Global equities series: Trumpism’s issues

This is the second of an eight-part series that covers the themes and challenges facing global equities in the second Trump administration. Part 1 covers the impact of an America-first world order while Part 2 looks at Trumpism's issues. In Part 3 we delve into immigration, the Federal workforce and US labor markets. Part 4 unpacks deregulation, oil demand and inflation pressures. Part 5 covers the US fiscal policy, debt and deficit and Part 6 looks at foreign economic policies and trade concerns. In Part 7 we deep dive into geopolitics and geoeconomics and Part 8 unpacks portfolio diversification in America-first global equity markets.

We see four “I’s” – Inflation, inequality, immigration, and identity (including cancel culture and “woke” in general) – as major political drivers for Trump’s unexpectedly strong performance in the election and his rhetoric and personnel choices since. We expect these issues to feature in domestic and foreign policy as Trump seeks to deliver on platform pledges, maintain momentum in the Make America Great Again (MAGA) movement, and define his legacy, which implies navigating underlying tensions and contradictions – and sustained market volatility.

The big four “I’s” are perhaps where the tensions and internal contradictions of the Trump platform will come to a head. For example, falling inflation has probably been assisted by high immigration, but at a cost to social stability and public services, as well as doubts about personal safety and diversion of public spending, which the Trump campaign arguably fanned up. We would therefore expect team Trump to tread carefully to navigate trade-offs between specific campaign goals, such as lower immigration, and other contradictory goals, such as lower inflation.

Identity and Inequality: Identity, we expect, will have the least direct macro, sectoral, and financial market impact, yet is an important socioeconomic and sociopolitical signifier, for it represents a backlash against the preferences of globalized elites and centrist political groups, such as canceling “cancel culture,” political correctness, “woke,” and the like. This implies that the Trump administration will reverse or sideline key elements of associated policy agenda items, spanning climate change, regulatory restrictions on the economic and financial freedom of businesses and individuals and corrective public policies such as redistribution, affirmative action, etc. The most direct market impact is likely to be a stronger aversion to “ESG” writ large in financial, real investment, hiring, and access decisions (such as federal jobs or college admissions criteria, perhaps via federal education and research grant funding).

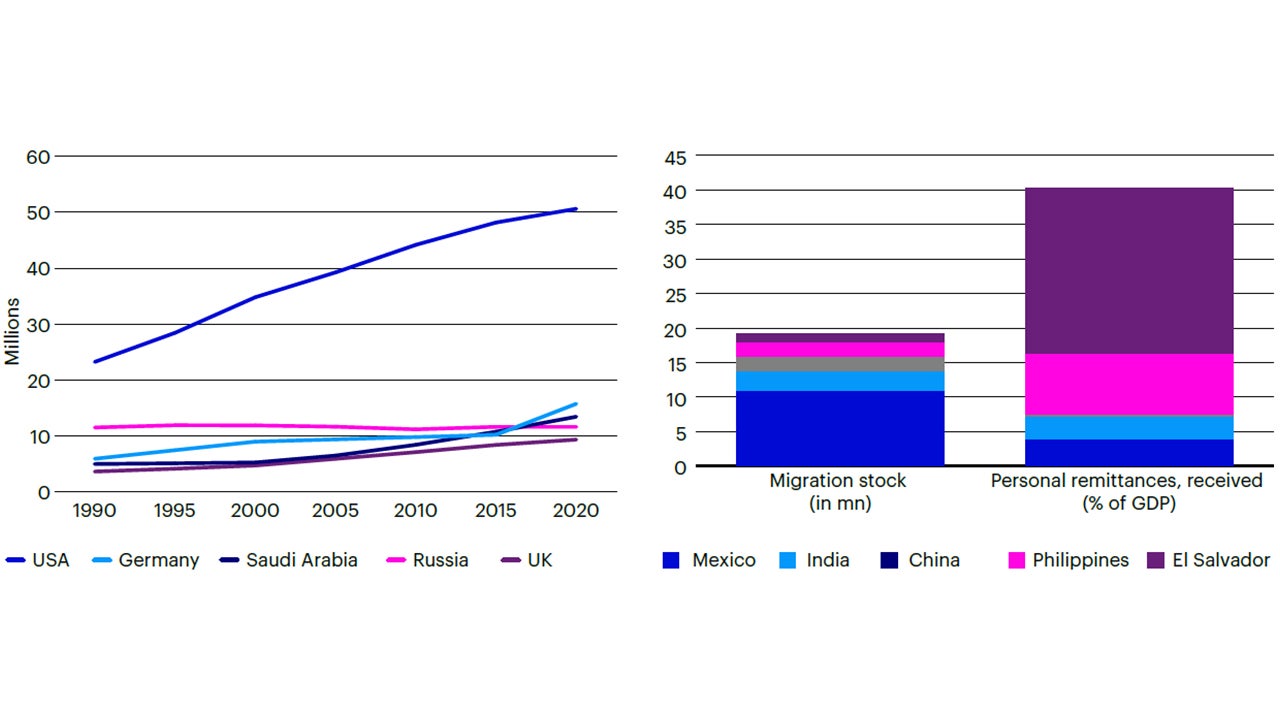

Immigration, Inequality, and Inflation: Immigration arguably contributed to the “immaculate disinflation” of recent years, in which there has been no major sacrifice of growth or employment by keeping wages in check and the US labor market well supplied in the face of a surge in demand for labor that accompanied post-COVID-19 reopening. The US is the largest recipient of immigration in absolute numbers and among the largest proportionally among the world’s top-five destinations, including Germany, Saudi Arabia, Russia, and the UK. By 2020, before the collapse of migration that accompanied COVID-19 lockdowns, the stock of immigrants in the US had exceeded 50 million and is thought to have increased by another 15 million or more (including illegal immigration) in the Biden era. As a result, migrants likely account for over 20% of the US population. We would expect team Trump to move fast to reduce illegal, uncontrolled immigration and deport illegal aliens, especially those with criminal records, yet gradually to maintain meaningful access for legal immigrants based on skills, education, and possibly demand in US labor markets (to help prevent wage pressures from driving up CPI inflation).

Inflation, high consumer prices, high asset prices, and Inequality: We see the high level of prices as a major problem that is only partly relieved by declining inflation, a tight labor market, and rising real-terms wages. Inflation and immigration have contributed to inequality, as did the easy money response to the Global Financial Crisis and COVID-19, driving up asset prices but holding down real wages – while the severe inflation shock causes a real wage shock. Crucial prices like rents, groceries, dining out and other services remain at elevated levels versus median or low incomes and are still rising, albeit at a more manageable pace now that inflation is close to target. Yet keeping asset prices high is crucial not only to Trump’s most visible metric of the quality of his actions but also to sustaining growth, investment, and by extension, jobs. Again, these are reasons to expect high volatility, but also constraints on excessively radical policies that destabilize domestic financial markets, though we expect far less, if any, concern about financial stability overseas, given an America-First policy stance. Some countries benefit from large migrant remittances from the US – Mexico, Philippines, El Salvador, and India to an extent. Some of these may see slower migration to the US and hence a tailing off in remittances, which in turn may raise pressure on other sources of external financing, and hence show up in financial asset risk premia across currency, bonds, and stocks.

Source: IOM World Migration Report 2024, UN Department of Economic and Social Affairs, Invesco. 2020 data, latest available, as at 18 Dec 2024.