India election results and investment implications

The Nifty index fell -6%1 after India’s election results came in which showed that the ruling party BJP failed to win a much-expected landslide, let alone secure an outright majority in Parliament.

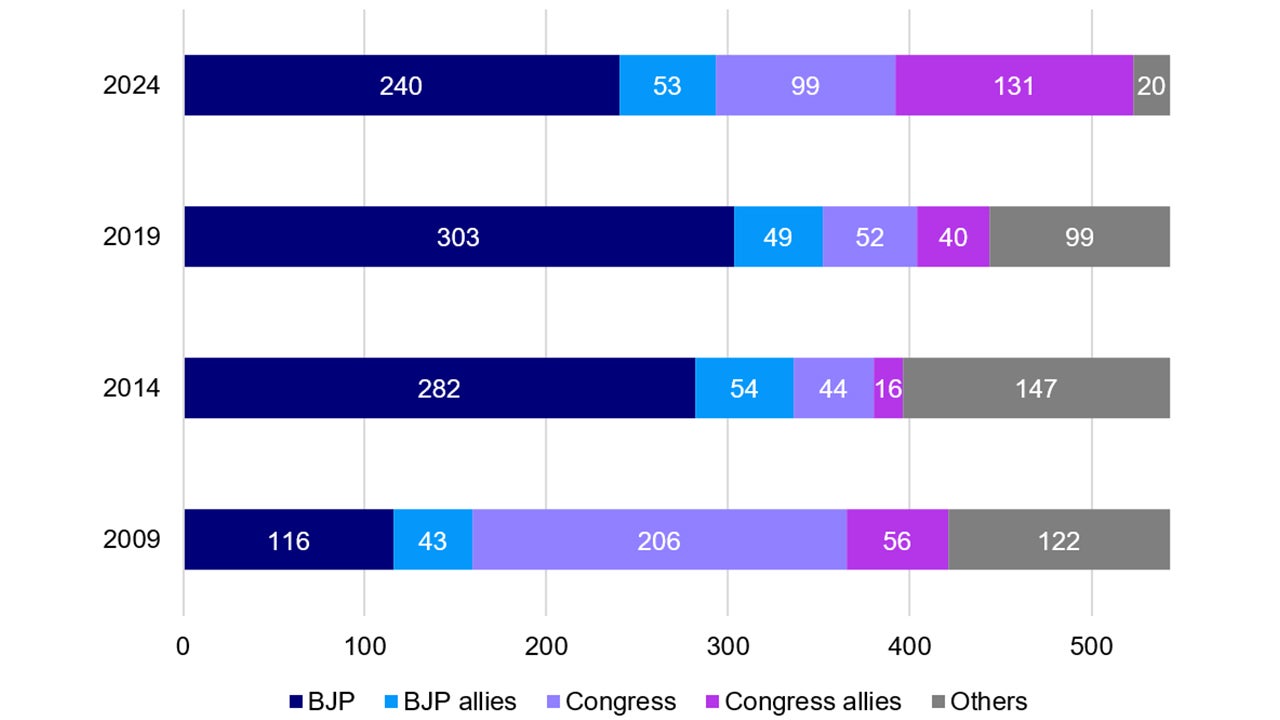

Despite a strong showing in the polls leading up to the election and misleading exit polls, BJP has won only 240 seats, compared to the 303 back in 2019.2

Still, the National Democratic Alliance – a political alliance led by the BJP – has won over 290 seats, which is more than the 272 seats needed for the majority.2

This is yet another reminder that election polls can be inaccurate and can over-estimate trends.

Source: Bloomberg. Data as at 5 June 2024.

Implications on the Indian economy and policies

As the election dust settles, the voters have spoken and they have decidedly narrowed the political capital from BJP – in the form of a near 60-seat loss.

The big question for markets now, is what this diminished composition means for policy continuity.

Will the pace and direction of earlier economic reforms to promote macro stability continue?

Looking at the initial results, I don’t believe that the results reflect voter dissatisfaction over BJP’s economic policies, rather it appears to be more on local and non-economic issues.

More so, BJP underperformed in three predominantly rural and agriculture-oriented states.

This leads me to think that the planned reforms that have already been put in place - aren’t going to change.

I would expect that the focus remains on getting these reforms implemented and executed over the next 5 years rather than any policy pivot.

The new political landscape

It’s also doubtful that the new coalition will implement any noticeable changes to the existing government’s commitment to macro stability measures – such as the opening-up of the capital markets and a relatively stable Rupee against major global currencies.

After two terms of a simple majority, BJP will now have to rely on its newly inducted coalition partners from Andhra Pradesh and Bihar to get majority votes.

These two parties are somewhat untested as they only joined the coalition less than 6 months ago and have historically been part of the opposition coalition.

I believe that the main issue going forward is likely to be policy coordination in this new coalition, not the policies themselves.

That said, the new NDA coalition maintains a comfortable majority relative to historical precedents.

Stable governments have been formed by NDA in the past despite slimmer majorities.

Investment implications

From a markets perspective, there could still be a bit of noise in the coming days due to disagreements over government and cabinet formation, though I believe that volatility has already peaked as the key election overhang has been removed.

Going forward, all eyes will be on the Reserve Bank of India (RBI) policy decision on 7th June (where the bank is expected to maintain status quo), the government’s budget released the week after, and corporate earnings season, which starts mid-July.

From an investment implication angle, the election results do raise some doubts over the notable premium of Indian equities earnings yields compared to 10-year India bond yields, which is why I continue to favor Indian bonds over equities.

India bonds have traded at the lowest premium to US yields in two decades, helped by stable government and predictable policies. Despite a drubbing at the election polls, I don’t believe that the results will affect this equation.

And while the INR may face depreciating pressures, it’s mostly due to the Fed’s uncertain path forward rather than a lack of confidence in India’s economy.

Moreover, both Bloomberg and JP Morgan bond indexes are set to include a raft of Indian bonds this year, which should drive passive flows and ignite more foreign investor interest.

From an equity market perspective, high valuation multiples could face some risk as investors look to obtain further governance clarity.

The Nifty continues to trade around 19x forward earnings and is at the 85th percentile and 1 standard deviation of its historical 18-year average.3

While Indian stocks have been viewed as expensive recently, they could still keep posting gains.

This also hasn’t been a narrow rally as both mid and small cap companies are at record highs versus the Nifty and there could be near-term volatility given the recent political outcome.

Still, domestic investors are likely to buy at the current dip and for foreign investors looking for a more palatable entry point, now could be the time.

Source: Bloomberg. Data as at 5 June 2024.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference:

-

1

Source: Bloomberg, as of June 5, 2024

-

2

Source: Bloomberg, as of June 5, 2024

-

3

Source: Bloomberg, as of June 5, 2024