Japanese yen outlook and investment implications

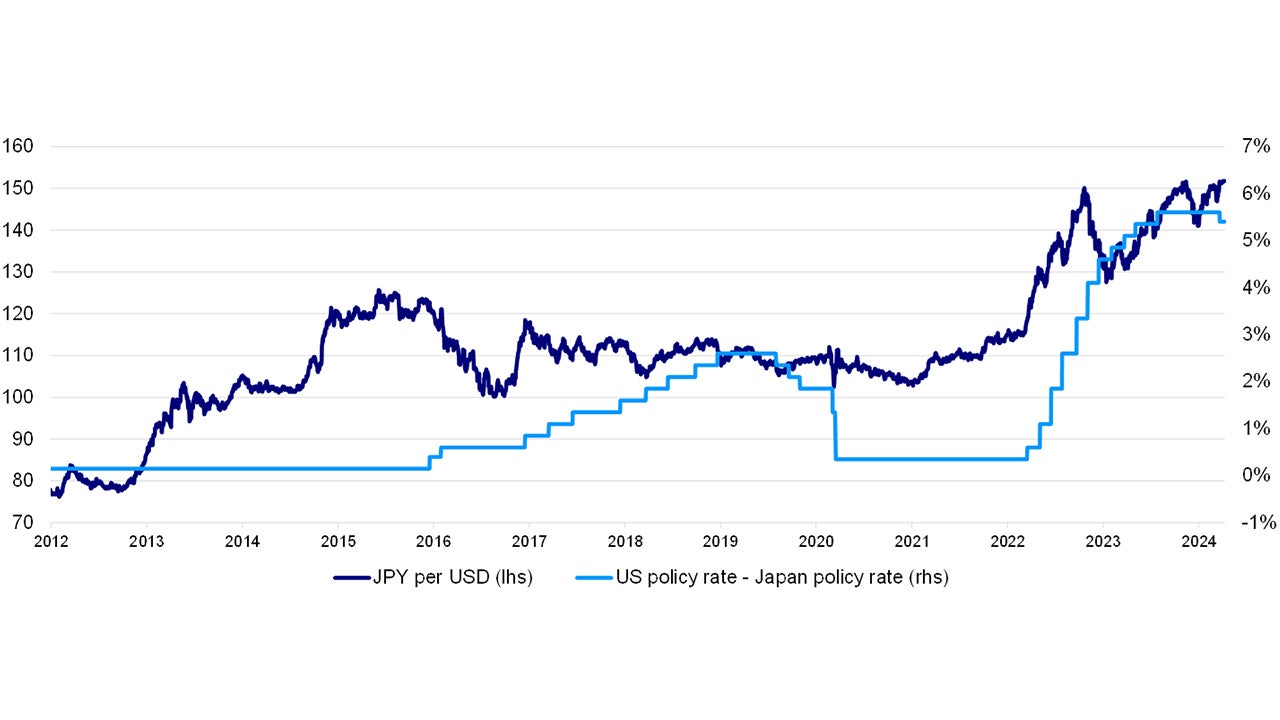

The Japanese Yen (JPY) has been the worst performing major DM currency this year, weakening by close to 7% against the greenback.

This is in spite of the Bank of Japan (BoJ) delivering tighter monetary policy than anticipated at the start of the year – exiting its negative interest rate policy (NIRP), yield curve control (YCC) and other unconventional policy tools.

Still, dovish statements from the BOJ coupled with the bank’s continued purchase of JGBs1, could mean that the JPY remains at these levels against the USD or until it becomes clear when the Fed is expected to start cutting rates.

While we expect a cut in June, the prospects of one have diminished given the most recent labor and inflation data, both of have robust.

This could mean that Fed cuts this year may be limited and driven by cooling inflation pressures rather than rising recession risk. Historically, a more resilient US growth environment generally portends to stronger US dollar and weaker JPY.

JPY likely to remain under pressure

These dynamics can largely explain the recent pressure on JPY though recent comments from the Ministry of Finance suggest that policymakers are likely to intervene if the local currency slides toward the 155 level.

We maintain the expectation for the BoJ to hike rates again in June/July, which is sooner than consensus expectations, because economic and wage growth have been better than expected and thus could bring some relief to the beleaguered Yen.

Source: Macrobond. Data as at 9 April 2024.

For example, the recent Tankan survey for businesses shows resilient and good business conditions and that corporate long-term inflation expectations remain above 2%.2 This is very positive since Japan has endured decades of stagflation.

That said, we believe the BoJ is likely to maintain a cautious approach to tightening monetary policy, especially since household consumption remains fragile.

Consumption is at the crux of the Japanese growth story in the coming year and is likely to motivate how quickly the BoJ normalizes monetary policy. For example, the BoJ’s March JCB consumption was weaker than expected.

Just as the BOJ doesn’t want to see an unmanaged depreciation in the currency, the central bank doesn’t want to see the currency appreciate too quickly.

