Global equities series: US federal fiscal policy, the debt, and the deficit

This is the fifth of an eight-part series that covers the themes and challenges facing global equities in the second Trump administration. Part 1 covers the impact of an America-first world order while Part 2 looks at Trumpism's issues. In Part 3 we delve into immigration, the Federal workforce and US labor markets. Part 4 unpacks deregulation, oil demand and inflation pressures. Part 5 covers the US fiscal policy, debt and deficit and Part 6 looks at foreign economic policies and trade concerns. In Part 7 we deep dive into geopolitics and geoeconomics and Part 8 unpacks portfolio diversification in America-first global equity markets.

We share investors’ deep concerns that the US is on an unsustainable fiscal trajectory with outsized deficits at or above full employment and possibly above-trend GDP growth. Such worries reflect a lack of political constituents for cutting US federal debt and Trump’s desire to cut taxes despite difficulties in cutting federal spending or the workforce. Yet we think the direct trigger for a sharp rise in bond yields and term premia would be a loss of control of inflation, in turn, driven by the independence of the Fed – or challenges to its ability to carry out its price stability mandate. We, therefore, see Trump’s occasional attacks on the Fed or the chair as a greater source of jump risk in bonds with knock-on consequences for the dollar and US and global equities than federal deficits or debt per se.

An enduring mystery in the US bond market is the placidity of the so-called “bond vigilantes,” who used to punish profligate governments with sharp selloffs that would force monetary tightening or crowd out non-interest spending. Arguably, the US is already there, for the interest bill already exceeds defense spending. Yet despite Congressional Budget Office projections of an explosive debt trajectory on current policies, the yield curve is well-behaved and the term premium low.

