India election and market outlook

The world’s largest election kicked off today and is slated to last 6 weeks, with around 969mn voters and 2,600 parties.

In our analysis, we review the key things to watch for and resulting market and investment implications.

The election will be conducted from 19th April – 1st June and the final results will be counted on 4th June with the new administration sworn in by mid-June.

Base Case Scenario

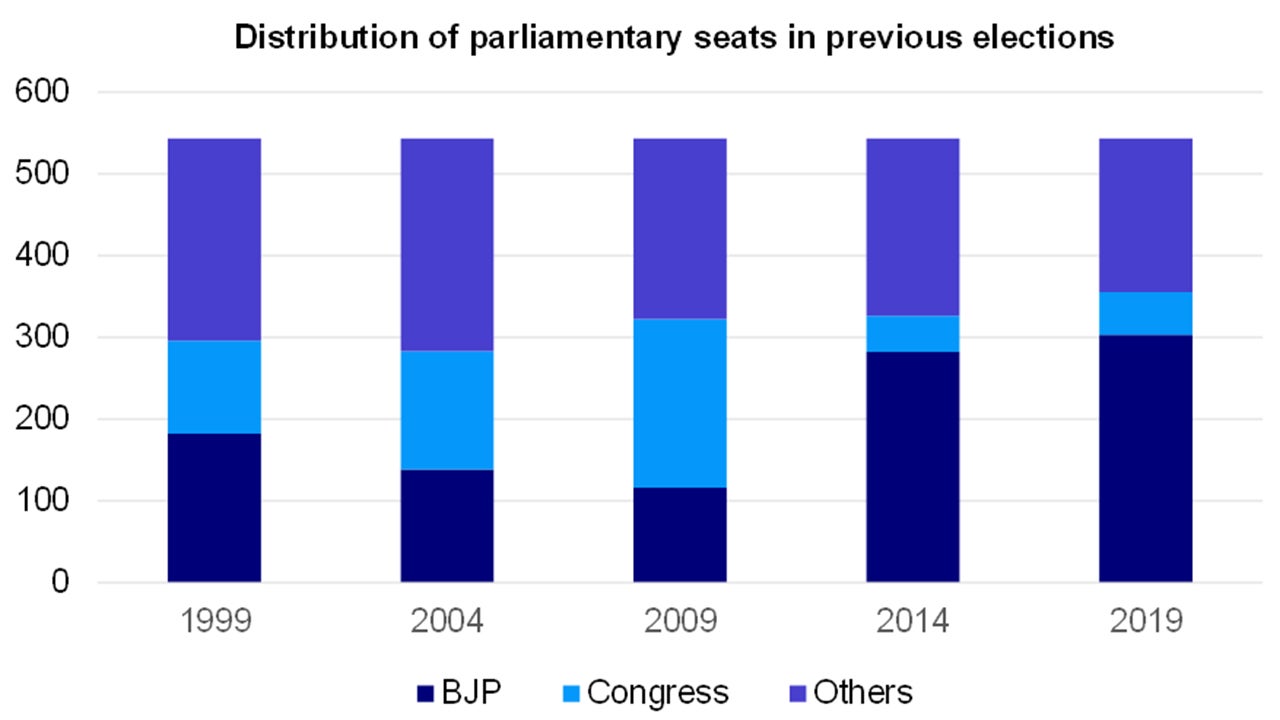

In our base case scenario, we expect an outright Bharatiya Janata Party (BJP) victory with over 272 seats and that Prime Minister Modi remains in power.1

Source: Election Commission of India. Data as at 19 April 2024. Note: The number of contested seats in the lower house of the parliament is 543 Congress formed the government in 2004 with 145 seats and 12 allies

A recent poll by News18 show that 80% of Indians are somewhat to very satisfied with the government.2

In a separate survey, the Mood of Nation found that respondents highly rated the government on its handling of the COVID-19 pandemic, the consecration of the Ram Mandir temple and its pursuit of being corruption-free.

A recent survey showed that 44% of respondents said Prime Minister Modi as being the best prime minister of all time.3

A definitive win by BJP would imply policy continuity with a focus on strong infrastructure investments and a continued push for structural land and labor reforms.

