Global equities series: Deregulation, “drill baby, drill!” and inflationary pressures

This is the fourth of an eight-part series that covers the themes and challenges facing global equities in the second Trump administration. Part 1 covers the impact of an America-first world order while Part 2 looks at Trumpism's issues. In Part 3 we delve into immigration, the Federal workforce and US labor markets. Part 4 unpacks deregulation, oil demand and inflation pressures. Part 5 covers the US fiscal policy, debt and deficit and Part 6 looks at foreign economic policies and trade concerns. In Part 7 we deep dive into geopolitics and geoeconomics and Part 8 unpacks portfolio diversification in America-first global equity markets.

A pro-business deregulation fever for corporates, financials, and energy seems to grip Trump. US administrations can deliver by easing enforcement and interpretation without legislation: The EU and UK, though debating, seem to be doing the opposite, but some EMs (e.g., Argentina) are delivering. Deregulation can cut operating costs, boost investment, productivity, and growth, and often has. We are more dubious that “Drill, Baby, Drill!” can raise energy output and cut inflation: US Big Oil has opted for high cash flow/low investment business models. If anything, higher oil prices are normally needed to induce higher output, given the long-cycle nature of production. Plus, there’s no free lunch; a low regulation, high carbon growth model may raise tail risks of financial or climate crises, which could boost the value of tail-risk hedging/insurance strategies and cash/bond buffers.

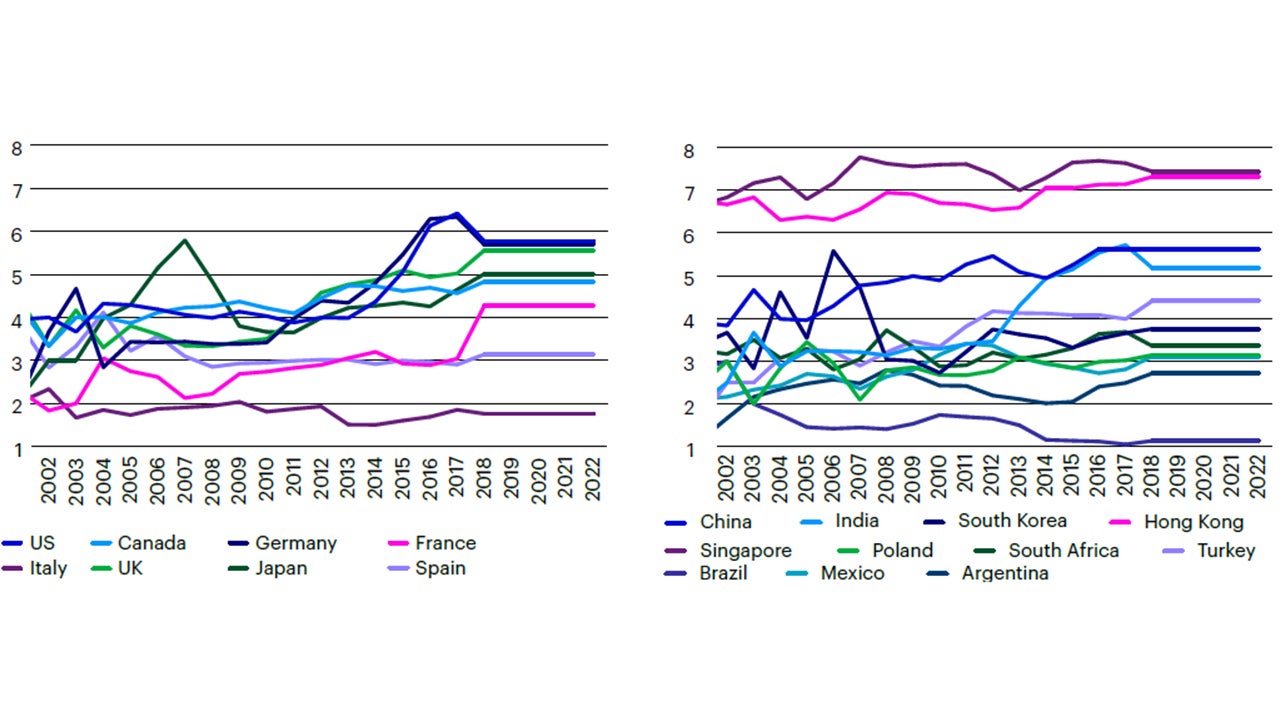

Deregulation? Yes! The US is already among the least regulated of major economies, though there has clearly been re-regulation of financials since the GFC and, more generally, for the climate transition. Yet the incoming Trump administration intends to deregulate the US to help make it more competitive, productive, and profitable and reduce inflationary pressures. Many mainstream economists doubt there is much room to deregulate, but we think deregulation could induce competition and investment, piling on pressure for productivity gains despite protectionism. Some regulatory indices suggest that the US has significant room to move to a “Singapore model,” as espoused by some Brexiters, but which the UK has failed to adopt, at least so far. (NB: the UK Labour government campaigned on planning deregulation, which it continues to push, but has also reregulated labor markets and raised payroll taxes in a blow to investment hopes).

