Examining Asian market fund flows

For investors on the lookout for opportunities within in the Asian region, Japan and India have undoubtedly caught the spotlight over the past year – though the respective investment narratives couldn’t be more different.

Japan’s economy has broken out of decades-long deflationary shackles while corporate governance reforms have aided to boost equity multiples.

Meanwhile, India has taken the baton as the world’s fastest growing major economy with attractive demographics, and an advantageous position within global geopolitics.

Can the outperformance in Japan and India’s equity markets be sustained? We think so – both the domestic and global-macro stars are lining up in the coming year which could attract even stronger foreign fund flows this year.

Foreign Flows

Let’s take a closer look at recent capital flows into both countries.

During FY2023, fund flows were strong through, with around USD 29 billion of inflows into Japanese equities and USD 21 billion into Indian equities.1

However, the trajectory of year-to-date flows in 2024 paints a different picture. Japan has continued to experience strong foreign investor interest, while flows into Indian equities have slowed. Should current trends continue, Japanese equities are on track to experience a record-breaking year. (chart 1)

It’s possible the slowdown of foreign flows into India may have less to do with hesitancy over the investment narrative and more to do with how much is already priced in.

Currently, India is trading at 21x forward PE2 – a steep valuation relative to EM peers. That said, these valuation levels are made more tolerable by having one of the highest ROEs in EM.

We expect that India ROEs will remain high as earnings compound going forward and corporate leverage can build from current levels as nominal and real rates remain low to history.

Source: Bloomberg, Central Depository Services (India) Ltd, Ministry of Finance Japan and Invesco. Data as at 22 March 2024. India YTD figures up to 20 March 2024. Japan YTD figures up to 15 March 2024.

It’s also possible that uncertainty over the 2024 India general election is leading markets to price something of a political premium.

We believe that fund flows to India are likely to continue this year as the election looms and the existing Bharatiya Janata Party (BJP) ruling party is likely to win more seats in Parliament.

A strong showing by BJP is likely to boost the stock market given greater policy certainty and continuity in the coming years.

