FOMC June Decision - A “hawkish pause”

The Fed announced its policy rate remained unchanged at 5.0 - 5.25% as it allows committee members to “assess additional information and its implications for monetary policy.”

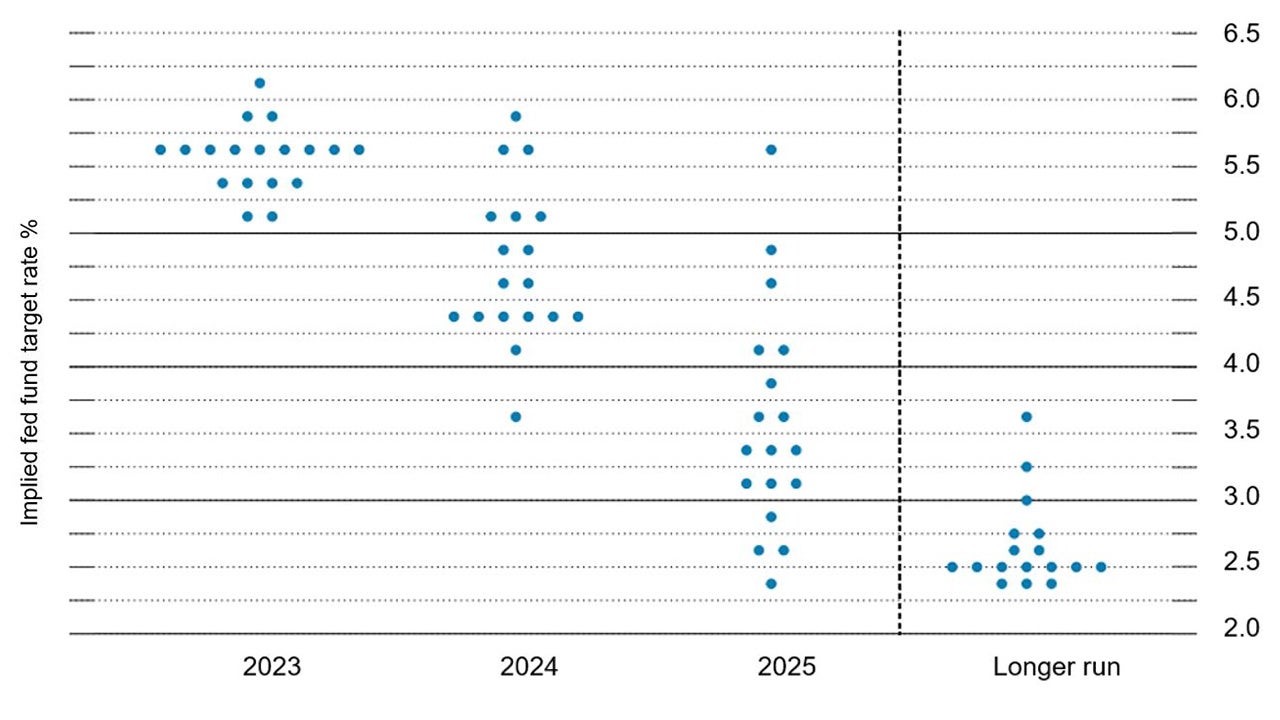

Still, this was a very hawkish pause as the Fed updated its dot plot to show 50bps of additional rate hikes before the end of this year with the new median fed funds rate at 5.6%.1

Source: Federal Reserve. Data as of 14 June 2023.

Despite the updated dot plot, I believe the Fed is unlikely to hike 50bps more. The Fed has bought itself time to assess further data, and I believe it will conclude no more rate hikes are necessary.

Data is weakening – just look at ISM (Institute of Supply Management) Services. PPI (Producer Price Index) on a y/y basis is now negative. CPI (Consumer Price Index) on a y/y basis is likely to dip below 4% in June. Money growth as measured by M2 (Money Supply M2), has normally led CPI by 12-18 months, and M2 is now -4.6% y/y.2

While it’s true that inflation remains elevated above the Fed’s 2% targeted range, core CPI ex-shelter has fallen below 4% y/y.3

Shelter is still the biggest contributor, even as home price growth is essentially flat over the past year and the apartment rental market appears to have softened considerably. It’s unlikely that shelter continues to climb 8% on a y/y basis.

Outlook

The dot plot is just each Fed member’s policy prescription, and it can be very wrong at times and it can change significantly over time. So I don’t put a lot of stock in it - it is probably intended to stop the market from assuming there will be any rate cuts this year, and it is intended to keep financial conditions from tightening.

If the Fed does tighten two more times this year, it really risks overkill - sending the economy into a significant recession. This is the most significant amount of tightening in the shortest amount of time we have ever witnessed. More so, the US economy hasn’t seen much of an impact yet because of monetary policy lag.

All tightening cycles end with accidents. This time however is the first that the Fed continued to raise rates after the accident.

By now, the Fed is typically on the path to renormalizing the yield curve. My biggest concern is that we haven’t seen the lagged effects of all this tightening and I believe we will.

Investment Implications

US markets experienced a bit of initial volatility because of the surprise hawkish tilt in the dot plot, but I believe markets are coming to the same conclusion and I would be surprised if there was any meaningful downward pressure on APAC stocks.

Remaining defensively positioned tactically in the US seems appropriate until there is more clarity from the Fed.

From an APAC perspective, I remain overweight in Japanese equities as the Bank of Japan remains committed to its existing loose monetary policy, the People's Bank of China is cutting rates to boost domestic and regional growth and the Fed has hit a pause. This remains the goldilocks scenario for Japanese equities.

With contributions from Kristina Hooper and Brian Levitt.

Footnotes

-

1

Source: Federal Reserve, as of June 14, 2023

-

2

Source: Federal Reserve. Data as of May 2023.

-

3

Source: U.S. Bureau of Labor Statistics (BLS). Data as of May 2023.