Japanaissance? Japan’s inflation revival and structural transformation

In Focus: “Japanaissance”? Japan’s inflation revival and structural transformation

The Japanese asset bubble popped more than three decades ago, beginning a prolonged period of depressed growth and sluggish asset performance. But in February this year, Japanese equities finally climbed to new all-time highs and are now up more than 20% year-to-date. A raft of structural reforms beginning nearly a decade ago, together with a series of post-pandemic changes, are starting to pay off, helping to make Japan into an attractive investment destination once again.

With inflation and wage growth seeing a revival, many investors are now speculating that Japan has broken out of its long-term stagnation and should feature more prominently in investor portfolios. Indeed, in March, the Bank of Japan tightened policy for the first time in 17 years and released its policy of Yield Curve Control (YCC). In the corporate sector, firms are beginning to implement reforms, including more share buybacks and greater dividends.

We anticipate Japan will see returns considerably higher than recent history and may see a structural revival. With 45% of TOPIX stocks having no analyst coverage (versus just 3% of the US Russell 3000 Index), we also believe there is ample room for active management. Valuations also remain attractive, sitting well below other major developed markets and well below historical averages. With growth poised to be higher and asset returns improving, we ask: Are we about to witness a “Japanaissance” in Japanese growth and asset performance?

1) After 34 years, Japanese equities are trading above previous all-time highs

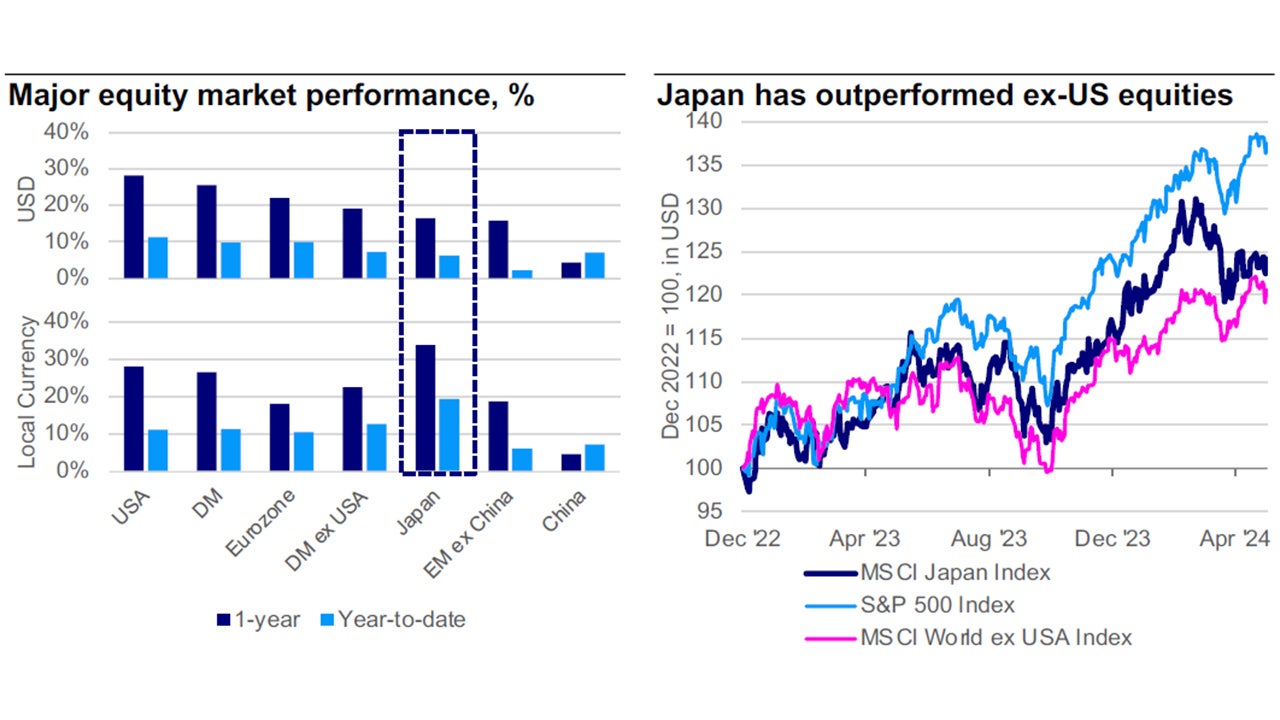

Sources: Invesco and Bloomberg. Left: Indices are as follows: US = S&P 500 Index, DM = MSCI World, EM ex. China = MSCI Emerging Markets excluding China, Japan = MSCI Japan, Eurozone = MSCI European Monetary Union, DM ex. US = MSCI World ex US, China = MSCI China. Right: Daily data indexed from 29 December 2022 = 100. All data as at 31 May 2024.