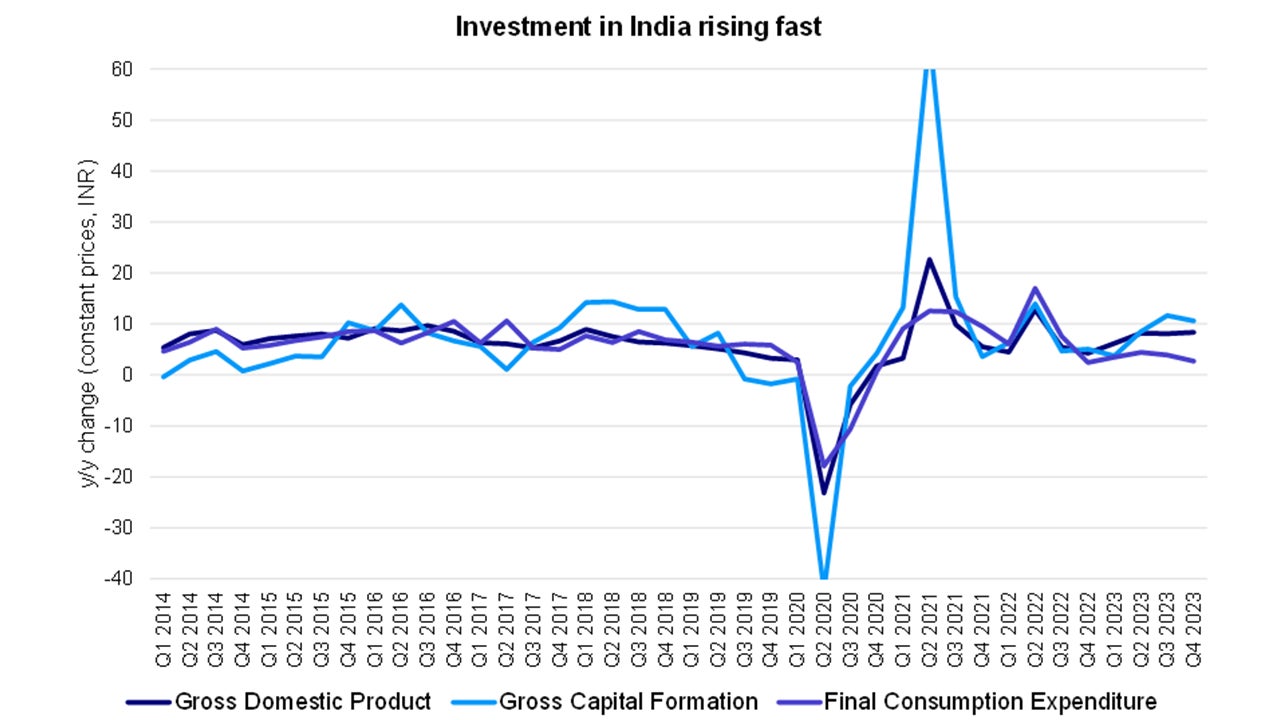

Source: Indian Ministry of Statistics & Programme Implementation (MoS&PI). Data as of Q4 2023.

From a fiscal and budgeting perspective, I expect BJP to remain focused on reducing deficits and the accumulation of debt and that the party would stick to its fiscal deficit target of 4.5% or less of GDP by FY26.

The latest poll by TV-CNX in February shows BJP securing 335 seats and that the NDA wins 393 seats4 - this would be considered a landslide victory. I expect strong foreign inflows after the election into both the debt and equity markets.

Bond Market Implications

Policy continuity, fiscal conservatism and a commitment to structural reforms are likely to be cheered by the markets.

Under these conditions, I would expect very little election impact on interest rates and policy rates – suggesting minimal bond market volatility.

Equity Market Implications

Initial polls and recent local elections suggest the possibility of a landslide by the BJP and its key allies, also known as The National Democratic Alliance (NDA).5

A landslide win by NDA that gets close to 400 seats could lead to a very positive equity market reaction. Domestic sectors such as consumer staples & discretionary, industrials, infrastructure, public sector undertaking (PSU) and financials are likely to benefit and could outperform.

There is a possibility that BJP fails to win an outright majority but still achieves it with its NDA coalition. Under this scenario, Modi still retains his premiership but is forced to share power with key allies in certain ministries.

While I don’t expect many governance changes, I believe that equity markets may be muted under this scenario, with a possible sell-off in PSUs and industrials & infrastructure sectors.

