FX Pulse: 2024 Q4

The Fed has joined the easing party and we expect it to ease more aggressively than other central banks over the next 12 months. Meanwhile, we think BOJ tightening will make JPY the strongest among major currencies.

USD has strengthened on revised market views about Fed easing (partly linked to the election outcome) but we expect a reversal in 2025. We think BOJ tightening will make JPY the strongest major currency.

| Favoured currency | Hedge from | Hedge to | |

| 3M view | JPY, AUD | USD, HKD | JPY, AUD, CAD |

| 12M view | JPY, AUD | USD, HKD | AUD, JPY, CAD |

Note: See the appendix of the downloadable PDF file for currency and central bank abbreviations.

Source: Invesco Global Market Strategy Office

The central bank easing cycle continues, with around 40 central banks cutting interest rates during 2024 Q4 (according to CentralBankRates). Eight of them were among our selection of the 10 most traded currencies (the BOJ and Australia’s RBA were the exceptions).

However, there is now less optimism about the extent of Fed rate cuts, with Federal Funds futures suggesting the upper end of the Fed’s policy range will be around 4.00% by the end of 2025 (versus the current 4.50%). That is a full percentage point higher than what markets were suggesting three months ago. This has had a knock-on effect on expectations for some other central banks. Though policy easing has caused 3-month rates to fall in most countries since September (China, Hong Kong and Japan are exceptions), 10-year yields are up almost everywhere (except China and Switzerland) but nowhere as much as in the US (except Hong Kong).

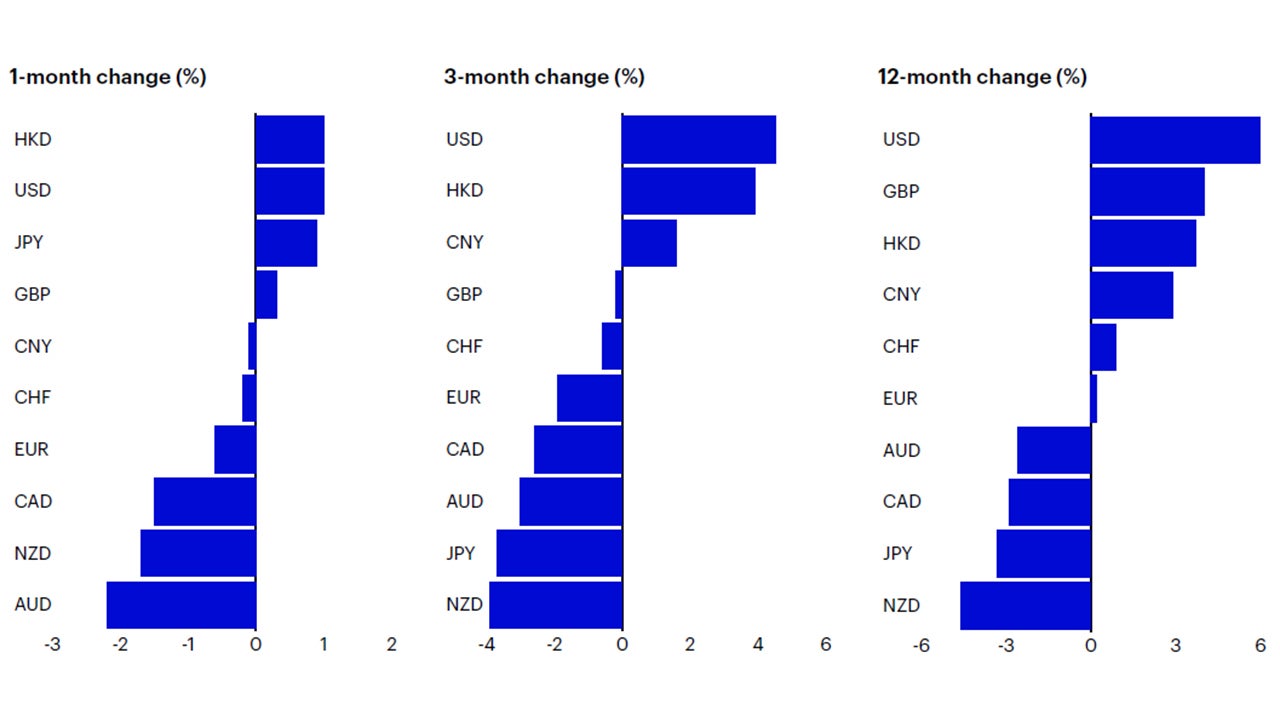

It should then come as little surprise that USD is among the strongest currencies over the timeframes shown in Figure 2. Despite the shockingly weak July payrolls data (which provoked market volatility in early August), the US economy appears to be robust.

We think this partially explains market reassessment of the potential for Fed rate cuts. The other factor, in our opinion, is the victory of Donald Trump in November’s elections and the Republican clean sweep. There could be both good and bad reasons for this: on the good side may be the belief that the US economy will receive a boost from a second Trump presidency, while more negative would be any expectation of higher inflation due to tariffs. Either way, the election outcome could persuade the Fed to be less aggressive in cutting rates than it would otherwise have been.

We think the strong showing of HKD and CNY in Figure 2 is explained by the weighting of the US dollar within their currency targeting regimes (100% and around 19%, respectively). GBP on the other hand seems to have benefitted from the relatively high rate of wage and price inflation in the UK, which may cause the BOE to delay rate cuts. However, a weak economy may eventually encourage the BOE to ease more rapidly.

More confusing is that RBA reluctance to ease has not prevented AUD weakness, perhaps due to economic softness. CAD and NZD have also been weak but those central banks have been easing aggressively (and the New Zealand economy is in recession).

Notes: Past performance is no guarantee of future results. As of 31 December 2024. Based on JP Morgan Nominal Broad Trade Weighted Indices.

Source: JP Morgan, LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.