Exploring cryptocurrencies

What started it all?

A financial crisis and a distrust in institutions

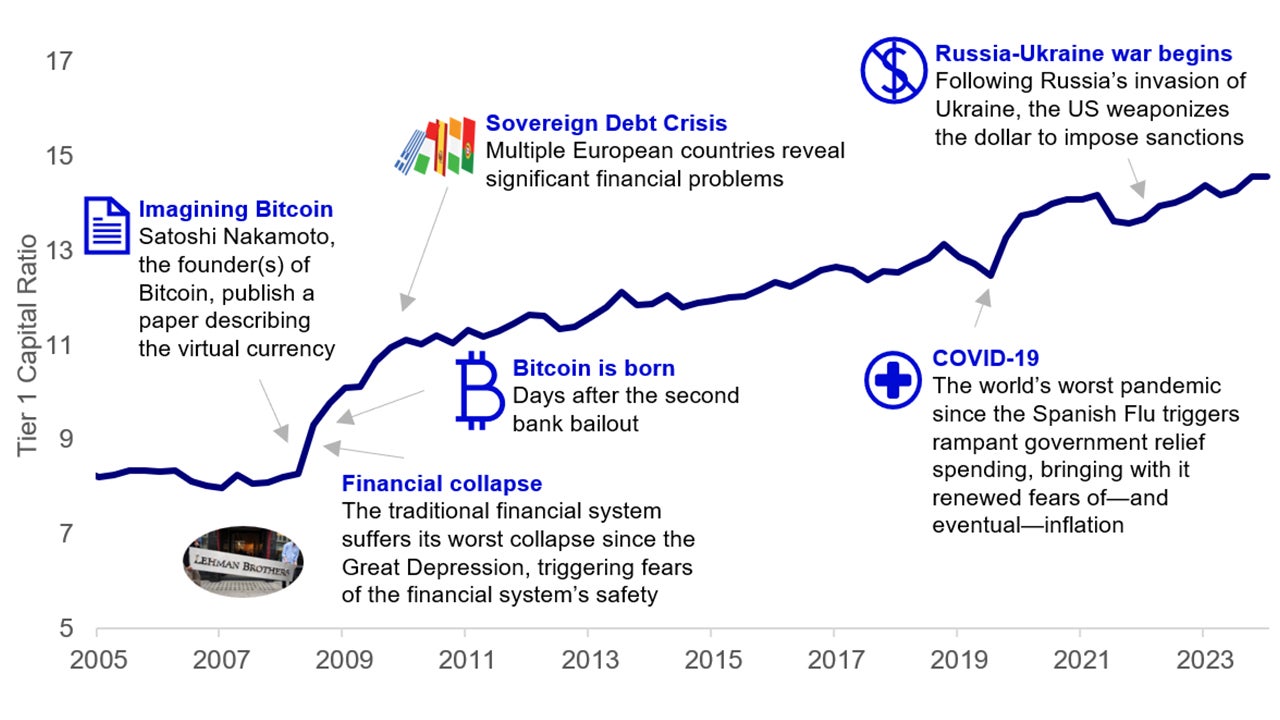

Bitcoin, the first cryptocurrency, was invented in the depths of the financial crisis as an alternative to the traditional banking system. Satoshi Nakamoto, the anonymous author(s) of the research paper that pioneered Bitcoin, approached the impending financial crisis like any other technologist: Take something fragile, inefficient, and far too large, and disrupt it. As banks were failing, Satoshi inscribed in the code of the first mined bitcoin block a message that reads, ”The Times 3 January 2009 Chancellor on brink of second bailout for banks.”

Since 2009, self-styled ‘cryptocurrencies’ have developed well beyond Bitcoin, becoming a vast and rapidly changing ecosystem. In 2024, bitcoin spot exchange traded funds in the US were formally authorized and launched, marking a significant milestone in the acceptance of digital assets.

This paper offers an overview of the trend and technology behind cryptocurrencies, as well as an assessment of the risks, valuation, and potential long-term outcomes of cryptocurrencies. No matter Bitcoin’s outlook, 15 years after the Bitcoin whitepaper and despite a pandemic, Satoshi would be surprised to see well-capitalized banks, US equities up 692%,* and a booming economy.

