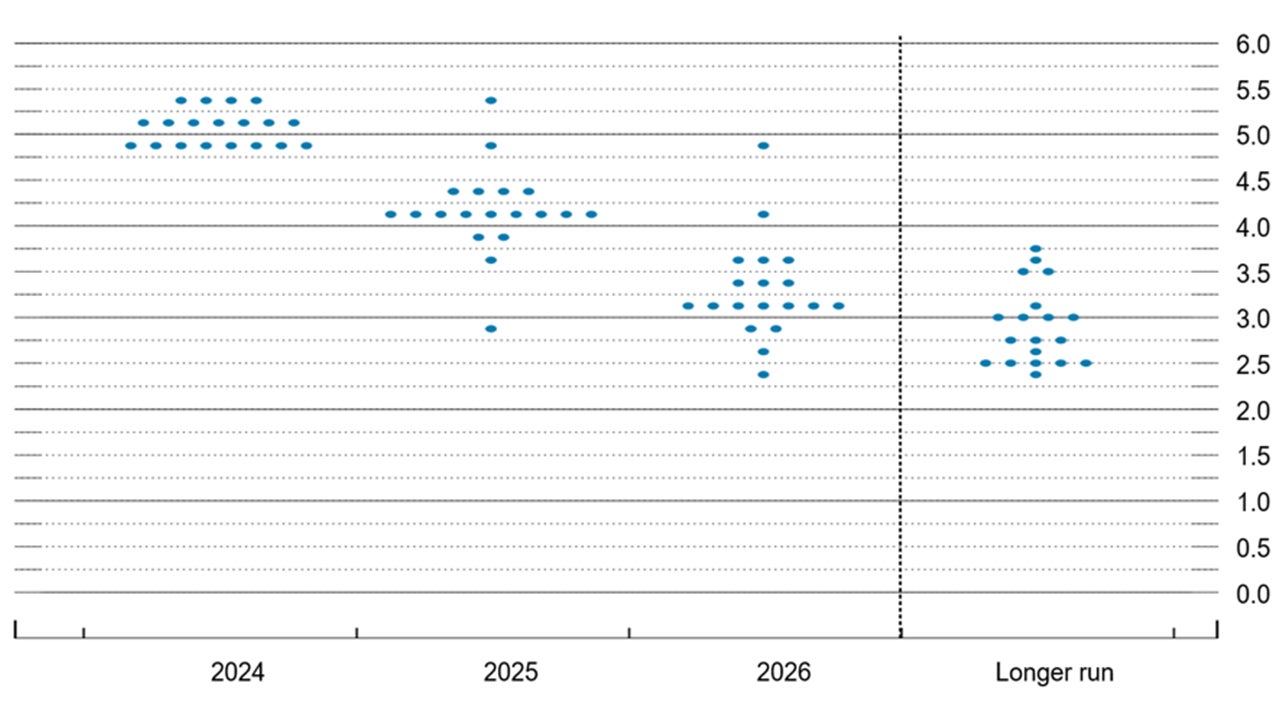

The updated dot plot

Still, the updated dot plot shows the fed funds rate falling to 4.1% at the end of 2025 and 3.1% by the end of 2026.1 Taken together, the total cuts over the next 2.5 years remains the same as in March, just with a later start of the easing cycle.

Source: Federal Reserve. Data as at 13 June 2024.

The Fed also increased their median projection for the core Personal Consumptions Expenditures Index (their preferred measure of inflation) at the end of 2024 to 2.8%.1

This is up from 2.6% in the March dot plot and 2.4% in the December 2023 dot plot.1 This helps explain why the Fed only expects to cut rates once this year.