Longer term, market participants can expect some JPY support from structural factors. Japan maintains a significant current account surplus and valuations of the currency look attractive in purchasing power parity terms and trades near historical lows against a trade-weighted basket of currencies.

In sum, we are underweight USD and overweight JPY though near-term dynamics continue to suggest pressure on the JPY. This environment continues to be positive for Japanese equities, which remain attractive at these levels.

Changes to Japan’s monetary policy path & outlook

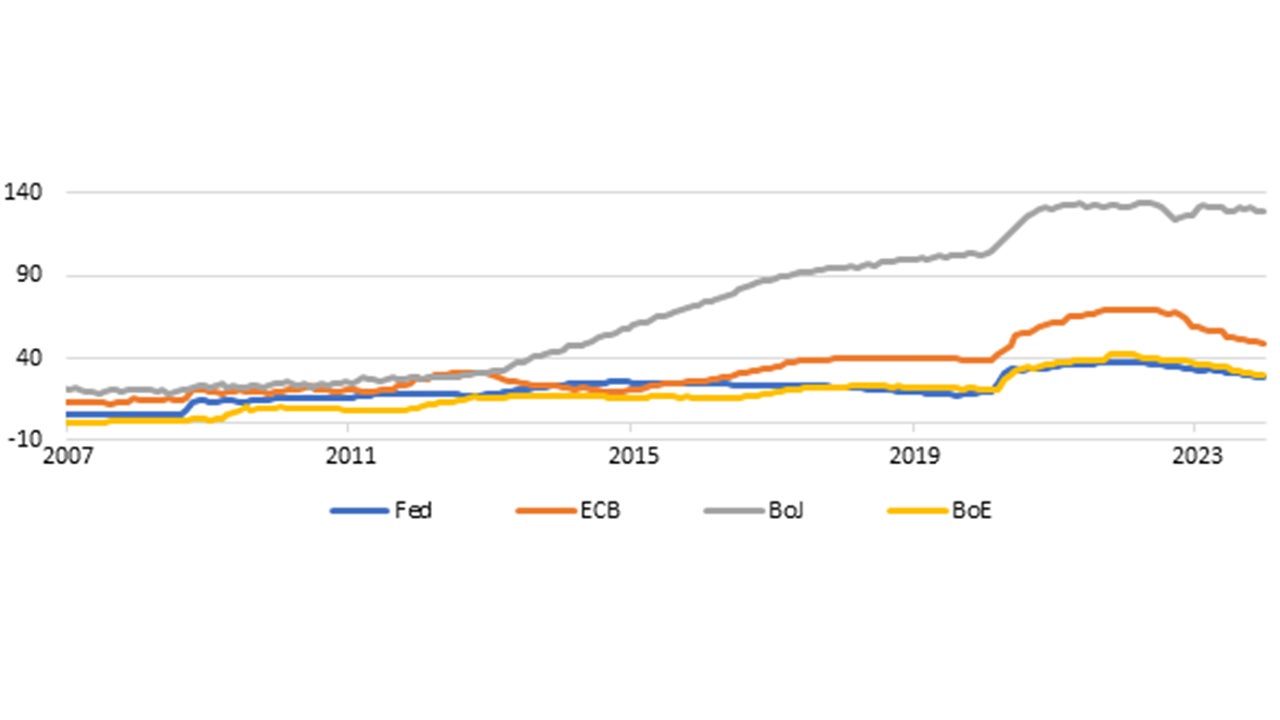

The Fed famously says it has just one blunt policy tool, rates. This hasn’t been the case for the BoJ, because once rates hit rock bottom in Japan in the mid-90s, the BoJ was forced to think of other policy tools – and thus gave birth to quantitative easing (QE).

In short, QE is a tool that central banks purchase a set amount of government bonds or other financial assets in order to add liquidity to the market and invigorate commercial activity.

The BoJ was the first to introduce QE decades ago, starting with F/X, then Japanese government bonds (JGBs), and then equity ETFs. Both the Fed and BoE performed QE during the GFC, and the ECB reluctantly followed in the EZ debt crisis in 2010. All of these major central banks resumed QE during COVID.

Because the significant monetary and fiscal stimulus during the pandemic era caused inflation to take off, the Fed, BoE and ECB began cutting balance sheets back down to size in 2022. Finally, the time for monetary policy change has come for Japan.

After an extended period of ultra-loose monetary policy, the BoJ recently decided in March to lift its negative interest rate policy and YCC.

