French elections, EU right swing and market implications

With the EU parliamentary results showing a rise in right-wing parties, French President Emmanuel Macron called for snap elections in France for its lower house of parliament.

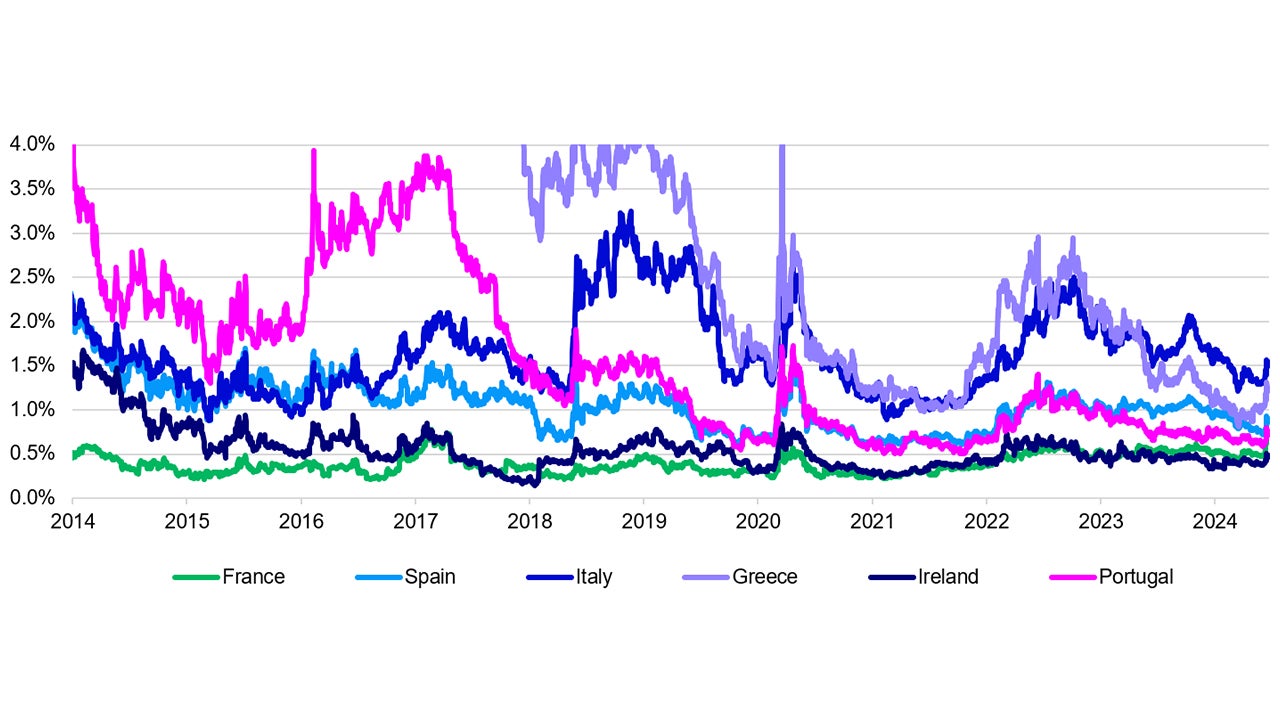

This has sent the spread between the French 10-year government bond and the German 10-year government bond to its widest level in more than a decade.1 (Chart)

The spread between French bonds and other European sovereign debt such as German Bunds could remain at these elevated levels for a while.

This is a point that bond markets made rather forcefully in response to the 2022 UK mini budget crisis.

On the equities front, French stocks took the brunt of the selloff relative to the main European indices, with the CAC 40 down by over 4% since the snap election call by Macron.1

Stocks with higher revenue exposure domestically in France experienced a larger decline. French banks looked the most vulnerable, given they hold substantial government debt and could possibly be targeted for proposed windfall taxes.

French utilities and infrastructure also took a bit of a hit, on the back of talks around mandated lower retail prices.

Uncertainty clouds the upcoming French elections

More uncertainty clouds the upcoming French elections. The 2-round structure and short campaign period poses much logistical challenge and results in opinion polls with lower predictive power.

Source: Macrobond. Daily data from 1 Jan 2014 to 20 Jun 2024, as at 21 June 2024.

Looking at how other global elections have surprised this year from Mexico to India, it makes sense to price for a wider distribution of outcomes and higher volatility.

The fact is that France is rather indebted, with government debt at around 110% of GDP. 2

The far right Rassemblement National (RN) have historically proposed unfunded spending plans which throws the outlook for fiscal consolidation up in the air.

Taken together with the recent sovereign downgrade of France by the S&P to AA-, the sustainability of France’s public finances is in question.3

Even so, early polls suggest the RN would top polls but fall short of an absolute majority. A hung parliament could lead to political deadlock.

We believe that there could be further headwinds for both French bonds and equities leading into the election that start on 30th June.

Implications on the European economy and markets

From a broader European economy and markets point of view, some market caution makes sense in response to the rightward swing in European parliament and investors are apt to associate Europe with higher risk premia.

EU fiscal and single market reforms may be harder to implement going forward. There is now also greater nationalist opposition to the EU charter pledge of “even deeper union” and may derail efforts for greater fiscal and macro alignment between European nations.

Investment Implication

European stocks more broadly have fared better, and the more muted reaction is a reflection of fewer policy direct impacts.

We remain overweight on European equities on the back of reaccelerating economic growth - if the volatility spreads to the wider European market and the Euro, we believe that this could be a buying opportunity, as we view the odds for contagion risk to the broader Eurozone area to be rather low.

The S&P Global/HCOB Eurozone composite PMI is at a 12-month high, and economic surprises have been improving. European stock indices have more of a value and cyclical tilt, both of which tend to perform better as growth recovers.

Rate cuts enacted by the European Central Bank will also be a catalyst.

While we broadly prefer European equities over bonds, we are more selective about European government bonds.

For example French and Portuguese 10-year government bonds have similar yields though we much prefer Portuguese bonds since the government has a much lower debt load and has much more room to raise taxes to fund the budget, if needed.

With contributions from Arnab Das

Reference:

-

1

Source: Bloomberg, as of June 20. 2024

-

2

Source: Bloomberg, as of June 19. 2024

-

3

Source: S&P Global Ratings, as of June 1. 2024

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.