FX Implications

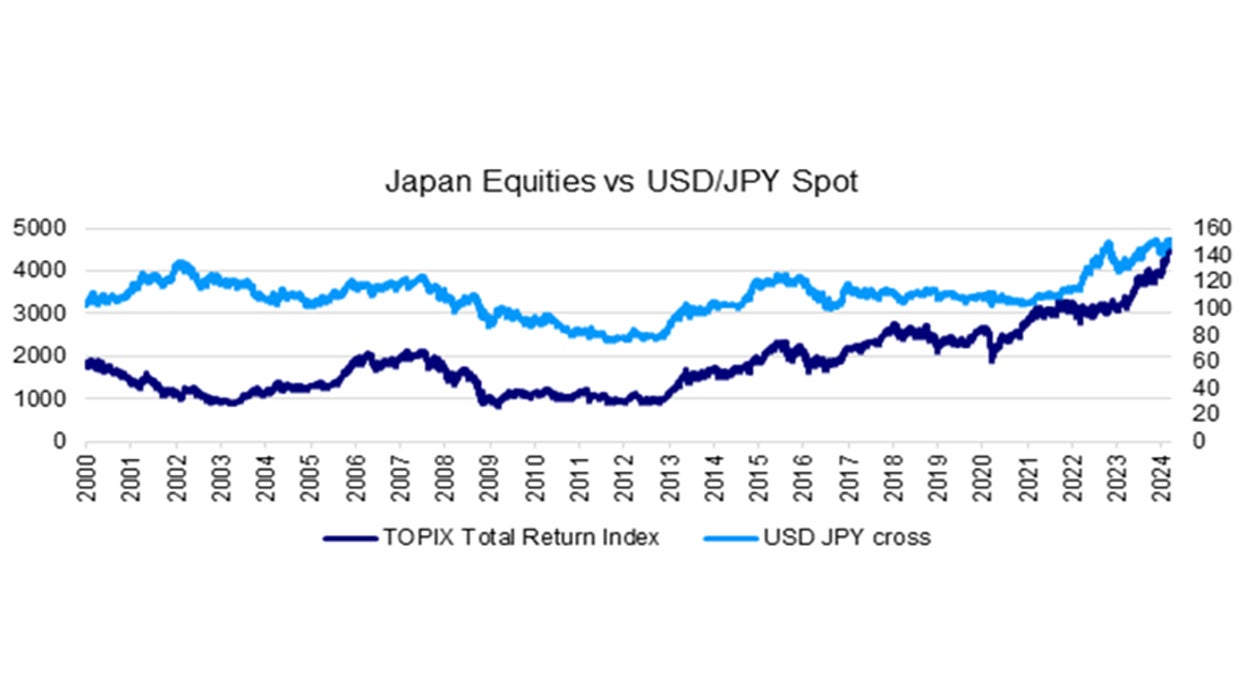

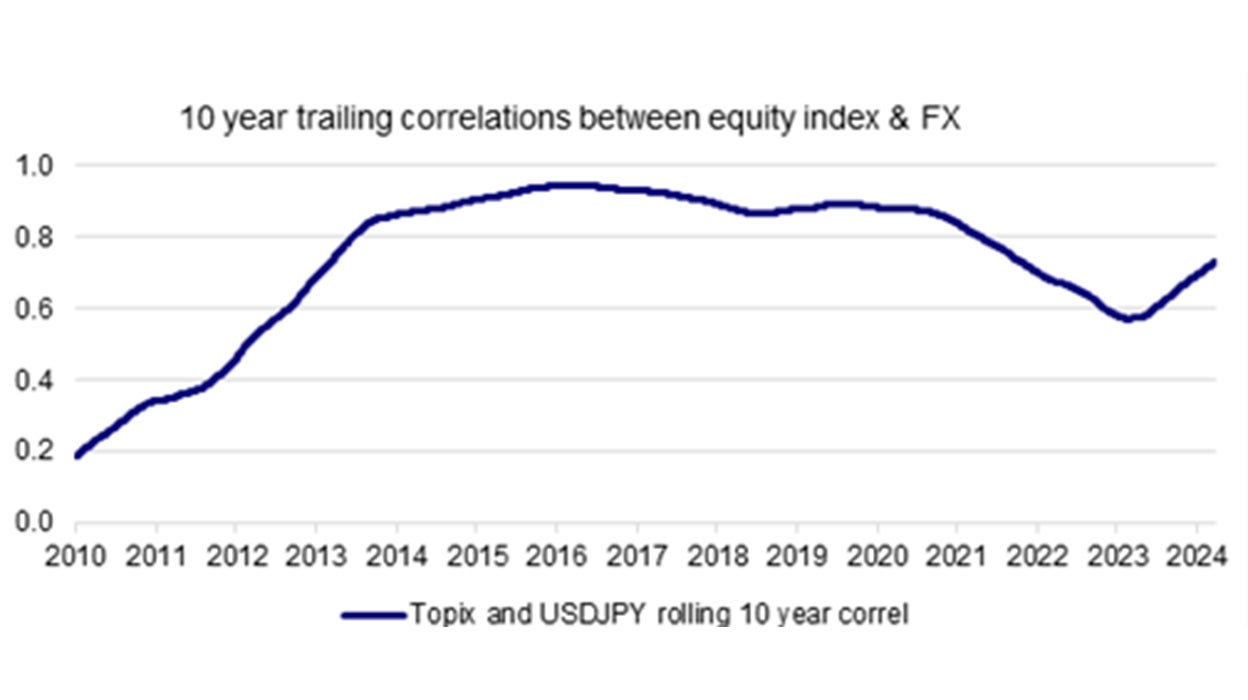

There has been some concern over the potential for Japanese equities to pull back should the JPY appreciate. Analysis into the relationship between FX and the Japanese stock market reveals that there is validity to this concern.

A 10-year rolling window trailing correlation shows that Japanese equity performance is indeed positively correlated with a weaker JPY.

This makes sense if we contextualize the relationship – Many Japanese corporates generate a substantial slice of total sales from abroad. In some years, more than half of total sales are originated in USD or other foreign currencies.3

Hence a weaker JPY leads to higher revenues in local currency terms for Japanese corporates. There’s also the lagged effect of exports appearing more attractive with a weaker JPY.

This tie-up can also explain the outperformance of Japanese large cap stocks over small caps to some degree, given that many large caps are multinational corporates with foreign income streams.

The correlation could also have something to do with the JPY being perceived as a safe haven currency.

A weaker JPY tends to coincide with a stronger global macro environment, and under such a backdrop global equities typically outperform.

Source: Bloomberg, Invesco. Data as at 22 March 2024.

Source: Bloomberg, Invesco. Data as at 22 March 2024.