Sources: Bloomberg, Macrobond, US Federal Deposit Insurance Corporation, latest available data as of 29 January 2025.

*US equity performance measured by the S&P 500 index, an index of large capitalization stocks in the United States between the date of release of the Bitcoin white paper, 17 November 2008 and 31 January 2025.

Past performance does not guarantee future results. An investment cannot be made directly in an index.

Why is everyone paying attention?

Bitcoin has traded higher with each price cycle

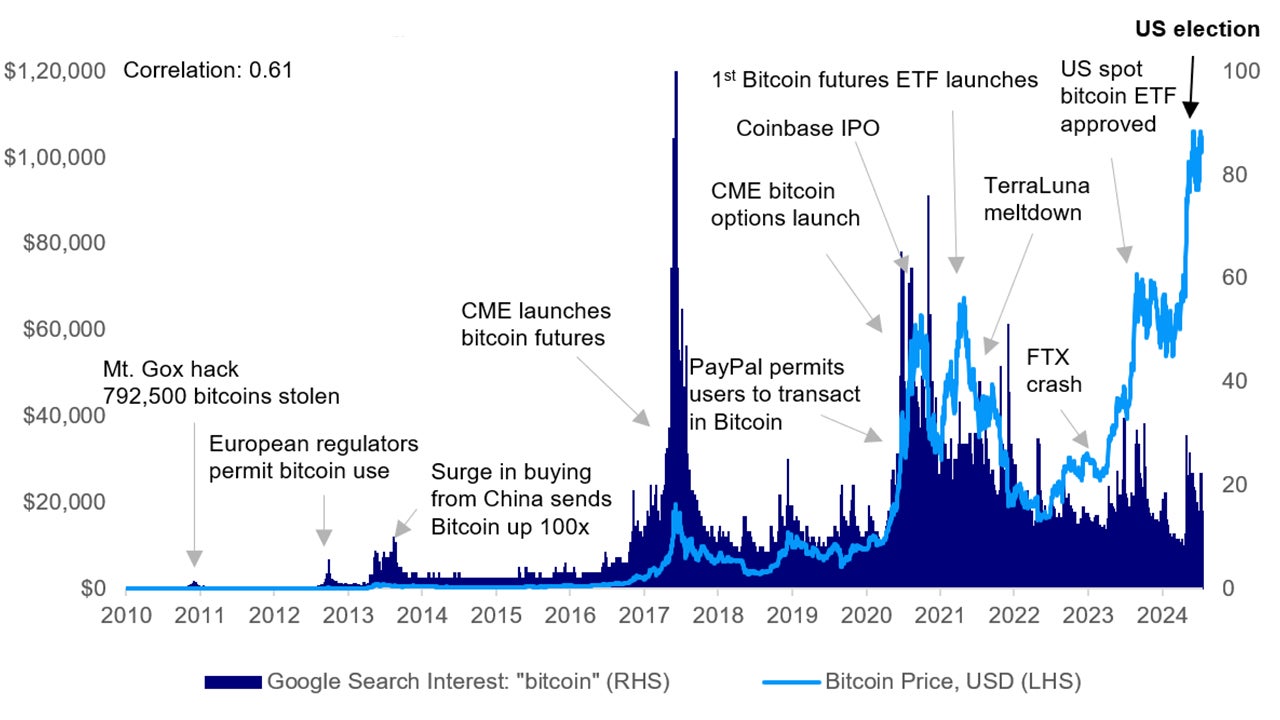

From January 2024 to the end of the year, bitcoin increased from $42,500 to a high of about $107,000. Over the past decade, bitcoin has delivered a stunning 77% annualized return. Following the launch of spot bitcoin ETFs in the US, bitcoin has seen a surge of demand from individual and institutional investors alike, with a further boost after President Trump’s electoral victory.

Although applications of Bitcoin’s underlying blockchain technology are interesting and may offer great potential, we argue that such applications are often an afterthought. Instead, many crypto-investors focus on Bitcoin’s potential for rapid price appreciation.