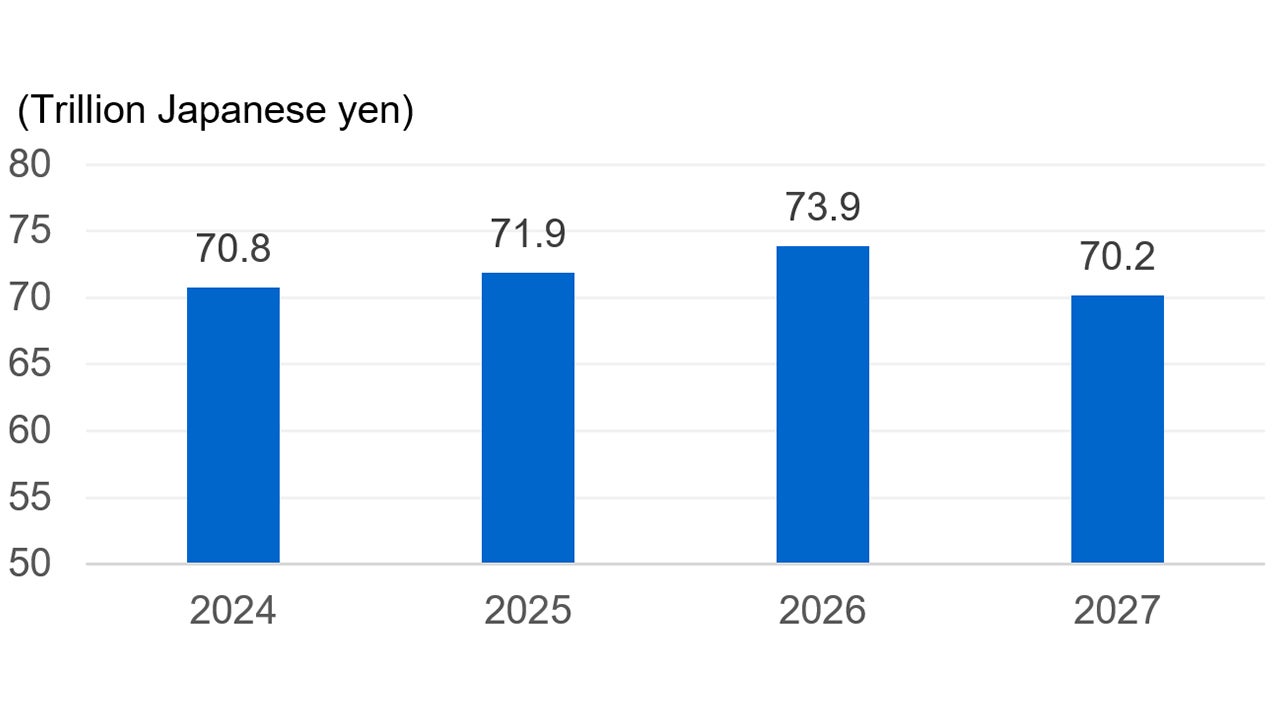

The central bank has announced that it will continue purchasing long-term JGBs3 though recently released data shows that the BoJ reduced bond purchases by 36% in fiscal 2023 when compared to a year ago.4

Further, we estimate that these purchases only partially cover the amount of JGBs being redeemed5. This means that the BoJ has effectively stopped expanding its JGB holdings and it’s a fair assumption that the central bank could start to shrink its balance sheet in the near future.

Notes: Certain assumptions are used in estimating redemption amounts.

Source: Invesco from BOJ data. Data as at 29 March 2024

Investors may wish to recall that the BoJ has been a significant buyer of JGBs, purchasing almost all the long-term JGBs issued in 2022 and 2023 on a net basis.

As the BoJ has stopped its QE policy, Japan’s long-term bond yield is likely to rise moderately in the coming quarters, which could prompt the BoJ to buy additional JGBs, effectively re-initiating QE policy. I expect 10-year JGB yield to rise to around 1% at the end of 2024, from the current 0.717%.

Source: Bloomberg, Macrobond, Invesco. Annual data through 2023 as at 29 March 2024.

Will the halt in the expansion of the BoJ’s balance sheet matter more than rates? Fed Chair Powell once said focusing on the balance sheet is like watching paint dry – i.e., boring.

I tend to agree that in general, central bank action is in rates. This is true for the BoJ’s balance sheet, I believe it’ll make even less difference than rates, given how carefully the BoJ is moving.

With contribution from Tomo Kinoshita, Arnab Das and Thomas Wu.

Reference:

-

1

Source: Excerpts from the Bank of Japan (BOJ) policy statement on 19 March 2024; “The Bank will continue its JGB purchases with broadly the same amount as before”; Note: The amount of JGB purchases is currently about 6 trillion yen per month.

-

2

Source: TANKAN : 日本銀行 Bank of Japan (boj.or.jp); The BoJ’s Tankan survey collects both qualitative and quantitative data from around 10,000 firms.

-

3

Source: Invesco estimates 6 trillion yen per month, or 72 trillion yen per year, on a gross basis;

-

4

Source: Bank of Japan bond purchases shrank 36% in fiscal 2023 - Nikkei Asia

-

5

Source: Invesco estimates the amount of BoJ-held long-term JGBs that will be redeemed will be 70.8 trillion yen in 2024 and 71.9 trillion yen in 2025