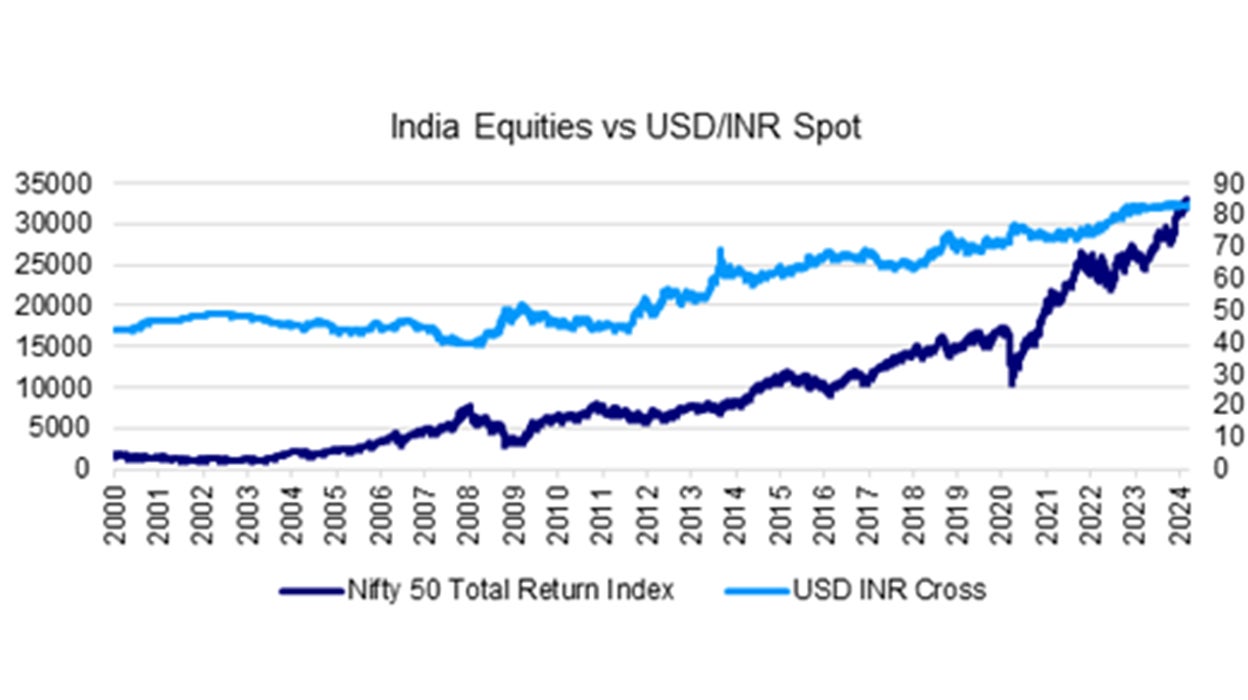

On the other hand, the relationship between the INR and Indian equities is less clear. The correlations flip around depending on time window and results are not statistically significant.

It does seem that a minor negative correlation exists with a weaker INR (i.e. positive correlation with stronger INR).

This makes sense as Indian corporate revenues are largely local currency. Foreign equity buyers will need INR to buy into the local equity market, boosting both INR demand and local markets.

Source: Bloomberg, Invesco. Data as at 22 March 2024.

That said, the recent upswing in Indian equities has been largely disconnected from INR trends, suggesting that investors are looking at other domestic factors (and perhaps that volatile monetary policy dynamics in recent years, interest rate differentials etc. are impacting the currency more).

Elsewhere in Asia/EM

Within the rest of EM, the dominant flow rebalancing over the past month for foreign fund flows has been towards the semiconductor and semiconductor equipment industries – as investors become more bullish on Taiwan and Korea.

This has been a redirection of flows from India and Brazil and from the automobiles and consumer services sectors.

Still, the top three markets that have higher portfolio composite weights versus their MSCI EM index weight, remain India, Brazil and Mexico.

It is also worth to note that China’s portfolio composite weight has improved by 0.2% YTD to 23.0%, whereas the MSCI EM index weight for China is 25.8%.4 China has recently seen net inflows.

There has recently been growing interest among foreign investors of Chinese equities given their low valuation and more policy support. We continue to expect foreign capital to be buying at these levels.

The opportunities that AI brings to Asia

We believe that the AI theme still has legs – as AI-related companies continue to post stellar earnings and upsize consensus estimates.

AI-companies in Asia are also much cheaper than their US peers, thus we believe that foreign fund flows are apt to continue chasing the AI theme that should benefit Taiwan, Korea and China.

From a sector perspective, while information technology remains hot and is likely to see near-term inflows, it’s possible that more cyclical sectors could start to benefit as the global economy transitions from a contractionary / below-trend growth part of the economy cycle, to a recovery part of the cycle.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Reference:

-

1

Source: Bloomberg, as of March 15, 2024

-

2

Source: Bloomberg, as of March 28, 2024

-

3

Source: https://asia.nikkei.com/Economy/Japan-Inc.-s-overseas-revenue-ratio-rises-to-record-in-fiscal-2015

-

4

Source: Bloomberg, as of March 28, 2024