In the past, price fluctuations could mostly be explained by retail interest. Yet, as cryptos have become more mainstream, their price behavior has increasingly reflected conditions in broader financial markets.

Note: Correlation is calculated on the change of average weekly Bitcoin prices versus the change of Google search interest over the same period. Sources: Google, Macrobond, and Invesco. As of 29 January 2025. Past performance does not guarantee future results.

1. Bitcoin and blockchain… How does it work?

The “crypto believer manifesto”

A dash of distrust of institutions and a pinch of cryptographic tech…

For many, the Global Financial Crisis—including the institutional and government responses to it—highlighted just how fragile and outdated financial systems had become. Satoshi Nakamoto’s seminal paper, Bitcoin: A Peer-to-Peer Electronic Cash System, envisioned a financial system that put power and accountability in the hands of decentralized systems.

In his paper, Satoshi described a system which was decentralized, democratized, international and immutable. Bitcoin captures those primary characteristics. Cryptocurrencies developed after bitcoin are often designed to fulfil a specific use-case or better reflect a specific belief about how financial systems ought to be structured. Naturally, some cryptocurrencies appear far more cozy with traditional financial structures than others.

Still, common themes tend to re-emerge, and they are usually based on a distrust of institutions and fiat currencies and the pursuit of a decentralized financial system.

Source: Invesco. For illustrative purposes only. Note that not all cryptocurrencies exhibit the principles outlined above.

How do you get a bitcoin?

The circle of a bitcoin’s life

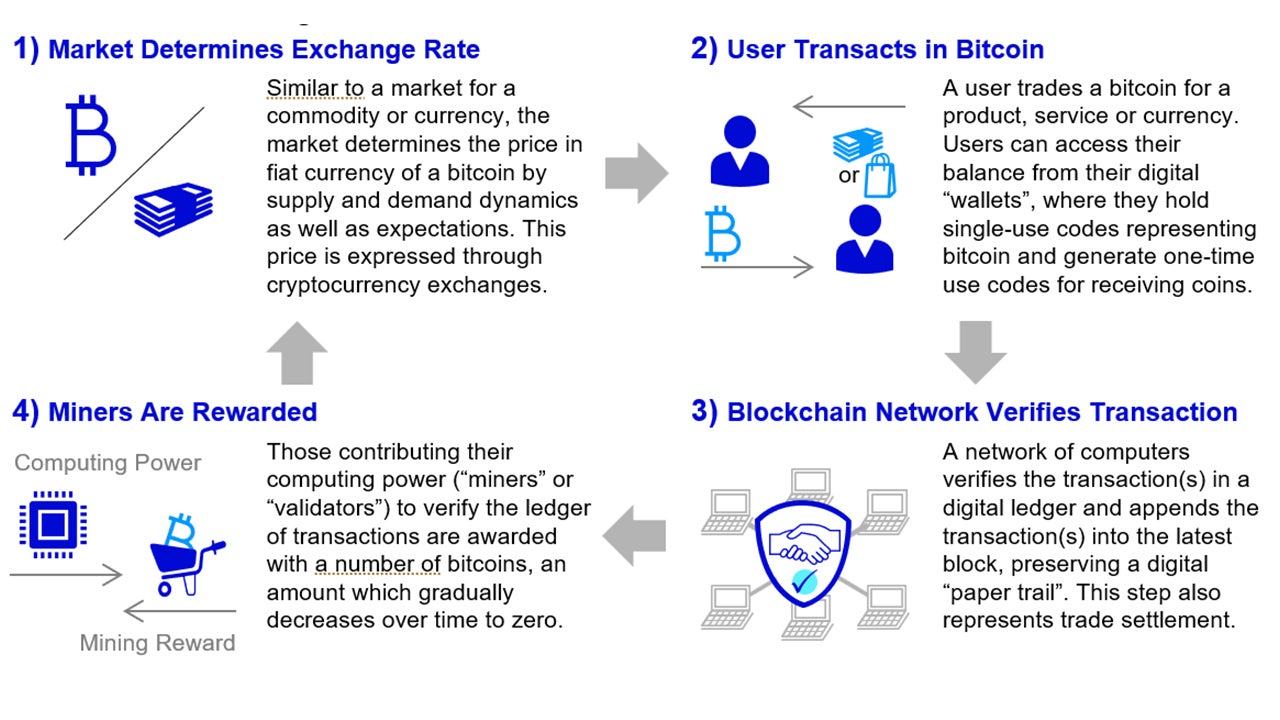

Before exploring the technical details of blockchain technology, it is useful to first understand how one may obtain a bitcoin.