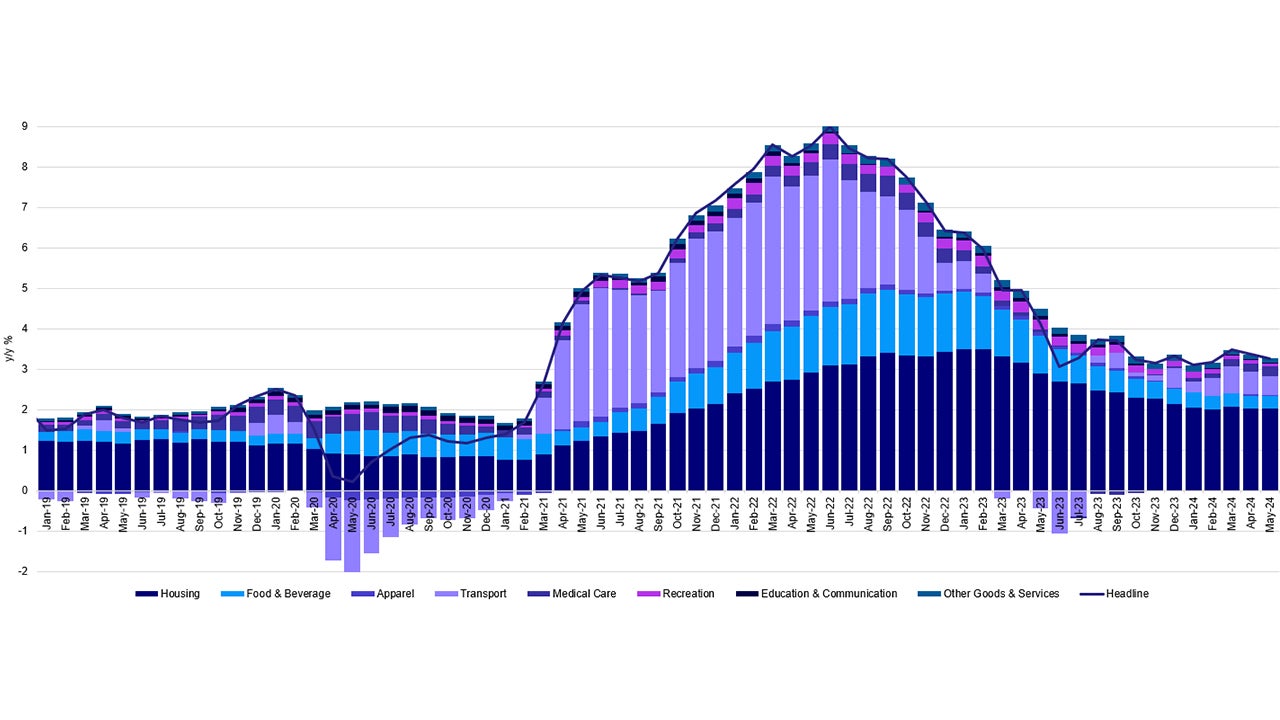

US May CPI

US May CPI came in softer than expected, with headline +3.3% y/y (vs consensus +3.4%) and core CPI 3.4% y/y (vs consensus +3.5%, prior 3.6%).2

Source: U.S. Bureau of Labor Statistics (BLS). Data as at 13 June 2024.

Auto insurance fell -0.1%, a significant reprieve after accounting for around half of the most recent increase in the super core index. 2

Currently, the Fed supports the view that we are approaching the start of an easing cycle with very likely 1, possibly 2 rate cuts during this year and more cuts to come next year.

This has contributed to a softening of the dollar and rally in the bond market.

The softness in the May CPI reading also supports the possibility that further progress in disinflation will reinforce expectations for an easing cycle that gets going this year.

Powell again said that policy is restrictive and that the Fed has made “considerable progress” towards its goal however, the data hasn’t given the Fed the greater confidence that it needs to begin cutting.

It wants to see more data to be confident it is moving towards 2% inflation levels.

Powell admitted he anticipates once the Fed cuts rates, there will be a significant loosening of financial conditions which suggests that the Fed is fearful of reversal of disinflationary progress too soon if they open the financial conditions floodgates.

Thus, the bumpy disinflation path continues and all signs point to a further deceleration in economic activity. We continue to watch for softening in the labor market and disinflation towards target in the coming few months – all paving the way to gradual rate cuts.

Investment Implications

In conclusion, the FOMC dot plot poured cold water over a better-than-expected CPI print. However, Chair Powell came across as reasonable and thoughtful in the press conference.

Just like the Fed didn't overreact to a stalling of inflationary progress in the first quarter, it is not overreacting to solid disinflationary progress made in the second quarter.

In addition, the Fed didn’t take September off the table, which is important.

We are confident that the Fed will continue to look at a mosaic of data and that they can get sufficiently comfortable in time for a September rate cut and for another cut later on in the year.

All this argues for a balanced portfolio, scaling in global exposure on the basis that the Fed will ease as the US economy continues to normalize and slow, even as other major economies, including China and the EZ see further improvements in growth.

Eventual easing in Fed policy, and a somewhat softer dollar should also be EM-supportive.

With contribution from Kristina Hooper, Arnab Das and Thomas Wu.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference:

-

1

Source: Federal Reserve. Data as at 13 June 2024.

-

2

Source: U.S. Bureau of Labor Statistics (BLS). Data as at 13 June 2024.