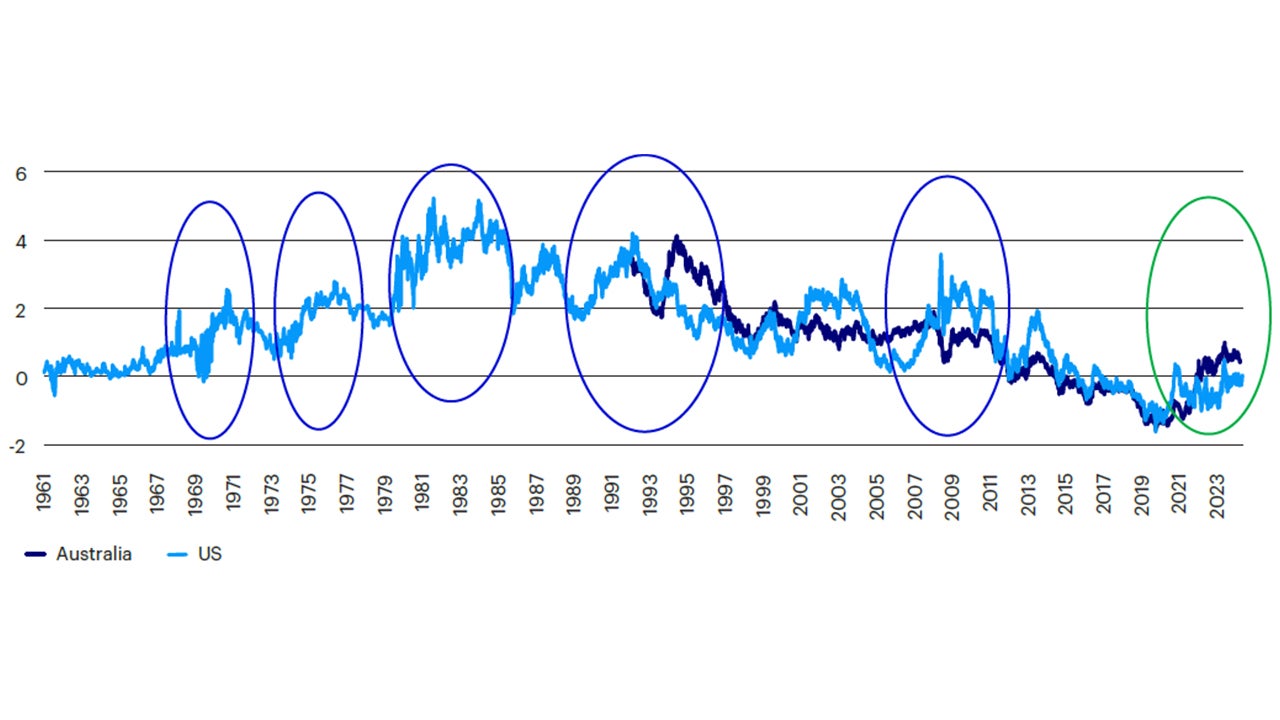

In our view, the real danger for bond investors, and by extension for dollar and US equity exposures, would come from threats to Fed independence and credibility. US term premia rose sharply amid high volatility in the late 1960-early-1980s, when US debt and deficits were only about a third of current levels – but when the Fed had been repeatedly and severely undermined by Presidents Johnson and Nixon. We think drastic, repeated inflation surprises and sharp rises in bond yields and term premia, which severely punish bondholders during a loss of institutional credibility, are far worse than bond yields rising due to fiscal pressure, which allows for a gentler rebalancing of bond and risk-asset portfolios. We believe the 2022 UK Gilt crisis fits this bill: PM Truss fired top civil servants, prevented the Office of Budget Responsibility from scoring her unfunded tax cuts, and threatened to blame the BoE for inflation fallout from fiscal expansionism. Gilts have adjusted far more smoothly despite major increases in deficits and borrowing by a leftist Labour government in 2024, at least so far.

Note: Term premium is the excess yield required to extend duration instead of rolling over short-term debt.

Source: Reserve Bank of Australia, NY Federal Reserve, Macrobond, Invesco. Daily data to 07 October 2024.

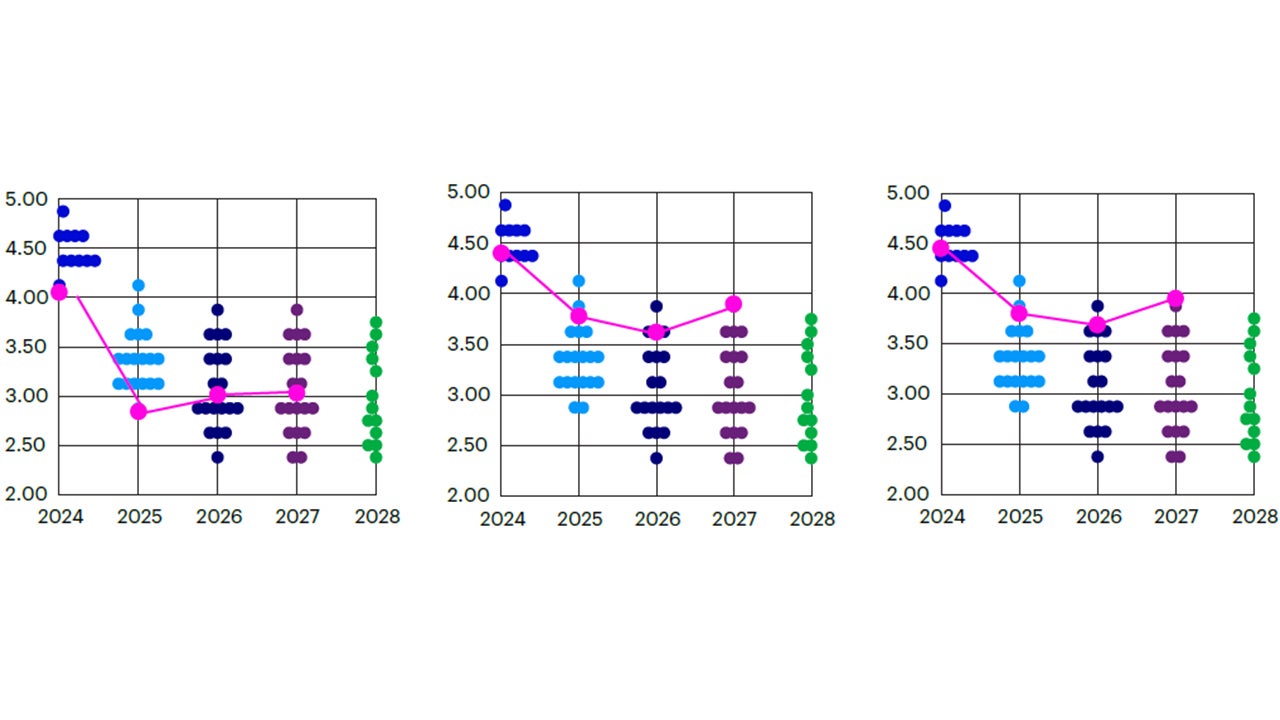

We worry that cross-asset class risks lurking in potentially inflationary policies (e.g., immigration curbs) may be triggered by Trump’s periodic attacks on the Fed. Market pricing has repriced for tighter Fed policy since the election, and this could exacerbate market volatility should Trump really lash out at the Fed. We believe the market expertise of key nominees like Bessent for Treasury and Congress’s support of the Fed in Trump’s first term will contain these risks.

Note: Red – Fed Fund futures-based market pricing for policy path to the last FOMC meetings of 2024-26, and January 2027. Color dots, FOMC members’ Fed Funds forecasts for each year-end, as per the 18 September 2024 Summary of Economic Projections. Source: CME Group FedWatch tool, Invesco. Market data for 18 September, and 7 and 22 November 2024, all as at 22 November 2024.