There are three options:

- Buy bitcoins—and other cryptocurrencies—from centralized exchanges.

- Participate in the “mining” process whereby new coins are generated.

- Participate in blockchain-based transactions and receive bitcoins as part of an exchange.

Participants can trade bitcoins for other currencies or goods and services from a limited number of participating vendors. Crypto exchange rates (e.g. Bitcoin/USD) are determined by inter-exchange trading.

Sources: Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 30 October 2008. Please refer to glossary for further definitions.

Understanding blockchain

A blockchain is a decentralized database, maintained by a network of peers

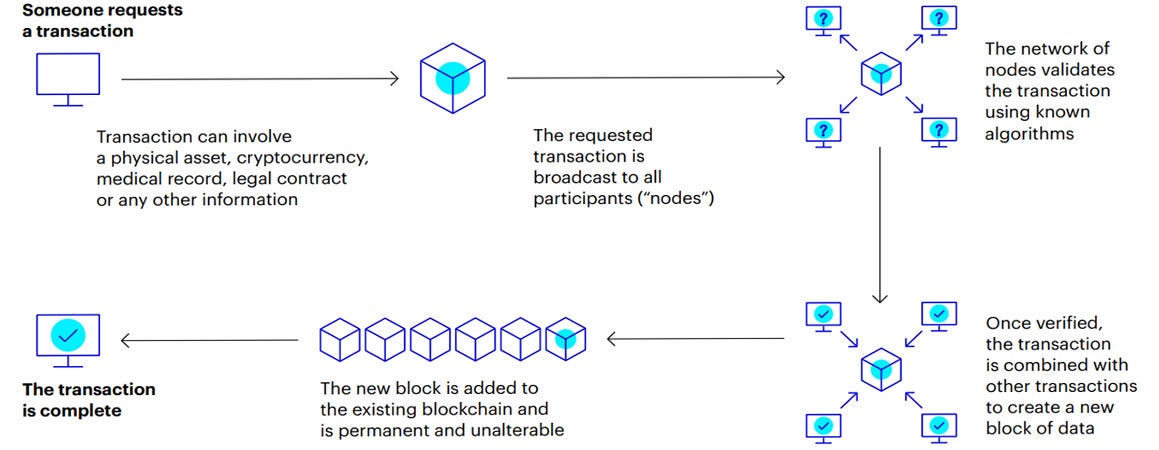

Blockchain technology is the darling of the cryptocurrency phenomenon. In essence, a blockchain is a new kind of database, owned and maintained by a network of peers.

Each transaction—or change in data—is provided to the network and integrated into a packet of data called a “block”. In contrast with a traditional centralized system, a decentralized database needs to have a mechanism whereby the various participants in the database agree on the current state of data (including any changes to it). To achieve this, each block undergoes an energy-intensive verification process using a series of cryptographic rules and puzzles. Newly verified blocks are broadcast to the network and appended to the blockchain.

To incentivize participation, new bitcoins are minted automatically and awarded to the participant(s) that successfully complete the cryptographic puzzle first. This “mining” process continually creates new “blocks” in the blockchain with new transaction data, forming a “distributed ledger” where each participant has record of every transaction.*

* Technically, only nodes carry the full history of the blockchain; validators do not necessarily need to be nodes.

Source: Invesco. For illustrative purposes only.

Investment risks

Investing in cryptocurrencies is high risk. Cryptocurrencies do not have any intrinsic value and may become worthless. Cryptocurrencies are subject to extreme price volatility and the price of cryptocurrency can be affected by factors such as global or regional political conditions and regulatory or judicial events.