Source: Fraser Institute Regulatory Burden index; 10 is lowest burden; Macrobond, Invesco. Annual data to 2022, latest available, at 19 Dec 2024.

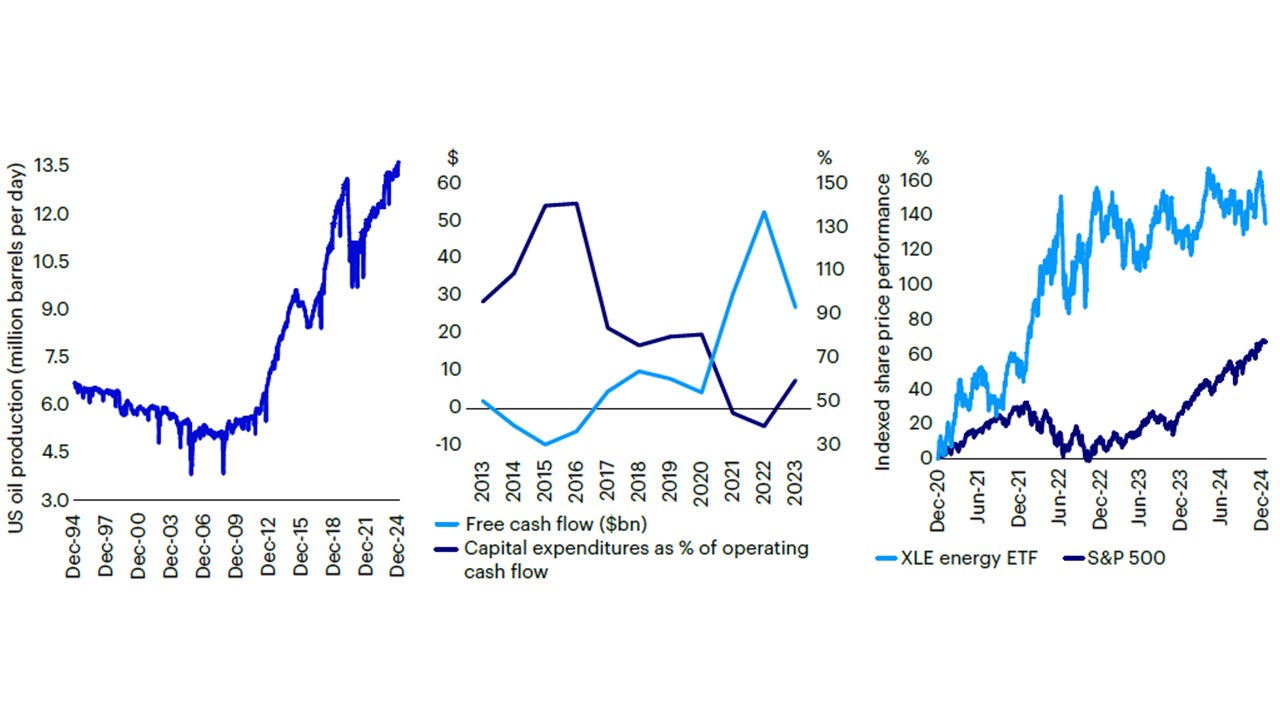

“Drill, Baby, Drill!”? – Not so fast Treasury Secretary nominee Bessent has outlined a rule of 3s: 3% growth, 3% fiscal deficits, 3mn bbl/day higher oil output. In contrast to deregulation, we see less room for major oil output increases, though permitting reform and opening up more federal lands for drilling might help. US Big Oil is arguably already a paragon of free enterprise, generating record output with a low capital/high cash flow model, and is handily outperforming the stock market. Furthermore, geopolitics might be mixed at best: Returning to Trump’s policy of sanctions on Venezuela and maximum pressure on Iran (which Biden reversed while sanctioning Russia) would not help, at least vis-á-vis Western oil markets.

Note: Free cash flow defined as operating cash flow less capital expenditures. Right, equity price performance reindexed, Dec 2020=100.

Source: Company filings; Bloomberg; CNBC; Invesco. Monthly and annual (middle) data all as at 19 December 2024.