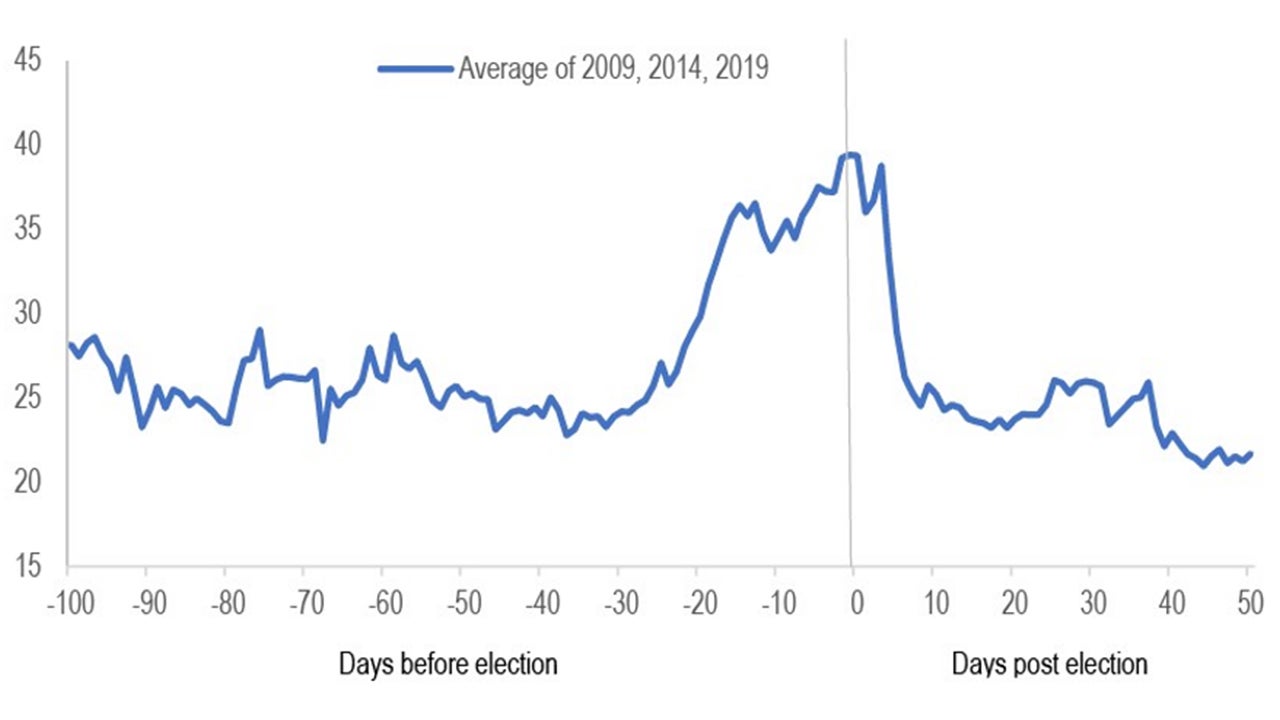

Looking over the past seven elections, India equities have outperformed global and emerging market indices both before and after election results6 as market sentiment tends to be positive during an election year.

Source: Bloomberg and JPM. Data as of 19 April 2024.

INR Outlook

Historically, the Indian Rupee (INR) tends to outperform heading into the general election by around 2.0% against the USD, remains consistent during the election and is on average 1.4% lower after the election.7

I believe that this time around, the INR outlook is likely to have more to do with the Fed and its monetary path forward than the domestic election.

I expect INR to be relatively stable during the election period and for INR to appreciate especially if NDA achieves a large majority.

A landslide victory could improve investor sentiment and lead to strong foreign portfolio inflows.

In the unlikely case of a negative surprise from BJP and its NDA alliance losing, then I would expect meaningful selling pressure both in equity, bonds and the INR due to investor concerns over India’s growth outlook and policy consistency.

Reference:

-

1

Source: Latest opinion polls for 2024 Lok Sabha elections by India Today, ABP, India TV, Times Now.

-

2

Source: News18's Mega Opinion Poll Shows BJP Dominant Force in North India, Modi Popularity Unmatched - News18

-

3

Source: PM Modi best Prime Minister so far, shows Mood of Nation survey - India Today

-

4

Source: Lok Sabha Elections 2024: BJP-led NDA may win 393 seats, predicts India TV-CNX Opinion Poll – India TV (indiatvnews.com)

-

5

Source: Lok Sabha Opinion poll survey: Hattrick for PM Modi-led NDA with 335 seats, predicts Mood of the Nation, INDIA bloc at 166 - India Today.

-

6

Source: Bloomberg: Nifty performance 1 year, 6 months, 3 months, 1 month pre and post election results: 1996, 1998, 1999, 2004, 2009, 2014, 2019.

-

7

Source: Nomura Economic Research: Four past general elections INR versus USD 2004, 2009, 2014 and 2019.