- In February this year, Japan’s Nikkei 225 registered its first all-time-high since the Japanese real estate bubble 34 years ago. In local currency terms, the index is up 33.9% year-over-year (16.4% in USD).

- However, in USD terms, performance has been sapped by dollar strengthening in the face of recent upside US inflation surprises.

- As in the right-side chart, Japanese assets have also outperformed their ex- US developed market counterparts in Q4 last year and Q1 this year. This begs the questions—what’s changed in Japan, and how sustainable is this?

2) The Bank of Japan finally tightened policy at its March meeting, and policymakers suggest more tightening is to come

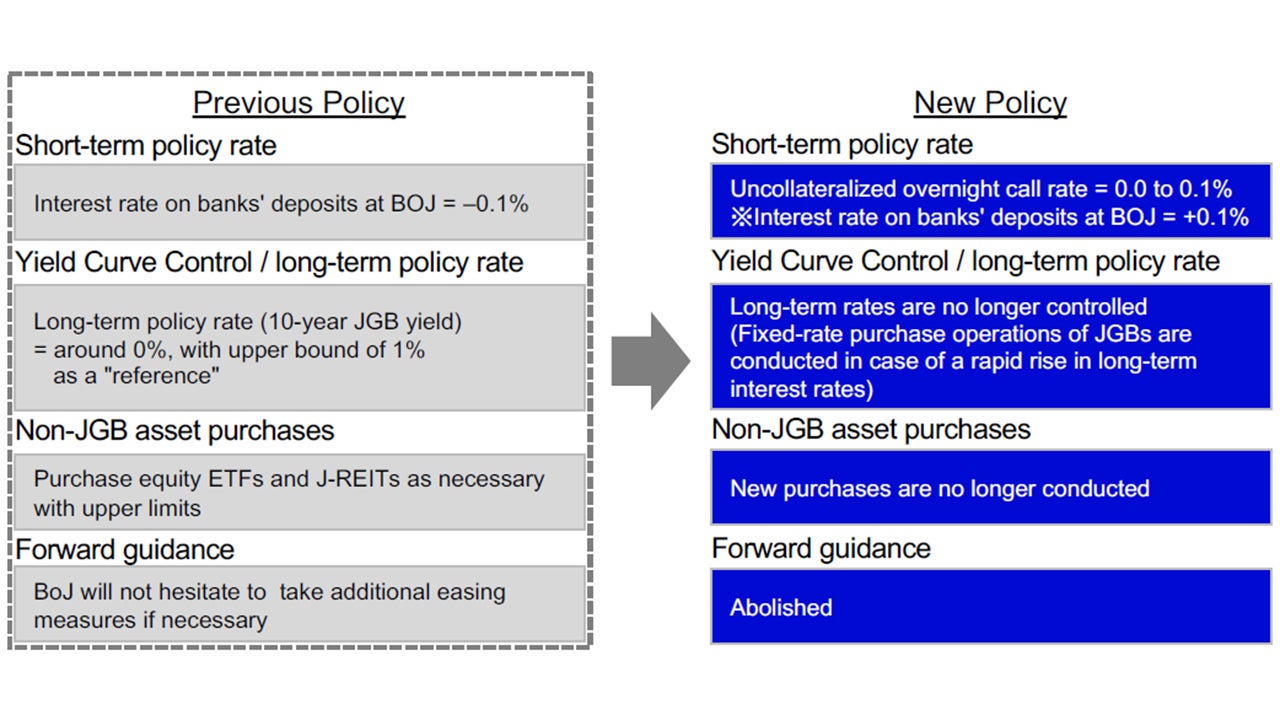

Source: Invesco from the Bank of Japan. As at the BOJ meetings on 22 March 2024 and 7 May 2024. JGBs = Japanese government bonds.

- Among the most significant recent changes from Japan came in March this year, when the Bank of Japan (BOJ) tightened monetary policy for the first time since February 2007. At this time, the BOJ abolished negative interest rate policy, YCC policy, and its policy of forward guidance.

- This has stoked the view that Japan has finally made a transition from a deflationary economy to an inflationary economy. Meanwhile, investment has been picking up (see point #5).

- With yields rising, some market participants anticipate renewed domestic appetite for JGBs and other Japanese assets.

- The BOJ also suggested further policy tightening in its policy meeting on 25- 26 April as it showed its will to raise policy rate if the economy and inflation proceed as it expects in its outlook report. We now expect the BOJ to make one or two additional policy rate hikes by end-2024.

3) Why tighten? Japanese inflation is back!

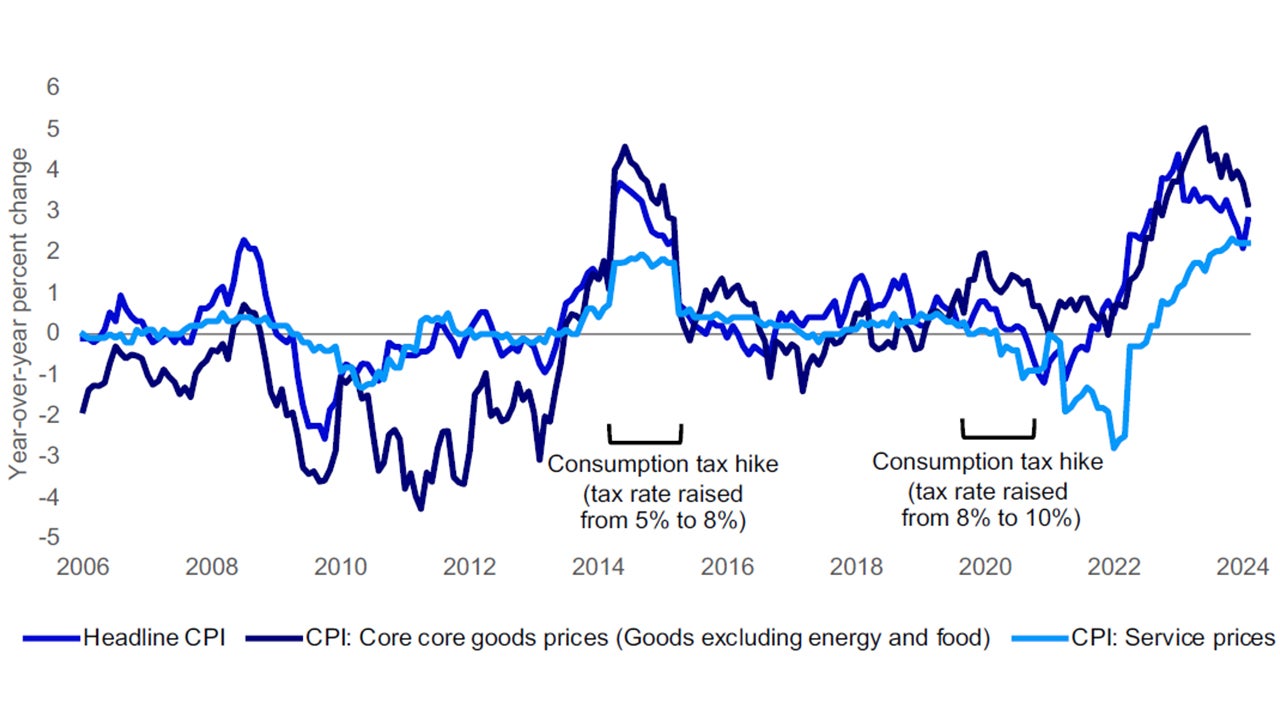

Source: Invesco from CEIC. Monthly data as at 8 April 2024.

- After a decades-long struggle with trying to prevent deflation, Japanese inflation has finally moved higher and is expected to be sustained near 2% year-over-year, which triggered the March rate hike by the Bank of Japan.

- Importantly, services inflation finally picked up to near 2% level in recent months, which reflects a significant change in corporations’ price-setting behavior. We anticipate that services inflation is likely to stay around 2% level, supported by wage hikes.

- Although goods inflation has decelerated in recent months, the recent depreciation of yen and a rise in oil prices should keep it at a relatively high level in the coming months, in our view.